- Home

- »

- Next Generation Technologies

- »

-

Biometric Payment Cards Market Size Report, 2024 - 2030GVR Report cover

![Biometric Payment Cards Market Size, Share & Trends Report]()

Biometric Payment Cards Market (2024 - 2030) Size, Share & Trends Analysis Report By Card Type (Credit Cards, Debit Cards), By End Use (Retail, Transportation, Healthcare, Hospitality, Government, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-947-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range:

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

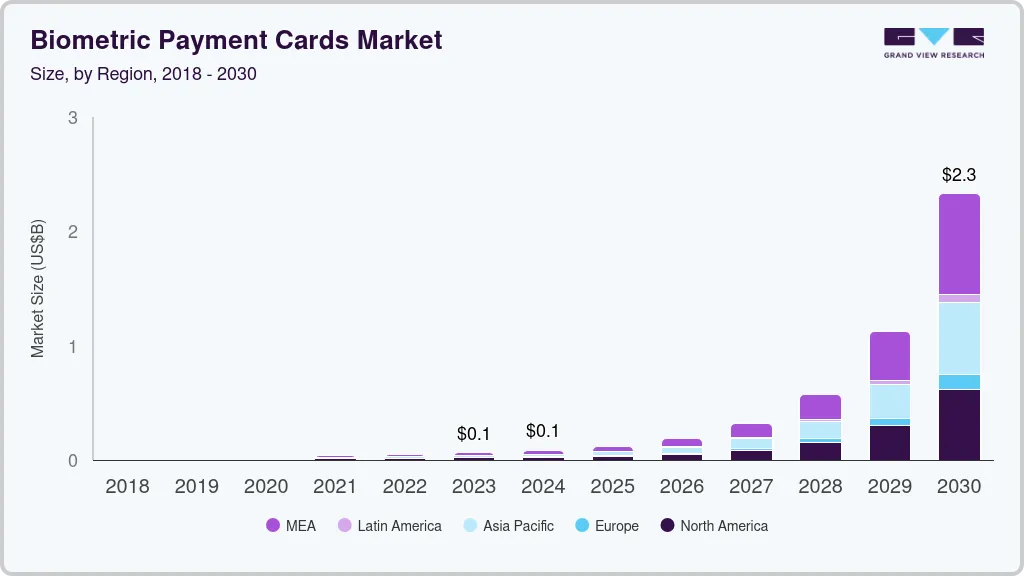

The global biometric payment cards market size was valued at USD 64.1 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 67.1% from 2024 to 2030. The growth of the market can be attributed to the rising technological advancement and global acceptance of the contactless payment method. Biometric payment cards are gaining popularity over the Near Field Communication (NFC) cards due to their higher transaction limit on contactless payment transactions. For instance, the Indian government has restricted NFC card contactless transactions to USD 68.48. Thus, as biometric payment cards have no transaction limits, such as NFC cards, they are replacing NFC cards and are gaining popularity in the market.

The biometric payment cards market is growing because consumers use biometrics to unlock mobile phones, and desire to have a biometric sensor for easy payment processing. According to Visa, amongst the surveyed American consumers in 2017, 65.0% of the consumers were familiar with biometrics, and almost 86.0% of the consumers were interested in making use of biometrics to verify identity and make payments.

The other major factor driving the growth of the biometric payment card is reduced administration. For instance, merchants need to manage the queues, covering administrative expenditures, while using traditional payment methods. However, by utilizing biometric payment cards, as the payments are processed at a faster pace, the queues for payment would be shortened, which cuts the administration costs for the merchants.

Businesses have witnessed the potential of biometric payment cards, which has enabled many banks and financial institutions to integrate with biometric payment providers in order to offer their customers these smart cards. For instance, in April 2022, Zwipe, a biometric payment provider, announced that the National bank of Iraq has selected Zwipe to pilot biometric cards through the Zwipe pay platform. This would be one of the first pilots for next-generation contactless payment cards across Iraq. Such initiatives are boosting the global growth of the market for biometric payment cards.

