- Home

- »

- Medical Devices

- »

-

Biosensors Market Size, Share And Trends Report, 2030GVR Report cover

![Biosensors Market Size, Share & Trends Report]()

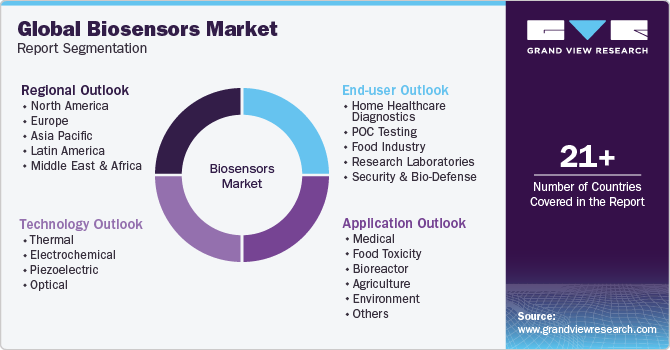

Biosensors Market Size, Share & Trends Analysis Report By Technology (Electrochemical, Thermal, Piezoelectric), By Application By End-user, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-321-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Biosensors Market Size & Trends

The global biosensors market size was estimated at USD 28.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. The demand for biosensors is increasing due to the diversity of medical applications, increasing number of diabetic patients, high demand for compact diagnostic devices, and rapid technological improvement.Accurate early diagnosis of the disease is critical to a positive disease prognosis and patient survival. Demand for disposable, convenient, and economical devices with fast response times has increased dramatically in recent years. The emergence of COVID-19 had a positive impact on the medical device industry. Early symptoms of COVID-19 were scanned using a variety of methods.

The biosensors market is on the verge of substantial expansion, driven by noteworthy technological advancements and strategic endeavors by key market players. For instance, in January 2023, Intricon, a developer and manufacturer of medical devices leveraging smart miniaturized electronics, made a significant stride by inaugurating a Biosensors Center of Excellence (CoE). This strategic move highlights Intricon's commitment to integrating its expertise and capabilities in a vertically integrated business unit devoted to introducing biosensor devices to the medical market. Combining technological innovation with a specific focus drives positive growth in the biosensors market.

Nanotechnology-based biosensors are expected to have wide application scope in various industries, such as food analysis, imaging, and microbial activity monitoring. The global market is consolidating due to the growing preference for non-invasive biosensors, rising popularity of medical devices & specialty drugs, and increasing research collaborations & contracts between various manufacturers. For example, Ethicon Endo-Surgery Inc.under contracts administered by Johnson & Johnson Innovation. Another important factor boostingindustry growth is the rising awareness about continuous health monitoring. As a result, the interest of athletes is increasing. Many athletes use Electromyography (EMG) biosensors to keep a close eye on their health and get alerts if something goes wrong.

This early detection can help athletes perform better and stay ahead of their competition. For example, in December 2022, biosensor company Nix launched its first consumer product, Nix Hydration Biosensor. The Hydration Nix Biosensor consists of a Bluetooth-enabled reusable module, a mobile app, and a single-use patch.Despite these considerations, the global market is expected to be constrained by strict regulations and complex cost recovery policies in the global healthcare sector. In addition, existing regulations are slow to adapt to new technologies, hindering product adoption and limiting industry development. The global biosensors market growth is projected to be driven by government programmes focused on the development of proteomics and genomics.

National Information and Communication Technology Australia (NICTA), for example, is projected to expand its data mining, networks, and embedded systems research in this subject. The majority of IT firms are also heavily investing in this sector. Market growth is also driven by investments from major IT companies, such as IBM, Infosys, and TCS. Furthermore, the Chinese government is heavily investing in its computing infrastructure, primarily through the China Grid, which was launched by the Chinese Academy of Sciences, the Ministry of Education, and the China National Grid (CNGrid), supported by the Ministry of Science & Technology. The presence of such beneficial initiatives is projected to boost the market growth.

However, the biosensors market encounters significant challenges, including the necessity for developing compatible single-task tools alongside existing software. The market growth is hindered by a substantial volume of data lacking standardization, impeding seamless integration. There is a crucial demand for user-friendly databases to streamline the analysis of extensive data held by institutions and governments globally, reducing both effort and time.

Market Concentration & Characteristics

Biosensors have made rapid advances in the medical field due to their ability to meet various criteria through a combination of interdisciplinary approaches in chemistry, nanotechnology, and medicine. The market growth is influenced by a number of factors that affect industry dynamics in both positive and negative ways. Furthermore, consumers are being urged to use biosensors for regular detection of pathogenic activities in the body due to the prevalence of chronic and lifestyle-related ailments, which is projected to drive product demand.

