- Home

- »

- Clinical Diagnostics

- »

-

Blood Collection Market Size, Share & Growth Report, 2030GVR Report cover

![Blood Collection Market Size, Share & Trends Report]()

Blood Collection Market (2025 - 2030) Size, Share & Trends Analysis Report By Collection Site (Venous, Capillary), By Application (Diagnostics, Treatment), By Method (Manual, Automated), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-382-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Collection Market Summary

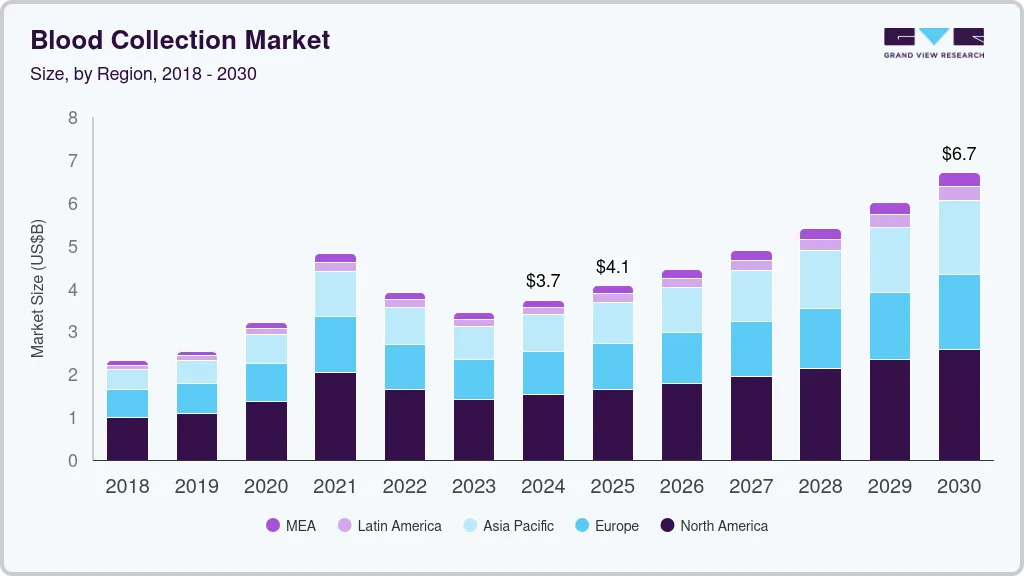

The global blood collection market size was estimated at USD 3.73 billion in 2024 and is projected to reach USD 6.71 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. The growth is attributed to an increase in the number of diagnostic procedures involving blood samples.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- The blood collection market in Asia Pacific is expected to witness the fastest CAGR over the forecast period.

- In terms of collection site, the venous segment dominated the market and accounted for the largest revenue share of 82.68% in 2024.

- The capillary segment is anticipated to witness the fastest growth rate during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3.73 Billion

- 2030 Projected Market Size: USD 6.71 Billion

- CAGR (2025-2030): 8.7%

- North America: Largest market in 2024

Key procedures include disease screening and medication monitoring. In addition, regular blood tests are necessary for treatment evaluation & monitoring of chronic illnesses, such as diabetes, cardiovascular disease, and cancer. High efficiency and ease in ensuring precise sample collection & preservation make these tests popular among medical experts. The growing prevalence of chronic diseases can further increase the need for diagnostic testing, boosting the demand for blood collection equipment.

Blood samples often require specific temperature conditions (e.g., refrigeration or freezing) to maintain stability and integrity. Ensuring consistent temperature control throughout the storage and transportation is crucial to prevent sample degradation. In addition, coordinating the timely & efficient transportation of samples from collection sites to testing laboratories or facilities is a major challenge in blood collection. For instance, improper transportation of a sample intended for coagulation testing may result in the degradation of clotting factors due to incorrect temperature control. This could potentially lead to inaccurate test results indicating a clotting disorder, resulting in unnecessary anticoagulant therapy for the patient and heightened risks of bleeding complications.

