- Home

- »

- Medical Devices

- »

-

Biosensors Market Size, Share, Growth, Industry Report 2033GVR Report cover

![Biosensors Market Size, Share & Trends Report]()

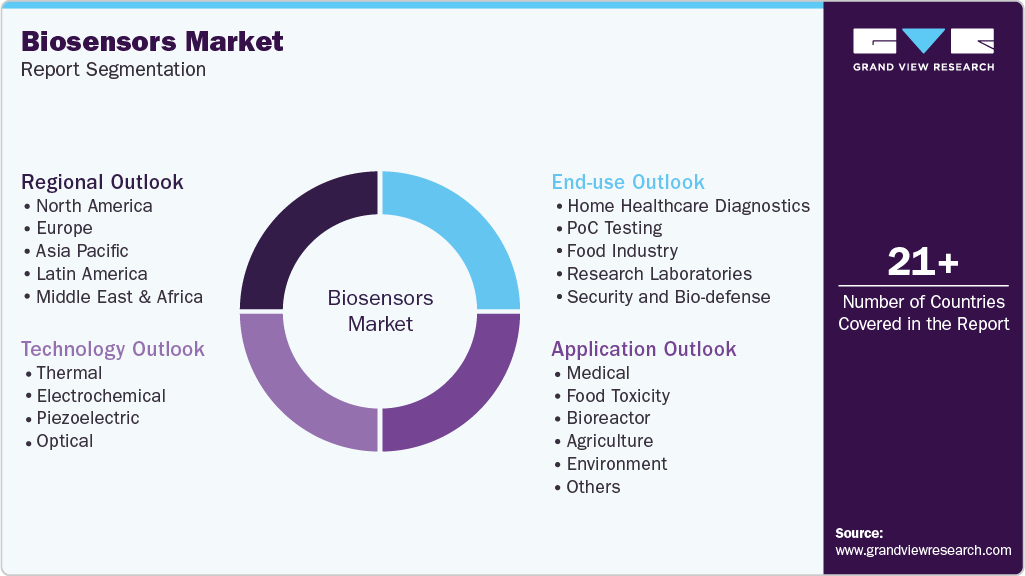

Biosensors Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Electrochemical, Thermal, Piezoelectric), By Application (Medical, Bioreactor, Agriculture), By End Use (PoC Testing, Food Industry), By Region, And Segment Forecasts

- Report ID: 978-1-68038-321-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biosensors Market Summary

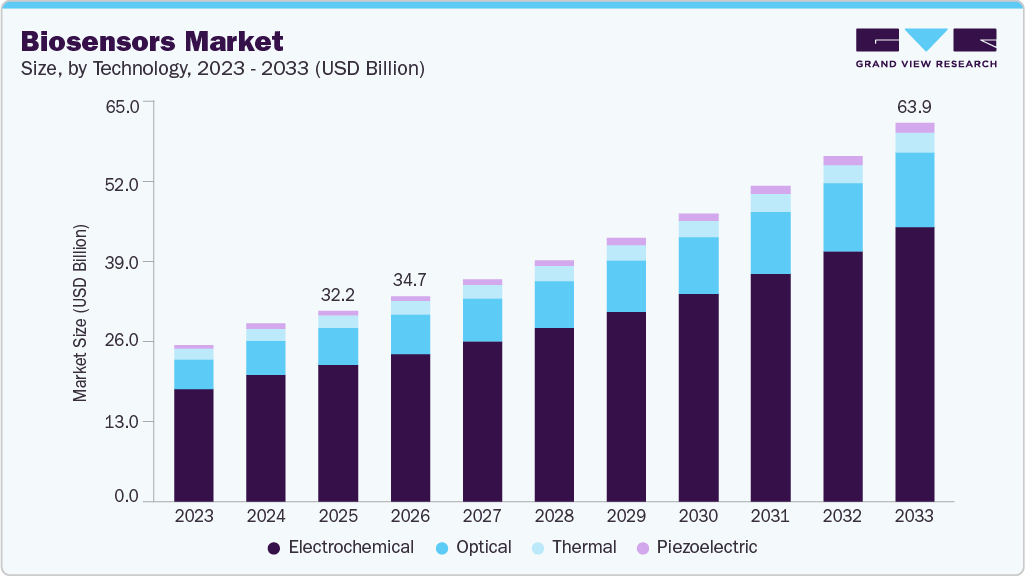

The global biosensors market size was estimated at USD 32.21 billion in 2025 and is projected to reach USD 63.96 billion by 2033, growing at a CAGR of 9.12% from 2026 to 2033. The demand for biosensors is increasing due to the diversity of medical applications, growing prevalence of chronic and non-communicable diseases such as diabetes and hypertension, high demand for compact diagnostic devices, and rapid technological advancements.

