- Home

- »

- Next Generation Technologies

- »

-

Big Data As A Service Market Size, Industry Report, 2030GVR Report cover

![Big Data As A Service Market Size, Share & Trends Report]()

Big Data As A Service Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Solution, By Enterprise Size, By End Use, By Region And Segment Forecasts

- Report ID: GVR-3-68038-664-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Big Data As A Service Market Size & Trends

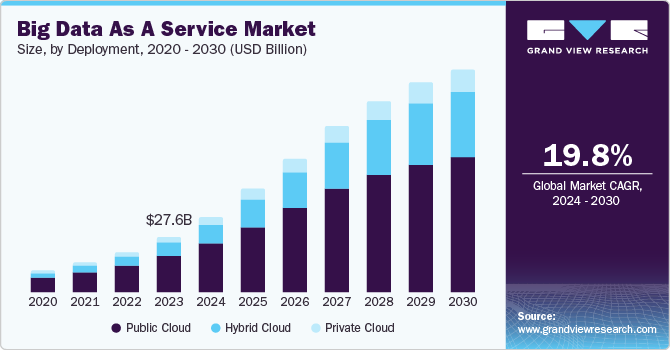

The globalbig data as a servicemarket size was valued at USD 27.55 billion in 2023 and is projected to grow at a CAGR of 19.8% from 2024 to 2030. Companies require customized solutions that cater to their specific needs. The Big Data as a Service (BDaaS) platform offers high customization, allowing organizations to customize data analytics to their unique requirements. Additionally, the scalability of BDaaS solutions enables businesses to expand their data analytics capabilities as their data volumes grow. This flexibility and scalability drive the adoption of BDaaS as part of their digital transformation strategies.

With the expansion of digital devices, social media, IoT, and cloud computing, organizations produce vast amounts of structured and unstructured data. The need to analyze and derive insights from this data to drive business decisions drives companies toward Big Data solutions. BDaaS offers a scalable and flexible platform to manage these massive datasets without requiring heavy upfront investments in infrastructure. The exponential growth in data generation drives the significant demand in the BDaaS market.

Technology providers, cloud service companies, and industry-specific firms are developing strategic alliances to offer more comprehensive and integrated BDaaS solutions. These partnerships enable companies to combine their expertise, resources, and technologies, providing customers with advanced analytics tools, improved data processing capabilities, and customized solutions that meet specific industry needs. This increases innovation and expands the reach of BDaaS across various sectors. For instance, in June 2024, Yahoo Advertising announced a partnership with VideoAmp. The partnership combines Yahoo's cookieless identifier, Yahoo ConnectID, with VideoAmp's advanced data engine, VALID (VideoAmp Linked Identity & Data). This integration aims to enhance advertisers' ability to reach their target audiences effectively. The Yahoo DSP offers advertisers audience segments and real-time optimizations based on audience exposures and frequency.

Deployment Insights

The public cloud segment dominated the market and accounted for a revenue share of 63.1% in 2023. Public cloud platforms offer a pricing model of pay based on how much they use a product or service, allowing organizations to avoid the high capital expenditures associated with on-premise infrastructure. This model is particularly suitable for small and medium-sized enterprises that require big data analytics capabilities without maintaining costly hardware. Additionally, public cloud services offer scalability, enabling businesses to scale their data storage and processing capacities up or down based on demand, ensuring optimal resource utilization and cost management.

The hybrid cloud segment is expected to register the fastest CAGR over the forecast period. Hybrid cloud solutions allow organizations to dynamically allocate resources between public and private clouds based on real-time demands and workload requirements. This flexibility is valuable for companies experiencing fluctuating data volumes or unpredictable spikes in data processing needs. By leveraging the public cloud's scalability and the private cloud's control, businesses efficiently manage their big data workloads, ensuring high performance and cost-effectiveness. The flexibility and scalability hybrid cloud deployment offers to drive its demand in the market.

Solution Insights

The data analytics-as-a-service segment accounted for the largest revenue share in 2023. Organizations across industries increasingly recognize the value of data-driven decision-making, significantly boosting the DAaaS market. DAaaS solutions enable businesses to analyze vast amounts of data quickly and efficiently, providing actionable insights that drive strategic decisions. This demand is greater in the retail, finance, healthcare, and manufacturing sectors, where data insights lead to improved customer experiences, optimized operations, and competitive advantages. The ability of DAaaS to deliver real-time, data-driven insights is a key factor in its growing adoption.

