- Home

- »

- Consumer F&B

- »

-

Brain Health Functional Food And Beverage Market Report 2030GVR Report cover

![Brain Health Functional Food And Beverage Market Size, Share & Trends Report]()

Brain Health Functional Food And Beverage Market Size, Share & Trends Analysis Report By Ingredient (Choline, Curcumin), By Product (Dairy, Bakery), By Distribution Channel (Specialty Stores, Online), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-033-9

- Number of Report Pages: 83

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global brain health functional food and beverage market size was valued at USD 18.10 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.5% from 2023 to 2030. Various desirable nutrients and bioactive compounds, such as vitamins, minerals, unsaturated fatty acids, dietary fibers, antioxidants, and others, can be incorporated into brain health functional foods and beverages. Owing to such factors, the demand of consumers towards brain health functional foods and beverages is growing globally. Brain health functional foods and beverages are tailored according to consumers’ choice to enhance mental focus and do not have adverse effects on health as compared to other drug treatments.

Moreover, major changes have been occurring in the daily lives of consumers that lead to physical and emotional stress. This has resulted in the addition of beverages and foods for brain health in their diets. In addition, their increasing availability through various distribution chains is expected to propel market growth. For instance, in May 2022, Koios Beverage Corp. launched its nootropic functional beverage in more than 600 CVS locations across Missouri, Texas, New Jersey, Tennessee, Florida, New York, California, and Indiana. Mental health is becoming a priority for a huge base of consumers all over the world who are ready to spend on products that support their mental health.

The interest of consumers is increasing in food and beverage products that offer functional benefits regarding stress relief and sleep quality. Furthermore, there has been an increase in spending on packaged drinks and snacking products among consumers as they spend more time at home owing to scenarios of working from home. Such factors are creating various opportunities for brain health food and beverage manufacturers, which are expected to drive the market in the coming years. Rising awareness among consumers regarding health and wellness is boosting product demand. More consumers are relying on nutraceutical products, such as functional foods and beverages, to lead a healthy life and prevent diseases including brain health diseases, such as depression, anxiety, and others.

Functional foods are available in various flavors and are more palatable than medicines. This factor is also likely to drive industry growth over the forecast period. Increasing demand for food items and beverages that help reduce anxiety and stress is boosting the demand for brain health functional food and beverages. Functional food and beverage manufacturers are also using attractive packaging as an effective marketing solution to attract customers and increase profits. Manufacturers are focusing on incorporating new technologies and customized solutions to meet consumer demands. The functional foods market is highly competitive and is expected to register a significant CAGR owing to the rising demand for functional foods among millennials. Manufacturers are constantly experimenting with new raw material sources to produce functional foods.

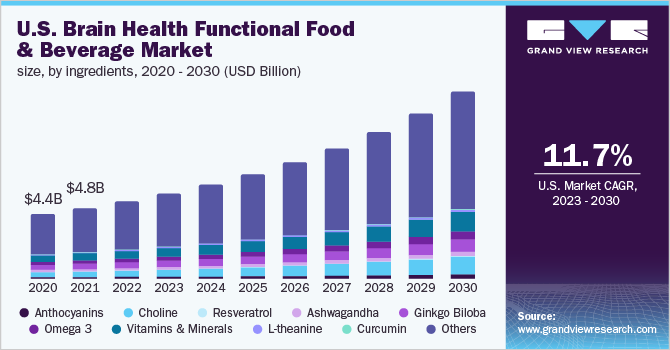

Ingredient Insights

On the basis of ingredients, the industry has been further categorized into anthocyanins, choline, resveratrol, ashwagandha, ginkgo biloba, omega 3, vitamins & minerals, l-theanine, curcumin, and others. The vitamins & minerals segment was one of the dominant ingredient segments in 2022 and accounted for the second-largest share of more than 10.00% of the overall revenue. The vitamins in this functional food and beverages have been proven to boost brain power, fight depression, restrict brain aging as well as relieve stress.

Along with vitamins, the above-mentioned minerals, help regulate nerve transmission, support memory & learning, and boost brain metabolism. The choline segment is estimated to have a lucrative CAGR during the forecast period. It is a vital ingredient that regulates mood, memory, muscle control, and brain fog. Choline aids in basic brain functions and key biochemical chain reactions that affect brain cells directly. According to research, choline supplementation at vital stages of a newborn’s development can improve memory over time. The growing popularity of this ingredient has attracted several brands worldwide.