The increasing prevalence of chronic & infectious diseases is a major factor driving the use of blood collection devices. With the U.S. becoming more globalized, health risks transcend borders. Economic integration, industrialization, urbanization, and mass migration contribute to various public health challenges. The emergence of infectious diseases, such as COVID-19, has caused significant morbidity & mortality, highlighting the urgent need for effective disease management strategies. Blood collection devices are crucial in diagnosing and monitoring chronic & infectious diseases. They provide a safe, hygienic, and efficient method for collecting samples, ensuring accurate test results & reducing the risk of contamination. In the context of the COVID-19 pandemic, these devices have been essential for collecting samples for diagnostic testing, tracking disease spread, and monitoring patient health.

The rising number of blood transfusions is one of the key factors expected to drive the market. According to the WHO 2023 estimate, around 118.5 million donations were collected worldwide. Among these, around 40% were collected from high-income countries, home to 16% of the global population. In addition, around 13,300 blood centers across 169 countries collectively gather around 106 million donations annually across the globe. Donations per center vary significantly based on the country’s income level.

Furthermore, climate change poses additional risks to public health, emphasizing the need for effective disease management tools. As the world continues to witness demographic and epidemiological transition, blood collection devices are expected to remain a critical component of healthcare systems, helping address the growing burden of chronic and infectious diseases and improving health outcomes for U.S. populations.

Blood transfusions are a common medical procedure conducted only after thorough compatibility testing. While generally safe, complications can sometimes arise weeks or even months after the transfusion. Complications include immune-related & nonimmune reactions, such as fever, acute immune hemolytic reactions, lung injury, bloodborne infections, delayed hemolytic reactions, iron overload, and graft-versus-host disease. These issues typically occur due to mismatches between donor and recipient despite rigorous precautions taken by clinicians. If not promptly addressed, these risks can be fatal, posing a significant challenge to market growth. For instance, in September 2023, the U.S. FDA recently released a report detailing fatalities potentially associated with blood collection and transfusion in the U.S. for fiscal year 2021. This report covers incidents reported between October 1, 2020 & September 30, 2021, and provides valuable insights by comparing these findings to data from the previous 5 fiscal years.

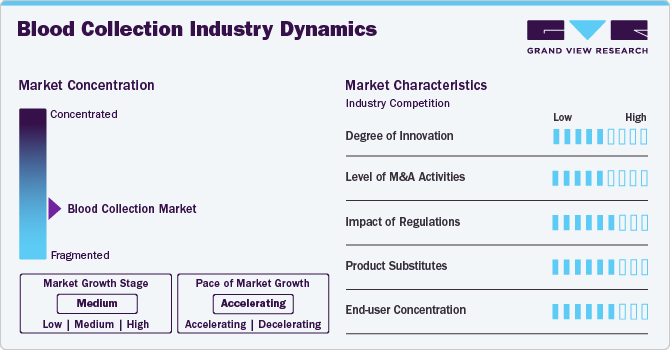

Market Concentration & Characteristics

The degree of innovation is high in the market, particularly with the new technologies enhancing convenience, accuracy, and patient experience. For example, Tasso, Inc. developed Tasso OnDemand, a nearly painless device that allows patients to self-collect blood samples at home, which they can mail directly to labs. This approach meets a growing demand for at-home healthcare and supports decentralized clinical trials. Similarly, wearable continuous glucose monitors (CGMs), like the Freestyle Libre by Abbott, offer non-invasive, continuous monitoring, reducing the frequency of traditional draws for diabetic patients.

Merger and acquisition activities are moderate in the market as companies seek to expand capabilities, increase market share, and integrate complementary services. For instance, Quest Diagnostics acquired ExamOne, a mobile phlebotomy service provider, to bolster its reach in at-home lab services and enhance its consumer-facing offerings. Similarly, Laboratory Corporation of America (LabCorp) has expanded its diagnostic services portfolio through acquisitions, including its purchase of Covance, which extended LabCorp's capabilities into clinical trial and testing services.

Regulation significantly impacts the market, with stringent guidelines aimed at ensuring patient safety, data privacy, and testing accuracy. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), mandate high standards for collection devices, sample handling, and mobile phlebotomy services.

