Biguanides Market Size & Trends

The global biguanides market size was valued at USD 5.10 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 3.8% from 2024 to 2030. The growing prevalence of diabetes is the primary reason for the growth of the biguanides market. Biguanides are mostly prescribed to diabetes patients. According to International Diabetes Federation estimates, global diabetes prevalence is expected to increase from 366 million in 2011 to 552 million by 2030; such rapid growth in prevalence is expected to have a high impact on the antidiabetics market growth over the coming six years. Biguanides are used for type 2 diabetes. According to the International diabetes federation, 90% of the diabetes population has type 2 diabetes, which is driven by socioeconomic, demographic, environmental, and genetic factors. In addition, biguanides are considered the safest medication with fewer side effects to treat diabetes.

In addition, the low cost of biguanides attracts healthcare providers to prescribe the medicine, and it encourages low-income groups to continue the medication. The cost of popular Biguanides in the U.S. ranges between USD11 and USD 14, which is highly affordable for patients. The increased focus of biologics manufacturers, pharmaceutics, and researchers on biguanides is surging the market growth. The researchers are involved in developing biguanides with more features, added advantages compared to the existing products, and fewer side effects. The irregular and unregulated dietary habits that contribute to causing diabetes are expected to drive the market.

Moreover, the versatility of biguanides increases the demand for the product. Biguanides can be used as a standalone medication and together with other medicines. It can also be used for the treatment of other diseases like cancer. Hence, the healthcare providers and physicians suggest the medication to the patients. It should also be noted that the medication is prescribed for long-term treatment.

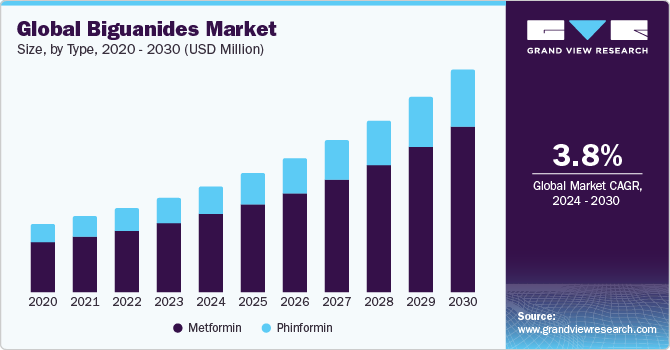

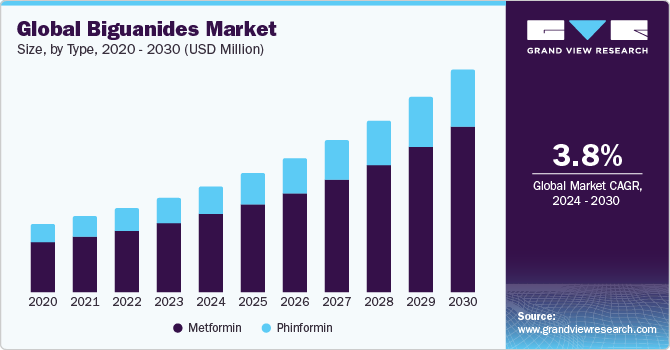

Type Insights

The metformin segment dominated the market in 2023. Metformin is the only biguanide currently approved for use in the U.S.It is the most prescribed antidiabetic drug in the U.S. Rising obesity and lifestyle changes are the major factors contributing to the metformin market growth. In addition, metformin can control the amount of sugar the liver produces. Hence, it is suggested to patients whose body does not use insulin normally.

The phenformin segment held a significant market share and is expected to grow at the fastest CAGR in the coming years. The anti-cancer effects of phenformin are expected to drive the segment. The article published by the National Institute of Health in November 2019 reveals that phenformin has anti-cancer effects and is effective on both solid and soluble components of the tumor microenvironment. However, phenformin is banned in certain countries like Hong Kong and the U.S. due to the identified hazards associated with the medicine.

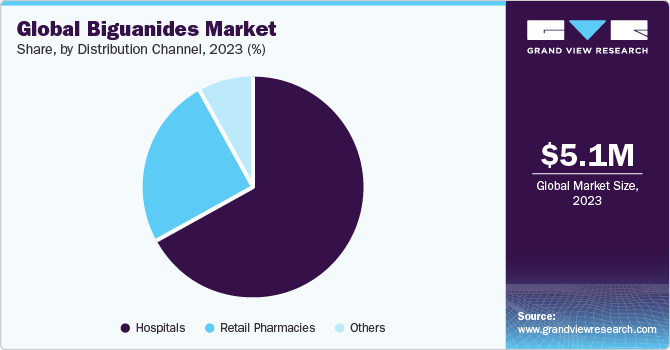

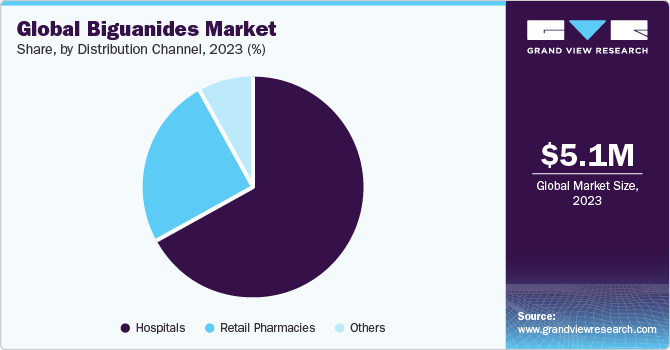

Distribution Channel Insights

Based on distribution channels, the biguanides market is classified into hospitals, retail pharmacies, and others. The retail pharmacy segment dominated the market owing to the availability of medicine at a lower cost. The discounts offered by retail pharmacies draw more customers to the market. In addition, the increasing burden of disease and the feasibility of home care patients are other major factors that drive the segment's growth.

The other segment is expected to grow at the fastest CAGR during the forecast period. The other segment includes online pharmacies.The comfort, flexibility, and convenience provided by online purchases of medications are major factors driving the segment. Customers get more choices when choosing the online mode of purchase. The discounts and price reductions also attract customers.

Regional Insights

North America dominated the market in 2023. This is due to the increasing prevalence of diabetic population in the region. According to the CDC, approximately 37.3 million people in the U.S. had diabetes in 2020, with 28.7 million diagnosed and 8.5 million undiagnosed cases. Furthermore, about 96 million people aged 18 years and older have prediabetes.

Asia Pacific is expected to witness significant growth during the forecast period, owing to factors such as rising investments by the market players in the region, increasing number of collaborations for the development of biosimilars, geographic expansion of key players, and active participation of government & nonprofit organizations in the market space.

Competitive Insights

Key players in the biguanides market include Sanofi-Aventis, Takeda Pharmaceuticals, Eli Lilly, Oramed Pharmaceuticals, Boehringer Ingelheim, Merck & Co. Inc., Novo Nordisk, Bristol-Myers Squibb, Halozyme Therapeutics and Pfizer. Certain initiatives taken by market players to expand their geographical reach include M&A, the development of digital platforms to support diabetic patients and formulations in biguanides.

-

In August 2023, Akums Drugs and Pharmaceuticals Limited introduced new diabetes solutions: Vildagliptin SR and Metformin SR tablets. This gives the diabetic patient effective glycemic control. It helps the patient in preventing hypoglycemia and weight gain during medication.

-

In August 2023, Dr Reddy’s Laboratories announced the launch and distribution of Saxagliptin and Metformin Hydrochloride Extended-Release Tablets in the U.S. It helps to improve glycemic control in adults with type 2 diabetes mellitus.