- Home

- »

- Medical Devices

- »

-

Blood Gas And Electrolyte Analyzer Market Size Report, 2030GVR Report cover

![Blood Gas And Electrolyte Analyzer Market Size, Share & Trends Report]()

Blood Gas And Electrolyte Analyzer Market (2024 - 2030) Size, Share & Trends Analysis Report By Products (Instruments, Consumables), By End-use (Clinical Laboratory, Point-of-care), By Region, And Segment Forecasts

- Report ID: 978-1-68038-420-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Gas And Electrolyte Analyzer Market Summary

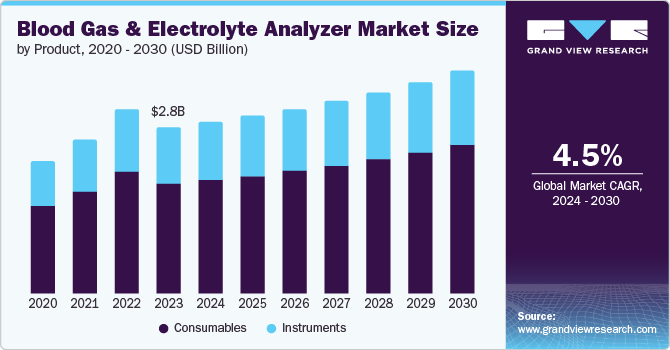

The global blood gas and electrolyte analyzer market size was estimated at USD 2.76 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030.The market's growth is attributed to the growing prevalence of chronic diseases, rising geriatric population, and increasing regulatory support and funding for developing novel blood gas and electrolyte analyzers.

Key Market Trends & Insights

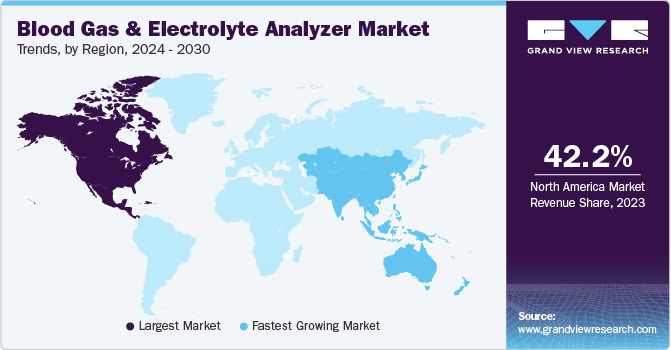

- North America blood gas and electrolyte analyzer market held the largest revenue share of 42.22% in 2023.

- By product, consumables dominated the market with a revenue share of 66.28% in 2023.

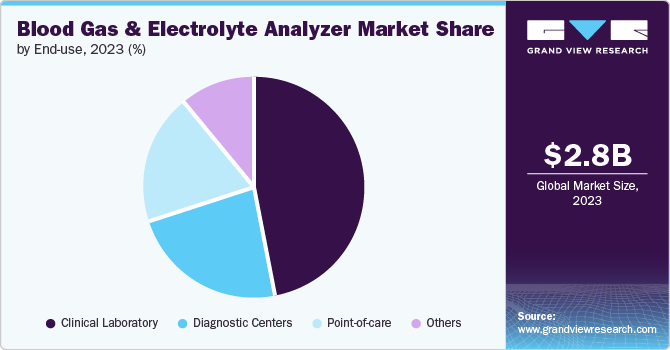

- By end use, clinical laboratory dominated the market with a revenue market share of 46.98% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.76 Billion

- 2030 Projected Market Size: USD 3.71 Billion

- CAGR (2024-2030): 4.5%

- North America: Largest market in 2023

Chronic diseases such as diabetes, cardiovascular diseases, and chronic respiratory conditions are becoming common due to various factors, including lifestyle changes and urbanization. These conditions require continuous monitoring and management.

Chronic diseases lead to complications that require blood gas and electrolyte analysis. For instance, diabetes can lead to diabetic ketoacidosis, a condition that necessitates the monitoring of blood pH and electrolyte levels. Similarly, cardiovascular diseases can result in heart failure, demanding regular checks of blood oxygen levels and electrolyte balance. As the prevalence of these diseases rises, the demand for blood gas and electrolyte analyzers is growing.

The growing geriatric population worldwide significantly drives the market. Aging leads to an increase in age-related diseases and conditions that require close monitoring & management. These conditions necessitate blood gas and electrolyte analyzers, which measure various parameters such as pH, gases (oxygen & carbon dioxide), and electrolytes in the blood. This equipment is crucial in diagnosing and monitoring patients in critical care, respiratory care, and for those undergoing surgery. According to the Population Reference Bureau, the number of individuals in the U.S. aged 65 years and above is projected to increase from 58 million in 2022 to 82 million by 2050. This rising aging population is anticipated to bring about challenges and opportunities in the country with the rising adoption of blood gas and electrolyte analyzers.

