- Home

- »

- Pharmaceuticals

- »

-

Bipolar Disorder Market Size, Share & Trends Report, 2030GVR Report cover

![Bipolar Disorder Market Size, Share & Trends Report]()

Bipolar Disorder Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Mood Stabilizer, Anticonvulsants, Antipsychotic Drugs), By Drug Class, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-033-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bipolar Disorder Market Size & Trends

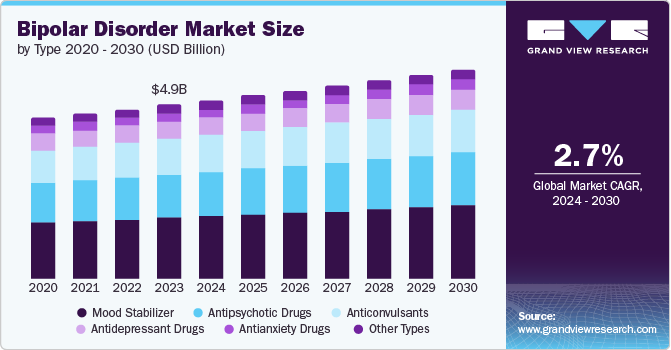

The global bipolar disorder market size was valued at USD 4.88 billion in 2023 and is projected to grow at a CAGR of 2.7% from 2024 to 2030. The major factors responsible for the growth of this market are the rising prevalence of bipolar disorder and the increase in government investment in order to spread awareness and advancements in medical institutes. Furthermore, there is an increase in the prevalence of bipolar disorders due to changing lifestyles and urbanization, which has led to high stress and substance abuse. Therefore, this increase in the demand for the management of bipolar disorder has led to the upward growth of this market.

Bipolar disorder can occur due to various genetic and environmental factors, as a stressful environment or emotional abuse can trigger it. Due to changing lifestyles and an increase in stressful work environments, there is a rise in the diagnosis of bipolar disorders. Furthermore, increased awareness of bipolar disorders due to initiatives led by governments and NGOs has increased the number of patients seeking medical help in order to diagnose and treat their mental health. These initiatives have resulted in a change of perspective and the elimination of stigma related to bipolar disorders, which has further helped in the growth of this market.

Furthermore, heavy investments by key medical institutes in the research and development of bipolar disorder and its treatment have contributed to the upward market growth. Therefore, there is an increase in the number of medicines available to treat bipolar disorders. Due to increased awareness, there is a rise in demand for diagnosis and medication for bipolar disorders. With the increase in the consumption of medicines related to bipolar disorders, companies are increasing the number of drugs in the market by getting approvals from regulatory bodies.

Type Insights

The mood stabilizer segment dominated the market in 2023, with a share of 35.0% in 2023 due to the rising prevalence of bipolar disorder. The rise in the demand for mood stabilizer drugs is attributed to their property of managing mood swings and stabilizing the mental and emotional condition of patients who have bipolar disorder. With increased awareness of bipolar disorders, patients are now seeking medical help to treat their disorders. Due to this increase in diagnosis, reliance on drugs such as mood stabilizers has increased as they help the patient in better functioning. These factors are responsible for the positive market growth of this segment.

The antipsychotic drugs segment is expected to witness a significant growth rate over the forecast period attributed to the rise in the diagnosis of bipolar disorders and various other mental disorders. These drugs are prescribed in order to treat symptoms such as delusions, hallucinations, mood swings, and more, which are related to these disorders. Furthermore, advancements in the drug forms have contributed to the market growth of this segment as newer forms of antipsychotic drugs, such as long-acting injectables (LAIs), have improved stability and adherence.

