- Home

- »

- Automotive & Transportation

- »

-

Bicycle Accessories Market Size, Share, Growth Report 2030GVR Report cover

![Bicycle Accessories Market Size, Share & Trends Report]()

Bicycle Accessories Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Apparels, Components), By Bicycle (Mountain Bikes, Hybrid Bikes, Road Bikes, Cargo Bikes), By Type (OEM, Aftermarket), By Sales Channel, Region, And Segment Forecasts

- Report ID: GVR-4-68040-044-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bicycle Accessories Market Summary

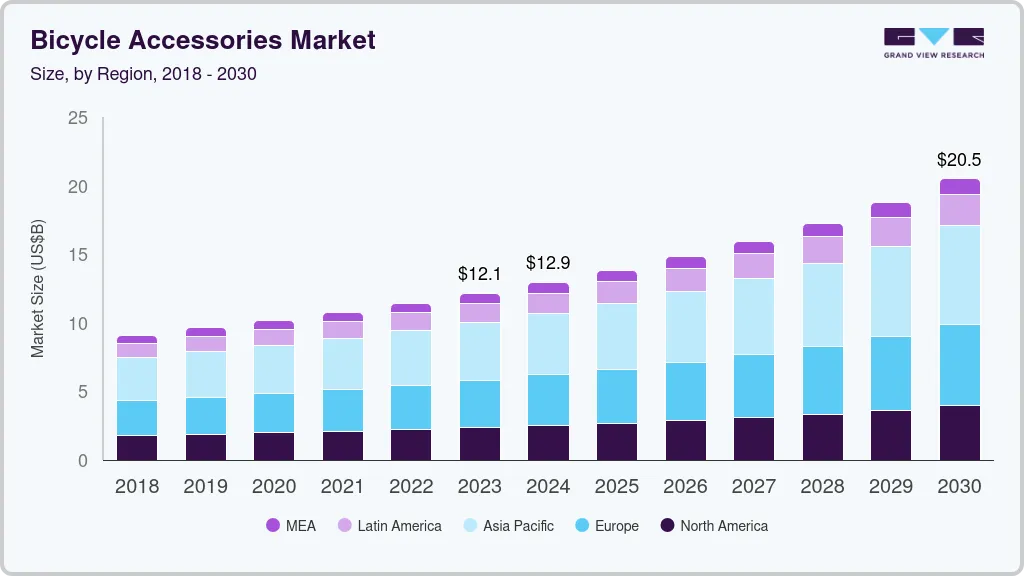

The global bicycle accessories market size was estimated at USD 12.94 billion in 2024 and is projected to reach USD 20.50 billion by 2030, growing at a CAGR of 8.2% from 2025 to 2030. The market growth can be attributed to factors such as health and fitness trends and increasing environmental concerns.

Key Market Trends & Insights

- Asia Pacific bicycle accessories market held a significant revenue share of around 34.69% in 2024.

- Country-wise, Canada is expected to register the highest CAGR from 2025 to 2030.

- By product, the component segment dominated the market and accounted for a revenue share of over 62.0% in 2024.

- Based on bicycle type, the road bikes segment accounted for the largest revenue share of 40.66% in 2024.

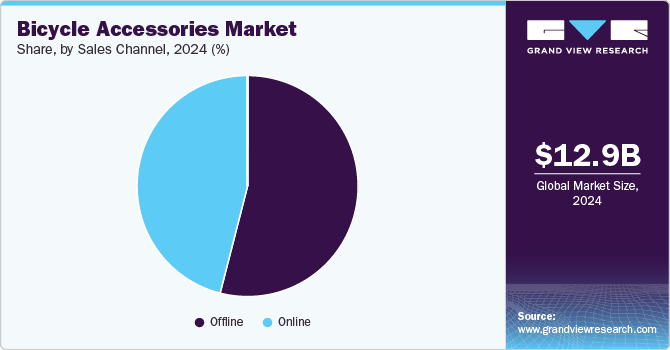

- By sales channel, the offline sales channel segment dominated the market and accounted for a revenue share of over 53.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.94 Billion

- 2030 Projected Market Size: USD 20.50 Billion

- CAGR (2025-2030): 8.2%

- Asia Pacific: Largest market in 2024

As more people take up cycling for transportation, exercise, or leisure, the demand for bicycle accessories has also increased. From helmets, lights, and locks to bags, mirrors, water bottle cages, and pedals, bike accessories are crucial in enhancing the safety, comfort, and functionality of bicycles and cyclists. Growing awareness of health benefits associated with cycling, such as improved cardiovascular health and fitness, has let more people adopt cycling as a regular activity. This trend boosts demand for accessories like fitness tracking devices, saddlebags, and hydration systems, supporting long-distance and performance-oriented cycling.