Key Market Trends & Insights

- Asia Pacific biosensors industry is expected to grow at the fastest CAGR from 2026 to 2033.

- North America biosensors industry held the largest global revenue share of 42.58% in 2025.

- The U.S. biosensors industry held the largest market share in North American region in 2025.

- By technology, the electrochemical segment held the largest market share of 71.59% in 2025.

- By end use, the Point-of-Care (PoC) segment is anticipated to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 32.21 Billion

- 2033 Projected Market Size: USD 63.96 Billion

- CAGR (2026-2033): 9.12%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The increasing demand for health monitoring and fitness tracking, coupled with rising interest in personalized digital wellness, is a primary driver in the growth of the market. In addition, nanotechnology-based biosensors are expected to have wide application scope in various industries, such as food analysis, imaging, and microbial activity monitoring. The global market is consolidating due to the growing preference for non-invasive wearable biosensors, rising popularity of medical devices & specialty drugs, and increasing research collaborations between various manufacturers.Moreover, biosensors enable continuous, real-time monitoring of physiological metrics such as heart rate, sleep patterns, blood oxygen saturation, and steps taken, providing actionable data for consumers and healthcare professionals. For instance, according to an article published by the University of Arizona Health Sciences in June 2025, advanced sensor platforms use deep learning models to predict physiological events, including labor onset and stress response, from high-frequency biometric data. These devices serve as an early warning system to detect health risks prior to symptom onset. This approach transforms health management from episodic to proactive intervention, reducing the burden of late diagnoses and emergency care.

Similarly, the Cardiosense CardioTag is a significant example of this trend. It is an FDA-cleared, multimodal wearable sensor for cardiac monitoring, combining ECG (electrocardiogram), PPG (photoplethysmogram), and SCG (seismocardiogram) signals. It leverages advanced AI algorithms to analyze these high-fidelity signals for early heart failure detection, comprehensive cardiac assessment, and personalized therapy guidance, enabling noninvasive measurement of cardiac mechanics, hemodynamics (such as left ventricular ejection time), and volume status in both clinical and home settings.

Furthermore, advances in artificial intelligence, machine learning, and sensor miniaturization have significantly enhanced the functionality and accuracy of wearable devices. Integration of AI algorithms enables real-time data processing, predictive analytics, and personalized feedback. In patient management, Medtronic’s edge AI-enabled insulin delivery systems demonstrate clinical-grade, real-time decision-making by fusing biosensor streams for dynamic insulin dose adjustment. This system highlights the capability of AI-enabled wearables to deliver responsive, personalized interventions without requiring external connectivity, thereby supporting precision medicine in ambulatory settings. In addition, smart rings are gaining traction due to improved measurement accuracy from finger-based sensors and enhanced comfort for 24-hour wear.

Furthermore, increasing partnerships and collaborations withing the industry contribute to market growth. For instance, partnerships between French firms and global startups, such as Livingston’s collaboration for biosensors and wearables in June 2025, enable scalable production and global market reach. This expansion supports personalized fitness, wellness, and lifestyle applications, reflecting increasing adoption among fitness enthusiasts and urban consumers.

“The diagnostics industry has changed post COVID, wearable technology has risen up the agenda, along with AI having an increasing impact, and we think the collaboration with Linxens will keep us ahead of the curve while significantly improving our market reach.”-Kevin Fallon, FlexMedical’s CEO and co-founder,

“This collaboration expands our biosensor portfolio by integrating functionalisation capabilities, enabling us to deliver end-to-end solutions - from flex-PCB or printed electrodes to fully functional sensor platforms. Together, we streamline the journey from R&D to mass production, accelerating the delivery of innovative diagnostic solutions.”

