- Home

- »

- Clinical Diagnostics

- »

-

Blood Testing Market Size And Share, Industry Report, 2030GVR Report cover

![Blood Testing Market Size, Share & Trends Report]()

Blood Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Test Type (Glucose, Lipid, COVID-19, A1C, CRP, Vitamin-D, ALT, AST, Thyroid Stimulating Hormone, PSA, Cortisol), By Region, And Segment Forecasts

- Report ID: 978-1-68038-897-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Testing Market Summary

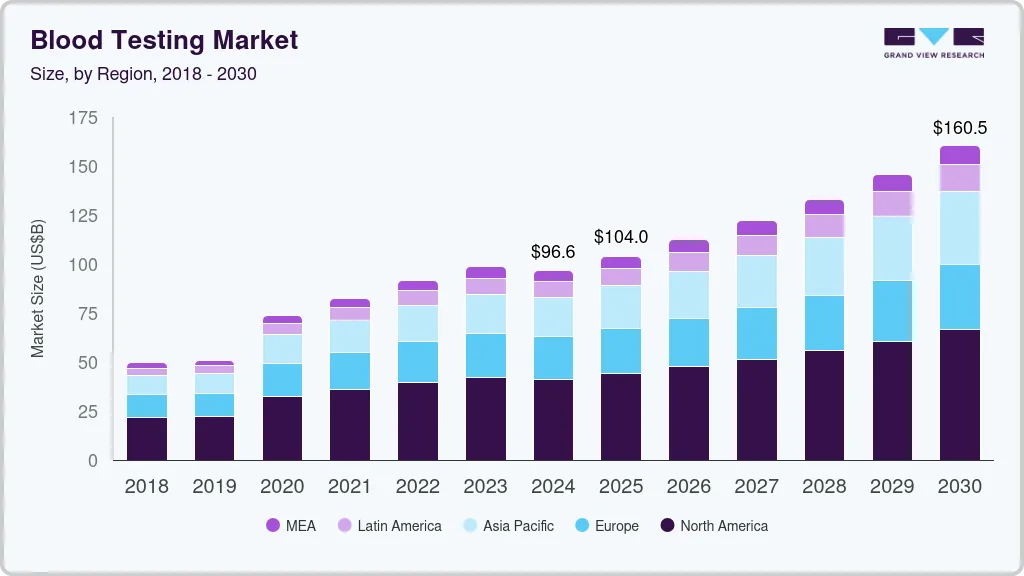

The global blood testing market size was estimated at USD 96.62 billion in 2024 and is projected to reach USD 160.50 billion by 2030, growing at a CAGR of 8.83% from 2025 to 2030. The market growth is attributed to rising awareness of preventative healthcare and advancements in testing technologies aided by an increasing healthcare expenditure by governments and regulatory bodies, which actively promote routine diagnostic testing to improve patient outcomes.

Key Market Trends & Insights

- North America blood testing market dominated the industry with the largest revenue share of 44.83% in 2024.

- The blood testing market in U.S. is expected to grow at the fastest CAGR over the forecast period

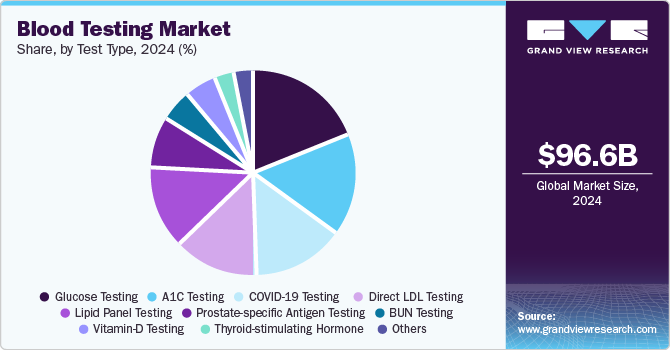

- Based on test type, the glucose testing segment led the market with the largest revenue share of 15.97% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 96.62 Billion

- 2030 Projected Market Size: USD 160.50 Billion

- CAGR (2025-2030): 8.83%

- North America: Largest market in 2024

For example, developing advanced blood tests, such as those providing early detection for severe illnesses like COVID-19, demonstrates the growing focus on early detection and personalized care. These factors, combined with expanding healthcare infrastructure in emerging markets, are anticipated to drive market growth over the forecast period.

The rising adoption of blood testing solutions is driven by increasing awareness of preventive healthcare and the growing need for accurate and early disease diagnosis. Healthcare providers are leveraging advanced technologies to detect chronic and infectious diseases, monitor health conditions, and personalize treatment plans. In addition, advancements in automation and point-of-care testing devices have made blood tests more accessible and efficient, reducing turnaround times and enhancing patient outcomes. The shift towards minimally invasive techniques and home-based blood kits further supports adoption by offering convenience and ease of use. These trends, coupled with growing healthcare spending and a focus on early detection, are propelling the widespread adoption across both developed and emerging markets.

