- Home

- »

- Consumer F&B

- »

-

Brain Health Supplements Market Size, Industry Report, 2030GVR Report cover

![Brain Health Supplements Market Size, Share & Trends Report]()

Brain Health Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Natural Molecules, Herbal Extract, Vitamins & Minerals), By Form, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-866-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Brain Health Supplements Market Summary

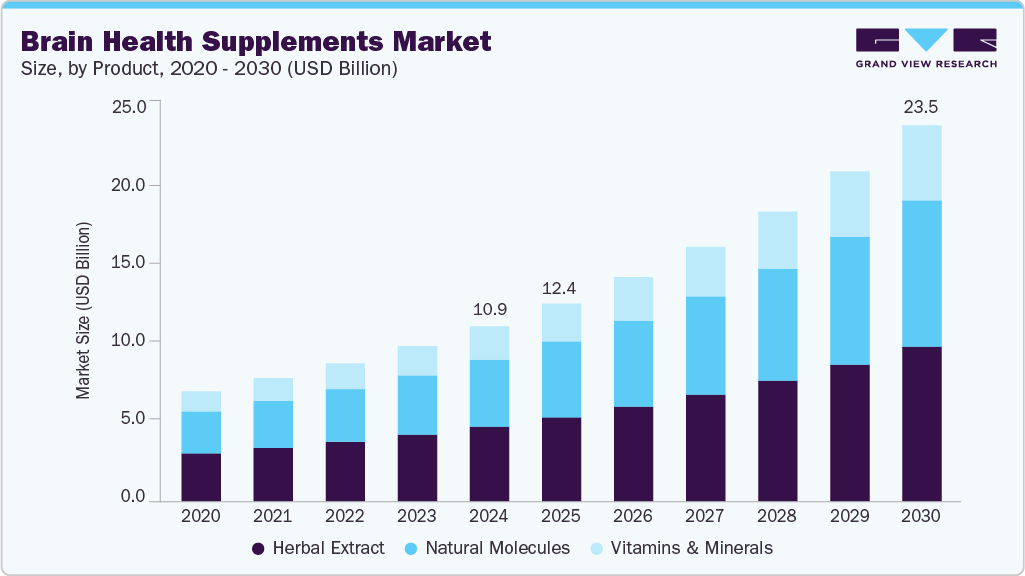

The global brain health supplements market size was estimated at USD 10.95 billion in 2024 and is projected to reach USD 23.52 billion by 2030, growing at a CAGR of 13.7% from 2025 to 2030. The market growth can be attributed to rising awareness regarding mental health issues, such as lack of attention and focus, declining memory, and heightened anxiety and depression.

Key Market Trends & Insights

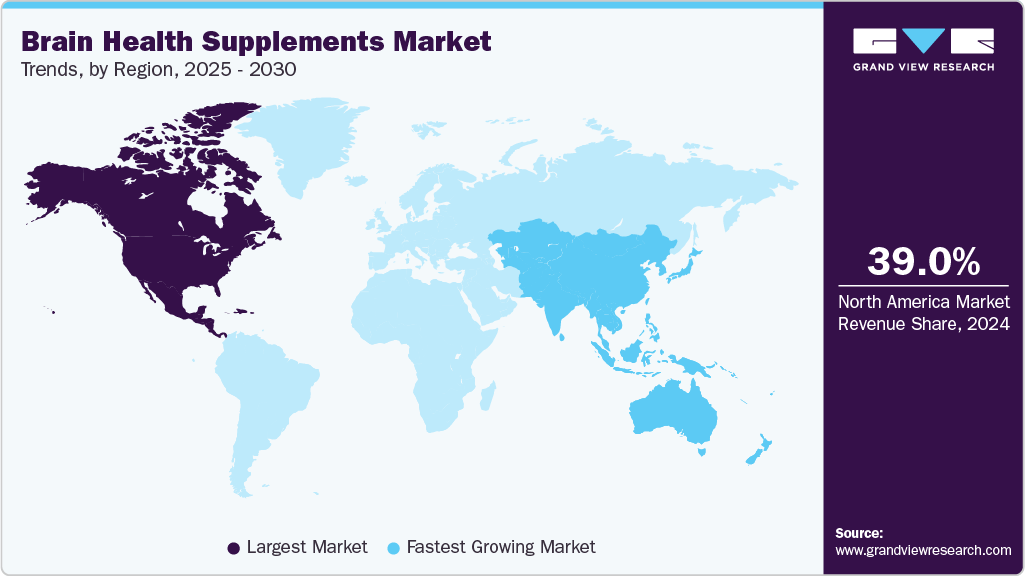

- North America dominated the global market with a share of 39.0% in 2024.