With the emergence of e-bikes and the growing popularity of cycling among younger generations, the market is expected to continue its growth trajectory in the coming years. Increase in e-bike sales: E-bikes, or electric bikes, have also contributed to the growth of the market. As more people switch to e-bikes for their daily commutes or leisure rides, there is an increasing demand for accessories such as mounts, integrated lighting, and horn systems, as they help increase the rider’s safety. For example, bicycle lights help cyclists be seen by other road users, especially in low-light conditions or when riding at night. This can be especially important on roads with heavy traffic, where motorists may have difficulty spotting cyclists. In addition, cyclists can reduce the risk of an accident by making themselves more visible by installing appropriate lighting systems.

The high volume of traffic and resulting congestion, coupled with concerns for rider safety and the increasing popularity of cycling, have contributed to a surge in the adoption of bicycle accessories. Other factors driving growth in the market include the rising interest in cycling sports, growing demand for sports and mountain bikes, and increasing sales of electric bicycles in emerging markets. As a result, accessories such as speedometers, mudguards, handlebar grips, LED lights, gloves, helmets, mirrors, and other related products have experienced a rise in demand, leading to projections of rapid expansion in the market.

Technological advancements are transforming the market, especially as cycling becomes more connected, performance-oriented, and safety-focused. For instance, equipped with sensors and connectivity features, smart helmets can detect impacts, provide navigation instructions, and alert emergency contacts in case of an accident. These helmets often come with features like Bluetooth connectivity for phone calls or music. Furthermore, integrated GPS trackers allow cyclists to track their routes and find their bikes if stolen. High-tech locks and smart alarms equipped with IoT technology are also gaining popularity in the market.

Product Insights

The component segment dominated the market and accounted for a revenue share of over 62.0% in 2024. The pedal sub-segment of components dominated the segment market, gaining a market share of over 14.0% in 2024, and is also to witness considerable growth over the forecast period. The high market share can be attributed to pedals being one of the most frequently replaced parts on a bicycle, as they are subject to significant wear and tear overtime, especially for avid cyclists who ride frequently. Pedals also allow the rider to customize their riding experience by changing the position of the pedal relative to the foot and the angle of the foot on the pedal. As a result, the demand for replacement pedals is relatively high, and they are sold in large numbers by bicycle accessory manufacturers and retailers.

The apparel segment is expected to register the highest growth rate over the forecast period. The primary factor attributed to this segment's growth is that the advancements in fabric technology and design have led to the creation of high-performance materials that are moisture-wicking, breathable, and provide UV protection, among other features. This has made it possible for cyclists to wear apparel that is not only comfortable but also functional and stylish. In the apparel segment, the protective gear sub-segment holds the largest market share in 2024. The share can be attributed to the fact that, while riding a bicycle, there is always a risk of accidents and falls, which can result in serious injuries. Wearing protective gear can help reduce the severity of injuries and even prevent them altogether. Additionally, countries like Australia, Canada, Spain, and Israel have made bicycle helmets mandatory in their bicycle regulations.

Bicycle Insights

Based on bicycle type, the road bikes segment accounted for the largest revenue share of 40.66% in 2024. The increase in popularity of basic bicycles can be explained by the fact that they are simpler to modify compared to other types of bicycles like racing, mountain, or specialized ones. Additionally, the rising trend of individuals personalizing road bikes for particular uses is predicted to boost the market's growth in years to come.

The cargo bikes segment is anticipated to exhibit the highest growth rate during the forecast period. This can be attributed to the increasing trend of utilizing cargo bikes as a sustainable and eco-friendly substitute for conventional vehicles when transporting goods. As a result, there is a higher demand for accessories that can enhance the functionality and carrying capacity of cargo bikes, such as racks, bags, and baskets. Brands, such as Benno and Larry & Harry, are monetizing the high potential of cargo bikes by investing in ways of increasing the positive perception of cargo bikes and promoting them through various role models. Moreover, the market for mountain bicycle is also expected to grow significantly over the forecast period as consumers opt for mountain bicycling as a form of adventure and leisure. Furthermore, the number of females and kids entering sports is advancing steadily and is likely to influence the global segment growth.

Sales Channel Insights

The offline sales channel segment dominated the market and accounted for a revenue share of over 53.9% in 2024. This is primarily due to a significant number of consumers preferring to buy from physical stores to have the opportunity to test- the accessories before purchase. These stores also provide customized options for consumers to choose their preferred designs and colors for bicycle accessories, and the product is available instantly. In addition, the physical stores allow customers to see and touch the products, giving them a better understanding of the quality and suitability of the accessories for their needs. Additionally, the availability of branded bicycle accessories in local supermarkets and other stores is expected to drive demand for the segment.

