- Home

- »

- Animal Health

- »

-

Bovine Tuberculosis Diagnosis Market Size Report, 2030GVR Report cover

![Bovine Tuberculosis Diagnosis Market Size, Share & Trends Report]()

Bovine Tuberculosis Diagnosis Market Size, Share & Trends Analysis Report By Test (Serological Tests, Molecular Diagnostic Tests, Traditional Tests), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-944-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

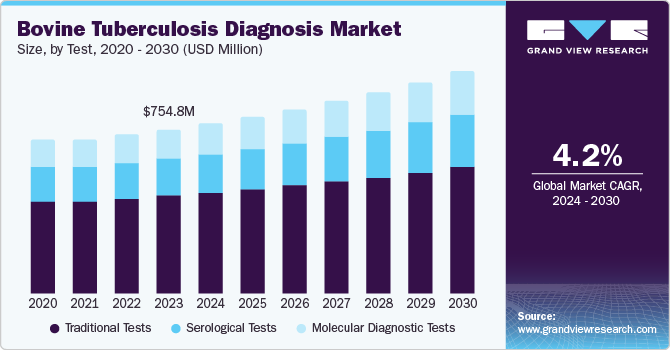

The global bovine tuberculosis diagnosis market size was valued at USD 754.8 million in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. Bovine tuberculosis is a chronic disease caused by Mycobacterium bovis that affects cattle. The prevalence of this disease is rising globally, particularly in developing countries. Through zoonotic transmission, the disease poses significant risks to animal health and human health. As governments and health organizations implement better control measures, the demand for reliable and rapid diagnostic tools has increased, driving market growth.

Bovine tuberculosis is a significant threat to the dairy and meat industries, which are critical components of the agricultural economy in many countries. Infected cattle often suffer from reduced milk production and lower meat quality, leading to economic losses for farmers. The threat of Bovine tuberculosis outbreaks also leads to trade restrictions and a loss of consumer trust. As a result, dairy and meat producers are increasingly investing in preventive measures, including regular testing and diagnosis of cattle, to safeguard their animals and ensure product quality, driving the Bovine Tuberculosis Diagnosis market.

The expansion and modernization of veterinary healthcare infrastructure, particularly in developing regions, drive the Bovine Tuberculosis Diagnosis market. Improved access to veterinary services and the establishment of specialized animal health clinics and laboratories enable more widespread and efficient disease diagnosis. As these infrastructures develop, the availability and adoption of advanced diagnostic tools are expected to increase, contributing to market growth.

Test Insights

The traditional tests segment dominated the market and accounted for a market revenue share of 59.4% in 2023. Traditional Bovine tuberculosis tests benefit from widespread availability and the established infrastructure required for their administration. Veterinary clinics, agricultural cooperatives, and government agencies in many regions are well-equipped to conduct tuberculin skin tests, ensuring easy access for farmers. The infrastructure for handling, storing, and administering these tests is already in place in many areas, reducing the need for additional investments in new equipment or training. This established infrastructure supports the continued demand for traditional diagnostic tests.

The molecular diagnostic tests segment is expected to witness the fastest CAGR over the forecast period. Molecular diagnostic tests offer significantly higher sensitivity and specificity. These tests detect the presence of Mycobacterium bovis at the molecular level, allowing for more accurate and early detection of the disease. This capability is essential in cases where early diagnosis is crucial to prevent the spread of bovine tuberculosis within and between herds. The ability to provide more reliability drives the adoption of molecular diagnostic tests.

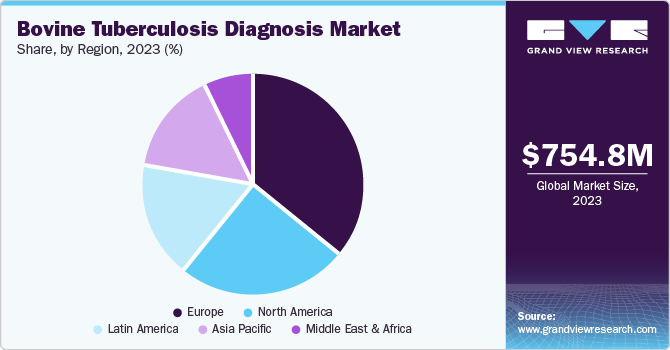

Regional Insights

The North America bovine tuberculosis diagnosis market is expected to witness significant growth over the forecast period. There is a growing focus on animal health and the prevention of zoonotic diseases in North America, driven by public health concerns and the potential impact on human health. Bovine tuberculosis is a zoonotic disease that is able to transmit from animals to humans, typically through unpasteurized dairy products or close contact with infected animals. The risk of zoonotic transmission has led to increased efforts to monitor and control bovine tuberculosis, driving the demand for reliable diagnostic tests.

U.S. Bovine Tuberculosis Diagnosis Market Trends

The U.S. bovine tuberculosis diagnosis market accounted for the largest revenue share in 2023. Veterinary schools and professional associations provide ongoing training on the latest diagnostic methods and biosecurity practices. This education ensures that veterinarians are well-equipped to implement the most effective testing protocols, contributing to the consistent use of traditional and modern diagnostic tools. The focus on education and training helps drive the market by ensuring that diagnostic methods are used effectively and widely.

