- Home

- »

- Medical Devices

- »

-

Brachytherapy Market Size, Share & Trends Report, 2030GVR Report cover

![Brachytherapy Market Size, Share & Trends Report]()

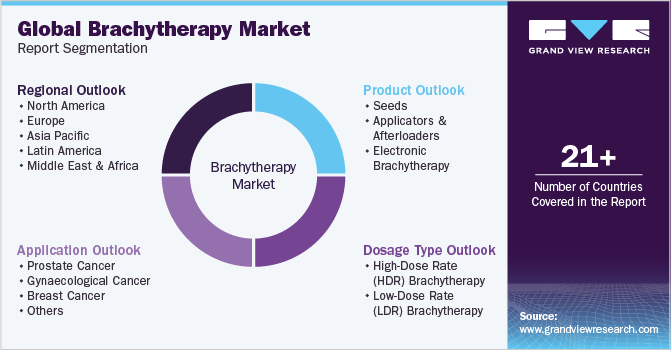

Brachytherapy Market Size, Share & Trends Analysis Report By Dosage Type, By Product (Seeds, Electronic Brachytherapy), By Application (Prostate Cancer, Breast Cancer), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-618-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global brachytherapy market size was estimated at USD 907.76 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. The increasing prevalence of cancer, technological advancements, and a significant rise in the adoption of brachytherapy are expected to drive the growth of the market during the forecast period. Brachytherapy is a type of radiation therapy used for the treatment of cancer. The radioactive materials are placed inside the body with the help of catheters. It is an excellent treatment for localized tumors. Currently, artificially produced radionuclides such as Caesium-137, Iridium-192, Gold-198, Iodine-125, and Palladium-103 are routinely used.

According to the American Cancer Society, in the U.S., there were 609,360 cancer deaths and an estimated 1.9 million new cancer cases in 2022. This is expected to increase to 24.6 million by 2030. The increasing cancer burden is one of the major factors driving the market growth.

Radiation therapy can be used for prophylactic, palliative, or curative treatment. It can also be used as monotherapy or as an adjuvant with surgery, immunotherapy, and chemotherapy. The wide range of applications of radiotherapy has increased its adoption by physicians. The latest advancements in radiation therapy allow the delivery of a high amount of dose to the target area with minimum damage to nearby healthy tissues. This has increased the chances of localized tumor control and has improved cure rates, leading to an increase in demand for radiation therapy.

However, the lack of skilled radiotherapy professionals and access to technologically advanced products, particularly in developing countries is expected to be a major restraining factor for this market. According to the IAEA’s Directory of Radiotherapy Centres (DIRAC), there are around 3300 brachytherapy systems installed across radiation therapy centers globally, as of 2020. Around 60% of the cancer cases occur in LMICs and 80% of patients in these countries lack access to treatment due to limited access to technologically advanced systems. Around 60%-80% of the radiotherapy needs are met in the European countries, however, in LMICs, only 3%-4% of the radiotherapy needs are met.

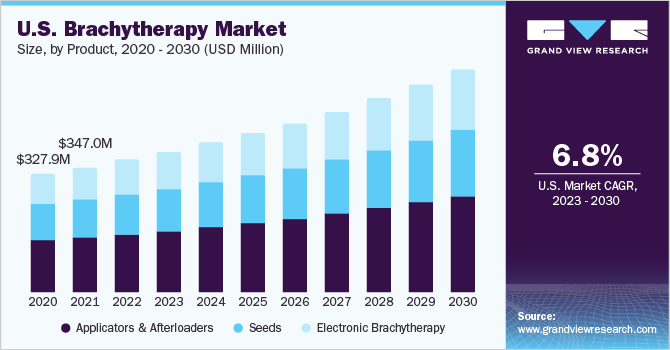

Product Insights

The applicators & afterloaders segment dominated the market for brachytherapy and accounted for the largest revenue share of 44.5% in 2022. Applicators are more effective than others and are minimally intrusive, granting them a high level of patient preference. The radioactive sources are transported to the treatment site by a device called an afterloader. During HDR brachytherapy, a single radioactive source is momentarily inserted inside the tumor and then expelled.

The electronic brachytherapy segment is expected to grow at a significant CAGR over the forecast period. This technique is suitable for treating skin lesions and enables radiation shielding, thereby eliminating the challenges associated with radioisotope handling. Various advantages of electronic brachytherapy such as no leakage of radiation in off-state, less shielding, low dose to organs at risk, and no radioactive waste make it a preferable treatment in the region. ELEKTA AB and Xoft, Inc. are some of the prominent companies in this market.

Recently, encouraging results have emerged from clinical trials for new products being developed in this domain. For instance, in August 2021, iCAD, Inc.’s Xoft Axxent Electronic Brachytherapy System for the treatment of recurrent glioblastoma showed significant improvements in the overall survival of patients who received this treatment.

Application Insights

The prostate cancer segment accounted for the largest revenue share of 32.91% of the market for brachytherapy in 2022. The prostate cancer brachytherapy industry is expected to grow at a lucrative rate due to various advantages over other types of treatments. These advantages include safely increasing the dose to the tumor while minimizing the dose to the surrounding organs such as the rectum, bladder, and urethra; shorter duration of treatment; faster recovery; minimal risk of side effects due to the accurate and precise delivery of radiation dose; and effective treatment for patients with prostate cancer recurrence.

The breast cancer segment is expected to grow at the fastest CAGR during the forecast period. Accelerated Partial Breast Irradiation (APBI) is an innovative method of radiation therapy, which is employed after a lumpectomy.Brachytherapy APBI includes two methods. The first method involves multicatheter brachytherapy and the second method involves a single catheter, which inflates into a balloon once placed inside the breast. The single catheter method is not prescribed for all breast cancer patients. Multicatheter brachytherapy offers great flexibility and is said to be the most targeted APBI treatment. The presence of a wide range of products & instruments such as SagiNova and Breast CT/MR template set is expected to boost the breast cancer brachytherapy industry’s growth.