The hadoop-as-a-service is anticipated to witness the fastest CAGR over the forecast period. Hadoop-as-a-Service simplifies the complexity of managing and maintaining the infrastructure by offering a managed service that handles the technical aspects of Hadoop, such as setup, configuration, and maintenance. This ease of use enables organizations to deploy Hadoop-based big data solutions without needing a team of specialized IT staff. By reducing the technical barriers associated with Hadoop, HaaS makes big data analytics more accessible to a broader range of companies, including those without extensive in-house expertise.

Enterprise Size Insights

The large enterprise segment accounted for the largest market revenue share in 2023. Large enterprises increasingly rely on advanced analytics to gain competitive advantages, optimize business processes, and enhance decision-making. BDaaS platforms provide access to powerful analytics tools, including predictive analytics, machine learning, and artificial intelligence, without requiring significant in-house expertise or infrastructure investments. These capabilities allow large enterprises to find actionable insights, forecast trends, and make data-driven decisions that drive business growth and efficiency. The demand for these advanced analytics solutions significantly drives BDaaS adoption among large enterprises.

The small and medium enterprise segment is anticipated to register the fastest CAGR over the forecast period. SMEs need more IT departments and specialized data scientists than larger organizations might have. BDaaS platforms are designed to be user-friendly, with intuitive interfaces and automated processes that reduce the complexity of big data analytics. This ease of implementation and use allows SMEs to quickly deploy big data solutions and start analyzing data without requiring extensive technical expertise. By lowering the barriers to entry, BDaaS makes it feasible for SMEs to benefit from data-driven decision-making, which significantly drives the market growth in this segment.

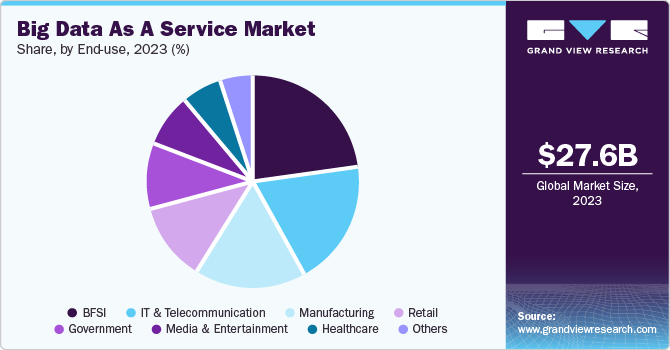

End Use Insights

The BFSI segment accounted for the largest market revenue share in 2023. In the BFSI sector, managing risk and detecting fraudulent activities are critical priorities. The growing complexity of financial transactions and the rise of cyber threats have increased the need for advanced data analytics. BDaaS provides BFSI organizations with powerful tools to analyze large datasets in real time, enabling them to identify unusual patterns, predict potential risks, and detect fraud more efficiently. The ability to proactively manage risk and enhance security drives the adoption of BDaaS in the BFSI sector.

The manufacturing segment is expected to witness the fastest CAGR over the forecast period. Maintaining high product quality and performance is essential for manufacturers to meet customer expectations and comply with industry standards. BDaaS platforms facilitate the analysis of quality control data, production metrics, and customer feedback to monitor and improve product quality. By leveraging big data analytics, manufacturers detect quality issues early, implement corrective actions, and continuously refine their production processes. The focus on delivering high-quality products and reducing defects increases the adoption of BDaaS solutions, which provide the tools required for effective quality management.

Regional Insights & Trends

North America big data as a service market accounted for the largest revenue share of 35.5% in 2023. The adoption of cloud computing is widespread in North America, with many businesses already leveraging various cloud services. BDaaS, as a cloud-based solution, benefits from this existing infrastructure and cloud adoption trend. Organizations in the regions are increasingly migrating their data workloads to the cloud to take advantage of its scalability, flexibility, and cost-efficiency. The strong adoption of cloud computing in the region supports the growth of BDaaS as businesses seek integrated big data solutions with their cloud strategies and infrastructure.

U.S. Big Data as a ServiceMarket Trends

The U.S. big data as a service market accounted for the largest revenue share in 2023. The U.S. has a well-established and advanced cloud computing infrastructure, with major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud operating extensively in the region. This strong cloud ecosystem supports the growth of BDaaS by providing scalable, flexible, and cost-effective data solutions. U.S. businesses are increasingly adopting cloud services, including BDaaS, to efficiently manage and analyze large volumes of data. The established cloud infrastructure and the widespread use of cloud technologies increase the adoption of BDaaS in the U.S. market.