- Asia Pacific is expected to register the fastest CAGR of 16.1% from 2025 to 2030.

- By product, the herbal extract segment accounted for a market share of 42.7% in 2024.

- By form, the capsules segment accounted for a market share of 31.3% in 2024.

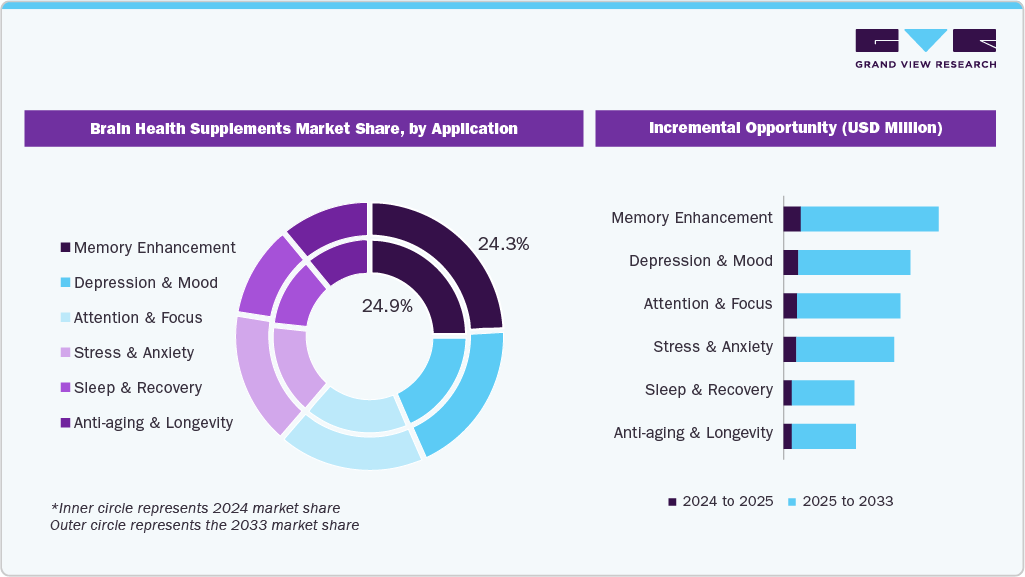

- By application, the memory enhancement segment dominated the market with a revenue share of 24.9% in 2024.

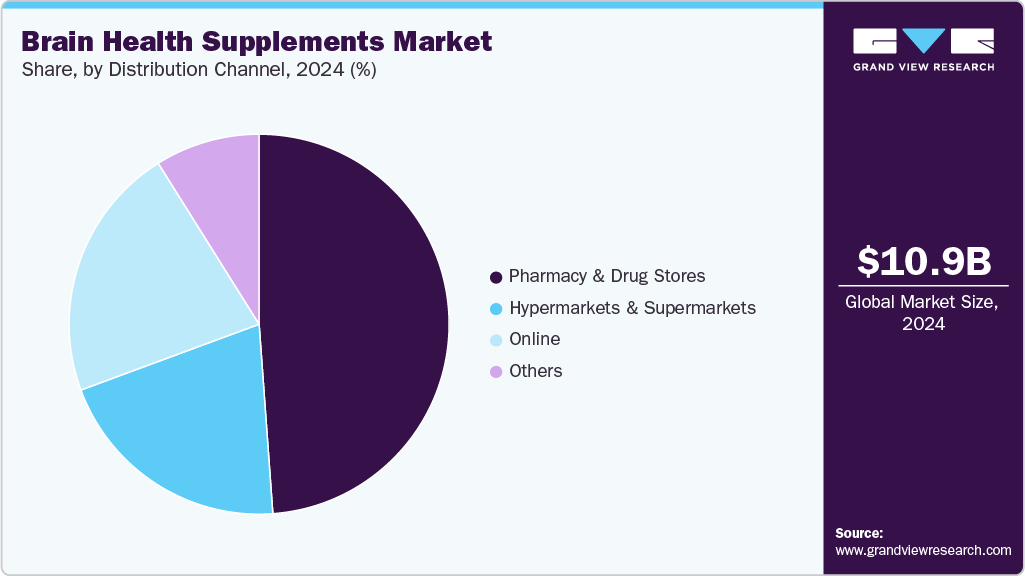

- By distribution channel, the pharmacy & drug stores segment dominated the market with a revenue share of 48.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.95 Billion

