- Home

- »

- Pharmaceuticals

- »

-

Botanicals And Acupuncture Market Size, Share Report, 2030GVR Report cover

![Botanicals And Acupuncture Market Size, Share & Trends Report]()

Botanicals And Acupuncture Market (2025 - 2030) Size, Share & Trends Analysis Report By Intervention Scope (Botanicals, Acupuncture), By Distribution Method (Direct Sales, E-Sales), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-759-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Botanicals And Acupuncture Market Trends

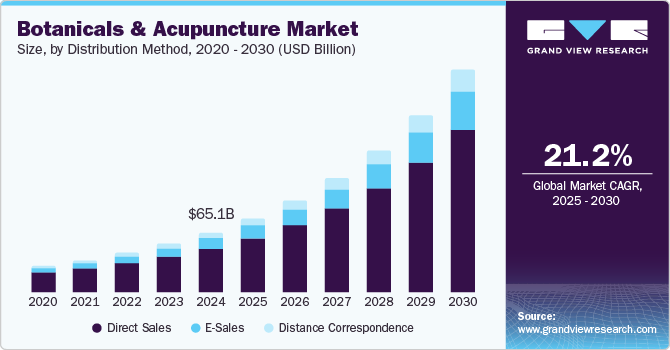

The global botanicals and acupuncture market size was valued at USD 65.1 billion in 2024 and is anticipated to grow at a CAGR of 21.2% from 2025 to 2030. Wide acceptance for the manufacturing of multicomponent drugs is expected to increase the penetration rate of botanicals in the medical field. Reverse pharmacology strategy has gained significant traction in botanical manufacturing by reverse-engineering of traditional herbal medicines. This strategy reduces the overall time and costs of drug development as compared to conventional synthetic drug manufacturing, which boosts the growth of botanicals and acupuncture market. The safety and efficacy of botanical drugs are essential aspects which are targeted by economies such as China, Europe and U.S. These regions demand access to data relating to pharmacokinetics, drug-drug interaction, and mechanism of action. Therefore, the partnerships between countries or organizations offer sufficient resources which are successful for the launching of botanical complementary therapies.

The development in the market reflects a growth in the integration of natural therapies into mainstream healthcare. The demand of consumers has led to an increase in product formulation, enhancing on high-quality, sustainably sourced botanicals. Furthermore, the rise of digital health platforms enables accessibility to acupuncture and botanical therapies, developing an audience.Plant resources have gained significant value in the manufacture of herbal medicine. Traditional plant resources are a key drug development material and account for more than 70% of the total traditional medication. Germany, China, South Korea, Japan, and India are among the top countries that devise various strategies for the procurement of plant resources in the development of herbal medicines, such as herbal medicine for malaria.

Technology usage has increased significantly among the professionals operating in the market space. A combination of traditional acupuncture Chinese medicine with cutting-edge devices is set to gain immense popularity in the coming years. Moreover, the common preference and trust of patients toward technology-based therapies and an increase in the number of practitioners using advanced tools are expected to drive the market.

Government regulations vary significantly across regions, revealing different methods to safety, efficacy, and consumer protection. In addition, guidelines have been established for manufacturing and labelling of products to enhance safety and quality standards. Healthcare providers in acupuncture will have to obtain licenses or certifications, including training and continuation of education requirements.

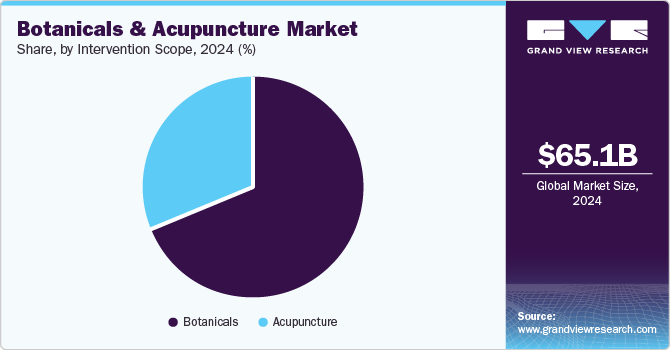

Intervention Scope Insights

The botanicals segment dominated the market and accounted for the largest revenue share of 68.5% in 2024. Botanical complementary therapy is the most ancient form of alternative medicinal practice. Besides, herbs and medicinal plants have gained significant popularity as these can be processed and transported in different formulations. The growth in preference for herbal medicines among the geriatric population and botanical medicine for women's health also results in the segment growth.