The online sales channel segment is anticipated to be the fastest-growing segment over the forecast period. Consumer engagement in online stores is expected to increase in emerging economies, such as Brazil, China, India, and Mexico, due to the growing penetration of smartphones and the internet. Additionally, the expanding internet reach prompts vendors to sell their products in previously untapped markets through online platforms like Ali Express, Amazon, and Flipkart. Furthermore, online channels offer attractive discounts on products, attracting consumers to purchase online and bolstering the growth of the online bicycle accessories market.

Type Insights

The OEM (original equipment manufacturer) segment accounted for the largest revenue share of 57.2% in 2024, owing to the fact that they are explicitly designed to fit the bicycle model and tested for quality and durability. As a result, OEM accessories are more likely to provide a better fit and function than aftermarket accessories, which may have compatibility issues. OEM accessories are usually covered by the bicycle manufacturer's warranty, which provides additional assurance to the customer about the product's quality, compatibility, negligible shipping cost, and authenticated manuals to troubleshoot problems. OEM accessories are designed to match the aesthetics of the bicycle and are often available in the same color and finish. This provides a cohesive and integrated look to the bicycle, which many customers prefer.

The aftermarket type is expected to emerge as the fastest-growing segment during the forecast period. The aftermarket accessories offer a wider variety of options than OEM accessories, which are limited to the specific bicycle model. Aftermarket accessories provide more choices in color, design, and functionality, allowing customers to customize their bicycles to their preferences. The aftermarket accessories are often priced lower than OEM accessories, making them more affordable for customers. This is especially true for customers looking to upgrade their bicycles without spending significant money. Aftermarket accessories are often designed and manufactured by specialized companies focusing solely on producing high-quality bicycle accessories. These companies may have better expertise and resources to create innovative, high-performance accessories. Additionally, the increasing popularity of e-commerce platforms and online marketplaces has made it easier for customers to access and purchase aftermarket accessories. These platforms offer a more comprehensive selection of products and competitive pricing, making them a preferred option for customers.

Regional Insights

North America bicycle accessories market is expected to grow at a considerable growth rate during the forecast period in the market. The emphasis on healthy living has led to an increase in recreational cycling. Accessories for outdoor fitness, like hydration packs, gloves, and bike racks, have gained popularity as consumers invest more in active lifecycles. Moreover, North America has seen significant investments in expanding bike lanes, improving safety features, and developing dedicated cycling areas in cities. This trend supports the sales of accessories like lights and locks to improve safety and security in urban environments.

U.S. Bicycle Accessories Market Trends

Helmets, lights, and locks are among the most popular accessories in the U.S., partly due to stringent safety regulations in certain states. For instance, states like California have mandatory helmet laws for minors, which boosts helmet sales. Furthermore, mountain biking and gravel biking continue to gain popularity, especially in Western states like Colorado and Utah. This trend has led to increased demand for rugged accessories, such as reinforced tires, bike racks for cars, and off-road lights.

Asia Pacific Bicycle Accessories Market Trends

Asia Pacific bicycle accessories market held a significant revenue share of around 34.69% in 2024. The growing urbanization that is leading the demand for sustainable transportation options is, in turn, driving the demand for bicycle components market in the region; the Asia-Pacific region is home to some of the world's largest bicycle manufacturers, such as Giant Manufacturing Co. Ltd, and Merida Industry Co. Ltd., which has led to a well-established supply chain for bicycle parts and accessories. This makes it easier for accessory manufacturers to source raw materials and manufacture products in the region, reducing costs and lead times.

Europe Bicycle Accessories Market Trends

Europe is expected to witness the highest growth over the forecast period. The growth is supported by various reasons, such as the well-established cycling culture, which has led to a higher demand for high-performance accessories that cater to the needs of cycling enthusiasts. This includes accessories like cycling shoes, helmets, and clothing designed for optimal performance and comfort. In addition, the increasing popularity of e-bikes in the region has led to a growing demand for accessories that cater to the needs of e-bike users, such as batteries, chargers, and motor components. Furthermore, Europe is home to cities highly conducive to bicycle commuting. In addition, Europe hosts multiple well-known cycling events, such as the Ronde van Vlaanderen and Tour de France. Moreover, European countries like Belgium, Denmark, France, and Italy invest heavily in infrastructure to support and encourage bicycle commuting. This aggressive approach toward promoting cycling as a sustainable mode of transportation has significantly contributed to the growth of the market in the region.

