- Home

- »

- Medical Devices

- »

-

Biohazard Bags Market Size & Share, Industry Report, 2030GVR Report cover

![Biohazard Bags Market Size, Share & Trends Report]()

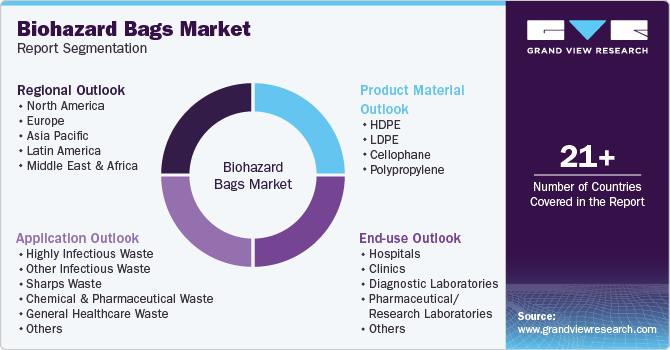

Biohazard Bags Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Material (HDPE, LDPE, Cellophane, Polypropylene), By Application (Highly Infectious Waste), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-205-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biohazard Bags Market Summary

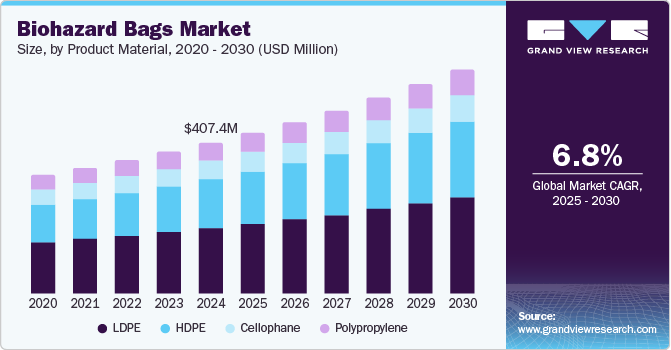

The global biohazard bags market size was estimated at USD 407.4 million in 2024 and is projected to reach USD 601.9 million by 2030, growing at a CAGR of 6.8% from 2025 to 2030. The World Health Organization (WHO) estimated that healthcare waste generation will rise by 25%-30% due to expanding healthcare activities, particularly in developing countries.

Key Market Trends & Insights

- Asia Pacific biohazard bags market dominated the global market with a revenue share of 33.4% in 2024.

- The U.S. biohazard bags market dominated the North America market with a revenue share of 80.2% in 2024.

- By product material, the Low-density Polyethylene (LDPE) segment dominated the market and accounted for a share of 42.8% in 2024.

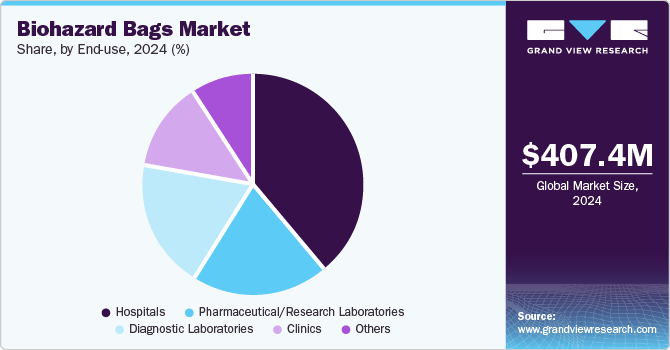

- By end use, the hospitals segment held the largest revenue share of 39.1% in 2024.

- By application, the other infectious waste segment led the market with a revenue share of 21.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 407.4 Million

- 2030 Projected Market Size: USD 601.9 Million

- CAGR (2025-2030): 6.8%

- Asia Pacific: Largest market in 2024

In response, the waste management industry, along with waste management devices and supplies such as biohazard bags and medical waste containers, has experienced considerable growth. In 2023, India reported over 1.5 million hospital beds, significantly increasing the volume of medical waste and necessitating effective management solutions. Similarly, in Lebanon, hospitals generate an estimated 7,255 tons of infectious waste annually, underscoring the substantial healthcare waste issue demanding attention. According to the WHO, the COVID-19 pandemic has dramatically affected waste management dynamics, with hospitals reporting a remarkable 30% increase in biohazardous waste due to heightened testing and treatment protocols. This trend highlights the critical need for biohazard bags, reinforcing their vital role in ensuring safety within healthcare settings and establishing a strong market foundation for effective waste disposal solutions.