Recently, there has been a steady increase in the number of acupuncture clinics. This is attributed to a rise in the number of accredited education institutes offering Ph.D. and master’s degree programs for traditional Chinese medicine. This also drives the research communities to explore novel acupuncture mechanisms and its applications, such as acupuncture for mental health and women’s health. These factors are expected to drive the acupuncture segment at a lucrative CAGR.

The emergence of additional acupuncture-based spa services further boosts the segment growth. Acupuncture is marketed for several spa offerings, such as weight loss, relaxation, beauty treatments, energy enhancements, and stress relief. Besides, an increase in the number of practitioners using marketing intelligence and advanced tools in this field positively impacts segment growth.

Naturopathy, within the botanicals segment, is expected to grow at the fastest CAGR of 21.5% over the forecast period. Consumers are shifting their focus towards naturopathy for its importance on prevention, wellness, and natural remedies, including herbal supplements and dietary alterations. The rise towards promoting sustainability and organic practices is significantly growing, exposing an expansive movement towards integrative health solutions.

The acupuncture segment is expected to grow at the fastest CAGR of 21.5% over the forecast period owing to increasing awareness. Growing awareness about improving health conditions, such as reducing chronic pain, managing stress, and treating digestive disorders is driving the segment growth. The segment is marketed for several spa offerings, such as weight loss, relaxation, beauty treatments, and energy enhancements. Furthermore, the increase in the number of practitioners using marketing intelligence and advanced tools in this field positively impacts segment growth.

Distribution Method Insights

The direct sales segment dominated the market and accounted for the largest revenue share of 73.4% in 2024. Direct sales or medical consultation is largely preferred by patients inclined towards certain complementary therapeutic procedures, especially acupuncture and naturopathy. Ayurveda and naturopathy practitioners have implemented various marketing strategies to increase direct sales between the practitioner and the patient, which results in a larger revenue share of direct sales.

Distinct local Ayurveda and acupuncture practitioners as well as entities are also exploring the direct distribution sales channel to expand their business. These entities focus on the doctor or practitioner-patient interaction and therapeutic approaches that improve profitability. Besides, there is a significant increase in the number of new market entrants, scientific evidence, and demand for Ayurveda, which contributes to the growth of this segment.

The distance correspondence segment is expected to expand at the fastest CAGR over the forecast period. An increase in the employment of distance correspondence education programs to train professionals operating in the market space is expected to propel the distance correspondence segment growth. In addition, practitioners have initiated the provision of long-distance energy treatments and virtual acupuncture therapies, which further boosts the segment growth.

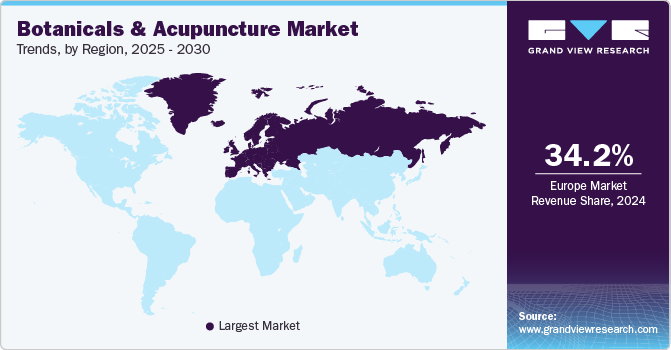

Regional Insights

The North America botanicals and acupuncture market dominated the market and accounted for the third largest revenue share of 20.4% in 2024 on account of its growth in demand for natural health solutions and effective treatment. Consumers shift their focus toward traditional pharmaceutical treatments and botanicals such as herbs and plant-based supplements, which have gained popularity. In addition, they also prefer acupuncture treatments, which help in treating chronic pain and managing anxiety. Therefore, this results in achieving consumer loyalty and wider accessibility for botanicals and acupuncture in North America.

U, S, Botanicals And Acupuncture Market Trends

The U.S. botanicals and acupuncture market dominated the North American region with the largest revenue share of 90.5% in 2024. This can be attributed to awareness of improving wellness and acupuncture treatments. According to UC News published in January 2024, it is stated that consumers prefer acupuncture to improve metabolism, reduce cravings and improve gastrointestinal issues. In addition, it also plays a significant role in weight loss. Therefore, this results in the acceptance and awareness of alternative therapies, expediting the growth of botanicals and acupuncture in U.S. market.