Key Bicycle Accessories Company Insights

Some of the key players operating in the market include Accell Group, Avon Cycles Ltd, Campagnolo S.R.L., Garmin Ltd, Shimano Inc., and Giant Manufacturing Co., Ltd, among others.

-

Giant Manufacturing Co., Ltd specializes in manufacturing bicycles and related accessories, including bike bags, racks, saddles, lights, and riding gear, among others. The company has a robust and expansive global distribution network, established through its bicycle sales, allowing it to easily reach international markets with accessories. The company strategically invested in retail stores and experience centers globally, where customers can try out accessories and receive expert guidance.

Lezyne, Wahoo Fitness, and Quad Lock, among others are some of the emerging market participants in the target market.

-

Lezyne specializes in providing bicycle accessories. The company offers a broad product lineup that covers essential bicycle accessories, including lights, pumps, tools, GPS devices, and repair kits. The diverse product portfolio helps the company capture multiple market segments, from casual commuters to performance-driven cyclists. The company has expanded its global reach through partnerships with cycling retailers and online platforms, making its products easily available to customers across the globe.

Key Bicycle Accessories Companies:

The following are the leading companies in the bicycle accessories market. These companies collectively hold the largest market share and dictate industry trends.

- Accell Group

- Avon Cycles Ltd.

- Campagnolo S.R.L

- Garmin Ltd.

- Giant Manufacturing Co. Ltd.

- Merida Industry Co. Ltd.

- Specialized Bicycle Components, Inc.

- Trek Bicycle Corp.

- DT Swiss

- Lezyne

- Endura Ltd.

- Eastman Industries

Recent Developments

-

In August 2024, Fizik, a provider of cycling shoes and bike saddles, partnered with Amani, a cycling team of Kenya to provide gravel bike shoes. The shoes are made up of lightweight woven mesh, having one Li2 BOA for foot adjustment and replaceable toe spikes.

-

In May 2023, UNIT 1, a provider of smart cycling accessories, launched the AURA Cycling System for rider safety. The system includes a navigation remote, a hybrid smart helmet, a mobile app, and smart lights. The products are available on Kickstarter, and it allows customers to choose different product combinations, sizes, and colors.

Bicycle Accessories Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 13.83 billion

Revenue forecast in 2030

USD 20.50 billion

Growth Rate

CAGR of 8.2% from 2025 to 2030

Actuals

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Bicycle, Sales Channel, Type, End Use, and Region

Regional scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Accell Group; Avon Cycles Ltd; Campagnolo S.R.L; Garmin Ltd.; Giant Manufacturing Co. Ltd; Merida Industry Co. Ltd.; Specialized Bicycle Components, Inc.; Trek Bicycle Corporation; DT Swiss; Lezyne; Endura Limited; Eastman Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bicycle Accessories Market Report Segmentation

This report forecasts market revenue growth at global, regional, as well as at country levels and offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bicycle accessories market report based on product, bicycle, type, sales channel, and region:

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Apparels

-

Cycling Gloves

-

Cycling Clothes

-

Cycling Shoes

-

Protective Gears

-

Others

-

-

Components

-

Saddles

-

Pedals

-

Lighting System

-

Mirrors

-

Water Bottle Cages

-

Lock

-

Bar Ends/Grips

-

Kickstands

-

Fenders & Mud Flaps

-

Air Pumps & Tyre Pressure Gauge

-

Others

-

-

-

Bicycle Outlook (Revenue, USD Million; 2017 - 2030)

-

Mountain Bikes

-

Hybrid Bikes

-

Road Bikes

-

Cargo Bikes

-

Others

-

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

OEM

-

Aftermarket

-

-

Sales Channel Outlook (Revenue, USD Million; 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bicycle accessories market size was estimated at USD 12.94 billion in 2024 and is expected to reach USD 13.83 billion in 2025.

b. The global bicycle accessories market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 20.50 billion by 2030.

b. The offline sales channel segment dominated the market and accounted for a revenue share of over 53.9% in 2024. This is primarily due to a significant number of consumers preferring to buy from physical stores to have the opportunity to test- the accessories before purchase.

b. Some of the key players in bicycle accessories market include Avon Cycles Ltd, Campagnolo S.R.L, Giant Manufacturing Co. Ltd, and Specialized Bicycle Components, Inc, among others.

b. Key factors that are driving bicycle accessories market growth include health & fitness trends, increasing environmental concerns leading to more people taking up cycling for transportation, exercise, or leisure and thus surging demand for bicycles and their accessories. In addition, the bicycle accessories such as helmets, lights, lock, bags, mirrors, water bottle cages, and pedals are crucial in enhancing the safety, comfort, and functionality of bicycles and cyclists further bolstering the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.