The growing prevalence of target diseases such as diabetes, cardiovascular diseases, and cancer is a major driver for the market growth. As these chronic conditions continue to rise globally, the demand for diagnostic tools to monitor and manage these diseases has surged. For example, the International Diabetes Federation reports that approximately 537 million adults are living with diabetes worldwide, and this number is expected to increase to 783 million by 2045. In the U.S., nearly 122 million adults have hypertension, contributing to a greater need for blood pressure and cholesterol testing. In addition, the rise in cancer cases, with an estimated 19.3 million new cancer cases globally in 2020 according to the World Health Organization, further fuels the demand for early detection tools such as liquid biopsy tests. As more people are diagnosed with these conditions, regular and accurate blood testing becomes essential for effective disease management and prevention, driving the expansion of the industry.

The growing demand for point-of-care (POC) tests is propelling the growth, as they offer quick, accurate, and convenient diagnostic results outside traditional laboratory settings. POC tests are increasingly preferred for their ability to provide immediate results, reducing wait times and enabling timely medical interventions. This is particularly valuable in emergency situations, rural areas, or for patients seeking at-home solutions. For example, Abbott’s FreeStyle Libre system, a continuous glucose monitoring device, allows patients with diabetes to track their glucose levels in real time without needing a lab visit. Similarly, devices like Roche’s COBAS Liat System provide rapid molecular testing for various infectious diseases, such as COVID-19 and influenza, directly at the point of care. These innovations have made blood testing more accessible and efficient, driving the adoption of POC tests across healthcare facilities and homes, and fueling the overall growth of the blood testing industry.

The implementation of favorable government initiatives and external funding for research and development (R&D) activities is significantly driving the growth of the blood testing industry. Governments across various regions are recognizing the importance of early disease detection and preventive healthcare, which has led to increased funding for medical research and innovation in diagnostic technologies. For example, the U.S. government’s support for health initiatives like the National Institutes of Health (NIH) funding research in non-invasive diagnostic methods has accelerated the development of advanced solutions.

One key factor restraining the market growth is the complexity and cost associated with some advanced blood testing technologies, which can limit their accessibility, particularly in developing regions. In addition, stringent regulatory requirements, such as the FDA approval process for new diagnostic devices, can delay the market introduction of innovative testing solutions, slowing down the pace of advancement. Furthermore, reimbursement policies in certain regions, especially for home-based or non-invasive tests, can be restrictive, limiting patient access to these technologies. In many cases, insurance companies may not cover the full cost of certain blood tests, particularly for conditions that are still under research or are not yet widely recognized, further hindering market growth. These factors combine to create barriers to the widespread adoption of new technologies and services.

Test Type Insights

Based on test type, the glucose testing segment led the market with the largest revenue share of 15.97% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by increasing global awareness of diabetes and the rising prevalence of the disease. Diabetes, both type 1 and type 2, has become a major public health concern, with the World Health Organization (WHO) estimating that approximately 422 million people worldwide suffer from the condition. As the incidence of diabetes continues to rise, there is a growing demand for glucose monitoring solutions to manage the disease effectively and prevent complications. Furthermore, the increasing shift towards home-based and point-of-care testing has significantly impacted the growth of glucose testing, as patients prefer convenient, at-home options for monitoring their glucose levels. This trend is reflected in the growth of blood glucose test strips, glucose meters, and wearable devices designed for continuous monitoring, positioning glucose testing as a key driver in the overall market growth.

The A1C testing segment is expected to grow at a significant CAGR during the forecast period, due to the increasing global prevalence of diabetes, particularly type 2 diabetes, and the growing awareness of the importance of long-term glucose control. A1C tests, which measure the average blood sugar levels over the past two to three months, are a critical tool in managing diabetes and preventing complications, as they provide a more comprehensive picture of a patient’s glucose control than traditional fingerstick tests. The segment is further expanding as A1C testing becomes increasingly available at the point of care, allowing healthcare providers to quickly assess a patient's long-term glucose control. In 2020, Abbott received FDA approval for its Afinion 2, a device that provides A1C testing results in just 3 minutes, making it a convenient option for both healthcare professionals and patients. Similarly, devices like the A1CNow+ from PTS Diagnostics allow for at-home testing, offering individuals the flexibility to monitor their A1C levels regularly without needing to visit a clinic. These innovations are driving the growth by improving accessibility, reducing wait times for results, and enabling better patient engagement in managing their condition.

