Biobetters Market Size & Trends

The global biobetters market size was valued at USD 42.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.22% from 2023 to 2030 due to benefits associated with biobetters, like enhanced therapeutic effectiveness, reduced side effects, and more cost-effective and simpler production techniques.

Market competition is a powerful driver of the biobetters market, compelling pharmaceutical companies to develop improved versions of existing biologic drugs to gain a competitive edge. In the biopharmaceutical industry, competition is fierce, and biobetters offer a strategic advantage by differentiating products from competitors. By enhancing efficacy, safety, or dosing convenience, biobetters can capture market share, particularly when original biologics face biosimilar competition or patent expirations. This intense competition spurs innovation, fosters the development of more cost-effective therapies, and expands the range of treatment options, ultimately benefiting patients and shaping the dynamic landscape of the biobetters market.

Furthermore, patent expirations play a significant role in development of biobetters market as they create a window of opportunity for pharmaceutical companies to develop improved versions of existing biologic drugs. When patents for original biologics expire, it paves the way for biobetter developers to enter the market, offering alternatives that are often more cost-effective, making them attractive to both patients and healthcare systems. Biobetters can provide comparable efficacy to the original biologics while potentially addressing limitations like side effects or dosing schedules, thus offering a competitive advantage. As a result, patent expirations incentivize innovation, foster competition, and stimulate the growth of the biobetters market, expanding options for patients and potentially reducing healthcare costs.

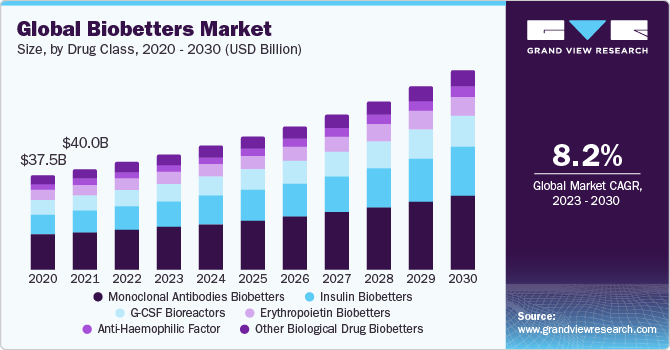

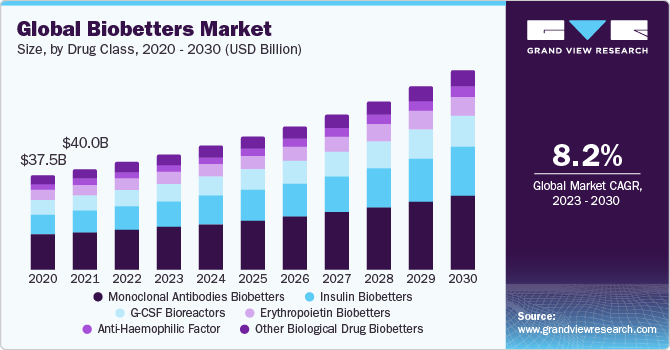

Drug Class Insights

On the basis of drug class, the market is segmented into erythropoietin biobetters, insulin biobetters, g-csf bioreactors, monoclonal antibodies biobetters, anti-haemophilic factor, and others. The monoclonal antibodies biobetters segment held the largest market share in 2022 due to their widespread therapeutic applications and established success in treating a variety of diseases, including cancer, autoimmune disorders, and infectious diseases. These mAb biobetters offer several advantages, such as improved efficacy, reduced side effects, and optimized dosing schedules compared to their originator mAbs, making them appealing to both patients and healthcare providers. On the other hand,insulin biobetters are expected to show lucrative growth over the forecast period.