-Minh Le, vice-president of Linxens Healthcare

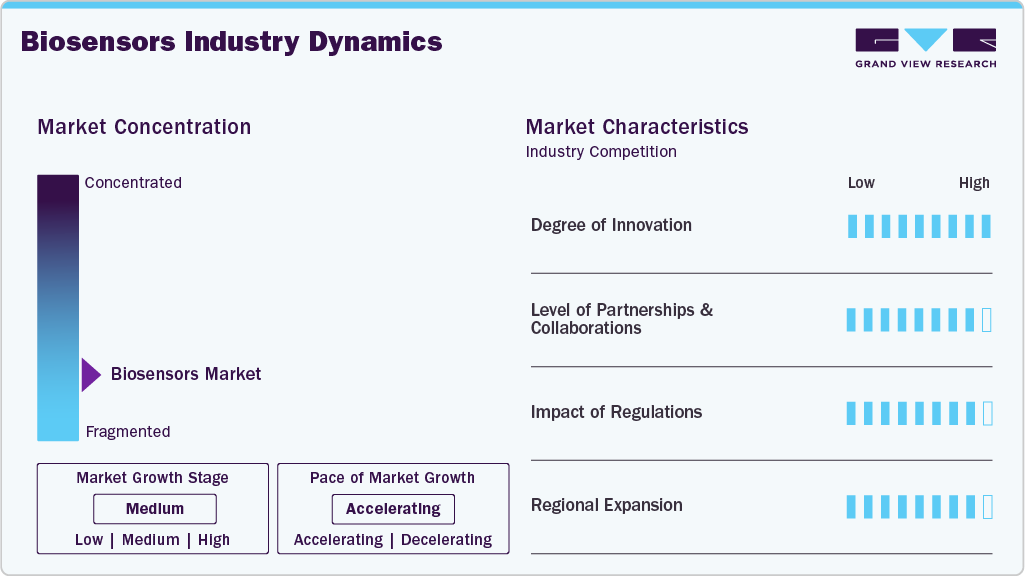

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations, degree of innovation, impact of regulations, and regional expansion. The biosensors industry is fragmented. Several emerging players are entering the market, thereby contributing to increased fragmentation within the market. The degree of innovation, the level of partnerships & collaborations, the impact of regulations, and the regional expansion of industry is high.

The biosensors industry is characterized by constant innovation. Biosensors have made rapid advances in the medical field due to their ability to meet various criteria through a combination of interdisciplinary approaches in chemistry, nanotechnology, and medicine. For instance, the Ring AIR by Ultrahuman Healthcare Pvt Ltd. is a sleek, lightweight health tracker, designed for continuous, passive biometric monitoring. Featuring advanced sensors including infrared photoplethysmography (PPG), non-contact medical-grade skin temperature sensors, and 6-axis motion sensors, the Ring AIR measures heart rate, heart rate variability (HRV), blood oxygen saturation, skin temperature, movement, and sleep quality.

The industry is experiencing a high level of partnerships & collaborations undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in November 2024, Dexcom and ŌURA announced a strategic partnership to integrate Dexcom glucose biosensor data with vital sign, sleep, stress, and activity metrics from the Oura Ring.

Regulations, such as the HIPAA in the U.S. and the GDPR in Europe, establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

The industry is witnessing high geographical expansion. Companies within the biosensors industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. For instance, in June 2025, Huawei launched Band 10 in India, featuring advanced health and fitness tracking, AI-powered swim stroke and lap recognition (with 95% accuracy), Pro-Level sleep analysis, and an emotional well-being assistant.

Technology Insights

Based on technology, the electrochemical segment held the largest market share of 71.59% in 2025, owing to its ubiquitous use in biochemical and biological processes for measurement and analysis. For instance, AccuChek SmartGuide by F. Hoffmann-La Roche Ltd. It is an advanced continuous glucose monitoring (CGM) system featuring real-time, AI-enabled predictive analytics for diabetes management. The sensor provides accurate glucose readings every five minutes for up to 14 days, connecting wirelessly to the SmartGuide apps (monitoring and prediction).

The optical segment is expected to grow at the fastest CAGR during the forecast period. Optical biosensors are increasingly adopted for point-of-care testing due to their ability to provide real-time results with high accuracy, making them essential in critical care and emergency settings. The segment is experiencing robust growth, driven by the rising prevalence of chronic diseases and the demand for efficient monitoring systems.

Application Insights

Based on application, the medical segment accounted for the largest revenue share of 66.84% in 2025. Biosensors are used in the fields of cholesterol testing, blood glucose monitoring, drug discovery, pregnancy testing, blood gas analyzer, and infectious disorders in the medical segment. These devices are critical for point-of-care diagnostics, chronic disease monitoring, and real-time health tracking, supporting early intervention and personalized care. For instance, Signos Inc.’s Signos is an FDA-cleared metabolic health platform that combines a continuous glucose monitor (CGM) and an AI-powered app, designed for weight management and personalized healthy living. It uses a 15-day Dexcom Stelo glucose biosensor to deliver real-time continuous glucose data directly to your smartphone, enabling round-the-clock monitoring.