- 2030 Projected Market Size: USD 23.52 Billion

- CAGR (2025-2030): 13.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the increasing adoption of natural and herbal health products is anticipated to fuel the industry's growth over the forecast period. Rising demand for multi-efficacy drugs that work as energy boosters, antidepressants, brain enhancers, and resist anxiety is expected to drive greater R&D activities in this industry. Moreover, increasing demand by the sports industry to improve the brain efficacy of players is also expected to generate growth opportunities for the global market. Individuals associated with academic and professional arenas are expected to contribute to the demand for the brain health supplements industry over the next few years. In addition, these products are likely to gain high acceptance among people suffering from various brain ailments such as depression, dementia, anxiety, and insomnia, to name a few.

As of March 2023, the World Health Organization (WHO) reported that approximately 3.8% of the global population suffers from depression, with this figure rising to 5% among adults, 4% for men, and 6% for women, and reaching 5.7% in adults over the age of 60. Depression affects approximately 280 million individuals globally, making it a widespread mental health condition. Increasing awareness about mental illnesses is expected to widen the scope of application for brain health supplements in the near future.

Moreover, the supplements are employed for the treatment of other cognitive and age-related disorders, including hyperactivity and Parkinson's disease. Growing concern regarding mental health wellness and cognitive development is expected to augment the growth of the global brain health supplements market.

A wide variety of supplements are available that support brain health and help lower the risk of neurodegenerative conditions such as Alzheimer’s disease and dementia. While these supplements have potential to prevent certain disorders, concerns remain regarding their safety and effectiveness. Some marketed brain health supplements may include undeclared ingredients on the nutrition label or present inaccurate dosages. Additionally, overconsumption can expose individuals to adverse effects.

To address these issues, researchers are increasingly working on the development of new extracts and ingredients that are both safe and effective for consumers. Manufacturers, in turn, are emphasizing securing regulatory approval to gain marketing authorization. For instance, in August 2023, AKER BIOMARINE, a biotechnology innovator, received new dietary ingredient status from the U.S. FDA for LYSOVETA, a brain health ingredient designed to mitigate cognitive decline associated with aging.

This approval enabled the company to market the product to the general adult population. Introducing novel ingredients is expected to drive significant growth in the brain health supplements market.

Product Insights

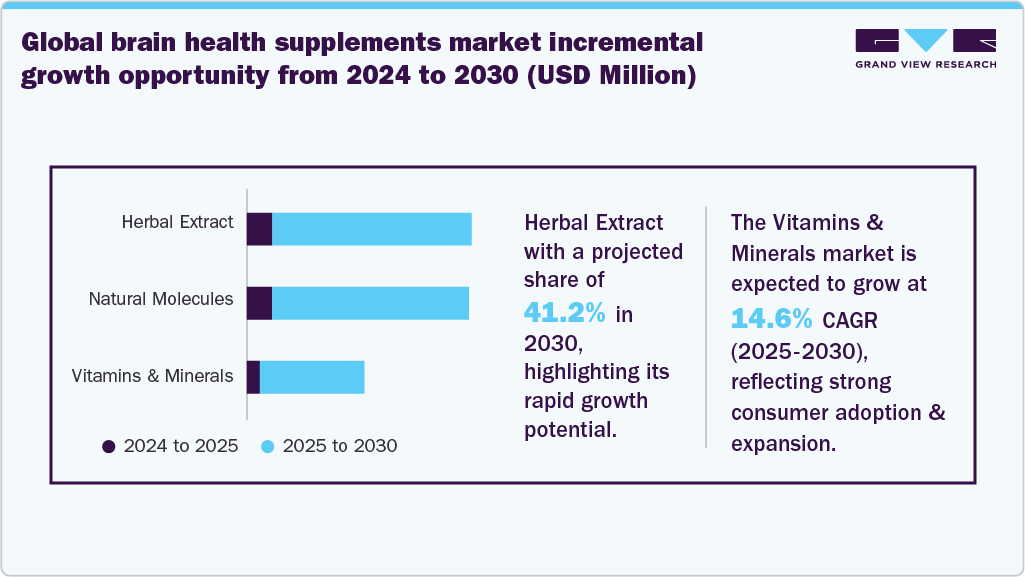

The herbal extract segment held the largest market share of 42.7%, in 2024. This segment's dominance can be attributed to the shifting consumer preference from synthetic brain supplements to supplements with herbal extracts. An increasing number of consumers are turning to traditional herbal medicines for various health concerns, which is likely to boost segment growth.