Distribution Channel Insights

The hypermarkets and supermarkets segment dominated the global industry in 2022 and accounted for the maximum share of more than 30.15% of the overall revenue. This distribution channel remains a preferred choice for many consumers globally. Hypermarkets and supermarkets feature a large variety of products, with different variants and options under one roof. Consumers can easily compare and differentiate products and make an informed choice. Moreover, products available here are priced lower than in other places due to the fewer expenses incurred by economies of scale.

The high footfall of consumers at supermarkets and hypermarkets is encouraging more brands to sell their products through these stores. The online distribution channel is expected to register the highest CAGR from 2023 to 2030. Several brands operate exclusively via the e-commerce channel. Such portals give lucrative discounts to consumers, which helps garner more attention and sales. In September 2022, Fonterra, a dairy giant operating in New Zealand, launched BioKodeLab, a supplement brand aimed to improve cognitive performance.

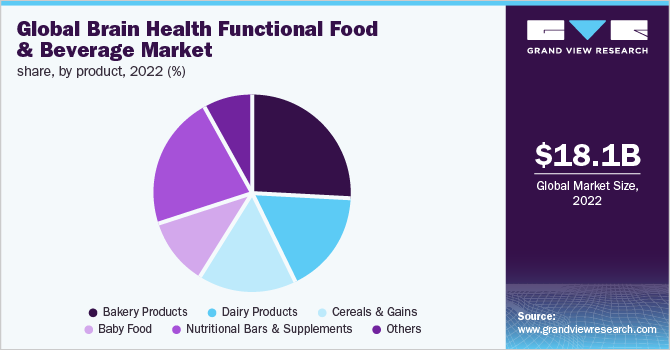

Product Insights

The bakery product segment dominated the industry in 2022 and accounted for the largest share of more than 26.30%of the overall revenue. As consumers become more and more health conscious, food fortification is an action undertaken by several bakery product manufacturers to improve the nutrient content in foods. For instance, Power Up Foods is a Texas, U.S.-based brand that sells baked items, such as flavored cookies and brownies, which contain green tea caffeine, a major source of L-theanine, a nutrient that relieves stress and improves mood & sleep. Similarly, New York-based Uplift offers Gut Happy Cookies that contain 1B CFU probiotics along with 4 diverse prebiotics, which is helpful for issues related to the gut-brain axis.

The nutritional bars & supplements segment is anticipated to have the highest CAGR during the forecast period. The demand for bars and supplements has risen as lifestyles become increasingly hectic, leaving little to no time for proper home-cooked nutritional meals. These bars and supplements contain added nutrients and therefore, a majority of them are marketed as functional foods. IQBar’s Brain and Body Keto Protein Bars contain six brain-boosting nutrients and are fortified with vitamin E, Lion’s Mane, MCTs, omega-3, choline, and flavonoids. Similarly, the nootropic brand Mind Lab Pro launched Nu: tropic in August 2022. These snack bars contain omega-3, phosphatidylserine, choline, vitamins, minerals, and gut-healthy prebiotic fiber, which boost cognitive function.

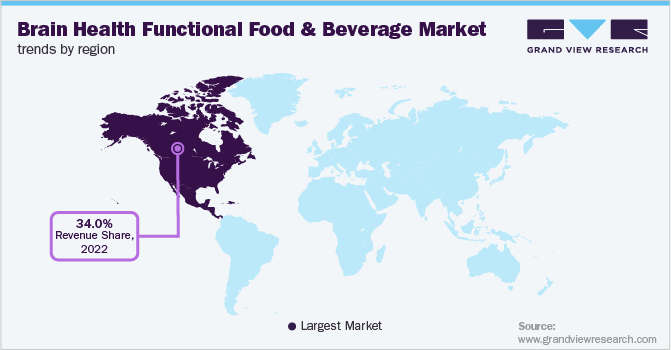

Regional Insights

North America dominated the global industry in 2022 and accounted for the maximum share of more than 34.00% of the overall revenue. The large population of North America has been experiencing an increase in brain health and lifestyle-related diseases due to poor dietary habits, sedentary lifestyles, and busy schedules. As a result, there has been a growing awareness about the benefits of regularly incorporating functional foods and beverages into the diet to improve overall health and obtain essential nutrients, which has driven the industry's growth in the region. Asia Pacific is expected to register the highest CAGR from 2023 to 2030.