The market faces moderate substitution pressure from alternative diagnostic and monitoring technologies that reduce the need for traditional blood draws. Wearable devices, such as Abbott's Freestyle Libre and Dexcom’s G6, provide continuous glucose monitoring (CGM) without requiring frequent finger pricks or blood draws, offering diabetic patients a less invasive option for blood glucose tracking. Similarly, advancements in saliva-based and urine tests, like those offered by Everlywell, are emerging as non-invasive diagnostic options that can measure biomarkers traditionally assessed via blood samples, such as cortisol or hormone levels. While these substitutes are limited to specific tests and are not yet comprehensive enough to replace traditional blood collection in all cases, they provide growing alternatives for patients seeking less invasive or at-home options.

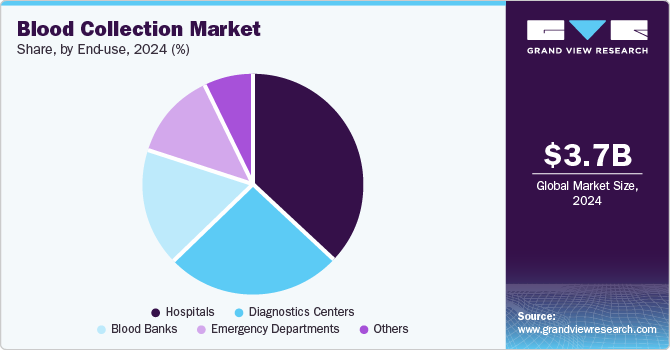

The market shows a high level of End User concentration, with primary demand coming from healthcare providers, diagnostics labs, and clinical trial organizations, as well as a growing segment of at-home healthcare users. Hospitals and diagnostics laboratories, like Quest Diagnostics and LabCorp, represent the largest portion of the market, as they require consistent blood testing for patient care, chronic disease management, and routine health screenings.

Collection Site Insights

The venous segment dominated the market in 2024 and accounted for the largest revenue share of 82.68%. The demand for venous blood collection is increasing due to the growing need for comprehensive diagnostic testing across various healthcare settings. As chronic diseases like diabetes, cardiovascular conditions, and cancer become more prevalent, there is a greater demand for routine blood tests and advanced diagnostics, many of which require venous samples for accurate analysis. Venous collection allows for larger sample volumes, enabling multiple tests to be conducted from a single draw, which is essential for patients with complex health needs. In addition, the rise in decentralized clinical trials and home-based health services has further driven demand for venous collection, as it supports extensive and reliable testing required for monitoring patient outcomes remotely.

The capillary segment is anticipated to witness the fastest growth rate during the forecast period owing to factors, such as its convenience, minimally invasive nature, and adaptability for at-home and point-of-care testing. Capillary sampling, often performed through a simple finger prick, requires less specialized equipment and is ideal for situations where smaller sample volumes are sufficient, such as glucose monitoring, cholesterol testing, and rapid diagnostic tests. With the expansion of telehealth and the demand for remote healthcare options, capillary collection enables patients to self-administer tests at home, reducing the need for in-person visits and making regular monitoring more accessible.

Application Insights

Diagnostics dominated the market with a share of 66.89 % in 2024 and is anticipated to grow at the fastest growth rate over the forecast period, driven by the increasing need for precise, rapid, and minimally invasive testing across healthcare. Blood collection for diagnostic purposes is critical in identifying various medical conditions, from common infections to chronic diseases. A key example of this dominance is the widespread use of blood tests in managing diabetes, where frequent blood draws help monitor blood glucose levels and guide treatment. During the COVID-19 pandemic, diagnostics via blood collection surged with antibody and serology tests that enabled widespread testing and tracking of immunity levels. Companies like Becton, Dickinson, and Company (BD), and Thermo Fisher Scientific expanded their diagnostic blood collection technologies to meet demand.