According to an article published in September 2025, research indicates that natural remedies such as turmeric, sage, and ginkgo may help support brain health, improve concentration, and slow age-related memory loss. These herbs, long used in traditional medicine, contain antioxidants and anti-inflammatory compounds that promote circulation and cognitive function. Market growth is further supported by innovation in ingredient combinations, scientific validation of efficacy, and the rising availability of these products through online and retail channels, making them more accessible to a broader audience.

The vitamins & minerals segment is projected to grow at the fastest CAGR of 14.6% from 2025 to 2030. Increasing consumer awareness of the role of micronutrients in supporting cognitive function, memory, and mental clarity is expected to drive the growth of the brain health supplements industry. Vitamins such as B-complex, D, and E, along with minerals such as magnesium and zinc, are recognized for their contributions to neurotransmitter function, neuroprotection, and healthy brain aging. The segment is further fuelled by a preference for evidence-backed, safe, and convenient formulations and the wider availability of these products through retail and online channels, making them accessible to a broad audience.

Form Insights

The capsules segment accounted for the largest share of 31.3 % of the revenue in 2024. The demand for brain health capsules is on the rise, fueled primarily by their convenience, formulation flexibility, and perceived precision in dosing. They are often favored when active ingredients are sensitive to taste or odor, since capsules mask unpleasant flavors. For brain health supplements, ingredients such as nootropics, herbal extracts, or amino acids are commonly delivered in capsule form because they can be dry-filled, which helps preserve stability. It has been observed that consumers who are performance-oriented, such as professionals or older adults seeking clinically backed cognitive support, tend to trust capsules due to their reputation for purity and consistency. Moreover, manufacturing costs for capsules are relatively lower (versus some non-pill formats) and tooling is well standardized, which allows faster SKU expansion and variety.

The softgels segment is anticipated to grow at the fastest CAGR of 14.8% from 2025 to 2030. The segment's growth is driven by convenience, effectiveness, and consumer appeal. Softgels are easy to swallow and quickly dissolve, allowing the active ingredient to be absorbed faster than tablets or capsules.

In October 2025, HelthJin Biotech launched JOURTHON Brain Health Softgel. This formula, grounded in nutritional science, supports focus, memory, and long-term neuron protection.

Application Insights

The memory enhancement segment accounted for the largest share of 24.9% in 2024. The growing cognitive demands of modern lifestyles largely influence the adoption of brain health supplements for memory enhancement. Increasing engagement in knowledge-based work, multitasking, and continuous learning has heightened the need for improved memory retention and mental agility across age groups. Consumers are increasingly turning to supplements containing ingredients such as ginkgo biloba, phosphatidylserine, acetyl-L-carnitine, and nootropic compounds, which are believed to support synaptic plasticity, neuronal communication, and overall cognitive performance.

The stress & anxiety segment is projected to grow at the fastest CAGR of 14.6% from 2025 to 2030. The rising demand for brain health supplements in stress and anxiety management is largely influenced by increasing global exposure to high-pressure environments, including demanding workplaces, academic pressures, and socio-economic uncertainties. Chronic stress and anxiety have been recognized as significant contributors to cognitive dysfunction, sleep disturbances, and overall health deterioration, prompting individuals to seek preventive and supportive interventions. According to a report published by WHO in September 2025, anxiety disorders are the most common mental health conditions globally, affecting around 359 million people in 2021, with women more likely to be affected than men.

As awareness of mental wellness continues to grow globally, the stress and anxiety segment is expected to contribute significantly to the overall expansion of the brain health supplements market.

Distribution Channel Insights

The pharmacy & drug stores segment accounted for the largest market share of 48.8% in 2024. The presence of pharmacists and the perception of regulated, safe products make this channel attractive, especially for more risk-averse consumers, elderly users, or those managing chronic conditions. When supplement packaging displays compliant claims and the product is visible on the pharmacy counter or shelf, confidence in the product is enhanced. Consumer preferences are shaped by perceived authenticity and the possibility of professional recommendation or guidance.