The agriculture segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by the need for precision farming, sustainable practices, and real-time monitoring of crop and soil health. Biosensors enable farmers to detect pathogens, monitor nutrient levels, optimize irrigation, and manage pesticide use, leading to improved yields and reduced environmental impact. These devices are also critical for ensuring food safety by detecting contaminants and toxins in agricultural produce. The integration of IoT and smart farming technologies further enhances the utility and scalability of biosensors in modern agriculture. In January 2025, Classiq and Florence Quantum Labs collaborated to develop quantum-enhanced biosensors and AI-quantum hybrid algorithms for precision agriculture. Their work focuses on real-time soil health diagnostics, nutrient management, and ecosystem modeling, aiming to advance sustainable farming and global food security through scalable, climate-smart solutions.

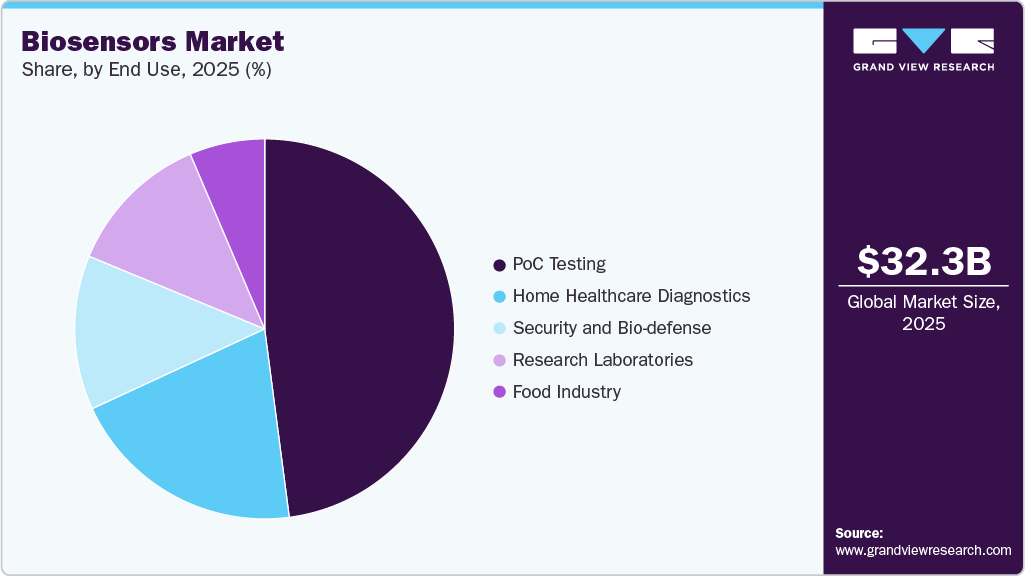

End Use Insights

Based on end use, the Point-of-Care (PoC) segment held the largest market share of 47.93% in 2025. In addition, this segment is anticipated to grow at the fastest CAGR during the forecast period. Key factors driving segment growth include technological advancements that create innovative products, such as ultra-sensitive printable biosensors for PoC applications that help detect or monitor organic fluids like urine, saliva, blood, and sweat. For instance, in August 2022, NanoDx, Inc., a developer of innovative medical diagnostic solutions, and SkyWater Technology announced the first commercially available protein-responsive nano biosensor.

The research laboratories segment is anticipated register a significant CAGR from 2026 to 2033. The research laboratories segment is a key end use in the biosensors industry, driving demand for advanced analytical platforms for drug discovery, biomarker identification, and disease research. These labs utilize biosensors for high-throughput screening, monitoring cell cultures, and validating new diagnostic assays, which accelerates the pace of scientific innovation. For instance, in December 2025, Monod Bio and Gator Bio partnered to integrate Monod’s AI-designed NovoBody binding proteins into Gator’s biolayer interferometry (BLI) biosensor platform. This collaboration advances next-generation biosensors for life science research, offering enhanced stability and performance compared to traditional antibodies.