Treatment is expected to grow lucratively during the forecast period primarily due to its essential role in therapeutic procedures that involve sampling, transfusion, and cellular therapies. Blood collection for treatment purposes is critical in managing various health conditions, including anemia, leukemia, and other hematological disorders, where regular blood transfusions or stem cell treatments are required. For example, patients undergoing chemotherapy often need blood collection to monitor blood cell counts and receive transfusions to manage treatment-related side effects. With rising cases of chronic diseases and a growing elderly population globally, the treatment segment’s stronghold in the market is likely to continue, supported by innovations in collection technologies aimed at improving patient outcomes.

Method Insights

The manual blood collection segment dominated the market with a share of 75.82% in 2024, largely due to its widespread use in various healthcare settings, from primary care to specialized clinics, where reliable and cost-effective blood collection methods are essential. Unlike automated methods, manual collection, typically using syringes or vacuum-based tubes, allows healthcare providers greater control and flexibility, which is critical when handling patients with difficult vein access, such as children, elderly individuals, or those with certain medical conditions. This approach remains prevalent, especially in regions with limited access to advanced automated systems.

Automated blood collection is expected to register the fastest CAGR during the forecast period, propelled by advancements in technology that enhance precision, safety, and efficiency in the collection process. Automated systems, which use sophisticated devices to draw blood with minimal human intervention, are especially beneficial in high-throughput settings like hospitals, diagnostic labs, and donation centers where large volumes of samples are processed daily. These systems reduce the likelihood of human error, minimize patient discomfort, and streamline operations, making them an attractive choice for healthcare facilities aiming to optimize workflow and maintain high standards of care. In addition, automated systems are increasingly favored in developed regions where healthcare infrastructure supports integrating high-cost, technology-driven solutions.

End Use Insights

The hospitals segment dominated the market with a share of 36.88% in 2024. As primary healthcare facilities, hospitals and clinics handle a large daily influx of patients, including those requiring routine blood tests, emergency care, and surgical procedures. The high number of blood tests performed in these settings creates a consistent demand for vacuum blood collection tubes. Furthermore, increasing healthcare spending to enhance the healthcare infrastructure in developing countries is leading to the construction of new hospitals and the modernization of existing ones. For example, in March 2022, the Delhi government announced plans to upgrade 15 hospitals and build four new healthcare facilities in the city, increasing the number of hospital-based diagnostic centers. Such developments are likely to drive market growth. In addition, many hospitals & clinics provide integrated services, including in-house laboratories and diagnostic centers. This integration further increases the demand for vacuum collection tubes, enabling a streamlined blood collection and analysis workflow within the same facility.

Diagnostics centers is expected to register the fastest CAGR during the forecast period. Technological advancements have transformed diagnostic capabilities, enabling more accurate and rapid testing for various medical conditions. Furthermore, the trend toward personalized medicine and genomic testing has broadened the scope of diagnostic services, catering to individual patient needs and improving treatment outcomes. In addition, the increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, necessitates frequent monitoring and early detection through diagnostic testing, driving market demand. The increasing number of individuals with heart and circulatory diseases is leading to a growing demand for diagnostic and monitoring tests, many requiring sample collection.

Regional Insights

North America dominated the blood collection market with the largest revenue share of 40.93% in 2024. The growth of North American market is driven by several factors, including the increasing incidence of accidents, rising prevalence of chronic & lifestyle diseases, and the growing geriatric population. The sedentary lifestyle of many individuals has contributed to the rise in Noncommunicable Diseases (NCDs), which are the leading cause of death in the U.S., affecting 200 million people and causing an estimated 3.9 million deaths annually. Innovations in collection technologies, such as home sampling kits and advanced diagnostic devices, align with the need for ongoing disease management & preventive care, thus expanding market opportunities and driving growth. Moreover, major players in North America's market include BD, Thermo Fisher Scientific, Greiner Bio-One, Haemonetics, Roche Diagnostics, Bio-Rad Laboratories, Medline Industries, Capillary Biomedical, Luminex, and Sanguine Biosciences. They offer a range of products, from collection tubes and devices to diagnostic solutions and research kits.

U.S. Blood Collection Market Trends

The blood collection market in the U.S. is expected to grow over the forecast period,driven by the increasing prevalence of chronic & infectious diseases, rapid advancements in blood collection technologies, and increasing demand for routine & specialized testing. Key factors include rising incidence of HIV, syphilis, & preterm births, growing awareness, and increasing government initiatives, such as the CDC’s HIV eradication plan.