In 2024, over 70 countries have instituted strict regulations governing medical waste management, making it mandatory to utilize biohazard bags for safe disposal. The European Union’s Waste Framework Directive is a prime example of such regulations, enforcing adherence across member states and resulting in heightened demand for appropriate waste management products. Consequently, stringent compliance demands are compelling healthcare facilities to prioritize biohazard bags in their waste disposal strategies.

Moreover, the number of hospitals is projected to reach approximately 60,000 by the end of 2024, with noticeable growth in Asia Pacific. According to the International Trade Association, China alone is expected to open over 3,000 new hospitals by 2025, significantly increasing medical waste production and the need for biohazard bags. Coupled with the aging population, these trends amplify the urgent need for effective waste disposal solutions such as biohazard bags.

Product Material Insights

The Low-density Polyethylene (LDPE) segment dominated the market and accounted for a share of 42.8% in 2024. LDPE bags are particularly suited for containing diverse biohazardous materials, as their soft and malleable properties minimize the risk of punctures and ruptures during handling and disposal, ensuring enhanced safety and reliability in waste management practices.

The High-density Polyethylene (HDPE) segment is expected to grow at the fastest CAGR of 7.4% over the forecast period. HDPE bags are designed to securely contain heavy or sharp biohazardous waste, making them indispensable in medical institutions and laboratories for efficient and effective waste management practices. Their robust properties ensure safety and reliability in various applications.

End-use Insights

The hospitals segment held the largest revenue share of 39.1% in 2024, owing to hospitals being the largest generators of biohazardous waste. As patient populations grow and healthcare services expand, effective waste management solutions become imperative, thereby driving the substantial demand for biohazard bags to ensure safe and compliant waste disposal.

The diagnostic laboratories segment is projected to experience the fastest growth rate of 7.0% over the forecast period due to the substantial volume of hazardous waste produced from diagnostic procedures. Given that these laboratories manage infectious and biohazardous materials on a daily basis, the need for effective disposal solutions is crucial to ensure safety and adherence to regulatory standards.

Application Insights

The other infectious waste segment led the market with a revenue share of 21.0% in 2024, driven by the rising volume of medical waste produced through diverse healthcare activities. This category encompasses items such as post-surgical blood, infected swabs, and other materials presenting infection risks, necessitating effective disposal solutions to safeguard public health and ensure environmental safety.

The general healthcare waste segment is expected to register the fastest growth of 7.3% over the forecast period. The rising volume of waste generated from healthcare facilities has aided segment growth. With the growth of patient populations and the expansion of healthcare services, effective waste management solutions have become crucial, increasing the demand for biohazard bags to facilitate safe and compliant disposal practices.

Regional Insights

Asia Pacific biohazard bags market dominated the global market with a revenue share of 33.4% in 2024, which can be attributed to the expansion of healthcare infrastructure and heightened awareness of waste management practices. The COVID-19 pandemic intensified the focus on infection control, driving demand. Stringent biomedical waste disposal regulations in countries such as India and China, alongside the rapid establishment of healthcare facilities, further boost market growth.

China Biohazard Bags Market Trends

The China biohazard bags market held the largest revenue share in the Asia Pacific market in 2024. China’s rapidly expanding healthcare system is a crucial factor driving market growth. The government has implemented stringent regulations for waste management, particularly after recent health crises. Moreover, the increasing number of hospitals and diagnostic laboratories generates significant biohazardous waste, boosting demand for effective disposal solutions such as biohazard bags.

North America Biohazard Bags Market Trends

North America biohazard bags market is expected to grow significantly over the forecast period, driven by robust healthcare infrastructure and increasing regulatory demands for waste management. The region’s high prevalence of chronic diseases generates significant medical waste, creating a need for effective disposal solutions. Moreover, heightened infection control awareness among healthcare providers and the presence of key manufacturers further fuel market expansion.