The application of biosensors is increasing due to growing elderly population worldwide and availability & affordability in conducting diagnostic tests. Diagnostic laboratories require various skills to test hundreds of samples per day; thus, the introduction of new-age biosensors will drive segment growth. For instance, in January 2023, researchers from the National Institute of Standards and Technology (NIST), Brown University, and CEA-Leti developed a diagnostic biosensor chip to offer accurate and inexpensive DNA biomarker identification. The key differential in the biomarker chip is its modular design, which allows manufacturers to lower the manufacturing cost.

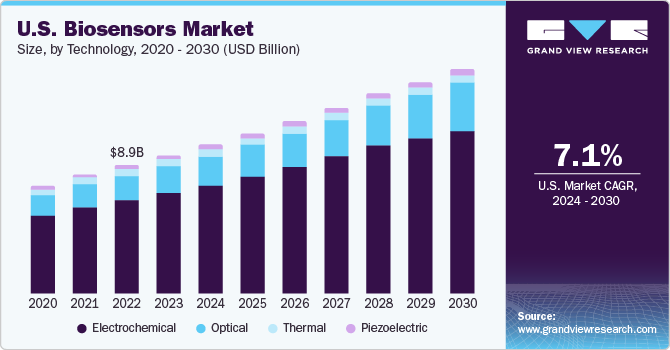

Technology Insights

Based on technology, the industry is categorized into piezoelectric, electrochemical, thermal, and optical. The electrochemical segment captured the largest market share of around 71.5% in 2023 and is expected to grow at the fastest CAGR of 8.2% from 2024 to 2030. This is due to its ubiquitous use in biochemical and biological processes for measurement and analysis. Low detection limits, wide linear response range, excellent stability, and repeatability are all advantages of electrochemical biosensors. Electrochemical detection has a number of advantages over piezoelectric, thermal, and optical detection, resulting in higher market penetration and consumption.

Robustness, compatibility with new microfabrication technologies, ease of operation, low cost, disposability, independence from sample turbidity, and low power needs are among a few benefits. The optical segment is expected to witness the fastest CAGR from 2024 to 2030. The need for optical biosensors in the analysis is predicted to increase throughout the forecast period owing to their broad analytical coverage. Receptor-cell interactions, fermentation monitoring, structural research, concentration, kinetic, and equilibrium analyses are all possible with optical biosensors. The market for optical biosensors is expected to grow as a result of these factors.

Application Insights

Based on applications, the industry is segmented into bioreactor, medical, agriculture, environment, food toxicity, and others. In 2023, the medical segment dominated the industry and accounted for around 66.8% of the total revenue share. Biosensors are used in the fields of cholesterol testing, blood glucose monitoring, drug discovery, pregnancy testing, blood gas analyzer, and infectious disorders in the medical segment. It is regarded as a vital instrument in the identification and monitoring of a wide range of medical diseases, including diabetes and cancer.The agriculture segment will register the fastest CAGR of 9.1% from 2024 to 2030.

In comparison to traditional techniques used to prevent the loss of livestock and crops due to natural threats and bioterrorism, biosensors allow rapid and specific identification of numerous funguses. Pesticides, heavy metals, and herbicides, as well as pesticides in the ground and soil water, are measured with this instrument. These are also utilized to predict the emergence of soil disease, which was previously impossible with conventional technology, and thus, provide dependable, improved methods for soil disease cleanup and prevention at an early stage. These factors boost the market’s expansion.

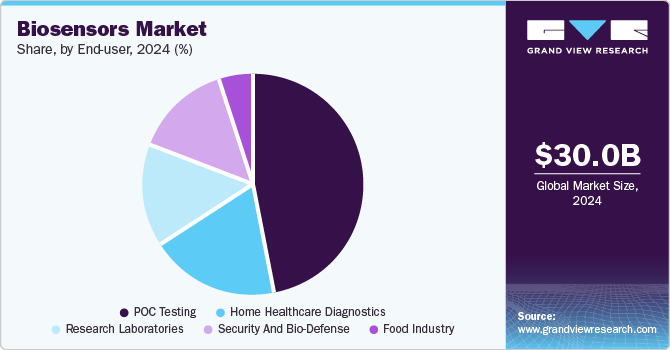

End-user Insights

The end-user segment includes research laboratories, the food industry, home healthcare diagnostics and security POC testing, and bio-defense. Biosensors in point-of-care testing led the market in 2023 accounting for a revenue share of 47.3%. Key factors driving the segment growth include technological advancements that create innovative products, such as ultra-sensitive printable biosensors for PoC applications that help detect or monitor organic fluids like urine, saliva, blood, and sweat.

For instance, in August 2022, NanoDx, Inc., a developer of innovative medical diagnostic solutions, and SkyWater Technology announced the first commercially available protein-responsive nano biosensor. The food industry segment is anticipated to witness the fastest CAGR of 9.1% from 2024 to 2030. Its capacity to tackle many issues in the food processing sector, such as minimizing expenses incurred during hygiene analysis by precise tests and offering speedy findings, are key elements contributing to its rapid growth. There are some potential application areas of biosensors in the food industry including fast analysis of food to keep the product freshness and raw material inspections on a regular basis.

