- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Botanical Ingredients Market Size & Share Report, 2030GVR Report cover

![Botanical Ingredients Market Size, Share & Trends Report]()

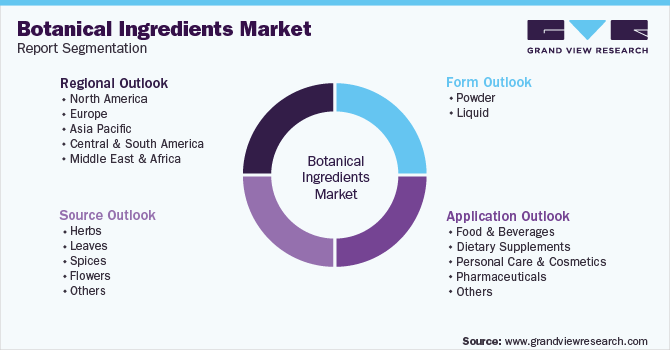

Botanical Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Spices, Flowers), By Form (Powder, Liquid), By Application (Food & Beverage, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-773-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Botanical Ingredients Market Summary

The global botanical ingredients market size was estimated at USD 175.44 billion in 2023 and is projected to reach USD 281.41 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. The industry is witnessing growth primarily due to the rising health-conscious consumer base coupled with clean-label trends in the pharmaceutical, food, and beverage industries.

Key Market Trends & Insights

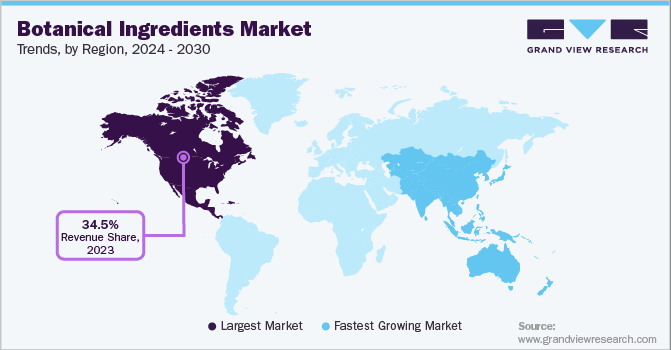

- North America dominated the industry with a revenue share of 34.54% in 2023.

- Asia Pacific is expected to witness the fastest CAGR during the forecast years.

- By sources, the spices segment dominated the global industry in 2023 with revenue share of 28.01%.

- By application, the food and beverage segment dominated the industry in 2023 with revenue share of 34.01%.

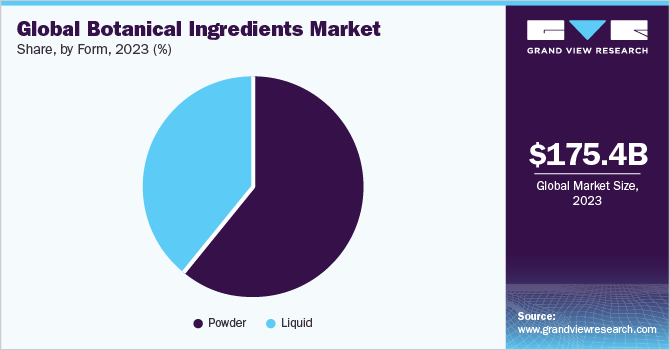

- By form, the powder segment dominated the global industry in 2023 revenue share of 60.25%.

Market Size & Forecast

- 2023 Market Size: USD 175.44 Billion

- 2030 Projected Market Size: USD 281.41 Billion

- CAGR (2024 - 2030): 7.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Consumers are increasingly shifting to healthier alternatives while adopting preventive care as a necessary tool to help them lead a better lifestyle. Thus, botanical ingredients are being increasingly utilized in the manufacturing of food & beverages as they are a rich source of bioactive compounds and render a diverse range of biological effects.The demand for botanical ingredients in the U.S. is highly influenced by the growing vegan population, the rising focus on the use of natural & organic food ingredients, and the presence of key manufacturers with wide distribution networks. The increasing demand for sports nutrition in the country is expected to amplify the demand for dietary supplements, benefitting the market. Clean labels cut through the clutter of too much data. The shifting trend toward clean-label sources is directly increasing the scope of botanical ingredients in the food, dietary supplements, and pharmaceutical industries.