Dosage Type Insights

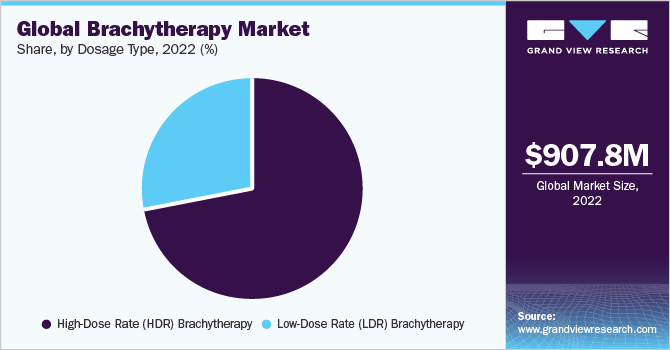

The High-Dose Rate (HDR) brachytherapy segment dominated the market and accounted for the largest revenue share of 71.5% in 2022. HDR brachytherapy is an outpatient procedure and can be used as a standalone treatment or after surgical removal of tumors. The pain-free treatment may require one session or multiple sessions depending on the type of cancer being treated. Eckert & Ziegler BEBIG, Varian Medical Systems, and ELEKTA AB are some of the prominent companies in the HDR brachytherapy industry.

Low-Dose Rate (LDR) brachytherapy is primarily used for the treatment of prostate cancer. The introduction of new products such as GammaTile for the treatment of brain cancer is expected to drive the growth of this segment. According to the recent technological advancements mentioned in a report published on Elsevier in May 2022, LDR brachytherapy has made it possible to administer precise doses and has excelled at treating aggressive prostate tumors.

Regional Insights

North America led the market for brachytherapy and accounted for the largest revenue share of 45.2% in 2022. Brachytherapy procedure offers various advantages over traditional methods including efficiency and safety of the treatment, hence, it is widely used in the North American region. Favorable regulatory and reimbursement scenario further supports regional growth. Additionally, the investment scenario has drastically changed in the region and companies are now investing in developing new products and collaborating with emerging companies to maintain their market share and presence.

In Asia Pacific, the market is estimated to witness the highest CAGR over the forecast period. The high disease burden and the rising awareness amongst the target population are some major factors responsible for the forecasted growth. In addition, limited access to technologically advanced cancer treatments offers various opportunities for the market players. Additionally, the launch of various brachytherapy systems in developing economies such as India is expected to impact the market positively. For instance, in November 2022, Medicover Hospitals launched Asia’s first TrueBeam Identify system. The system is also Telangana’s (an Indian state) first SGRT making treatment more accessible for patients.

Key Companies & Market Share Insights

Some of the key players have been operating in the market for more than 35 years. They already have a well-established network of suppliers and customers, which helps in strengthening their market position. Additionally, some of the major companies also operate in other business domains. Hence, most often they can invest huge amounts in R&D activities.

New product launches and mergers and acquisitions are some of the major strategies adopted by the players to gain market share. For instance, in May 2023, RaySearch Laboratories AB announced that the RayCare system can successfully connect to TrueBeam linear accelerators by Varian. Raycare is an oncology information system and this initiative is an outcome of the interoperability agreement between Varian Medical Systems and RaySearch Laboratories AB signed in 2020.

In July 2022, it was revealed that BEBIG Medical had successfully acquired Wolf-Medizintechnik GmbH ("WOmed") to broaden its product offering in the field of radiation therapy for the treatment of cancer. The German business WOmed is a global supplier of solutions for cutting-edge intraoperative radiation therapy and X-ray therapy. With a remarkable reputation in the radiation therapy sector, BEBIG Medical was a leading global supplier of high-dose-rate brachytherapy solutions. Some prominent players in the global brachytherapy market include:

-

Varian Medical Systems, Inc.

-

Becton

-

Dickinson & Company

-

Elekta AB

-

Isoray Medical, Inc.

-

Eckert & Ziegler BEBIG

-

iCAD, Inc.

-

CIVCO Medical Solutions

-

Theragenics Corporation

Brachytherapy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 969.92 million

Revenue forecast in 2030

USD 1.62 billion

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, dosage type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Denmark; Norway; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Varian Medical Systems, Inc.; Becton, Dickinson & Company; Elekta AB; Isoray Medical, Inc.; Eckert & Ziegler BEBIG; iCAD, Inc.; CIVCO Medical Solutions; Theragenics Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brachytherapy Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global brachytherapy market report based on product, dosage type, application, and region:

-

Dosage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

High-Dose Rate (HDR) Brachytherapy

-

Low-Dose Rate (LDR) Brachytherapy

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Seeds

-

Applicators & Afterloaders

-

Electronic Brachytherapy

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Prostate Cancer

-

Gynaecological Cancer

-

Breast Cancer

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global brachytherapy market size was estimated at USD 907.76 million in 2022 and is expected to reach USD 969.92 million in 2023.

b. The global brachytherapy market is expected to witness a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 1.62 billion in 2030.

b. The Applicators & After loaders segment dominated the global brachytherapy market and accounted for the largest revenue share of 44.5% in 2022.

b. The prostate cancer segment dominated the global brachytherapy market and accounted for the largest revenue share of 32.9% in 2022.

b. North America dominated the global brachytherapy market and held the largest revenue share of 45.2% in 2022.

b. Some key players operating in the brachytherapy market include Varian Medical Systems; Elekta AB; Becton, Dickinson and Company; IsoRay, Inc.; Eckert & Ziegler BEBIG; and iCAD amongst others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."