Regional Insights

North America held the largest share of more than 39.60% of the revenue in 2023 owing to the presence of key players and high incidence of targeted diseases in the region. Over the projected period, technological improvements, such as the introduction of miniaturized diagnostic equipment that provides increased market penetration of Electronic Medical Records (EMR), as well as precise & quick findings, are expected to fuel market expansion. Furthermore, the Clean Air Act, Clean Water Act, and National Environmental Policy Act all exist in the U.S. and are projected to create growth possibilities for the regional market.

Middle East and & Africa is expected to witness the fastest CAGR of 12.1% from 2024 to 2030. The presence of significant unmet medical requirements for target diseases, such as cancer, diabetes, and other infectious diseases, as well as continuously improving healthcare expenditure in the region and increasing patient awareness, drive the regional market growth. Increasing demand for home healthcare, PoC, and other healthcare businesses serving the adult population and government efforts to reduce hospital stays through the creation of outpatient care models are likely to drive market growth.

Key Biosensors Company Insights

The market is highly competitive. Key players focus on various strategic initiatives, such as new product launches, geographical expansions, mergers & acquisitions, collaborations, product upgradations, and partnerships, to gain higher industry share.

Some of the key players operating in the market include Bio-Rad Laboratories Inc.; Medtronic; Abbott Laboratories; Biosensors International Group, Ltd.; Johnson & Johnson; Koninklijke Philips N.V.; Nova Biomedical; and Siemens Healthcare.

-

Medtronic is a global health solutions company engaged in the development, manufacturing, distribution, and commercialization of device-based medical therapies and services. Organized into four segments—minimally invasive therapies, cardiac & vascular group, restorative therapies, and diabetes group—Medtronic operates globally with a presence in over 370 locations across approximately 160 countries. The company's products find applications in surgical centers, hospitals, home care, and long-term care facilities. Medtronic utilizes direct representatives in the U.S. and employs independent distributors and direct marketing methods in international markets to market its diverse range of medical solutions.

-

Abbott is a prominent global healthcare company dedicated to the development, manufacturing, and commercialization of healthcare products worldwide. The company operates through four key segments: pharmaceutical products, diagnostic products, nutritional products, and medical devices. Additionally, Abbott is a leading provider of blood glucose monitoring systems. With a widespread global presence, Abbott conducts operations in over 160 countries, emphasizing its commitment to addressing healthcare needs on a global scale. Notably, Abbott's subsidiary, St. Jude Medical, contributes to the company's diverse portfolio and overall impact in the healthcare industry.

Key Biosensors Companies:

The following are the leading companies in the biosensors market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these biosensors companies are analyzed to map the supply network.

- Bio-Rad Laboratories Inc.

- Medtronic

- Abbott Laboratories

- Biosensors International Group, Ltd.

- Pinnacle Technologies Inc.

- Ercon, Inc.

- DuPont Biosensor Materials

- Johnson & Johnson

- Koninklijke Philips N.V.

- LifeScan, Inc.

- QTL Biodetection LLC

- Molecular Devices Corp.

- Nova Biomedical

- Molex LLC

- TDK Corp.

- Zimmer & Peacock AS

- Siemens Healthcare

Recent Developments

- In January 2023, Intricon Corporation announced the opening of a Bionsensor Center of Excellence (CoE). The center aims to vertically integrate the company’s business to provide biosensors in medical devices.

Biosensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.29 Billion

Revenue forecast in 2030

USD 49.78 Billion

Growth rate

CAGR of 8.04% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in unit, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Belgium; Switzerland; The Netherlands; Sweden; Norway; Denmark; Japan; China; India; Australia; South Korea; Thailand; Indonesia; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE; Turkey; Kuwait

Key companies profiled

Bio-Rad Laboratories Inc.; Medtronic; Abbott Laboratories; Biosensors International Group, Ltd.; Pinnacle Technologies Inc.; Ercon, Inc.; DuPont Biosensor Materials; Johnson & Johnson; Koninklijke Philips N.V.; LifeScan, Inc.; QTL Biodetection LLC; Molecular Devices Corp.; Nova Biomedical; Molex LLC; TDK Corp.; Zimmer & Peacock AS; Siemens Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biosensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the biosensors market report on the basis of technology, application, end-user, and region:

-

Technology Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

-

Thermal

-

Electrochemical

-

Piezoelectric

-

Optical

-

-

Application Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

-

Medical

-

Cholesterol

-

Blood Glucose

-

Blood Gas Analyzer

-

Pregnancy Testing

-

Drug Discovery

-

Infectious Disease

-

-

Food Toxicity

-

Bioreactor

-

Agriculture

-

Environment

-

Others

-

-

End-user Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

-

Home Healthcare Diagnostics

-

POC Testing

-

Food Industry

-

Research Laboratories

-

Security and Bio-Defense

-

-

Regional Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Switzerland

-

The Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Turkey

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biosensors market size was estimated at USD 28.9 billion in 2023 and is expected to reach USD 31.29 billion in 2024.