Regional Insights

North America blood testing market dominated the industry with the largest revenue share of 44.83% in 2024. The market growth in North America is driven by factors such as the rising prevalence of chronic diseases, advancements in diagnostic technologies, and increasing healthcare awareness. Technological advancements in blood testing devices and procedures are another key factor contributing to the market's growth. Continuous glucose monitoring (CGM) devices, point-of-care testing systems, and molecular diagnostics innovations have revolutionized how diseases are detected and managed. Companies like Abbott, with their FreeStyle Libre system for glucose monitoring, and Roche, with their COBAS systems, are leading the market in bringing cutting-edge solutions to the market. These technologies not only improve the accuracy of tests but also reduce turnaround times, allowing healthcare providers to make quicker, more informed decisions, which is crucial for effective patient care.

U.S. Blood Testing Market Trends

The blood testing market in U.S.is expected to grow at the fastest CAGR over the forecast period, driven by the increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer. Technological advancements, including continuous glucose monitoring devices and point-of-care solutions, are enhancing diagnostic accuracy and accessibility. In addition, the increasing demand for home-based testing kits and the expansion of telemedicine have further fueled market expansion.

Europe Blood Testing Market Trends

The blood testing market in Europe accounted for a significant market share in 2024, driven by the increasing incidence of chronic diseases, an aging population, and rising healthcare awareness. Advancements in diagnostic technologies, including non-invasive blood tests and point-of-care devices, are driving demand for more efficient and accessible testing solutions.

The UK blood testing market is growing steadily, supported by the increasing prevalence of chronic conditions like diabetes, heart disease, and obesity. Advances in diagnostic technologies, including at-home kits and point-of-care devices, are making blood testing more accessible and efficient.

The blood testing market in France is expected to grow at a significant CAGR over the forecast period, due to the growing emphasis on early disease detection and personalized healthcare. As the prevalence of chronic conditions like diabetes and cardiovascular diseases rises, there is an increased demand for accurate and efficient diagnostic solutions. Technological advancements, such as point-of-care devices and automated systems, are improving the speed and precision of blood tests.

The Germany blood testing market is expected to exhibit at a significant CAGR during the forecast period, due to presence of strong healthcare infrastructure and increasing demand for advanced diagnostic solutions. The rising prevalence of chronic diseases, such as diabetes and cardiovascular disorders, is contributing to the higher adoption of blood testing technologies.

Asia Pacific Blood Testing Market Trends

The blood testing market in Asia-Pacific is expected to witness at the fastest CAGR over the forecast period, driven by rapidly expanding healthcare infrastructure, increasing awareness of chronic diseases, and rising healthcare expenditure. As the population ages and lifestyle-related diseases like diabetes, cardiovascular conditions, and cancer become more prevalent, there is a growing demand for diagnostic solutions. In addition, technological advancements in blood testing, such as point-of-care devices and affordable at-home kits, are driving market adoption. The rise of medical tourism in countries like India and China, along with the expansion of health insurance coverage, is also fueling demand for advanced diagnostic services. These factors, combined with government initiatives to improve healthcare access, position Asia Pacific as a key driver of market growth.

The China blood testing marketis expected to grow at the fastest CAGR over the forecast period, due to country's large population, increasing prevalence of chronic diseases, and significant investments in healthcare infrastructure.

The blood testing market in Japan is expected to grow at a significant CAGR over the forecast period, due to the high aging population and the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions. The country’s advanced healthcare system, high standards of medical research, and strong regulatory environment support the adoption of cutting-edge diagnostic technologies.

Latin America Blood Testing Market Trends

The blood testing market in Latin America was identified as a lucrative region in this industry due to increasing healthcare investments, rising awareness of chronic diseases, and expanding access to diagnostic services.

The Brazil blood testing market is expected to grow at the fastest CAGR over the forecast period. The prevalence of chronic diseases such as diabetes, hypertension, and cancer drives the market growth. As Brazil continues to expand its healthcare infrastructure, there is a growing demand for advanced diagnostic solutions, particularly in urban areas.

MEA Blood Testing Market Trends

The blood testing market in MEA was identified as a lucrative region in this industry. The market is witnessing significant growth opportunities driven by increasing healthcare investments and a rising burden of chronic diseases such as diabetes, cardiovascular diseases, and cancer.

The Saudi Arabia blood testing market is expected to grow at the fastest CAGR over the forecast period, attributed to the country’s expanding healthcare sector and increasing awareness of chronic diseases such as diabetes, hypertension, and cancer. With a growing population and a focus on improving healthcare services through Vision 2030, Saudi Arabia is investing heavily in advanced diagnostic technologies and healthcare infrastructure.

