- Home

- »

- Food Safety & Processing

- »

-

Bottling Line Machinery Market Size, Industry Report, 2030GVR Report cover

![Bottling Line Machinery Market Size, Share, & Trends Report]()

Bottling Line Machinery Market (2025 - 2030) Size, Share, & Trends Analysis Report By Technology (Automatic, Semi-Automatic), By Application (Beverages, Processed Food), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-919-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bottling Line Machinery Market Summary

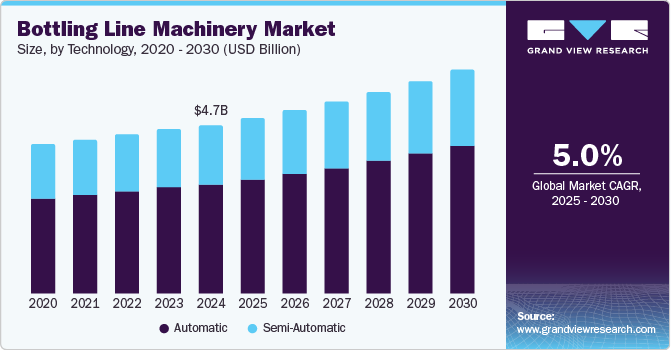

The global bottling line machinery market size was estimated at USD 4.74 billion in 2024 and is projected to reach USD 6.30 billion by 2030, growing at a CAGR of 5% from 2025 to 2030. The rising prominence of beverage products with unique tastes, colors, and textures is expected to boost the demand for bottling line machinery over the forecast period.

Key Market Trends & Insights

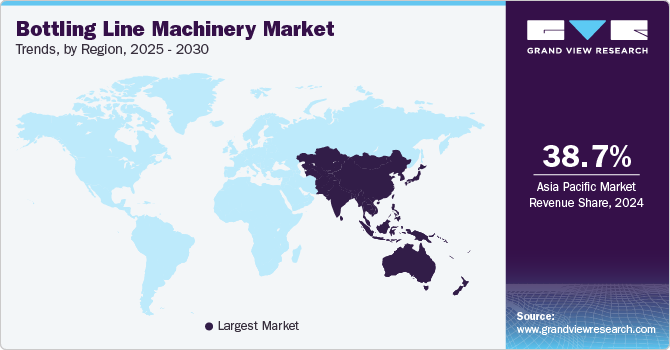

- The Asia Pacific bottling line machinery market dominated the global market and accounted for the largest revenue share of 38.7% in 2024.

- The bottling line machinery market in China led the Asia Pacific market and held for the highest revenue share in 2024

- In terms of technology, Automatic technology led market and accounted for the largest revenue share of 64.8% in 2024.

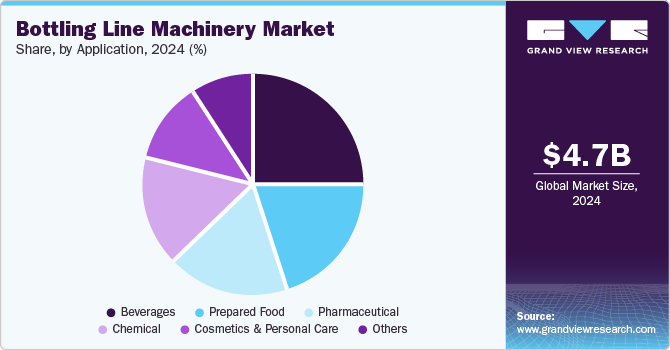

- In terms of application, The beverages segment dominated the global bottling line machinery industry with the highest revenue share of 25.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.74 Billion

- 2030 Projected Market Size: USD 6.30 Billion

- CAGR (2025-2030): 5%

- Asia Pacific: Largest market in 2024

In addition, increasing urbanization, and technological advancements in packaging including a growing focus on minimizing production costs, increasing industrial automation, and the expansion of the e-commerce industry are also contributing towards the markets’ growth.

The increase in demand for healthy beverages and pharmaceuticals due to the COVID-19 pandemic had a positive impact on the market's growth. Companies operating in the beverages and pharmaceutical industries adopted new and automated lines to meet this growing demand for their products, thereby boosting machinery demand.

Digital twin technology is emerging as a transformative force in the bottling line machinery sector, enabling the creation of virtual models that mirror physical processes for enhanced monitoring and analysis. This innovation facilitates simulation, testing, and optimization, leading to improved efficiency. The integration of automation, robotics, and artificial intelligence further refines bottling operations by boosting accuracy and speed. In addition, the growing urban population in the U.S. has influenced food preferences, which, in turn, favors the processing and packaging industry. Moreover, chemical industry players in the U.S. are keen on expanding and building capacity, creating demand for packaging. This is expected to positively impact the industry over the forecast period.