The COVID-19 pandemic severely disrupted the supply chain, retail distribution, and consumer behavior for numerous sources and services globally. However, botanical ingredients witnessed a surge in demand during the pandemic on account of the increased consumer preference for health and wellness sources, which support overall well-being. Various dietary supplement sources associated with joint health, obesity, anxiety, and the vascular system are formulated using botanical ingredients.

Source Insights

On the basis of sources, the industry has been further categorized into herbs, leaves, spices, flowers, and others. The spices source segment dominated the global industry in 2023 and accounted for the maximum share of more than 28.01% of the overall revenue. The segment will expand further at a steady CAGR retaining its leading position throughout the forecast period. This is attributed to the changing lifestyles demanding healthy food that is convenient along with a popular trend of experiencing novel foods. The flower source segment is projected to register the fastest growth rate during the forecast period.

Fresh flowers are not only used for the beautification of homes and offices but also in cosmetics, dry herbs, natural dyes, potpourri, and medicines. The herbs segment is also expected to witness a significant growth rate during the forecast period on account of the extensive utilization of herbs in traditional medicines. Herb-based medicinal sources are gaining importance globally on account of their health benefits, such as improved metabolism & immune system and stabilization of hormones. Numerous themes, such as Ayurveda, Yoga, Homoeopathy, and Siddha, are gaining importance, thus, boosting the growth of herb-based botanical ingredients.

Application Insights

The food and beverage application segment dominated the industry in 2023 and accounted for the maximum share of 34.01% of the overall revenue. This is attributed to the increasing use of ingredients in various food & beverage products owing to their unique flavor and several health benefits. Food manufacturers are increasingly fortifying their sources with nutritive ingredients, such as vitamins, minerals, and prebiotics, to improve the product’s nutritional value. This trend is likely to increase the penetration of botanical ingredients in the food & beverage segment. Beverages accounted for a significant share of the application segment in 2023 owing to consumer lifestyle changes, which have propelled the demand for RTD products.

In addition, increasing efforts by the manufacturer to develop RTD products with different flavors and fortified botanical ingredients are benefitting the segment growth. Botanical ingredients are widely utilized by cosmetics manufacturers for preparing natural skincare formulations due to their antifungal, antimicrobial, antioxidant, skin conditioning, oral care, and humectant properties. Furthermore, the growing demand for natural and clean-label cosmetic sources is expected to generate significant growth opportunities for the segment.

The use of botanical ingredients in pharmaceuticals is one of the upcoming trends in the current market scenario. Growing demand for plant-based medicines and rising awareness about the benefits of botanical ingredients are likely to be the major factors driving the segment growth over the forecast period. The rising prevalence of chronic conditions, such as arthritis, diabetes, and cardiovascular diseases, and the advantages of botanical drugs as compared to synthetic drugs, such as cost-effectiveness, are also expected to boost the product demand in the dietary supplements application segment.

Form Insights

The powder form segment dominated the global industry in 2023 and accounted for the maximum share of more than 60.25% of the overall revenue. This is attributed to the characteristics of powdered botanical ingredients, such as consistency in texture and restoring skin cells. Botanical ingredients extracted in the form of powder, are widely utilized to enhance the palatability of food and beverages as well as preservatives. Demand for sources, such as HUM Nutrition’s and ESI beauty collagen raw beauty powder, which include American ginseng, Eleuthera root powder, and ashwagandha root powder in the U.S. market are boosting the industry growth.

The liquid form segment is estimated to register the fastest CAGR from 2024 to 2030. Liquid-form products are more suitable for making Ready-to-Drink (RTD) beverages, cold beverages, and beverage mixes. The growing popularity of RTD beverages, owing to their ease of consumption, strong nutritional profile, and easy availability, is expected to drive the demand for liquid-form ingredients. However, the bulk packaging of liquid form causes inconvenience in handling and occupies more space. On the contrary, powder form offers high shelf life, high solubility, cost-effectiveness, and consistent nutrient concentration. This factor may hamper the liquid form segment growth to some extent.