b. The global biosensors market is expected to grow at a compound annual growth rate of 8.04% from 2024 to 2030 to reach USD 49.78 billion by 2030.

b. The electrochemical segment dominated the global biosensors market and accounted for the largest revenue share of 71.5% in 2023.

b. The POC testing segment dominated the global biosensors market and accounted for the largest revenue share of around 47.3% in 2023.

b. The medical segment dominated the global biosensors market and accounted for the largest revenue share of 66.8%.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product

1.2.2. Application

1.2.3. End-use

1.2.4. Regional scope

1.2.5. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Application outlook

2.2.3. End-use outlook

2.2.4. Regional outlook

2.3. Competitive Insights

Chapter 3. Biosensors Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.3. Biosensors Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. Biosensors Market: Technology Estimates & Trend Analysis

4.1. Technology Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Biosensors Market by Technology Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Thermal

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Electrochemical

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.3. Piezoelectric

4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.4. Optical

4.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. Biosensors Market: Application Estimates & Trend Analysis

5.1. Application Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Biosensors Market by Application Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Medical

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Cholesterol

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.3. Blood Glucose

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.4. Blood Gas Analyzer

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.5. Pregnancy Testing

5.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.6. Drug Discovery

5.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.7. Infectious Disease

5.4.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.8. Food Toxicity

5.4.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.9. Bioreactor

5.4.9.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.10. Agriculture

5.4.10.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.11. Environment

5.4.11.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.12. Others

5.4.12.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Biosensors Market: End-use Estimates & Trend Analysis

6.1. End-use Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Global Biosensors Market by End-use Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. Home Healthcare Diagnostics

6.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

6.4.2. POC Testing

6.4.2.1. Market estimates and forecasts 2018 to 2030 (USD million)

6.4.3. Food Industry

6.4.3.1. Market estimates and forecasts 2018 to 2030 (USD million)

6.4.4. Research Laboratories

6.4.4.1. Market estimates and forecasts 2018 to 2030 (USD million)

6.4.5. Security and Bio-Defense

6.4.5.1. Market estimates and forecasts 2018 to 2030 (USD million)

Chapter 7. Biosensors Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Global Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