Key Blood Testing Company Insights

The blood testing industry is driven by major players who continuously innovate to enhance diagnostic accuracy and accessibility. Companies like Abbott, Roche Diagnostics, and Quest Diagnostics Incorporated lead the industry with advanced technologies, including point-of-care devices, automated analyzers, and high-sensitivity testing platforms. Emerging players such as Guardant Health and Bio-Rad Laboratories are gaining traction with novel solutions like liquid biopsy tests and specialized diagnostic tools for oncology and infectious diseases. These companies invest heavily in R&D, strategic collaborations, and regulatory approvals to expand their product portfolios and cater to the growing demand for early disease detection and personalized healthcare globally.

Emerging players in the blood testing industry are making significant strides with innovative technologies that cater to niche diagnostic needs and evolving healthcare trends. Companies like Guardant Health, with its cutting-edge liquid biopsy tests for cancer detection, and Everlywell, which focuses on at-home testing kits, are reshaping the market by offering convenient and accessible solutions for both patients and healthcare providers. Other notable players, such as Freenome and GRAIL, are pioneering advancements in genomic-based blood tests for early cancer detection, leveraging artificial intelligence and machine learning to improve diagnostic accuracy. These emerging companies are gaining attention through strategic partnerships, robust R&D, and the introduction of personalized healthcare solutions, contributing to rapid market growth by addressing unmet medical needs and driving innovation in non-invasive diagnostics.

Key Blood Testing Companies:

The following are the leading companies in the blood testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc.

- bioMerieux

- Quest Diagnostics Incorporated

- Biomerica

- BD

- Siemens Healthineers AG

- Danaher Corporation

- Trinity Biotech Plc

Recent Developments

-

In July 2024, Guardant Health, Inc. announced that the U.S. Food and Drug Administration (FDA) had granted approval for its Shield blood test, designed for colorectal cancer (CRC) screening in adults aged 45 and older at average risk. Shield is the first blood test approved by the FDA as a primary screening option for CRC, enabling healthcare providers to offer it alongside other non-invasive methods recommended in screening guidelines.

-

In April 2024, Abbott's i-STAT TBI cartridge received FDA clearance for use with whole blood, enabling doctors to assess patients with suspected concussions directly at the bedside. This advancement provides lab-quality results within 15 minutes, eliminating the need for plasma or serum samples to be sent to a lab for processing, which was previously required for traumatic brain injury (TBI) assessments.

-

In May 2024, Roche announced that the Tina-quant lipoprotein Lp(a) RxDx assay received Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA). This assay is designed to identify patients who may benefit from innovative Lp(a)-lowering therapies currently in development. Lipoprotein (a), or Lp(a), is increasingly recognized as a significant yet underappreciated risk factor for cardiovascular disease, a leading public health concern.

Blood Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 104.00 billion

Revenue forecast in 2030

USD 160.50 billion

Growth rate

CAGR of 8.83% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Abbott; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; bioMerieux; Quest Diagnostics Incorporated; Biomerica; BD; Siemens Healthineers AG; Danaher Corporation; Trinity Biotech Plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood testing market report based on test type, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Glucose Testing

-

A1C Testing

-

Direct LDL Testing

-

Lipid Panel Testing

-

Prostate-specific Antigen Testing

-

COVID-19 Testing

-

BUN Testing

-

Vitamin-D Testing

-

Thyroid-stimulating Hormone (TSH)

-

Serum Nicotine/Cotinine

-

High sensitivity CRP Testing

-

Testosterone Testing

-

ALT Testing

-

Cortisol Testing

-

Creatinine Testing

-

AST Testing

-

Others Blood Tests

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood testing market size was estimated at USD 96.62 billion in 2024 and is expected to reach USD 104.00 billion in 2025.

b. The global blood testing market is expected to grow at a compound annual growth rate of 8.83% from 2025 to 2030 to reach USD 160.50 billion by 2030.

b. North America dominated the blood testing market with a share of 44.83% in 2024. Key factors attributing to the growth of the market include the rising prevalence of chronic diseases, advancements in diagnostic technologies, and increasing healthcare awareness.

b. Some key players operating in the blood testing market include Abbott, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., bioMerieux, Quest Diagnostics Incorporated, Biomerica, BD, Siemens Healthineers AG, Danaher Corporation, Trinity Biotech Plc.

b. Key factors that are driving the blood testing market growth include increasing patient awareness regarding self-testing, increasing demand for at-home diagnostic tests, and early detection of chronic ailments.

b. The glucose testing segment dominated the global blood testing market and accounted for the largest revenue share of 15.83% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.