- Home

- »

- Medical Devices

- »

-

Blood Pressure Monitoring Devices Market Size Report, 2030GVR Report cover

![Blood Pressure Monitoring Devices Market Size, Share & Trends Report]()

Blood Pressure Monitoring Devices Market Size, Share & Trends Analysis Report By End-use (Hospitals, Homecare), By Product (Ambulatory, Aneroid BP Monitors), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-586-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global blood pressure monitoring devices market size was estimated at USD 4.5 billion in 2022 and is projected to expand further at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030. Increasing incidences of hypertension due to changing lifestyles are the key factor attributed to the growth of the market over the forecast period. According to estimates published by the World Health Organization (WHO) in 2019, around 1.28 billion people around the globe have hypertension, which is a major cause of premature death worldwide. The demand for BP monitors is very high on account of the growing geriatric population base and increasing risk of lifestyle-associated disorders among a wide population base due to the rising incidences of obesity & sedentary lifestyle.

Self-measured home blood pressure monitoring was vital even before COVID-19, and it is even more important now to maintain blood pressure under control. The American Heart Association and the American Society of Hypertension, as well as the European Society of Hypertension and the National Institute for Health and Care Excellence (NICE), strongly advise that blood pressure be monitored twice daily for seven consecutive days, preferably in the morning and evening, with two measurements taken 1–2 minutes apart on each occasion. This is fueling the demand for BP monitors. Initiatives taken by the government, such as public blood pressure monitoring programs to create awareness among people and maintain the database created by remotely operational BP monitors are expected to propel further growth during the forecast period.

For instance, in February 2019, an activity funded by the American Medical Association (AMA), named The Integrated Health Model Initiative (IHMI), launched a data management model for providing opportunities to improve health outcomes. Advancements, such as mobile-based BP monitoring systems and digital sphygmomanometers, are anticipated to drive the demand. Improvements in devices for measuring BP, such as wearable & portable devices and mobiles, are gaining popularity owing to associated benefits, such as the wireless transmission of patient information and easy handling.

New technologies, such as mHealth, which support treatment & medication compliance for patients in chronic disease management are expected to fuel market growth. It helps in tracking the patient’s health information, medication schedule, and follow-up for the treatment. These associated advantages are some of the factors expected to propel growth. The increasing burden of hypertension globally led to an increase in the demand for home monitoring devices. In addition, the associated benefits with automated devices, such as repetitive measurements of BP to check the accuracy and banned mercury devices, are factors contributing to the industry growth.

Self-measurement devices are gaining popularity due to associated benefits, such as good monitoring, detection, and control, further anticipating segment growth. Automated BP monitors are available in different forms for the measurement of blood pressure. New product launches along with technological advancements are further expected to fuel the demand. For instance, in February 2021, Hillrom announced that it acquired the contact-free continuous monitoring technology from EarlySense for USD 30 million. This acquisition will help the company develop next-gen AI-based sensing technologies, specifically for the remote patient care market.

Product Insights

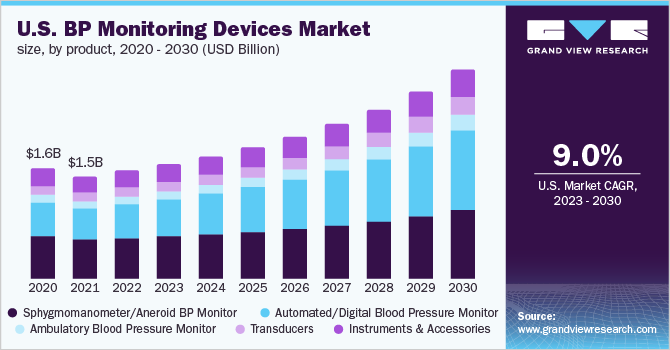

The aneroid BP monitors/sphygmomanometers segment accounted for the largest share of more than 37.1% of the overall revenue in 2022 due to high demand. Technological advancements coupled with new product launches are expected to further fuel the demand for sphygmomanometers globally. The continuous technological improvements, such as advances in wearable technology, apps, and mobiles in the consumer healthcare segment, declining average selling prices for retailers and manufacturers, and rising penetration in the professional market are the factors propelling the market growth.