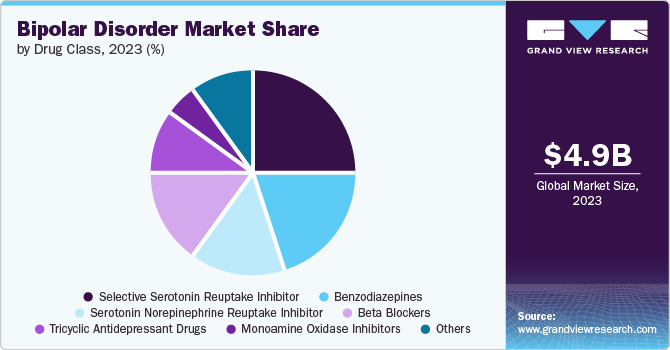

Drug Class Insights

The selective serotonin reuptake inhibitor segment dominated the market in 2023, with a share of 25.0%. The factors responsible for the market growth are the efficacy and safety profile of selective serotonin reuptake inhibitors (SSRIs), which are effective in managing the depressive symptoms occurring due to bipolar disorder. SSRIs are a better alternative to the old antidepressants as they have better safety with fewer side effects. Furthermore, increased investment in research and development has led to an increase in the availability of effective SSRIs.

The benzodiazepines segment is anticipated to showcase a significant growth rate during the forecast period due to their properties of controlling agitation, insomnia, and restlessness until mood-stabilizing drugs take effect. Therefore, benzodiazepines play a crucial role in managing bipolar disorder symptoms. Constantly evolving treatment methods and growing research have further contributed to the increased demand for the benzodiazepines segment.

Distribution Channel Insights

The hospital pharmacies segment dominated the market in 2023, with a share of 49.8% in 2023. This market growth was attributed to the increase in the number of patients seeking a diagnosis of their mental health. Growing awareness about mental health due to various initiatives taken by government bodies and NGOs has made the population seek medical help. This has resulted in the increased sale of medicines in hospitals' pharmacies. Patients prefer hospital pharmacies due to their convenience and trustworthiness as they are integrated with the hospital. These factors are responsible for the positive market growth of this segment.

The retail pharmacies segment is likely witness a substantial growth rate over the forecast oeriod. This market growth was due to retail pharmacies' high presence and strong distribution network. Retail pharmacies allow customers to shop for all types of medicines under one roof. Furthermore, due to frequent shopping at the same retail pharmacy, customers build a relationship of trust with their pharmacies. These pharmacies also help customers by giving prescription-free medicines in times of emergency. Therefore, these factors contribute to the market growth of this segment.

Regional Insights

North America dominated the bipolar disorder market with a market share of 39.4% in 2023. This was attributed to the increase in the cases of bipolar disorders and the presence of significant medical institutes in the region. Due to urbanization and stressful environment, more people are seeking medical help to treat their mental health. This has become possible due to the government's initiatives to spread awareness of the importance of mental health. Furthermore, changes in lifestyle and increased substance abuse have also resulted in market growth in this region.

U.S. Bipolar Disorder Market Trends

The U.S. dominated the bipolar disorder market of North America in 2023 with a market share of 90.2% due to the presence of better medical infrastructure and an increasing number of patients for the treatment of mental disorders. High-stress environment, increasing substance, and unhealthy eating and sleeping habits have resulted in an increase in the diagnosis of mental health issues among the population in the country. Furthermore, the presence of key companies has also helped in the market growth as these companies help in the availability of various alternatives to treat bipolar disorder.

Europe Bipolar Disorder Market Trends

Europe bipolar disorder market was identified as a lucrative region in this industry in 2023 due to the increase in the prevalence of bipolar disorder and increased awareness of mental health. Rapid urbanization and lifestyle changes have led to unhealthy practices and more stressful environments. This has resulted in increased diagnoses of bipolar disorder among patients who seek to check their mental health. Furthermore, the presence of key market players selling various medicines for treating bipolar disorder has also fueled the market growth in this region.

The UK bipolar disorder market is expected to grow rapidly due to the increasing awareness spread by the government to help the population seek medical help to treat their mental illnesses. Due to increased awareness, the stigma related to the treatment of mental health has been eliminated. Furthermore, the presence of key companies and developed healthcare facilities has resulted in the upward market growth of this country.