The increased global adoption of biometric payment cards is another major factor fueling the growth of the market. The players operating in the market are highly involved in launching biometric payment cards. Therefore, such increasing launches of biometric payment cards have augmented the adoption of these smart cards by consumers and merchants. For instance, in 2021, according to IDEMIA, a security company, 81.0% of the total global consumers preferred the use of fingerprint biometric over PIN codes while paying in-stores.

Though the biometric payment card market is surging, the cost attached to these cards is higher, which can act as a challenge and may restrain the market's growth during the forecast period. Another issue with the biometric payment card market is that most companies are still undergoing pilot programs, which raises the question of the actual commercialization of the technology.

However, the charges of the biometric payment card are expected to reduce as the market players are collaborating to reduce costs. For instance, Zwipe and IDEMIA have partnered and are on track to deliver radical unit cost reductions for biometric payment cards by means of offering a single silicon solution.

COVID-19 Impact Analysis

The outbreak of COVID-19 evidenced the sudden rise in global digitization that increased digital and contactless payments. For instance, in 2020, according to Fingerprint Cards, a biometric company, 57.0% of all in-store payments made across the U.K. were contactless payments. The rise in the adoption of such payment methods led to the introduction of biometric payment cards.

The biometric technology used in mobile phones was packed into the debit and credit cards to ensure high security while processing contactless payments, which resulted in the acceptance and adoption of biometric payment cards. Moreover, the increasing adoption of global contactless payment was the primary factor that boosted the growth of biometric payment cards. Thus, the aforementioned factors are responsible for the further growth of the market.

Card Type Insights

The debit cards segment dominated the market in 2021 and accounted for a revenue share of more than 64.0%. The companies operating in the biometric payment cards market are involved in piloting the debit cards, equipped with fingerprint sensors. Also, most of these market players have successfully completed debit card piloting.

For instance, in April 2019, NatWest bank along with visa debit cards launched a three-month national trial with 200 customers. This trial helped to confirm the benefits of biometric debit cards. Additionally, in 2020, according to the study titled Diary of Consumer Payment Choice, the Federal Reserve stated that debit cards were the most widely used payment method across the U.S.

The credit card segment is expected to register the fastest growth during the forecast period, registering a CAGR of 62.7%. Increasing adoption of credit cards by individuals is anticipated to propel segment growth. This adoption is due to multiple reasons, such as earning cash back, availing discounts, and using the leverage offered by the bank, among others.

Furthermore, the banks are launching the piloting of biometric credit cards, which is increasing their adoption. For instance, in October 2019, NatWest announced the piloting of biometric credit cards across the U.K. with 150 customers. NatWest has partnered with MasterCard and Gem alto to bring this service to customers across the U.K.

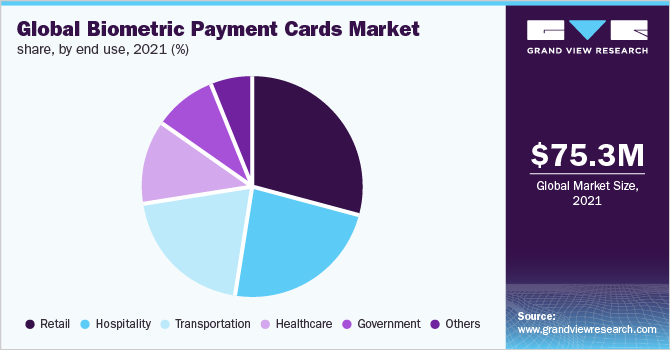

End-Use Insights

The retail segment dominated the market in 2021 and accounted for a revenue share of more than 29.0%. The retail segment is also anticipated to register the fastest growth with a significant CAGR of 63.3% during the forecast period. The retail market has already adopted NFC technology, QR code, and voice payment methods, thereby creating opportunities for segment growth. Additionally, retailers are largely adopting the digital and payment card contactless method.

Besides, to increase the technology's adoption, the market players have partnered with firms to use their retail networks. For instance, in December 2021, Zwipe partnered with Easy Pay, an Indian payment company. Easy Pay has a network of nearly 2 million retailers, which will assist Zwipe in launching its biometric payment cards in India.