Food and beverage industry players are resorting to contract manufacturing because of advantages such as lower upfront investment for the client, minimum storage and warehouse needs, high industry expertise, and time and cost savings. Pharmaceutical industry players are incorporating technology in bottling lines to reduce costs and enhance profit margins, which is likely to increase the demand for bottling line machinery. Moreover, the rise of Industry 4.0 principles promotes real-time data analytics and predictive maintenance, minimizing downtime. As sustainability becomes increasingly crucial, manufacturers are focusing on eco-friendly solutions that reduce energy use and waste. Concurrently, the escalating demand for packaged beverages due to urbanization and changing lifestyles drives the need for efficient bottling lines.

Technology Insights

Automatic technology led market and accounted for the largest revenue share of 64.8% in 2024. Increased compliance with legal and customer specifications coupled with rising efficient operations and consistency are some of the factors responsible for driving the demand for automatic segment over the forecast period. In addition, manufacturers of processed food products are presently adopting automated food technologies to enhance their conventional packaging technologies to deliver high-quality packaged products.

The semi-automatic segment is expected to grow at a CAGR of 4.4% from 2025 to 2030, owing to low initial capital and operational costs for making machinery with semi-automatic technology, suitable for labor-intensive countries such as China, Brazil, and India with easy availability of low-cost labor. In addition, the usage of semi-automatic machinery allows continuous improvements in processes that present an opportunity to change or upgrade a process as and when required. Furthermore, semi-automatic machinery offers operational flexibility and can manage a wide range of technology sizes and specifications, while automatic machinery is better in the production standard products.

Application Insights

The beverages segment dominated the global bottling line machinery industry with the highest revenue share of 25.5% in 2024. This growth is attributed to the rising demand for various packaged drinks, including soft drinks, juices, and bottled water. In addition, as consumer preferences shift towards convenience and ready-to-drink options, manufacturers are compelled to enhance production efficiency. Moreover, this trend is further supported by urbanization and changing lifestyles, which increase the need for automated solutions that can handle diverse packaging formats while maintaining high production speeds.

The pharmaceutical segment is expected to grow at a CAGR of 5.7% over the forecast period, owing to the rising demand for packaged medications and health products. The increasing focus on safety and efficiency in pharmaceutical manufacturing necessitates advanced bottling technologies that ensure precise filling and packaging. Furthermore, regulatory requirements for quality control and contamination prevention drive investments in automated systems. Moreover, as the global population grows and health awareness rises, the pharmaceutical industry’s need for reliable bottling solutions continues to propel market growth.

Regional Insights

The Asia Pacific bottling line machinery market dominated the global market and accounted for the largest revenue share of 38.7% in 2024. This growth is attributed to the rising food and beverage consumption and expanding pharmaceutical production in countries such as India, Vietnam, Malaysia, and Thailand. In addition, the region's large population and increasing demand for beverages, including milk and soft drinks, contribute significantly to market expansion. Furthermore, the growing popularity of premium bottled water further fuels this growth, prompting manufacturers to invest in advanced bottling technologies.

China Bottling Line Machinery Market Trends

The bottling line machinery market in China led the Asia Pacific market and held for the highest revenue share in 2024, driven by its vast population and a rising appetite for packaged beverages. In addition, increased domestic pharmaceutical production also drives market expansion as companies seek efficient bottling solutions. Furthermore, the demand for bottled water, innovative soft drinks, and other packaged beverages supports this trend, leading to significant investments in modern bottling technologies.

Latin America Bottling Line Machinery Market Trends

Latin America bottling line machinery marketis expected to grow at a CAGR of 5.5% over the forecast period, owing to a burgeoning population, rising disposable incomes, and an increasing demand for packaged beverages. Furthermore, the expanding food and beverage industry necessitates more efficient bottling solutions to satisfy consumer preferences. Moreover, heightened health awareness and a growing need for pharmaceutical products contribute to the overall growth of the bottling line machinery market in this region.

North America Bottling Line Machinery Market Trends

The bottling line machinery market in the North Americais expected to grow significantly over the forecast period, primarily driven by a steady rise in the beverage industry due to increased consumption of both alcoholic and non-alcoholic drinks. Furthermore, consumers are spending more on alcoholic beverages, which necessitates advanced bottling technologies for production efficiency. Moreover, the demand for healthy juices and smoothies further drives the need for innovative bottling line solutions.

The U.S. bottling line machinery market led the North American market with the highest revenue share in 2024. This growth is attributed to the high consumption of alcoholic beverages such as vodka. To meet this growing demand, manufacturing companies are deploying advanced bottle filling machines that enhance production efficiency. Furthermore, the increasing popularity of various packaged beverages, including soft drinks and bottled water, contributes significantly to the expansion of the bottling line machinery market.