Asia Pacific Bipolar Disorder Market Trends

Asia Pacific had a significant market share in 2023 due to increasing population and developing healthcare infrastructure. Due to the increasing population and awareness initiatives done by the government, there is an increase in the number of patients seeking diagnosis and treatment for their mental health. Furthermore, technological advancements in smartphones, smartwatches, and other wearable technologies have made it possible to detect mood patterns and mental health parameters easily. These factors are responsible for the upward market growth in this country.

The China bipolar disorder market held a substantial market share in 2023 due to the presence of key manufacturing industries and a strong distribution network in this country. Rapid urbanization and an increase in stressful environments have led to increased mental health diagnoses among the population. Moreover, government initiatives and an increase in the number of drug approvals have also helped in the upward market growth in this country.

Key Bipolar Disorder Company Insights

Some of the major companies in the global bipolar disorder market are AstraZeneca, Eli Lilly and Company, GSK plc, Johnson & Johnson Services, Inc., Pfizer, Inc. Companies are focusing on developing medicines and therapies in order to target various type of cancers. Companies are also focusing on reducing the side effects of medicines and treatments involved in treating bipolar disorders.

-

Pfizer, Inc. is a pharmaceutical and biomedical company, specializing in the research, production, and promotion of medications and vaccines for both people and animals. Pfizer collaborates with health care providers, governments and local communities to support and expand access to health care around the world.

-

AstraZeneca plc is a pharmaceutical and biotechnology company, which offers products for various major diseases such as oncology, cardiovascular, gastrointestinal, infection, neuroscience, respiratory, and inflammation.

Key Bipolar Disorder Companies:

The following are the leading companies in the bipolar disorder market. These companies collectively hold the largest market share and dictate industry trends.

- AstraZeneca

- Eli Lilly and Company

- GSK plc

- Johnson & Johnson Services, Inc

- Pfizer Inc.

- AbbVie Inc.

- Otsuka Holdings Co., Ltd.

- Bristol-Myers Squibb Company

- Teva Pharmaceutical Industries Ltd.

- Sumitomo Pharma America, Inc.

Recent Developments

-

In December 2023, Bristol-Myers Squibb Company acquired Karuna Therapeutics, a biopharmaceutical company that develops medicines related to psychiatric and neurological conditions. This acquisition strengthened the neuroscience portfolio of Bristol-Myers Squibb Company.

Bipolar Disorder Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.01 billion

Revenue forecast in 2030

USD 5.87 billion

Growth Rate

CAGR of 2.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug class, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

AstraZeneca, Eli Lilly and Company, GSK plc, Johnson & Johnson Services, Inc., Pfizer Inc., AbbVie Inc., Otsuka Holdings Co., Ltd., Bristol-Myers Squibb Company, Teva Pharmaceutical Industries Ltd., Sumitomo Pharma America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

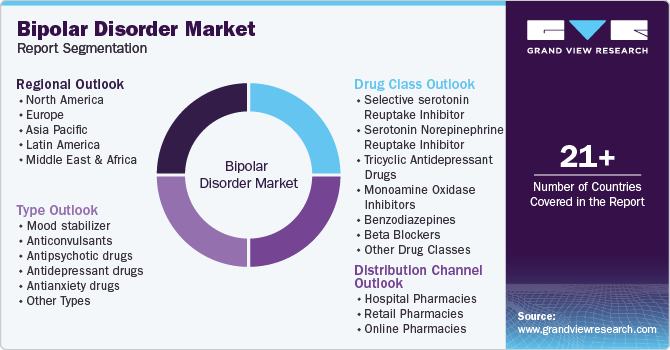

Global Bipolar Disorder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Global Bipolar Disorder Market report based on type, drug class, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mood stabilizer

-

Anticonvulsants

-

Antipsychotic drugs

-

Antidepressant drugs

-

Antianxiety drugs

-

Other Types

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Selective serotonin reuptake inhibitor

-

Serotonin norepinephrine reuptake inhibitor

-

Tricyclic antidepressant drugs

-

Monoamine oxidase inhibitors

-

Benzodiazepines

-

Beta blockers

-

Other Drug Classes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.