Regional Insights

North America dominated the industry with a revenue share of 34.54% in 2023. This is attributed to the high prevalence of various lifestyle diseases in the U.S. and Mexico, due to the rising cases of obesity. The source demand in Europe is increasing owing to a rise in the number of diet-conscious consumers, growing disposable income levels, and an increasing middle-class population. Moreover, the bakery industry in Europe has been significantly contributing to the demand for botanical-based nutrients, such as dietary fibers, with the high popularity of natural and healthy bakery sources containing dietary fibers.

Asia Pacific is expected to witness the fastest CAGR during the forecast years. Factors, such as the penetration of organized and e-commerce retail, are driving the consumption of convenience food sources incorporated with botanical ingredients. The region is characterized by the presence of a large number of suppliers. For instance, India, China, and Sri Lanka are the leading tea producers in the world. Moreover, several other medicinal, as well as non-medicinal botanicals, such as amla, hibiscus flower, and ginger, are extensively cultivated in the Asia Pacific region.

Key Companies & Market Share Insights

The global industry is highly fragmented and competitive owing to the presence of prominent and well-established players. The companies have a strong network of distributors and partnerships with farmers to achieve higher efficiencies across the value chain. Key companies are continuously involved in M&A and partnership activities to gain a competitive advantage over others. The M&A activities have enabled companies to expand their source portfolios and geographical presence. Some of the prominent players in the global botanical ingredients market include:

-

Indesso

-

Lipoid Kosmetic AG

-

The Herbarie at Stoney Hill Farm, Inc.

-

International Flavors& Fragrances, Inc.

-

Bell Flavors& Fragrances

-

Rutland Biodynamics Ltd.

-

Prakruti Sources Pvt. Ltd.

-

AmbePhytoextractsPvt. Ltd.

-

The Green Labs LLC

-

Berje, Inc.

-

Umalaxmi Organics Pvt. Ltd.

-

DSM

Botanical Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 187.41 billion

Revenue forecast in 2030

USD 281.41 billion

Growth rate

CAGR 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Source, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; China; India; Japan; Australia; South Korea; ASEAN; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

International Flavors & Fragrance,7 Inc.; Indesso Aroma; Bell Flavors & Fragrances; Prakruti Sources Pvt. Ltd.; Berje Inc.; Umalaxmi Organics Pvt. Ltd.; AmbePhytoextracts Pvt. Ltd.; Ribus Inc.; The Green Labs LLC; Rutland Biodynamics Ltd.; Lipoid Kosmetic AG; The Herbarie at Stoney Hill Farm, Inc; DSM

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Botanical Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global botanical ingredients market report on the basis of source, form, application, and region:

-

Form Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Source Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Herbs

-

Leaves

-

Spices

-

Flowers

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Food

-

Bakery & Confectionery

-

Sauces & Dressings

-

Others

-

-

Beverages

-

Energy Drinks

-

Sports Drinks

-

Functional Juices

-

Others

-

-

-

Dietary Supplements

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

ASEAN

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global botanical ingredients market size was estimated at USD 164.4 billion in 2022 and is expected to reach USD 175.44 billion in 2023.

b. The global botanical ingredients market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 281.4 billion by 2030.

b. Spices were the dominant source segment in terms of revenue, occupying over 26% in 2022, and is expected to experience significant growth over the forecast period. The rising use of spice-sourced botanical ingredients for offering novel taste and health benefits to customers is expected to drive the botanical ingredients market over the forecast period.

b. Some of the key players operating in the botanical ingredients market are International Flavors and Fragrance Inc. (Frutarom Ltd.), PT. Indesso Aroma; Bell Flavors & Fragrances; The Green Labs LLC; Rutland Biodynamics Ltd.; Lipoid Kosmetic AG; and The Herbarie at Stoney Hill Farm Inc.

b. The key factors that are driving the botanical ingredients market include increasing clean label trends in the pharmaceutical and food and beverage industries, coupled with growing consumer awareness towards health and safety products with natural origins.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.