Europe Bottling Line Machinery Market Trends

The bottling line machinery market in the Europeis expected to be driven by the increased demand for innovative packaging solutions and technological advancements within the food and beverage sector. In addition, rising consumption of premium alcoholic products, alongside the introduction of healthy juices and smoothies, contributes to growth in the beverage industry. Furthermore, surge in production necessitates advanced and efficient bottling line solutions to keep pace with consumer preferences.

Key Bottling Line Machinery Company Insights

Key companies in the global bottling line machinery industry include Krones AG, ProMach, Syntegon Technology GmbH, and others. These businesses are adopting strategies focused on innovation and sustainability. They are investing in advanced automation technologies to enhance operational efficiency and reduce production costs. In addition, firms are developing eco-friendly packaging solutions to meet growing consumer demand for sustainable practices. Furthermore, collaborations and partnerships with technology providers are also common, enabling companies to integrate smart manufacturing capabilities.

-

Krones AG design and implement complete lines for beverages and food, covering each production process from product and container creation to filling, packaging, material flow, and container recycling. The company manufactures machines for filling, labeling, and packing glass and PET containers, as well as cans. They offer customized system solutions for every container type and beverage category, including machines for process engineering.

-

KHS Group specializes in developing innovative bottling and packaging systems for the beverage and food industries. Their product portfolio includes advanced machinery for filling, labeling, and packaging various types of containers such as bottles, cans, and cartons. KHS operates in the bottling line machinery segment, providing comprehensive solutions that enhance production efficiency and sustainability.

Key Bottling Line Machinery Companies:

The following are the leading companies in the bottling line machinery market. These companies collectively hold the largest market share and dictate industry trends.

- Krones AG

- KHS Group

- The Tetra Laval Group

- SMI S.p.A.

- OPTIMA packaging group GmbH

- ProMach

- Zhangjiagang King Machine Co., Ltd

- Sacmi Imola S.C.

- Coesia S.p.A.

- Syntegon Technology GmbH

- Hiemens Bottling Machines

- APACKS

- Barry-Wehmiller Group, Inc.

- IC Filling Systems; Serac Group

Recent Developments

-

In October 2024, Syntegon and Azbil Corporation finalized Syntegon's acquisition of Telstar, expanding Syntegon’s pharmaceutical liquid filling and strengthening strategic growth. Telstar's workforce now joins Syntegon's Pharma Liquid Business Unit, creating a seamless technology and service portfolio for manufacturing antibiotics, vaccines, and biologics. This combination enhances Syntegon’s innovative technologies and expands global reach, providing complete bottling line machinery and solutions for pharmaceutical manufacturers and CMOs.

-

In October 2024, Krones launched a compact version of its Contipure AseptBloc, a sterile system integrating preform sterilization to sealing, ideal for bottling line machinery. Designed for outputs as low as 8,000 containers per hour, this system expands aseptic filling solutions to the low output range. This compact design utilizes a four-cavity blow-molding machine and a filler, requiring approximately 100 square meters of space. It's suited for juice, milk, or plant-based alternatives, offering material savings of around two grams per bottle compared to conventional aseptic processes. The advanced bottling line machinery is also designed for efficient lightweight containers.

Bottling Line Machinery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.93 billion

Revenue forecast in 2030

USD 6.30 billion

Growth Rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

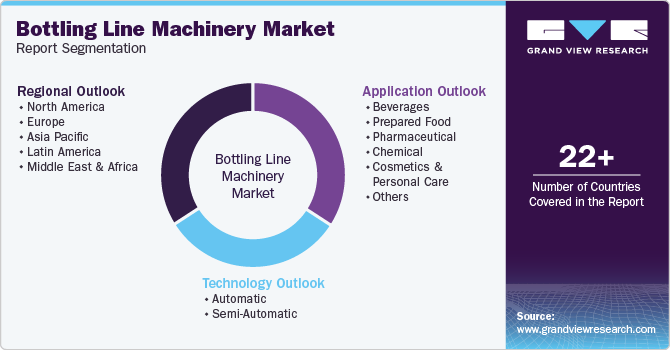

Segments covered

Technology, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Argentina, South Africa, and UAE

Key companies profiled

Krones AG; KHS Group; The Tetra Laval Group; SMI S.p.A.; OPTIMA packaging group GmbH; ProMach; Zhangjiagang King Machine Co., Ltd; Sacmi Imola S.C.; Coesia S.p.A.; Syntegon Technology GmbH; Hiemens Bottling Machines; APACKS; Barry-Wehmiller Group, Inc.; IC Filling Systems; Serac Group.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bottling Line Machinery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global bottling line machinery market report based on technology, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-Automatic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beverages

-

Non-alcoholic

-

Alcoholic

-

-

Prepared Food

-

Pharmaceutical

-

Chemical

-

Cosmetics & Personal Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.