With the rising health awareness, consumers are increasingly incorporating functional foods and beverages in their diet, which is estimated to drive industry growth. Improved lifestyles, rising disposable income, and rapid urbanization have led to consumers focusing on healthy diet options, which is expected to boost the growth industry. Brain health functional foods and beverages are commonly produced from ashwagandha (or Indian Ginseng), omega-3, vitamins, and minerals, which are readily available in large quantities in the region.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of the industry. Players are diversifying their service offerings to maintain market share. For instance,

-

In January 2023, Kellogg Company announced that after a petition by the company, the U.S. Food and Drug Administration (FDA) increased the fortification levels of vitamin D that are allowed within the cereal category. This move will help consumers access and consume vitamin D through Kellogg fortified cereals

-

For instance, in May 2022, Koios Beverage Corp announced that its nootropic functional beverages were approved for placement in more than 600 stores of CVS in Indiana, New York, Florida, California, New Jersey, Missouri, Texas, and Tennessee. This move is part of the company’s effort to gain placement in more national chains

Some of the key players operating in the brain health functional food and beverage market include:

-

Kellogg’s Company

-

Rage Coffee

-

Brain Bar

-

Cerebelly

-

Clutch Nutrition ApS

-

Ingenuit Brands – BRAINIAC

-

Koios Beverage Corp.

-

Memore

-

BrainMD Health

-

OF DREAMS & KNOWLEDGE - MILESTONE

Brain Health Functional Food And Beverage Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.75 billion

Revenue forecast in 2030

USD 40.34 billion

Growth rate

CAGR of 10.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; China; Japan; India; Australia & New Zealand; Brazil; South Africa

Key companies profiled

BrainMD Health; Clutch Nutrition ApS; Brain Bar; Cerebelly; Rage Coffee; Kellogg’s Company; Koios Beverage Corp.; Ingenuit Brands – BRAINIAC; OF DREAMS & KNOWLEDGE – MILESTONE; Memore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

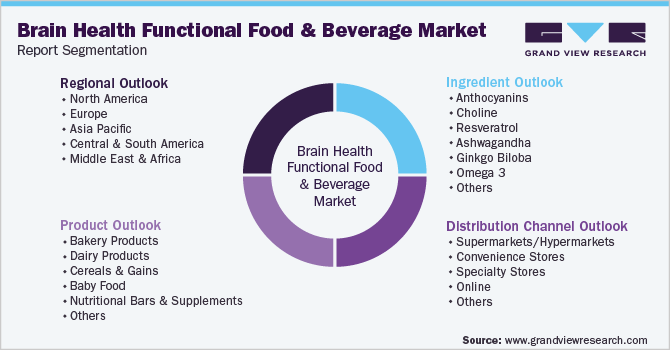

Global Brain Health Functional Food And Beverage Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global brain health functional food and beverage market report based on ingredient, product, distribution channel, and region:

-

Ingredient Outlook (Revenue, USD Million, 2017 - 2030)

-

Anthocyanins

-

Choline

-

Resveratrol

-

Ashwagandha

-

Ginkgo Biloba

-

Omega 3

-

Vitamins & Minerals

-

L-theanine

-

Curcumin

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Bakery Products

-

Dairy Products

-

Cereals & Gains

-

Baby Food

-

Nutritional Bars & Supplements

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global brain health functional food and beverage market was estimated at USD 18.10 billion in 2022 and is expected to reach USD 19.75 billion in 2023.

b. The global brain health functional food and beverage market is expected to grow at a compound annual growth rate of 10.5% from 2023 to 2030 to reach USD 40.34 billion by 2030.

b. North America dominated the brain health functional food & beverages market with a share of around 34.0% in 2022. This is owing to the increase in lifestyle and brain health-related diseases due to poor dietary habits, sedentary lifestyles, and busy schedules.

b. Some of the key players operating in the brain health functional food and beverage market include BrainMD Health, Clutch Nutrition ApS, Brain Bar, Cerebelly, Rage Coffee, Kellogg's Company, Koios Beverage Corp, Ingenuit Brands – BRAINIAC, OF DREAMS & KNOWLEDGE – MILESTONE, and Memore.

b. Key factors that are driving the brain health functional food & beverage market growth include the increasing spending on packaged drinks and snacking products and the readiness of consumers to spend on products that support their mental health.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."