Europe Blood Collection Market Trends

The blood collection market in Europe accounted for a significant share of the global market. The rise in the prevalence of chronic and infectious diseases, such as diabetes, CVD, cancer, & asthma, drives the demand for advanced & reliable collection methods. Increased investments in healthcare infrastructure & research, increasing initiatives by market players, and adopting new diagnostic technologies, further support this growth.

The UK blood collection market is growing primarily due to the increasing demand for advanced diagnostic and monitoring tools. Key market players include major healthcare companies specializing in blood collection technologies. The market shows a significant growth trend in the diagnostics segment due to the rising prevalence of chronic diseases.

The blood collection market in France is expected to grow over the forecast period due to the strong presence of strong healthcare systems, well-established insurance policies, government support, and the rising prevalence of infectious diseases. Respiratory viruses, including influenza, cause significant mortality, with annual seasonal outbreaks affecting 2 to 6 million people and resulting in 10,000 to 15,000 deaths, especially among vulnerable individuals.

Germany blood collection market is expected to exhibit significant growth due to several factors. Germany’s robust healthcare system, which covers 90% of the population under mandatory health insurance, supports widespread access to advanced treatments and infrastructure, fostering market expansion.

Asia Pacific Blood Collection Market Trends

The blood collection market in Asia Pacific is expected to witness the fastest CAGR over the forecast period, driven by rising healthcare demand, rapid technological advancements, and an aging population. In countries such as India and Japan, increasing incidences of chronic diseases, such as cardiovascular conditions and cancer, are propelling the need for advanced collection technologies and diagnostic tests. Japan’s rapidly aging demographic and rising cancer rates further boost market demand, while initiatives such as whole blood product innovations and DBS card adoption highlight the region’s focus on improving healthcare infrastructure. Rapid technological advancements, such as new collection devices and automated systems, are enhancing efficiency & patient comfort.

China blood collection market is expected to grow over the forecast period due to lifestyle changes, dietary habits, and an aging population.

The blood collection market in Japan is expected to grow over the forecast period due to the high government spending to reduce the disease burden. In Japan, around 36.4 million, i.e., 29.1% of the population, are aged 65 & above, and the figure is expected to rise to 35.3% by 2040.

Latin America Blood Collection Market Trends

The blood collection market in Latin America was identified as a lucrative region in this industrydue to improvements in healthcare infrastructure, increasing diagnostic awareness, and the rising prevalence of chronic diseases such as diabetes & cancer.

Brazil blood collection market is expected to grow over the forecast period. The market growth is driven by the high prevalence of chronic diseases that require regular monitoring and blood testing. With a population exceeding 200 million, Brazil represents a significant opportunity for healthcare services, especially diagnostic tests using collection devices.

Middle East & Africa Blood Collection Market Trends

The blood collection market in MEA was identified as a lucrative region in this industry. The market is witnessing significant growth opportunities, as the majority of it is untapped due to the absence of structured screening programs in underdeveloped African economies, which has impeded early detection efforts.

Saudi Arabia blood collection market is expected to grow over the forecast period, attributed to the government's increasing involvement and rising awareness.

Key Blood Collection Company Insights

The market is led by prominent companies with a strong global presence and advanced product offerings. Becton, Dickinson & Company (BD) is a dominant player, known for its high-quality blood collection tubes and needles used widely across healthcare facilities. Thermo Fisher Scientific provides extensive blood collection equipment and consumables that support diagnostic and therapeutic needs. Similarly, Fresenius Kabi and Terumo Corporation have carved significant positions by offering specialized blood donation and collection devices, particularly in areas requiring high-precision technology. These companies continue to lead the market due to their innovative product portfolios, established distribution channels, and commitment to meeting evolving healthcare standards.