The hospitality segment is anticipated to register significant growth throughout the forecast period. Restaurants and hotels have equipped biometric digital payment systems that enable customers to pay directly by utilizing fingerprint scanners. For instance, Hitachi has introduced a fingertip payment system that offers access to payment just by scanning a finger at the machine. Thus, such adoption of advanced payment systems in the hospitality industry is expected to drive the adoption of biometric payment cards as well.

Regional Insights

North America biometric payment cards market accounted for the highest revenue share of more than 35.0% in 2021. The growth of the regional market can be attributed to the presence of a large number of firms operating in the market. In April 2021, according to Visa, more than 70.0% of Visa cards in New York were enabled for contactless payments.

The New York MTA's rollout of contactless to all subways and buses is driving such acceptance. Thus, the increased use of the contactless card as a payment method in North America is expected to create growth opportunities for the regional market.

Asia Pacific is expected to register the fastest growth throughout the forecast period registering a CAGR of 63.6%. Asia-Pacific is home to some of the prominent market players such as Goldpac Fintech. Moreover, market players are set to launch biometric payment cards across Asia Pacific countries.

For instance, in October 2020, MasterCard along with IDEMIA, a security company, and Match Move, a Fintech company, undertook its first pilot of a biometric payment card with a fingerprint sensor to authorize in-store payment transactions across Asia. Such collaborations for piloting and launching biometric payment cards across the Asia Pacific are driving the growth of the segment during the forecast period.

Key Companies & Market Share Insights

The market can be described as a moderately fragmented market. Prominent market players are pursuing various strategies, such as strategic partnerships, product innovations & launches, mergers & acquisitions, and geographical expansion, as part of the efforts to cement their foothold in the market. Players are focusing on launching the biometric payment cards to offer customers a secured contactless payment processing experience; while other players are focusing on piloting the biometric credit and debit cards to instantly introduce the commercialization of these smart cards.

Companies are facing competition in the market and are implanting several strategies to gain market share. Strategic partnerships are the most implemented strategy. The companies are partnering in order to launch biometric payment cards. For instance, In February 2022, Rocker introduced the Rocker Touch, a biometric payment card, in Sweden. Rocker partnered with IDEMIA and IDEX to launch one of the world's first biometric payment cards to consumers. Some of the prominent players in the global biometric payment cards market include:

-

Bio-idz

-

BNP Paribas

-

Goldpac Fintech

-

IDEX Biometrics ASA

-

Infineon Technologies AG

-

MasterCard

-

NXP Semiconductors

-

Thales Group

-

Visa Inc.

-

Zwipe

Biometric Payment Cards Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 84.3 million

Revenue forecast in 2030

USD 2,328.1 million

Growth rate

CAGR of 67.1% from 2024 to 2030

Base year of estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Card type, end-use, region.

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, U.K., China, Japan, India, Brazil

Key companies profiled

Bio-idz; BNP Paribas; Goldpac Fintech; IDEX Biometrics ASA; Infineon Technologies AG; MasterCard; NXP Semiconductors; Thales Group; Visa Inc.; Zwipe

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the global biometric payment cards market report based on card type, end-use, and region.

-

Card Type Outlook (Revenue, USD Million, 2021 - 2030)

-

Credit Cards

-

Debit Cards

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2030)

-

Retail

-

Transportation

-

Healthcare

-

Hospitality

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global biometric payment cards market size was estimated at USD 75.3 million in 2021 and is expected to reach USD 90.5 million in 2022.

b. The global biometric payment cards market is expected to grow at a compound annual growth rate of 62.3% from 2022 to 2030 to reach USD 4,345.8 million by 2030.

b. North America dominated the biometric payment cards market with a share of 35.4% in 2021. The growth of the regional market can be attributed to the presence of a large number of firms operating in the biometric payment cards market.

b. Some key players operating in the biometric payment cards market include bio-idz; BNP Paribas; Goldpac Fintech; IDEX Biometrics ASA; Infineon Technologies AG; Mastercard; NXP Semiconductors; Thales Group; Visa Inc.; and Zwipe.

b. Key factors that are driving the biometric payment cards market growth include increasing contactless payment use across the world and increasing government initiatives to promote digital payments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.