The U.S. biohazard bags market dominated the North America market with a revenue share of 80.2% in 2024. The extensive healthcare system in the country generates substantial medical waste across hospitals, clinics, and laboratories. Stringent regulations on medical waste management, coupled with increasing infectious disease incidences, drive the demand for biohazard bags in the country.

Europe Biohazard Bags Market Trends

Europe biohazard bags market held a substantial market share in 2024, driven by stringent regulatory frameworks ensuring safe medical waste disposal. Emphasizing sustainable waste management, European countries implement comprehensive guidelines for biomedical waste handling. Enhanced awareness among healthcare providers about infection control further propels demand, with countries such as Germany and France leading in establishing robust biomedical waste management standards.

The Germany biohazard bags market is expected to grow over the forecast period, fueled by rising investments in healthcare infrastructure and stringent medical waste disposal regulations. The government’s comprehensive policies enhance waste management practices within healthcare settings. As hospitals grow and diagnostic laboratories increase, the demand for compliant disposal solutions such as biohazard bags will rise, driven by heightened public awareness of sustainability and health safety.

Middle East & Africa Biohazard Bags Market Trends

The Middle East & Africa biohazard bags market is expected to register a CAGR of 7.0% over the forecast period. The region is experiencing improvements in healthcare systems and stricter medical waste management regulations. Enhanced healthcare infrastructure is leading to greater volumes of medical waste, prompting demand for effective disposal solutions, including biohazard bags, amid increasing awareness of infection control and public health protection.

The biohazard bags market in Turkey dominated the Middle East & Africa market in 2024. Turkey’s growing healthcare sector is producing substantial medical waste from hospitals and laboratories, creating a demand for efficient disposal solutions such as biohazard bags. Government regulations promoting safe biomedical waste handling and investments in modern healthcare infrastructure are facilitating the adoption of effective waste management solutions amid rising public health concerns.

Key Biohazard Bags Company Insights

Some key companies operating in the market include Thermo Fisher Scientific Inc. and Bel-Art Products, a part of SP and an ATS company. Key players are enhancing product offerings and market presence through mergers, acquisitions, and collaborations while investing in sustainable materials and advanced manufacturing to address regulatory and environmental challenges.

-

Thermo Fisher Scientific Inc. is a provider of biohazard bags, delivering a diverse range of products designed for secure waste disposal in laboratory and healthcare environments, including autoclavable bags that comply with safety regulations and promote sustainable packaging.

-

International Plastics Inc. specializes in manufacturing various plastic products, including biohazard bags specifically designed for medical and laboratory applications. The company’s durable, puncture-resistant bags adhere to hazardous waste disposal regulations, facilitating safe containment in healthcare facilities.

Key Biohazard Bags Companies:

The following are the leading companies in the biohazard bags market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Bel-Art Products, a part of SP, an ATS company

- International Plastics Inc.

- Bioscience International

- Cole-Parmer Instrument Company, LLC

- TUFPAK, INC.

Recent Developments

-

In October 2024, Mun Australia launched new Sharps Containers made with up to 75% recycled plastic. These containers enhance medical waste management while ensuring compliance, durability, and safety for healthcare facilities.

Biohazard Bags Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 433.6 million

Revenue forecast in 2030

USD 601.9 million

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Indonesia, Brazil, Argentina, Columbia, South Africa, Turkey, Egypt, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Bel-Art Products, a part of SP, an ATS company; International Plastics Inc.; Bioscience International; Cole-Parmer Instrument Company, LLC; TUFPAK, INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biohazard Bags Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biohazard bags market report based on product material, application, end-use, and region:

-

Product Material Outlook (Revenue, USD Million, 2018 - 2030)

-

HDPE

-

LDPE

-

Cellophane

-

Polypropylene

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Highly Infectious Waste

-

Other Infectious Waste

-

Sharps Waste

-

Chemical & Pharmaceutical Waste

-

General Healthcare Waste

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Diagnostic Laboratories

-

Pharmaceutical/Research Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

Columbia

-

-

Middle East & Africa

-

South Africa

-

Turkey

-

Egypt

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.