Regional Insights

North America biosensors industry accounted for the largest revenue share of 42.58% in 2025. This is attributed to the high prevalence of chronic diseases, strong reimbursement frameworks, and rapid integration of advanced technologies such as AI and machine learning into digital health ecosystems. The U.S. leads with significant FDA clearances for AI-powered diagnostic and therapeutic devices, ensuring regulatory support for innovation. Moreover, rising collaborations between technology companies and healthcare providers further fuel innovation. For instance, in October 2024, Penn State received a USD 1.5 million NSF grant to develop AI-designed biosensors, aiming to systematically identify optimal materials for biosensing applications and accelerate device development.

U.S. Biosensors Market Trends

The U.S. biosensors industry held the largest market share in 2025. The country has witnessed a surge in approvals for wearable medical devices, reflecting robust innovation in healthcare technology. For instance, In May 2025, RingConn launched its Gen 2 Smart Ring for sleep apnea monitoring at Target.com, marking its U.S. retail debut. The slim, lightweight ring offers 10-12 days of battery life, real-time sleep health insights, and AI-driven personalized coaching. It tracks heart rate, SpO₂, skin temperature, activity, stress, and menstrual cycles, providing actionable recommendations to improve sleep and manage apnea.

Europe Biosensors Market Trends

Europe biosensors industry is expected to witness significant growth during the forecast period. This is attributed to the widespread adoption of biosensor technologies in healthcare and increasing investments by government and private organizations. Moreover, integrating 5G with healthcare drives Europe's market by enabling faster, more reliable connectivity for advanced sensor technologies.

The UK biosensors industry is expected to grow over the forecast period, owing to the robust healthcare infrastructure and increasing investments in AI technologies to enhance medical diagnosis and patient care. For instance, according to the two studies published in January 2023, researchers from University College London (UCL) used wearable motion sensors and AI to track progression in movement disorders, including Friedreich's ataxia and Duchenne muscular dystrophy. This technology identifies disease-specific movement patterns, predicts disease progression, and enhances trial efficiency and precision, enabling faster drug development, particularly for rare conditions with small patient populations.

Germany biosensors industry held the largest revenue share in 2025 in the European market, attributed to increasing investments in healthcare technology and robust healthcare infrastructure. In addition, favorable government initiatives, coupled with the country’s focus on integrating AI into nationwide healthcare, environmental, and agriculture systems, propel market growth further.

Asia Pacific Biosensors Market Trends

Asia Pacific biosensors industry is expected to grow at the fastest CAGR in the coming years. Rapid improvements in healthcare infrastructure, rising prevalence of chronic diseases, and increased demand for point-of-care diagnostics are key drivers of growth. Countries such as China, India, and Japan are making substantial investments in biotechnology, digital health, and medical device manufacturing, accelerating biosensor adoption in both clinical and consumer applications.

India biosensors industryis expanding rapidly. Rising prevalence of chronic diseases, demand for point-of-care diagnostics, and investments in healthcare infrastructure are key drivers of market expansion. The government’s focus on digital health initiatives and medical device manufacturing further accelerates adoption across hospitals, clinics, and research centers.

The Japan biosensors industry is driven by the country’s advanced digital infrastructure and rapidly aging population, creating demand for health monitoring and assisted living solutions. AI-enabled fitness bands, and medical-grade wearables are increasingly deployed for remote monitoring of elderly patients, fall detection, and chronic disease management.

Latin America Biosensors Market Trends

Latin America biosensors industry is anticipated to grow at a significant CAGR over the forecast period. This is attributed to the rising incidence of diabetes, cardiovascular disorders, and infectious diseases. Demand is concentrated in glucose monitoring, immunoassays, and point-of-care diagnostics. Improving healthcare access in urban centers supports adoption.

Middle East And Africa Biosensors Market Trends

Middle East and Africa biosensors industry is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by the growing adoption of technologically advanced medical devices, increasing healthcare expenditures and supportive government policies. Significant integration of AI in healthcare technology across the region contributes to market growth further.

Key Biosensors Company Insights

Key players operating in the biosensors industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key Biosensors Companies:

The following are the leading companies in the biosensors market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Medtronic

- Biosensors International Group

- Pinnacle Technology, Inc.

- Dupont.

- Sensirion AG

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche

- Siemens Healthineers

- Zimmer & Peacock AS

- Metrohm AG

- DexCom, Inc.

- Universal Biosensors, Inc.

- Johnson & Johnson Services, Inc.

- Nix Biosensors

- Cyrcadia Health

- Lifescan

Recent Developments

-

In August 2025, Levels launched Stelo, the first FDA-cleared glucose biosensor available in the U.S. without a prescription, making continuous glucose monitoring accessible to the general public.