Examples of technologically advanced digital BP monitors are Microlife WatchBP home A, QardioArm, LifeSource Advanced one-step auto inflate BP monitor, and iHealth BP monitor from Omron healthcare. The demand for blood pressure cuffs is expected to grow at a significant rate over the forecast period due to the increasing usage of BP monitors as a result of the growing incidence of high blood pressure. These cuffs are available in different sizes, according to the patient type. Disposable and reusable are the two types of cuffs available. Among these, the disposable segment is anticipated to expand at a high CAGR due to the rising adoption of eco-friendly products and increasing concerns about hospital-based cross-contamination events.

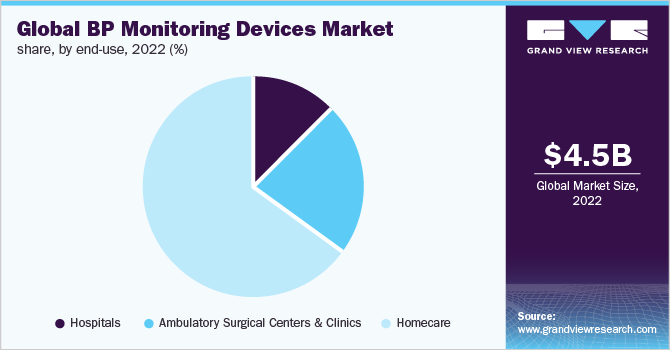

End-use Insights

On the basis of end-uses, the global industry has been further categorized into hospitals, Ambulatory Surgical Centers (ASCs), and homecare. The hospitals segment dominated the global industry in 2022 and accounted for the largest share of more than 65.4% of the overall revenue. The high share can be attributed to the presence of a large patient pool. The adoption of BP monitoring devices is driven by the rising need for cost-effective, fast, and accurate diagnostic tools for better health outcomes.

Homecare is anticipated to exhibit the fastest CAGR od around 11.3% over the forecast period. The cost efficiency of this alternate option for BP monitoring with the availability of smart wearables that offers mobility is expected to support the growth. Therefore, the inclination towards independent living is expected to propel the home healthcare market. Ambulatory BP Monitoring (ABPM) is used to measure out-of-office BP readings at specific time intervals, over a period of 24 hours. ABPM offers a better way to predict long-term cardiovascular disease outcomes.

Regional Insights

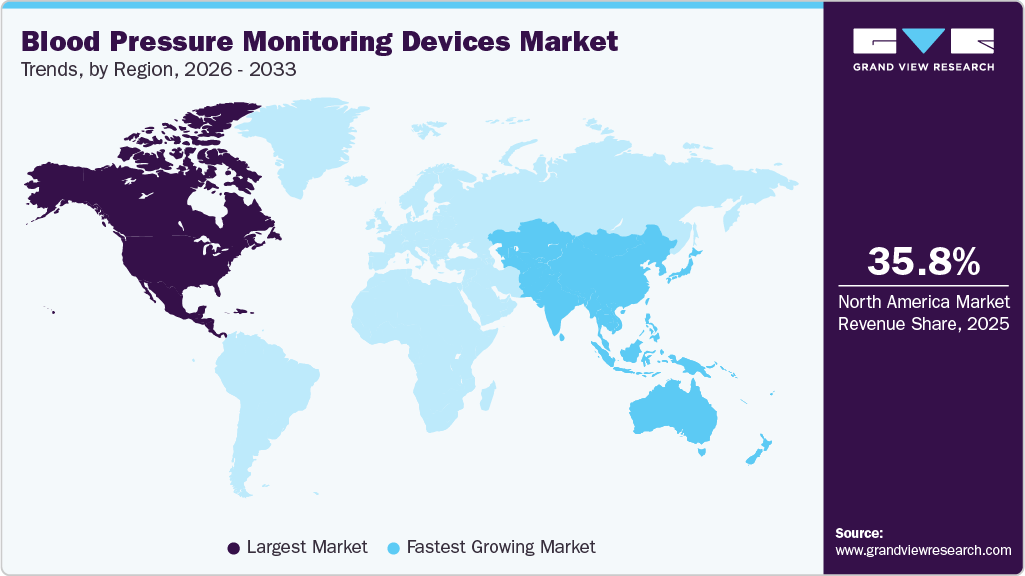

North America held the largest revenue share of more than 39.60% in 2022 as it has a highly regulated & developed healthcare infrastructure. Increasing investments in the development of accurate and effective BP monitors is the key factor expected to contribute to the market growth of BP monitoring devices in the coming years. Moreover, new product launches along with technological advancements are further expected to fuel the industry's growth. For instance, in February 2020, Hillrom announced the commercial launch of a new device, the Welch Allyn Spot Vital Signs 4400, which is an easy-to-use next-generation vital signs device used to improve hypertension detection in ambulatory & emergency department settings. Asia-Pacific, on the other hand, is expected to expand at the fastest CAGR over the forecast period.