7.5. North America

7.5.1. U.S.

7.5.1.1. Key country dynamics

7.5.1.2. Regulatory framework/ reimbursement structure

7.5.1.3. Competitive scenario

7.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

7.5.2. Canada

7.5.2.1. Key country dynamics

7.5.2.2. Regulatory framework/ reimbursement structure

7.5.2.3. Competitive scenario

7.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

7.6. Europe

7.6.1. UK

7.6.1.1. Key country dynamics

7.6.1.2. Regulatory framework/ reimbursement structure

7.6.1.3. Competitive scenario

7.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

7.6.2. Germany

7.6.2.1. Key country dynamics

7.6.2.2. Regulatory framework/ reimbursement structure

7.6.2.3. Competitive scenario

7.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

7.6.3. France

7.6.3.1. Key country dynamics

7.6.3.2. Regulatory framework/ reimbursement structure

7.6.3.3. Competitive scenario

7.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

7.6.4. Italy

7.6.4.1. Key country dynamics

7.6.4.2. Regulatory framework/ reimbursement structure

7.6.4.3. Competitive scenario

7.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

7.6.5. Spain

7.6.5.1. Key country dynamics

7.6.5.2. Regulatory framework/ reimbursement structure

7.6.5.3. Competitive scenario

7.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

7.6.6. Norway

7.6.6.1. Key country dynamics

7.6.6.2. Regulatory framework/ reimbursement structure

7.6.6.3. Competitive scenario

7.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

7.6.7. Sweden

7.6.7.1. Key country dynamics

7.6.7.2. Regulatory framework/ reimbursement structure

7.6.7.3. Competitive scenario

7.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

7.6.8. Denmark

7.6.8.1. Key country dynamics

7.6.8.2. Regulatory framework/ reimbursement structure

7.6.8.3. Competitive scenario

7.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

7.6.9. Netherlands

7.6.9.1. Key country dynamics

7.6.9.2. Regulatory framework/ reimbursement structure

7.6.9.3. Competitive scenario

7.6.9.4. Netherlands market estimates and forecasts 2018 to 2030 (USD Million)

7.6.10. Belgium

7.6.10.1. Key country dynamics

7.6.10.2. Regulatory framework/ reimbursement structure

7.6.10.3. Competitive scenario

7.6.10.4. Belgium market estimates and forecasts 2018 to 2030 (USD Million)

7.6.11. Switzerland

7.6.11.1. Key country dynamics

7.6.11.2. Regulatory framework/ reimbursement structure

7.6.11.3. Competitive scenario

7.6.11.4. Switzerland market estimates and forecasts 2018 to 2030 (USD Million)

7.7. Asia Pacific

7.7.1. Japan

7.7.1.1. Key country dynamics

7.7.1.2. Regulatory framework/ reimbursement structure

7.7.1.3. Competitive scenario

7.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

7.7.2. China

7.7.2.1. Key country dynamics

7.7.2.2. Regulatory framework/ reimbursement structure

7.7.2.3. Competitive scenario

7.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

7.7.3. India

7.7.3.1. Key country dynamics

7.7.3.2. Regulatory framework/ reimbursement structure

7.7.3.3. Competitive scenario

7.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

7.7.4. Australia

7.7.4.1. Key country dynamics

7.7.4.2. Regulatory framework/ reimbursement structure

7.7.4.3. Competitive scenario

7.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

7.7.5. South Korea

7.7.5.1. Key country dynamics

7.7.5.2. Regulatory framework/ reimbursement structure

7.7.5.3. Competitive scenario

7.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

7.7.6. Thailand

7.7.6.1. Key country dynamics

7.7.6.2. Regulatory framework/ reimbursement structure

7.7.6.3. Competitive scenario

7.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

7.7.7. Indonesia

7.7.7.1. Key country dynamics

7.7.7.2. Regulatory framework/ reimbursement structure

7.7.7.3. Competitive scenario

7.7.7.4. Indonesia market estimates and forecasts 2018 to 2030 (USD Million)

7.8. Latin America

7.8.1. Brazil

7.8.1.1. Key country dynamics

7.8.1.2. Regulatory framework/ reimbursement structure

7.8.1.3. Competitive scenario

7.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

7.8.2. Mexico

7.8.2.1. Key country dynamics

7.8.2.2. Regulatory framework/ reimbursement structure

7.8.2.3. Competitive scenario

7.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

7.8.3. Argentina

7.8.3.1. Key country dynamics

7.8.3.2. Regulatory framework/ reimbursement structure

7.8.3.3. Competitive scenario

7.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

7.8.4. Colombia

7.8.4.1. Key country dynamics

7.8.4.2. Regulatory framework/ reimbursement structure

7.8.4.3. Competitive scenario

7.8.4.4. Colombia market estimates and forecasts 2018 to 2030 (USD Million)

7.9. MEA

7.9.1. South Africa

7.9.1.1. Key country dynamics

7.9.1.2. Regulatory framework/ reimbursement structure

7.9.1.3. Competitive scenario

7.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

7.9.2. Saudi Arabia

7.9.2.1. Key country dynamics

7.9.2.2. Regulatory framework/ reimbursement structure

7.9.2.3. Competitive scenario

7.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

7.9.3. UAE

7.9.3.1. Key country dynamics

7.9.3.2. Regulatory framework/ reimbursement structure

7.9.3.3. Competitive scenario

7.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

7.9.4. Kuwait

7.9.4.1. Key country dynamics

7.9.4.2. Regulatory framework/ reimbursement structure

7.9.4.3. Competitive scenario

7.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

7.9.5. Turkey

7.9.5.1. Key country dynamics

7.9.5.2. Regulatory framework/ reimbursement structure

7.9.5.3. Competitive scenario

7.9.5.4. Turkey market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.3.3. Key company market share analysis, 2023

8.4. Company Profiles

8.4.1. BIO-RAD LABORATORIES INC.

8.4.1.1. Company overview

8.4.1.2. Financial Performance

8.4.1.3. Product benchmarking

8.4.1.4. Strategic initiatives

8.4.2. MEDTRONIC

8.4.2.1. Company overview

8.4.2.2. Financial Performance

8.4.2.3. Product benchmarking

8.4.2.4. Strategic initiatives

8.4.3. ABBOTT LABORATORIES

8.4.3.1. Company overview

8.4.3.2. Financial performance

8.4.3.3. Product benchmarking

8.4.3.4. Product benchmarking

8.4.4. BIOSENSORS INTERNATIONAL GROUP, LTD.

8.4.4.1. Company overview

8.4.4.2. Financial performance

8.4.4.3. Product benchmarking

8.4.4.4. Strategic initiatives

8.4.5. PINNACLE TECHNOLOGIES INC.

8.4.5.1. Company overview

8.4.5.2. Financial performance

8.4.5.3. Product benchmarking

8.4.5.4. Strategic initiatives

8.4.6. ERCON, INC.

8.4.6.1. Company overview

8.4.6.2. Financial performance

8.4.6.3. Product benchmarking

8.4.6.4. Strategic initiatives

8.4.7. DUPONT BIOSENSOR MATERIALS

8.4.7.1. Company overview

8.4.7.2. Financial performance

8.4.7.3. Product benchmarking

8.4.7.4. Strategic initiatives

8.4.8. JOHNSON & JOHNSON

8.4.8.1. Company overview

8.4.8.2. Financial performance

8.4.8.3. Product benchmarking

8.4.8.4. Strategic initiatives

8.4.9. KONINKLIJKE PHILIPS N.V.

8.4.9.1. Company overview

8.4.9.2. Financial performance

8.4.9.3. Product benchmarking

8.4.9.4. Strategic initiatives

8.4.10. LIFESCAN, INC.

8.4.10.1. Company overview

8.4.10.2. Financial performance

8.4.10.3. Product benchmarking

8.4.10.4. Strategic initiatives

8.4.11. QTL BIODETECTION LLC.

8.4.11.1. Company overview

8.4.11.2. Financial performance

8.4.11.3. Product benchmarking

8.4.11.4. Strategic initiatives

8.4.12. MOLECULAR DEVICES CORPORATION

8.4.12.1. Company overview

8.4.12.2. Financial performance

8.4.12.3. Product benchmarking

8.4.12.4. Strategic initiatives

8.4.13. NOVA BIOMEDICAL

8.4.13.1. Company overview

8.4.13.2. Financial performance

8.4.13.3. Product benchmarking

8.4.13.4. Strategic initiatives

8.4.14. MOLEX LLC

8.4.14.1. Company overview

8.4.14.2. Financial performance

8.4.14.3. Product benchmarking