Regulatory support and funding are crucial factors driving the market. These analyzers are essential for critical care, emergency departments, and clinical laboratories, providing vital information about patients' respiratory & metabolic status. Governments across various regions have been focusing on improving healthcare infrastructure and quality. Regulatory bodies have implemented stringent guidelines and standards for medical devices, ensuring the reliability, accuracy, and safety of blood gas & electrolyte analyzers. This regulatory environment helps build trust among healthcare providers and patients, promoting the adoption of these devices.

Furthermore, with the expansion of healthcare facilities, mainly in rural and remote areas, there is a growing demand for advanced medical equipment. New hospitals and clinics need the latest diagnostic technologies to provide high-quality care, driving the market demand. Regulatory bodies and governments conduct awareness programs and provide training for healthcare professionals on the latest medical technologies. This helps increase the adoption of new devices as healthcare providers become more knowledgeable about the benefits and usage of blood gas & electrolyte analyzers.

However, the high cost of advanced analyzers is one of the key factors restraining the market's growth. These advanced analyzers integrate advanced technology and features that offer precise & rapid results, which are crucial for critical care. Moreover, their high cost makes them less accessible to many healthcare facilities, especially in the developing countries of Southeast Asia, where budget constraints are a significant concern.In addition to the initial purchase price, advanced analyzers require ongoing expenditures for consumables such as reagents & cartridges and regular maintenance. These recurring costs can add up, making the overall cost of ownership high. Healthcare providers may be hesitant to invest in such equipment due to the long-term financial commitment required.

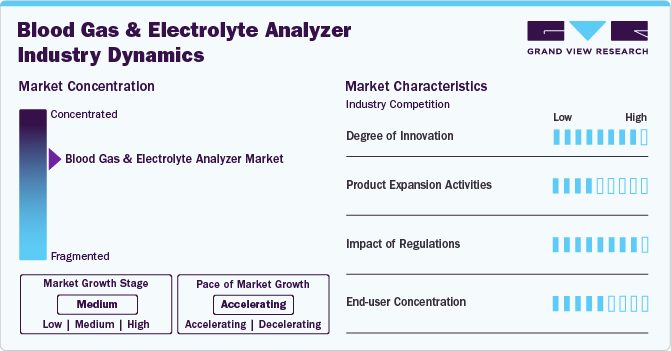

Industry Dynamics

The degree of innovation is high in the market, particularly due to the integration of wireless connectivity and enhanced data management capabilities, which are further enhancing the usability & efficiency of these instruments. Despite challenges such as high costs and stringent regulatory requirements, the market for blood gas & electrolyte analyzers is observing significant growth, driven by increasing healthcare needs and continuous technological innovations.

The market's product expansion activities are moderate. Integrating multiple functions into a single platform is a significant trend in the market. This trend involves the development of combined analyzers that enable healthcare providers to perform multiple tests simultaneously, including blood gas analysis, electrolyte analysis, and metabolite testing. This integration streamlines the testing process, reduces turnaround time, and enhances workflow efficiency, ultimately benefiting healthcare providers and patients.

Regulation plays a fundamental role in ensuring the accuracy and reliability of blood gas and electrolyte analyzers. Standardization of preanalytical procedures, awareness of analyzer limitations and interferences, quality control and calibration, and maintenance and calibration protocols are all crucial to ensure reliable results from these devices.

The market shows a high end-user concentration, with significant revenue generated from a limited number of key customers. The increasing demand for accurate and efficient diagnostic tools has encouraged the development of innovative BGAs tailored to meet the specific needs of healthcare professionals. These advancements include enhanced accuracy, faster turnaround times, and integration with hospital information systems.

Product Insights

Consumables dominated the market with a revenue share of 66.28% in 2023 and is anticipated to grow at the fastest growth rate over the forecast period, driven by their increasing demand. This drive is due to the rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, & respiratory conditions that necessitate regular monitoring of blood gases and electrolytes. The increasing number of ICUs, emergency departments, and diagnostic laboratories in Southeast Asia also boosts the demand for consumables. The importance and usage of blood gas analyzers in hospitals have become increasingly evident during the COVID-19 pandemic. Blood gas analyzers are crucial for managing critically ill patients, providing essential measurements of blood pH, oxygen (O2), carbon dioxide (CO2), and electrolytes. These parameters are vital for diagnosing & monitoring respiratory and metabolic disorders, which are common in severe COVID-19 cases.