This is owing to the presence of untapped opportunities, increasing investments by manufacturers, growing awareness levels, and rising incidences of hypertension. Rapidly improving healthcare facilities and the rising number of undiagnosed & untreated cases of high BP are key factors driving the regional market growth. Supportive government initiatives for increasing awareness among people and a rapidly growing target disease population base are further contributing to the market growth in this region. For instance, in May 2018, The Indian Council of Medical Research (ICMR), in collaboration with the Public Health Foundation of India, launched the “May Measurement Month 2018” campaign to spread awareness about BP, which is the leading cause of mortality and morbidity in India.

Key Companies & Market Share Insights

The industry is witnessing intense competition as it is price-sensitive. The companies are adopting competitive strategies, such as mergers & acquisitions, strategic alliances, collaborative agreements, and partnerships, to sustain the competition. The industry growth is directly associated with the rising investments by manufacturers for the development of cost-effective, innovative, and easy-to-use products. For example, in February 2019, physIQ Inc. and Omron Healthcare entered into a collaborative agreement for integrating the HeartGuide wearable BP monitor of Omron into the pinpointIQ platform used in outpatient facilities. Such initiatives are expected to present this market with lucrative opportunities. Some prominent players in the global blood pressure monitoring devices market include:

-

Omron Healthcare Welch Allyn, Inc.

-

A&D Medical Inc.

-

SunTech Medical, Inc.

-

American Diagnostics Corp.

-

Withings

-

Briggs Healthcare

-

GE Healthcare

-

Kaz Inc.

-

Microlife AG

-

Rossmax International Ltd.

-

GF Health Products Inc.

-

Spacelabs Healthcare Inc.

-

Philips Healthcare

-

Hill-Rom Services Inc.

-

Braun Healthcare

-

Contec

-

Biobeat

Blood Pressure Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.7 billion

Revenue forecast in 2030

USD 7.96 billion

Growth rate

CAGR of 9.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Omron Healthcare Welch Allyn, Inc.; A&D Medical Inc.; SunTech Medical, Inc.; American Diagnostics Corporation; Withings; Briggs Healthcare; GE Healthcare; Kaz Inc.; Microlife AG; Rossmax International Ltd.; GF Health Products Inc.; Spacelabs Healthcare Inc.; Philips Healthcare; B. Braun

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Pressure Monitoring Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global blood pressure monitoring devices market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sphygmomanometer/Aneroid BP Monitor

-

Automated/Digital Blood Pressure Monitor

-

Arm

-

Wrist

-

Finger

-

-

Ambulatory Blood Pressure Monitor

-

Transducers

-

Disposable

-

Reusable

-

-

Instruments And Accessories

-

Blood Pressure Cuffs

-

Disposable

-

Reusable

-

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers & Clinics

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood pressure monitoring devices market size was estimated at USD 4.5 billion in 2022 and is expected to reach USD 4.7 billion in 2023.

b. The global blood pressure monitoring devices market is expected to grow at a compound annual growth rate of 9.4% from 2023 to 2030 to reach USD 7.96 billion by 2030.

b. North America dominated the blood pressure monitoring devices market with a share of 39.6% in 2022. This is attributable to a highly regulated & developed healthcare infrastructure, increasing investments for the development of accurate, effective BP monitors, and increasing new product launches along with technological advancements.

b. Some key players operating in the blood pressure monitoring devices market include Omron Healthcare Welch Allyn, Inc., A&D Medical Inc., SunTech Medical, Inc., American Diagnostics Corporation, Withings, Briggs Healthcare, GE Healthcare, Kaz Inc., Microlife AG, Rossmax International Ltd., GF Health Products Inc., Spacelabs Healthcare Inc., and Philips Healthcare.

b. Key factors that are driving the blood pressure monitoring devices market growth include increasing incidences of hypertension due to changing lifestyles, growing geriatric population base, increasing the risk of lifestyle associated disorders, rising incidences of obesity & sedentary lifestyle, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."