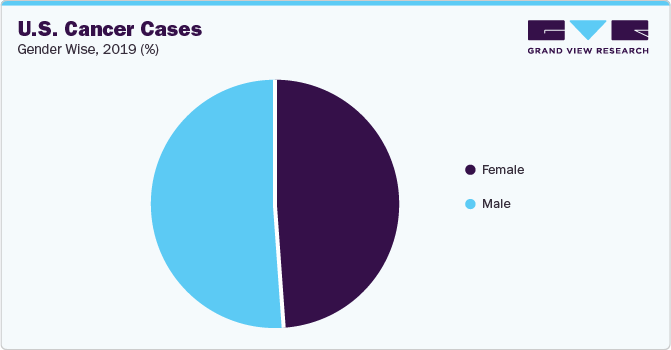

Application Insights

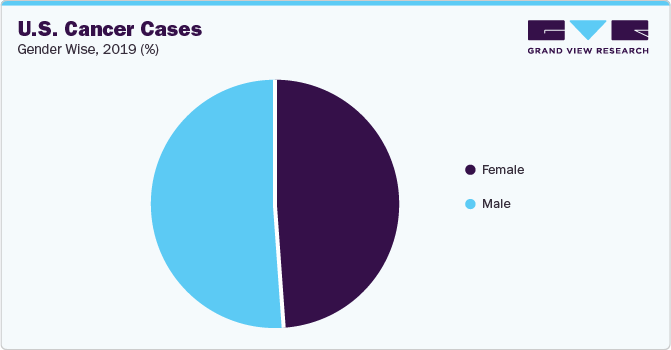

On the basis of application, the market is segmented into cancer, diabetes, renal disease, neurodegenerative disease,genetic disorders, and others. The cancer segment held the largest market share in 2022. Cancer is a prevalent and life-threatening disease with numerous biologics already approved for treatment, creating a substantial opportunity for biobetter development. Additionally, the complex and evolving nature of cancer drives ongoing research and innovation in the development of biobetters aimed at addressing resistance, reducing side effects, and improving overall treatment strategies, making it a key driver for the prominence of cancer in the biobetters market. On the other hand,neurodegenerative disease is expected to show lucrative growth over the forecast period.

Route Of Administration Insights

On the basis of the route of administration, the market is segmented into subcutaneous, oral, inhaledintravenous, and others. The subcutaneous segment held the largest market share in 2022. subcutaneous injections are generally less invasive and more convenient for patients compared to intravenous administration, improving patient compliance and reducing healthcare resource utilization. On the other hand,intravenous is expected to witness lucrative growth over the forecast period.

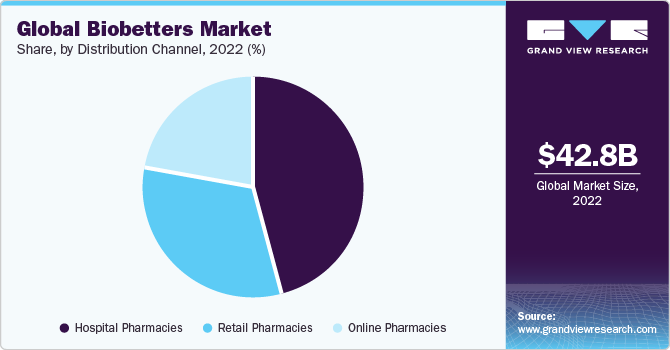

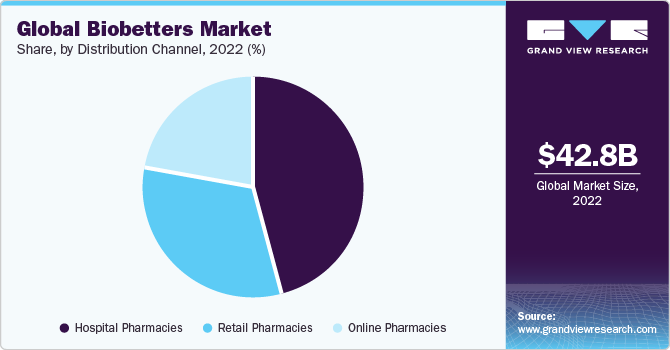

Distribution channel Insights

On the basis of distribution channels, the market is segmented intohospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies dominated the market in 2022 as many biobetters are complex and require specialized storage and handling, which hospital pharmacies are well-equipped to provide. Moreover, hospitals often have established relationships with pharmaceutical manufacturers and are well-positioned to procure and distribute biobetter products, ensuring efficient and safe delivery to healthcare professionals and patients. On the other hand, online pharmacies are expected to witness lucrative growth over the forecast period.

Regional Insights

North America dominated the market in 2022. The region is home to a robust pharmaceutical and biotechnology industry with a long history of innovation and investment in research and development. Moreover, regulatory agencies such as the FDA have introduced pathways for biosimilar and biobetter approval, facilitating the introduction of these products to the market. On the other hand, Asia Pacific is expected to show lucrative growth over the forecast period.

Competitive Insights

Key players operating in the market are Eli Lilly and Company, Amgen Inc., CSL Behring, Novo Nordisk A/S,Merck & Co., Inc. Sanofi, F. Hoffmann-La Roche AG, Pfizer Inc., and Biogen Inc. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain further market avenues. The following are some instances of such initiatives.

In January 2023, Celltrion Healthcare officially filed a biologics license application (BLA) for Remsima SC, a biobetter iteration of their infliximab biosimilar, Remsima, designed for subcutaneous administration.