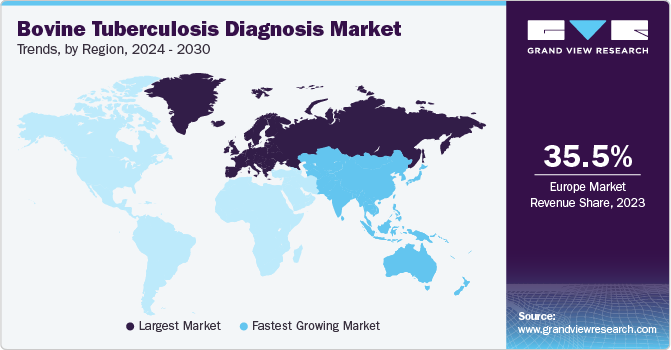

Europe Bovine Tuberculosis Diagnosis Market Trends

Europe bovine tuberculosis diagnosis market accounted for the largest market revenue share of 35.5% in 2023. The region's veterinary professionals and livestock producers have access to the latest diagnostic tools, including molecular diagnostics. The widespread adoption of these advanced technologies is driven by the more accurate, sensitive, and rapid detection of bovine tuberculosis, which is essential for effective disease management and control. The region's high level of awareness about bovine tuberculosis and the availability of advanced diagnostic technologies drives its demand in the market.

The UK bovine tuberculosis diagnosis market accounted for the largest revenue share in 2023. Bovine tuberculosis poses a severe threat to the productivity and profitability of livestock industries, making disease control a priority. The economic impact of bovine tuberculosis, including potential trade restrictions, loss of market access, and the costs associated with culling infected animals, drives the demand for reliable diagnostic testing. Producers regularly conduct tests on their herds to avoid outbreaks and maintain economic viability.

Asia Pacific Bovine Tuberculosis Diagnosis Market Trends

Asia Pacific bovine tuberculosis diagnosis market is expected to witness the fastest CAGR over the forecast period. As the livestock industry expands to meet the increasing demand for meat and dairy products, the risk of disease outbreaks, including bovine tuberculosis, also increases. The need to ensure herd health and productivity drives the demand for effective diagnostic tools to identify and manage bovine tuberculosis. The region's large-scale and intensive livestock farming necessitates regular testing and surveillance, fueling the growth of the Bovine Tuberculosis Diagnosis market.

The China bovine tuberculosis diagnosis market accounted for the largest revenue share in 2023. The beef and dairy sectors are economically significant in China, contributing to domestic consumption and exports. Maintaining disease-free is essential for the sustainability of these sectors, as outbreaks of bovine tuberculosis lead to substantial economic losses. The economic importance of these industries drives the demand for regular diagnostic testing to prevent and control the spread of bovine tuberculosis. Producers invest in diagnostic tools to avoid the financial problems of disease outbreaks, including potential culling of infected animals and loss of market access.

Key Bovine Tuberculosis Diagnosis Company Insights

Some key companies in the Bovine Tuberculosis Diagnosis market include IDEXX Laboratories, Inc., PBD Biotech Ltd, Thermo Fisher Scientific Inc., Bionote USA Inc., and others

-

IDEXX Laboratories, Inc. is a leading veterinary diagnostics, software, and water microbiology testing company. The company's product offerings include diagnostic instruments such as the Catalyst One and ProCyte Dx analyzers, which provide comprehensive blood chemistry, hematology, and immunoassay testing.

-

PBD Biotech Ltd is a biotechnology company that develops innovative diagnostic solutions for infectious diseases. Its product is the Actiphage test, an advanced diagnostic tool that uses bacteriophage technology to detect mycobacteria, the bacterium responsible for bovine tuberculosis.

Key Bovine Tuberculosis TB Diagnostic Companies:

The following are the leading companies in the bovine tuberculosis tb diagnostic market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories, Inc.

- PBD Biotech Ltd

- Zoetis Services LLC

- IDvet

- Thermo Fisher Scientific Inc.

- Enfer Group

- AsureQuality Australia Pty Ltd.

- Bio-Rad Laboratories, Inc.

- Bionote USA Inc.

View a comprehensive list of companies in the Bovine Tuberculosis Diagnosis Market

Bovine Tuberculosis Diagnosis Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 754.8 million

Revenue forecast in 2030

USD 1,018.3 million

Growth Rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, UK, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Mexico, Argentina, South Arabia and South Africa

Key companies profiled

IDEXX Laboratories, Inc., PBD Biotech Ltd, Zoetis Services LLC, IDvet, Thermo Fisher Scientific Inc., Enfer Group, AsureQuality Australia Pty Ltd., Bio-Rad Laboratories, Inc., Bionote USA Inc.,

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bovine Tuberculosis Diagnosis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bovine tuberculosis diagnosis market report based on test and region.

-

Test Outlook (Revenue, USD Million, 2017 - 2030)

-

Serological Tests

-

Molecular Diagnostic Tests

-

Traditional Tests

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."