The instruments segment is expected to grow significantly over the forecast period. The segment's growth is attributed to its rising adoption in healthcare settings. These instruments are essential for measuring pH, blood gases (such as oxygen and carbon dioxide), and electrolytes (including sodium, potassium, and chloride). They are critical in managing patients in critical care, emergency medicine, & neonatal care. The market includes various instruments, from benchtop models to portable, handheld devices, with leading manufacturers like Siemens Healthineers, Radiometer, Abbott, and Roche Diagnostics offering advanced solutions tailored to diverse clinical settings.

End-use Insights

Clinical laboratory dominated the market with a revenue market share of 46.98% in 2023. In the rapidly advancing landscape of healthcare technology, Blood Gas Analyzers (BGAs) have become indispensable for clinical laboratories, offering real-time insights into a patient's respiratory and metabolic status. The increasing demand for accurate & efficient diagnostic tools has impelled the development of innovative BGAs tailored to meet the specific needs of healthcare professionals. These advancements include enhanced accuracy, faster turnaround times, and integration with hospital information systems. The clinical laboratory market for BGAs continues to expand, driven by the need for precise monitoring in critical care settings, management of chronic diseases, and overall push for improved patient outcomes.

The point-of-care segment is anticipated to grow fastest over the forecast period owing to the increasing demand for quick & accurate diagnostic tools in critical care settings. These analyzers provide real-time insights into a patient's respiratory and metabolic status, essential for immediate clinical decision-making. Key drivers include the rising prevalence of chronic diseases, the need for rapid diagnostics in emergency & ICUs, and technological advancements that enhance portability, accuracy, & ease of use. Prominent products in this market, such as the Seamaty SG1, Radiometer ABL90 FLEX PLUS, & Siemens RAPIDPoint 500, offer comprehensive testing panels and user-friendly interfaces, ensuring swift results and improved patient outcomes at the POC.

Regional Insights

North America blood gas and electrolyte analyzer market held the largest revenue share of 42.22% in 2023. The region's dominance is attributed to the rising adoption of innovative technologies by the healthcare industry, which has aided the development of advanced healthcare infrastructure. This region shows a growing trend towards point-of-care testing that enables the need for accurate and rapid diagnostics results, particularly in remote and resource-limited locations. Moreover, integrating these analyzers into the healthcare workflow helps reduce the overall turnaround time, enhances operational efficacy, and helps improve the overall quality of patient care, further propelling the growth of the overall market.

U.S. Blood Gas And Electrolyte Analyzer Market Trends

The blood gas and electrolyte analyzer market in the U.S. is expected to grow over the forecast period. Government funding and support to facilitate the development of novel analyzers in the country are anticipated to create significant growth opportunities.

Europe Blood Gas And Electrolyte Analyzer Market Trends

The blood gas and electrolyte analyzer market in Europe accounted for a significant share of the global market in 2023. This can be attributed to the region's well-established pharmaceutical industry, rising prevalence of chronic diseases, increasing investment in healthcare, and technological advancements.

The UK blood gas and electrolyte analyzer market is growing primarily due to the government's rising investments and the presence of established R&D infrastructure aided by increasing innovation in the development of novel technologies by key players.

The blood gas and electrolyte analyzer market in France is expected to grow over the forecast period. The country has emerged as a hub for innovative and cutting-edge research and development in biological sciences.The increase in the development of advanced analyzers is anticipated to drive the market in the country.

Germany blood gas and electrolyte analyzer market is expected to grow substantially due to the presence of developed healthcare infrastructure, favorable government regulations, and rising technological advancements in diagnostic procedures.

Asia Pacific Blood Gas And Electrolyte Analyzer Market Trends

The blood gas and electrolyte analyzer market in Asia Pacific is expected to witness the fastest CAGR over the forecast period. Growth in the region can be attributed to advanced and developed healthcare infrastructure, increased demand for advanced diagnostics, and the rising prevalence of geriatric population and chronic diseases. According to The Asian Development Bank (ADB), the region has a rapidly aging population, which will result in the presence of one in every four people above the age of 60 by 2050. Moreover, this rising geriatric population is prone to the development of various chronic diseases, with CVDs, cancer, and diabetes being the major conditions found in the region.

China blood gas and electrolyte analyzer market is expected to grow over the forecast period, owing to the robust growth of the pharmaceutical, biotechnology, and biopharmaceutical sectors.

The blood gas and electrolyte analyzer market in Japan is expected to grow over the forecast period owing to the rising demand for these devices, which is aided by the high prevalence of chronic diseases.

Latin America Blood Gas And Electrolyte Analyzer Market Trends

The blood gas and electrolyte analyzer market in Latin America was identified as a lucrative region in this industry. Technological advancements, increasing government expenditure on R&D, the presence of skilled healthcare professionals, and the rising focus of multinational pharmaceutical companies on diagnostic instruments are some of the major factors expected to drive market growth in the region.