Several emerging players have entered the market in recent years, introducing novel approaches and targeting underserved segments. For instance, companies like Tasso Inc. have developed blood collection devices that allow for remote sampling, catering to the growing demand for at-home diagnostic solutions. Seventh Sense Biosystems has also made strides with its push-button blood collection device, simplifying the collection process for patients and healthcare providers. Emerging players like these are focused on enhancing convenience, reducing patient discomfort, and providing cost-effective alternatives, which is particularly appealing for telehealth and decentralized healthcare models. These new entrants' innovations are helping expand the market by making blood collection more accessible and patient-friendly.

Key Blood Collection Companies:

The following are the leading companies in the blood collection market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- NIPRO Medical Corporation

- BD

- Terumo Corporation

- Medtronic

- QIAGEN

- FL Medical s.r.l.

- Greiner AG

- Haemonetics Corporation

- F. Hoffmann-La Roche Ltd.

- Sarstedt AG & Co. KG

- Centogene N.V.

- SEKISUI CHEMICAL CO., LTD.

Recent Developments

-

In February 2024, Tasso, Inc. announced the launch of Tasso Care for Prescreening, an advanced, end-to-end service solution crafted to elevate the effectiveness of prescreening programs. Building on Tasso's established Tasso Care services platform, this new offering leverages the company’s deep expertise in remote blood collection and analysis, streamlining and enhancing clinical trial recruitment efforts.

-

In December 2023, BD (Becton, Dickinson & Company) announced it had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for an innovative blood collection device designed to obtain samples via a fingerstick. This device delivers lab-quality results for a range of commonly ordered blood tests, representing a significant advancement in convenient, high-accuracy blood sampling technology.

-

In October 2023, announced it has obtained additional regulatory approval for its TAP Micro Select blood collection device, securing CE Mark certification. This certification enables the device to be marketed and used across the European Economic Area (EEA), signifying compliance with stringent EU health, safety, and environmental requirements. The TAP Micro Select device allows for convenient, virtually painless collection from a fingertip, supporting high-quality sampling for diagnostic and monitoring purposes, which broadens its accessibility and use in various healthcare and at-home settings across Europe.

Blood Collection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.06 billion

Revenue forecast in 2030

USD 6.71 billion

Growth rate

CAGR of 8.72% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Collection site, application, method, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Abbott; NIPRO Medical Corporation; BD; Terumo Corporation; Medtronic; QIAGEN; FL Medical s.r.l.; Greiner AG; Haemonetics Corporation; F. Hoffmann-La Roche Ltd.; Sarstedt AG & Co. KG; Centogene N.V.; SEKISUI CHEMICAL CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Collection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global blood collection market report based on collection site, application, method, end use, and region:

-

Collection Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Venous

-

Needles and Syringes

-

Double-Ended Needles

-

Winged Blood Collection Sets

-

Standard Hypodermic Needles

-

Other Blood Collection Needles

-

-

Blood Collection Tubes

-

Serum-separating

-

EDTA

-

Heparin

-

Plasma-separating

-

-

Blood Bags

-

Others

-

-

Capillary

-

Lancets

-

Micro-Container Tubes

-

Micro-Hematocrit Tubes

-

Warming Devices

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Treatment

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Blood Collection

-

Automated Blood Collection

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics Centers

-

Blood Banks

-

Emergency Departments

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The diagnostics segment held the largest blood collection market share with a market share of 66.89%, owing to the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases, coupled with growing awareness about regular health checkups.

b. Some of the major players operating in the blood collection market include Abbott, NIPRO Medical Corporation, BD, Terumo Corporation, Medtronic, QIAGEN, FL Medical s.r.l., Greiner AG, Haemonetics Corporation, F. Hoffmann-La Roche Ltd., Sarstedt AG & Co. KG, Centogene N.V., SEKISUI CHEMICAL CO., LTD.

b. The increasing prevalence of infectious diseases, the mounting number of accident & trauma cases, and non-communicable diseases are the key factors contributing towards market growth.

b. The global blood collection market size was estimated at USD 3.73 billion in 2024 and is expected to reach USD 4.06 billion in 2025.

b. The global blood collection market is expected to grow at a compound annual growth rate of 8.72% from 2025 to 2030 to reach USD 6.71 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.