-

In June 2025, Nix Biosensors expanded to Great Britain, Ireland, and Wales, launching its wearable hydration technology for direct-to-consumer purchase. The Nix Hydration Biosensor utilizes AI-enabled sweat analysis to deliver real-time, personalized hydration recommendations, enabling athletes, laborers, and health-conscious individuals to optimize their fluid and electrolyte intake for enhanced performance, recovery, and safety.

-

In November 2024, STMicroelectronics launched the ST1VAFE3BX, a highly integrated biosensor chip for next-generation healthcare wearables, combining biopotential sensing, motion tracking, and embedded AI. The chip enables advanced monitoring of heart, brain, and muscular activity in compact devices, supporting ECG, EEG, and other vital sign measurements with low power consumption.

“Wearable electronics is the critical enabling technology for the upsurge in individual health awareness and fitness. Today, everyone can have heart-rate monitoring, activity tracking, and geographical location on their wrist. “Our latest biosensor chip now raises the game in wearables, delivering motion and body-signal sensing in an ultra-compact form-factor with frugal power budget.”

- Simone Ferri, APMS Group VP, MEMS Sub-Group General Manager at STMicroelectronics

-

In September 2024, Abbott launched Lingo, an over-the-counter continuous glucose monitoring (CGM) biosensor, available in the U.S. and U.K. without a prescription. Lingo features a 14-day wearable biosensor and a mobile app that provides real-time glucose tracking, personalized insights, and habit coaching for non-insulin users.

“There is a great deal of interest in tracking biomarkers that provide insights into one’s health and wellness that were previously undetectable using the trackers available to consumers. Glucose is a powerful signal of your body’s unique response to food and lifestyle. Abbott’s Lingo tracks your glucose 24/7, translating the data into insights and bridging the gap between traditional healthcare and preventative measures. Lingo empowers individuals to build new healthy habits and take control of their health and wellness.”

- Olivier Ropars, divisional VP of Abbott’s Lingo business

-

In August 2024, Signos launched the first FDA-cleared over-the-counter glucose monitoring system for weight management, combining Dexcom’s Stelo biosensor with an AI-powered platform.

-

In April 2024, Philips and smartQare partnered to integrate smartQare’s viQtor platform with Philips’ clinical monitoring systems, enabling continuous patient monitoring both in and out of hospitals. The collaboration combines Philips’ Healthdot wearable biosensor with smartQare’s monitoring solution to create a unified, open ecosystem, enabling seamless data sharing and the flexible use of third-party devices.

-

In March 2021, FOx Biosystems launched the White FOx, a new generation biosensor using fiber-optic surface plasmon resonance (SPR). It features a fluidics-free dip-in protocol, eliminating clogging risks associated with complex samples, such as lysates or whole blood.

Biosensors Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 34.71 billion

Revenue forecast in 2033

USD 63.96 billion

Growth rate

CAGR of 9.12% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott Laboratories; Medtronic; Biosensors International Group; Pinnacle Technology, Inc.; Dupont; Sensirion AG; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche AG; Siemens Healthineers; Zimmer & Peacock AS; Metrohm AG; DexCom, Inc.; Universal Biosensors, Inc.; Johnson & Johnson Services, Inc.; Nix Biosensors; Cyrcadia Health; Lifescan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biosensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biosensors market report based on technology, application, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Thermal

-

Electrochemical

-

Piezoelectric

-

Optical

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical

-

Cholesterol

-

Blood Glucose

-

Blood gas analyzer

-

Pregnancy testing

-

Drug discovery

-

Infectious disease

-

-

Food Toxicity

-

Bioreactor

-

Agriculture

-

Environment

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Home Healthcare Diagnostics

-

PoC Testing

-

Food Industry

-

Research Laboratories

-

Security and Bio-defense

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biosensors market size was estimated at USD 32.21 billion in 2025 and is expected to reach USD 34.71 billion in 2026.

b. The global biosensors market is expected to grow at a compound annual growth rate of 9.12% from 2026 to 2033 to reach USD 63.96 billion by 2033.

b. The electrochemical segment dominated the global biosensors market and accounted for the largest revenue share of 71.59% in 2025.

b. The POC testing segment dominated the global biosensors market and accounted for the largest revenue share of around 47.93% in 2025.

b. The medical segment dominated the global biosensors market and accounted for the largest revenue share of 66.84%.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.