Brazil's blood gas and electrolyte analyzer market is expected to grow over the forecast period owing to its established pharmaceutical industry compared to other countries in Latin America.

MEA Blood Gas And Electrolyte Analyzer Market Trends

The blood gas and electrolyte analyzer market in MEA was identified as a lucrative region in this industry. Moderate growth is due to low awareness, high cost, and high operational costs to maintain these instruments.

Saudi Arabia blood gas and electrolyte analyzer market is expected to grow over the forecast period, attributed to the increasing initiatives being undertaken by the government to expand the country's biotechnology sector.

Key Blood Gas And Electrolyte Analyzer Company Insights

Some leading players operating in the market include Abbott, Radiometer Medical ApS, Werfen, and Meizhou Cornley High-Tech Co., Ltd. Key players adopt various operating strategies to maintain their market positions. One key strategy is product innovation and differentiation. Moreover, these players emphasize innovation to derive innovation and bring new solutions to the market. The rising demand for technologically advanced products drives the competition among key players.

Scitek Global Co., Ltd., EDAN Instruments, Inc., and Erba Mannheim are some of the emerging market participants. Emerging players often develop novel products with unique features to differentiate themselves. The companies are focusing on introducing tools that can help in blood gas and electrolyte analysis to meet consumer demand, which is expected to drive competition among emerging players.

Key Blood Gas And Electrolyte Analyzer Companies:

The following are the leading companies in the blood gas and electrolyte analyzer market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Meizhou Cornley High-Tech Co., Ltd.

- Radiometer Medical ApS

- EDAN Instruments, Inc.

- Erba Mannheim

- F. Hoffmann-La Roche Ltd

- Fortress Diagnostics

- Werfen

- LifeHealth

- Medica Corporation

- OPTI Medical Systems, Inc.

- Sensa Core

- Siemens Healthineers AG

Recent Developments

-

In May 2024, Radiometer partnered with Etiometry to enhance workflow and clinical decision-making in hospital and healthcare settings. This partnership involves the integration of Radiometer’s acute care diagnostics with the Etiometry platform to improve the critical care settings for blood gas analysis.

-

In June 2023, B&E BIO-TECHNOLOGY CO., LTD. announced the launch of an i-Check handheld blood gas electrolyte to help enhance and advance point-of-care testing capabilities.

-

In September 2021, Sensa Core Medical Instrumentation announced the launch of ST-200CC Blood Gas Analyzers, its flagship blood gas analyzer used in clinics, hospitals, and diagnostic centers through its widespread network in India.

Blood Gas And Electrolyte Analyzer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.84 billion

Revenue forecast in 2030

USD 3.71 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Singapore; Malaysia; Indonesia; Thailand; Vietnam; Philippines; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Abbott; Meizhou Cornley High-Tech Co., Ltd.; Radiometer Medical ApS; EDAN Instruments, Inc.; Erba Mannheim; F. Hoffmann-La Roche Ltd; Fortress Diagnostics; Werfen; LifeHealth; Medica Corporation; OPTI Medical Systems, Inc.; Sensa Core; Siemens Healthineers AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Gas And Electrolyte Analyzer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood gas and electrolyte analyzer market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Instrument, by Type

-

Bench Top

-

Portable

-

-

Instrument, by Brand

-

I-STAT

-

epoc

-

GEM Premier (3500& 5000)

-

ABL Flex (90 and 800)

-

Cobas

-

RAPID Series

- Others

-

-

-

Consumables

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Laboratory

-

Point-of-care

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

Malaysia

-

Indonesia

-

Thailand

-

Vietnam

-

Philippines

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the blood gas and electrolyte analyzers market include Siemens, Medica, Roche, Erba, Nova stat, Bayer, Radiometer Medical, Samsung Medison, Edan Instruments, OPTI Medical systems Inc., Convergent Technologies, Alere Medical, Accurex, and Dalko Diagnostics.

b. Key factors that are driving the market growth include an increase in the number of patients in intensive care units, emergency departments, and operation rooms, rising demand for high throughput and integrated systems, consolidation of diagnostic facilities, awareness about accreditation, and increasing affordability of patients.

b. The global blood gas and electrolyte analyzers market size was estimated at USD 2.76 billion in 2023 and is expected to reach USD 2.84 billion in 2024.

b. The global blood gas and electrolyte analyzers market is expected to grow at a compound annual growth rate of 4.52% from 2024 to 2030 to reach USD 3.71 billion by 2030.

b. North America dominated the blood gas and electrolyte analyzers market with a share of 42.22% in 2023. This is attributable to the presence of high practitioner and patient awareness levels, well-established healthcare infrastructure, and government support for research and development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.