8.4.14.4. Strategic initiatives

8.4.15. TDK CORPORATION

8.4.15.1. Company overview

8.4.15.2. Financial performance

8.4.15.3. Product benchmarking

8.4.15.4. Strategic initiatives

8.4.16. ZIMMER & PEACOCK AS

8.4.16.1. Company overview

8.4.16.2. Financial performance

8.4.16.3. Product benchmarking

8.4.16.4. Strategic initiatives

8.4.17. SIEMENS HEALTHCARE

8.4.17.1. Company overview

8.4.17.2. Financial performance

8.4.17.3. Product benchmarking

8.4.17.4. Strategic initiatives

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviation

Table 3 North America biosensors market, by country, 2018 - 2030 USD Million and Volume Unit

Table 4 North America biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 5 North America biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 6 North America biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 7 U.S. biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 8 U.S. biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 9 U.S. biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 10 Canada biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 11 Canada biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 12 Canada biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 13 Europe biosensors market, by country, 2018 - 2030 USD Million and Volume Unit

Table 14 Europe biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 15 Europe biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 16 Europe biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 17 UK biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 18 UK biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 19 UK biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 20 Germany biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 21 Germany biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 22 Germany biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 23 France biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 24 France biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 25 France biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 26 Italy biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 27 Italy biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 28 Italy biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 29 Spain biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 30 Spain biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 31 Spain biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 32 Belgium biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 33 Belgium biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 34 Belgium biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 35 Switzerland biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 36 Switzerland biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 37 Switzerland biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 38 Netherlands biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 39 Netherlands biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 40 Netherlands biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 41 Sweden biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 42 Sweden biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 43 Sweden biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 44 Norway biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 45 Norway biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 46 Norway biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 47 Denmark biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 48 Denmark biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 49 Denmark biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 50 Asia Pacific biosensors market, by country, 2018 - 2030 USD Million and Volume Unit

Table 51 Asia Pacific biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 52 Asia Pacific biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 53 Asia Pacific biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 54 China biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 55 China biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 56 China biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 57 Japan biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 58 Japan biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 59 Japan biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 60 India biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 61 India biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 62 India biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 63 Australia biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 64 Australia biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 65 Australia biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 66 South Korea biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 67 South Korea biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 68 South Korea biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 69 Indonesia biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 70 Indonesia biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 71 Indonesia biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 72 Thailand biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 73 Thailand biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 74 Thailand biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 75 Latin America biosensors market, by country, 2018 - 2030 USD Million and Volume Unit

Table 76 Latin America biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 77 Latin America biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 78 Latin America biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 79 Brazil biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 80 Brazil biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 81 Brazil biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 82 Mexico biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 83 Mexico biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 84 Mexico biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 85 Argentina biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 86 Argentina biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 87 Argentina biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 88 Colombia biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 89 Colombia biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 90 Colombia biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 91 Middle East & Africa biosensors market, by country, 2018 - 2030 USD Million and Volume Unit

Table 92 Middle East & Africa biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 93 Middle East & Africa biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 94 Middle East & Africa biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 95 South Africa biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 96 South Africa biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 97 South Africa biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 98 Saudi Arabia biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 99 Saudi Arabia biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 100 Saudi Arabia biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 101 UAE biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 102 UAE biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 103 UAE biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 104 Turkey biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 105 Turkey biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 106 Turkey biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

Table 107 Kuwait biosensors market, by technology, 2018 - 2030 USD Million and Volume Unit

Table 108 Kuwait biosensors market, by application, 2018 - 2030 USD Million and Volume Unit