Europe Big Data as a Service Market Trends

The Europe big data as a service market accounted for the largest revenue share in 2023. Due to digital transformation, IoT, and other technological advancements, regional companies generate and manage increasingly large and complex datasets. Data's growing volume and complexity drive the demand for scalable and efficient big data solutions. BDaaS platforms offer the infrastructure and capabilities to handle, store, and analyze large datasets effectively. Managing and extracting value from big data significantly increases BDaaS adoption in the region, as businesses require solutions that can scale with their data growth.

The UK big data as a service market is expected to witness significant growth over the forecast period. Many companies in the UK prioritize data-driven decision-making to enhance their operational efficiency, customer experiences, and competitive positioning. BDaaS offers the tools and capabilities required to analyze vast amounts of data and derive actionable insights. Businesses leverage BDaaS to support strategic initiatives, optimize operations, and make informed decisions based on real-time data. The emphasis on data-driven strategies and the need for developed analytics drive the demand for BDaaS in the UK market.

Asia Pacific Big Data as a Service Market Trends

The Asia Pacific big data as a service market is expected to witness the fastest CAGR over the forecast period. Cloud computing adoption is rapidly increasing in the Asia Pacific, driven by the need for flexible, scalable, and cost-effective IT solutions. BDaaS, a cloud-based service, benefits from this trend by offering regional businesses access to powerful data analytics tools without significant capital investment in infrastructure. The growing acceptance of cloud technologies and the shift towards cloud-based solutions support the expansion of BDaaS in the Asia Pacific region. Businesses are leveraging BDaaS to utilize the benefits of cloud computing and enhance their data analytics capabilities.

The China big data as a service market is expected to witness significant growth over the forecast period. BDaaS platforms provide tools for analyzing operational data, identifying inefficiencies, and implementing improvements. By leveraging big data insights, organizations streamline operations, enhance productivity, and achieve cost savings. The aim is to improve operational efficiency and gain a competitive edge in the market, increasing the adoption of BDaaS in the Asia Pacific region. Additionally, as data privacy and security concerns rise globally, businesses in Asia Pacific increasingly prioritize protecting sensitive information. BDaaS providers offer solutions that include security measures, compliance with data protection regulations, and secure data management practices. The growing awareness of data security issues and the need for compliance with privacy regulations drives its market growth in the country.

Key Big Data As A Service Company Insight

Key players in big data as a servicemarket include Accenture, IBM Corporation, Microsoft, Oracle, SAP SE, and others.

-

Accenture is a professional services company with expertise in strategy, consulting, digital transformation, technology, and operations. The company provides various services to aid organizations to improve their performance and achieve their business goals. The company's product offerings include management consulting, technology services, digital transformation solutions, and outsourcing services.

-

IBM Corporation is a global technology and consulting company that focuses on innovation and digital transformation. The company offers solutions for cloud computing, artificial intelligence (AI), and data analytics. Its product offerings include the IBM Cloud platform, which provides infrastructure, platform, and software.

Key Big Data as a Service Companies:

The following are the leading companies in the big data as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amazon.com, Inc.

- Kyndryl Inc.

- Dell Inc.

- Google LLC

- IBM Corporation

- Microsoft

- Oracle

- SAP SE

- Teradata

Recent Developments

-

In June 2024, China launched Ocean Cloud, its first open marine big data service platform, during a ceremony in Xiamen, Fujian Province, coinciding with World Oceans Day. This initiative aims to enhance the integration and accessibility of marine data, facilitating better information exchange both nationally and globally. The global ocean three-dimensional observation network collects national data, connects marine information among departments, and enhances global marine information exchange.

-

In December 2023, DxVx signed a contract with LG CNS to co-develop a bio-healthcare big data platform that leverages artificial intelligence (AI) technology. This collaboration marks a strategic move for DxVx, which aims to enhance its capabilities in personalized precision medicine. The platform utilizes AI technology provided by LG CNS, which facilitates advanced data analysis and improved healthcare solutions.

Big Data as a ServiceMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.96 billion

Revenue forecast in 2030

USD 112.07 billion

Growth rate

CAGR of 19.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, solution, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, UK, Germany, China, India, Japan, Brazil and Mexico

Key companies profiled

Accenture, Amazon Inc., Kyndryl Inc., Dell Inc., Google LLC, IBM Corporation, Microsoft, Oracle, SAP SE, Teradata

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Big Data As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the big data as a service market report based on deployment, solution, enterprise size, end use and region.

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hadoop-as-a-Service

-

Data-as-a-Service

-

Data Analytics-as-a-Service

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium-sized business

-

Large enterprise

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Manufacturing

-

Retail

-

Media & Entertainment

-

Healthcare

-

IT & Telecommunication

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.