Europe Botanicals And Acupuncture Market Trends

The Europe botanicals and acupuncture market dominated the global market and accounted for the largest revenue share of 34.2% in 2024. This is attributed to the successful implementation of traditional Chinese and botanical medicines at a commercial level. Moreover, homeopathy is a more widely accepted alternative medicine in this region. In Germany, the number of registered homeopathy practitioners has risen by over 100% in the last decade, which accelerates the revenue generation in the European market.

Asia Pacific Botanicals And Acupuncture Market Trends

Ancient medicine, including Ayurveda and homeopathy, originates from Asia Pacific countries. An increase in the popularity of traditional Chinese medicine and Ayurveda across the globe has made Asia Pacific a lucrative zone for local, regional, and international entities that operate in this market. Several research studies have depicted that approximately 80% of people in China prefer traditional medicine supplements and acupuncture-based therapies to cure chronic ailments.

MEA Botanicals And Acupuncture Market Trends

The botanicals and acupuncture market in MEA is expected to register CAGR of 24.0% over the forecast period which can be attributed to its demand for natural and botanical products. In addition, consumers also prefer acupuncture to manage pain, reduce stress, and address a variety of health issues. The rise in disposable income, particularly in countries like the UAE and Saudi Arabia also contributes to the market’s growth. Forest Essentials, a part of Apparel Group portfolio, has celebrated its opening at 360 mall in Kuwait in June 2023. This has resulted in the promotion and delivery of ayurvedic skincare products to their consumers, gaining popularity and awareness.

Key Botanicals And Acupuncture Company Insights

Some key players in the market are Modern Acupuncture, ARC Acupuncture & Physical Therapy, Ayush Ayurveda and others. These companies employ various strategies to gain a competitive edge, such as launching new products to cater to diverse patient needs, focusing on personalized medicine to enhance treatment efficacy, and leveraging emerging markets to tap into increasing awareness about botanicals and acupuncture.

-

Modern Acupuncture is a wellness company that makes acupuncture available and approachable to a broader audience. The company plans to expand its business across U.S. to meet consumer demand. In addition, it has introduced membership models to boost regular treatment and foster customer loyalty.

Key Botanicals And Acupuncture Companies:

The following are the leading companies in the botanicals and acupuncture market. These companies collectively hold the largest market share and dictate industry trends.

- Modern Acupuncture

- ARC Acupuncture & Physical Therapy

- Ayush Ayurved

- GC Biopharma Corporation

- NatureKue, Inc.

- Columbia Nutritional

- Herb Pharm

- Pure Encapsulations, LLC.

- Sheng Chang Pharmaceutical Company

- LKK Health Products Group Limited

- Nordic Neutraceuticals

- Helio USA, Inc.

Botanicals And Acupuncture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 80.1 billion

Revenue forecast in 2030

USD 241.2 billion

Growth Rate

CAGR of 21.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Intervention Scope, Distribution Method, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Modern Acupuncture; ARC Acupuncture & Physical Therapy; Ayush Ayurveda; GC Biopharma Corporation; NatureKue, Inc.; Columbia Nutritional; Herb Pharm; Pure Encapsulation LLC; Sheng Chang Pharmaceutical Company; LKK Health Products Group Limited; Nordic Neutraceuticals; Helio USA, Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

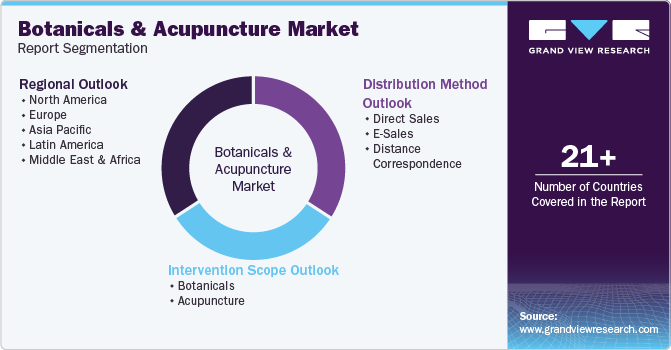

Global Botanicals And Acupuncture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global botanicals and acupuncture market report based on intervention scope, distribution method, and region.

-

Intervention Scope Outlook (Revenue, USD Billion, 2018 - 2030)

-

Botanicals

-

Ayurveda

-

Naturopathy

-

Homeopathy

-

-

Acupuncture

-

-

Distribution Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Sales

-

E-Sales

-

Distance Correspondence

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.