Table 109 Kuwait biosensors market, by end user, 2018 - 2030 USD Million and Volume Unit

List of Figures

Fig. 1 Biosensors market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Market outlook (2023)

Fig. 10 Segment outlook

Fig. 11 Strategy framework

Fig. 12 Penetration & growth prospect mapping

Fig. 13 Consumer behavior analysis

Fig. 14 Market driver relevance analysis (Current & future impact)

Fig. 15 Market restraint relevance analysis (Current & future impact)

Fig. 16 Porter’s five forces analysis

Fig. 17 SWOT analysis, by factor (political & legal, economic and technological)

Fig. 18 Biosensors market: Technology movement analysis

Fig. 19 Segment dashboard

Fig. 20 Biosensors market technology outlook: Key takeaways

Fig. 21 Thermal market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 22 Electrochemical market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 23 Piezoelectric market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 24 Optical market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 25 Biosensors market: Application movement analysis

Fig. 26 Segment dashboard

Fig. 27 Biosensors market application outlook: Key takeaways

Fig. 28 Medical market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 29 Cholesterol market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 30 Blood glucose market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 31 Blood gas analyzer market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 32 Pregnancy testing market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 33 Drug discovery market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 34 Infectious disease market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 35 Food toxicity market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 36 Bioreactor market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 37 Agriculture market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 38 Environment market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 39 Others market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 40 Biosensors market: End User movement analysis

Fig. 41 Segment dashboard

Fig. 42 Biosensors market end user outlook: Key takeaways

Fig. 43 Home healthcare diagnostics market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 44 PoC testing market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 45 Food industry market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 46 Research laboratories market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 47 Security and bio-defense market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 48 Regional outlook, 2022 & 2030

Fig. 49 Regional market dashboard

Fig. 50 Regional market place: Key takeaways

Fig. 51 North America biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 52 U.S. biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 53 Canada biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 54 Europe biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 55 UK biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 56 Germany biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 57 France biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 58 Italy biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 59 Spain biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 60 Belgium biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 61 Switzerland biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 62 Netherlands biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 63 Sweden biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 64 Norway biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 65 Denmark biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 66 Asia Pacific biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 67 Japan biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 68 China biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 69 South Korea biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 70 Indonesia biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 71 Thailand biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 72 Australia biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 73 India biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 74 Latin America biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 75 Brazil biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 76 Mexico biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 77 Argentina biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 78 Colombia biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 79 MEA biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 80 South Africa biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 81 Saudi Arabia biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 82 UAE biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 83 Turkey biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 84 Kuwait biosensors market, 2018 - 2030 (USD Million and Volume Unit)

Fig. 85 Company market share analysis, 2021

Fig. 86 Market differentiators

Fig. 87 Regional network mapWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Biosensors Technology Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Biosensors Application Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Biosensors End-user Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

- Home Healthcare Diagnostics

- PoC Testing

- Food Industry

- Research Laboratories

- Security & Bio-Defense

- Biosensors Regional Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

- North America

- North America Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- North America Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- North America Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- U.S.

- U.S. Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- U.S. Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- U.S. Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- U.S. Biosensors Market, By Technology

- Canada

- Canada Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Canada Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Canada Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Canada Biosensors Market, By Technology

- North America Biosensors Market, By Technology

- Europe

- Europe Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Europe Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Europe Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- UK

- UK Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- UK Biosensors Market, By Technology

- UK Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- UK Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Germany

- Germany Biosensors Market, By Technology

-

- Thermal

- Electrochemical

- Piezoelectric

- Optical

-

- Germany Biosensors Market, By Application

-

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

-

- Germany Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Germany Biosensors Market, By Technology

- France

- France Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- France Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- France Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- France Biosensors Market, By Technology

- Italy

- Italy Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Italy Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Italy Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Italy Biosensors Market, By Technology

- Spain

- Spain Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Spain Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Spain Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Spain Biosensors Market, By Technology

- Denmark

- Denmark Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Denmark Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Denmark Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Denmark Biosensors Market, By Technology

- Belgium

- Belgium Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Belgium Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Belgium Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Belgium Biosensors Market, By Technology

- Switzerland

- Switzerland Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Switzerland Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Switzerland Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Switzerland Biosensors Market, By Technology

- Netherland

- Netherland Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Netherland Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Netherland Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Netherland Biosensors Market, By Technology

- Norway

- Norway Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Norway Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Norway Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Norway Biosensors Market, By Technology

- Sweden

- Sweden Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Sweden Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Sweden Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Sweden Biosensors Market, By Technology

- Europe Biosensors Market, By Technology

- Asia Pacific

- Asia Pacific Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Asia Pacific Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Asia Pacific Biosensors Market, By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- China

- China Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- China Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- China Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- China Biosensors Market, By Technology

- Japan

- Japan Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Japan Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Japan Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Japan Biosensors Market, By Technology

- India

- India Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- India Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- India Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- India Biosensors Market, By Technology

- Australia

- Australia Biosensors Market, By Technology

-

- Thermal

- Electrochemical

- Piezoelectric

- Optical

-

- Australia Biosensors Market, By Application

-

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

-

- Australia Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Australia Biosensors Market, By Technology

- South Korea

- South Korea Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- South Korea Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- South Korea Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- South Korea Biosensors Market, By Technology

- Indonesia

- Indonesia Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Indonesia Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Indonesia Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Indonesia Biosensors Market, By Technology

- Thailand

- Thailand Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Thailand Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Thailand Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Thailand Biosensors Market, By Technology

- Asia Pacific Biosensors Market, By Technology

- Latin America

- Latin America Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Latin America Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Latin America Biosensors Market, By End-user

- Home healthcare diagnostics

- PoC testing

- Food industry

- Research laboratories

- Security and bio-defense

- Brazil

- Brazil Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Brazil Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Brazil Biosensors Market, By End-user

- Home healthcare diagnostics

- PoC testing

- Food industry

- Research laboratories

- Security and bio-defense

- Brazil Biosensors Market, By Technology

- Mexico

- Mexico Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Mexico Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Mexico Biosensors Market, By End-user

- Home healthcare diagnostics

- PoC testing

- Food industry

- Research laboratories

- Security and bio-defense

- Mexico Biosensors Market, By Technology

- Argentina

- Argentina Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Argentina Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Argentina Biosensors Market, By End-user

- Home healthcare diagnostics

- PoC testing

- Food industry

- Research laboratories

- Security and bio-defense

- Argentina Biosensors Market, By Technology

- Colombia

- Colombia Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Colombia Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Colombia Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Colombia Biosensors Market, By Technology

- Latin America Biosensors Market, By Technology

- Middle East and Africa

- Middle East and Africa Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Middle East and Africa Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Middle East and Africa Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- South Africa

- South Africa Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- South Africa Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- South Africa Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- South Africa Biosensors Market, By Technology

- UAE

- UAE Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- UAE Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- UAE Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- UAE Biosensors Market, By Technology

- Saudi Arabia

- Saudi Arabia Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Saudi Arabia Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Saudi Arabia Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Saudi Arabia Biosensors Market, By Technology

- Turkey

- Turkey Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Turkey Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Turkey Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Turkey Biosensors Market, By Technology

- Kuwait

- Kuwait Biosensors Market, By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

- Kuwait Biosensors Market, By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

- Medical

- Kuwait Biosensors Market, By End-user

- Home Healthcare Diagnostics

- Poc Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

- Kuwait Biosensors Market, By Technology

- Middle East and Africa Biosensors Market, By Technology

- North America

Biosensors Market Dynamics

Drivers: Various Applications Of Biosensors In Medical Fields

Early and precise disease diagnosis is essential for the survival of patients and the successful prognosis of diseases. In recent years, the demand for simple, disposable, user-friendly, and cost-efficient devices with fast response time has increased extensively. Biosensors fulfill all these criteria. Biosensors for the measurement of glucose, urea, creatinine, and lactate, using both electrochemical and optical modes of transduction, are being used and commercially developed in laboratories, self-testing, point-of-care testing, and in glucose monitoring. Biosensors have applications in various areas of the healthcare industry such as cardiovascular, cancer, and diabetes. The rising incidence of diabetes and cardiovascular diseases globally has led to an increase in the use of biosensors for early detection of these diseases. Biosensors are ideal for new applications in hospitals, by patients at home, and by caregivers in non-hospital settings, thus boosting the use of biosensors.

Drivers: Rising Prevalence Of Diabetes

The rising prevalence of diabetes across the globe is anticipated to boost the market growth. Factors such as antimicrobial resistance, adoption of unhealthy & sedentary lifestyles, alcohol consumption, and smoking are some of the major factors contributing to the rise in the prevalence of diabetes. According to the National Diabetes Statistic Report 2017, published by the Centers for Disease Control and Prevention (CDC), more than 100.0 million people in the U.S. were living with diabetes or prediabetes conditions. In addition, WHO reported that in 2016 approximately 1.6 million deaths globally were directly caused due to diabetes. As per the WorldAtlas, in 2018, the top ten countries with the highest prevalence rate of diabetes are Saudi Arabia (17.7%), Soloman Islands (18.7%), Guam (21.5%), Mauritius (22%), French Polynesia (22.6%), Kiribati (22.7%), New Caledonia (23.4%), Nauru (24.1%), Tuvalu (27.3%), and Marshall Islands (30.5%).

Restraints: High Cost Of Research & Development

There is a need to develop compatible single-task tools in combination with the available software. A large amount of data with a lack of standardization has impeded the growth of the biosensors market. There is a need for a user-friendly database to reduce the effort and time associated with the analysis of the large data available to institutions and governments globally. Enhancement of integration methods is also required to overcome statistical challenges arising due to integrated analysis of high-throughput biomedical research and genomic data. Constant addition of new genomes in public sequences databases is also leading to errors, hence making standardization crucial for optimum results of simulation and modeling.

What Does This Report Include?