In pharmacist-led stores or national pharmacy chains, the product mix tends to include clinically studied supplements, high quality or premium branded lines, sometimes therapeutically targeted ones (memory, neuroprotection etc.), rather than novelty or exotic ingredients. For example, CVS and Walgreens in the United States frequently stock brain health supplement products from established brands such as Nature Made, Schiff, or even specialty nootropic companies. The buying decision is influenced by label clarity, third-party certifications, and often by the advice of pharmacy staff.

The online segment is projected to grow at the fastest CAGR of 14.6% from 2025 to 2030. The segment is driven due to the convenience, wide product selection, and competitive pricing it offers to consumers. E-commerce platforms allow customers to browse, compare, and purchase supplements from the comfort of their homes, often with detailed product information and customer reviews to guide decisions. The growth of digital payment options, faster delivery services, and subscription models has further boosted consumer adoption.

Regional Insights

North America brain health supplements market dominated the global market with a 39.0% share in 2024. The demand for brain health supplements in North America has grown substantially in recent years, driven by rising consumer demand for products that improve cognitive health, backed by the growing trend of health consciousness, especially among the young population. In addition, increasing demand for products that enhance memory, focus, and overall brain function has prompted companies to innovate with personalized formulations, clinically backed ingredients, and advanced delivery systems.

U.S. Brain Health Supplements Market Trends

The U.S. led the North American brain health supplements market in 2024. The U.S. accounted for a major share of the overall North America brain health supplements market in 2024. As per one of the studies published by National Center for Biotechnology Information, factors such as continuous stress, lack of sleep, fast-paced lifestyle, and long working hours are expected to affect the quality of life of individuals, especially of those in the U.S, which, in turn, is anticipated to propel the demand for the product among the consumers in the country.

Over the past few years, consumer preference has shifted toward herbal health supplements containing caffeine, matcha tea, spinach, beets, Brahmi, Arctic root, turmeric, ginseng, and pine bark. According to the American Council on Exercise (ACE), 50% of consumers in the U.S. prefer purchasing products containing natural ingredients.

Europe Brain Health Supplements Market Trends

The brain health supplements market in Europe accounted for a revenue share of 22.6% in 2024. Consumers in the region have become more aware of a healthy lifestyle, and their behavior toward natural health supplements has altered over the years. Increasing consumer preference for naturally derived supplements over synthetic supplements is expected to create growth opportunities for key market players, which, in turn, drives the overall market growth.

According to the estimates published by UNICEF in October 2021, one in five Europeans aged 15 to 19 suffers from mental disorders, and 9 million adolescents are living with anxiety and other mental disorders. Several hospitals and medical authorities prescribe mental health supplements to treat mental illness and other disorders. Thus, the demand for natural molecule brain health supplements is expected to rise in the region.

In November 2024, Bayer Consumer Health launched a new product, Berocca Mind, exclusively on Amazon This Black Friday in the UK. The supplement, containing Spanish sage extract, is designed to support memory and mental performance, targeting consumers looking to boost their cognitive function.

Asia Pacific Brain Health Supplements Market Trends

The Asia Pacific market is projected to grow at the fastest CAGR of 16.1% from 2025 to 2030. The brain supplements market has shown exceptional penetration in Asia Pacific, especially in China, India, and Japan, due to increasing consumer awareness regarding their benefits, rising preference for natural supplements over pharmaceuticals, and the growing prevalence of Alzheimer’s.

Japan's brain health supplements market is expected to grow in the coming years. According to statistics published by the Alzheimer's Association, 4.6 million people in Japan are living with dementia, and the number is expected to rise as the population ages. Furthermore, several product manufacturers aim to produce brain health supplements exclusively aimed at sportspersons to improve their performance and strengthen their mental composure. This is expected to offer lucrative business opportunities for product manufacturers.

Brain health supplements in India is expected to grow at the fastest CAGR over the forecast period as consumers become more aware of cognitive wellness and mental performance. Increasing focus on preventive healthcare, stress management, and maintaining memory and concentration drives demand for products that support brain function. In July 2025, Aayush Wellness Limited launched Brain Fuel Capsules, a nutraceutical product with herbal ingredients to support memory retention, cognitive function, and mental clarity.

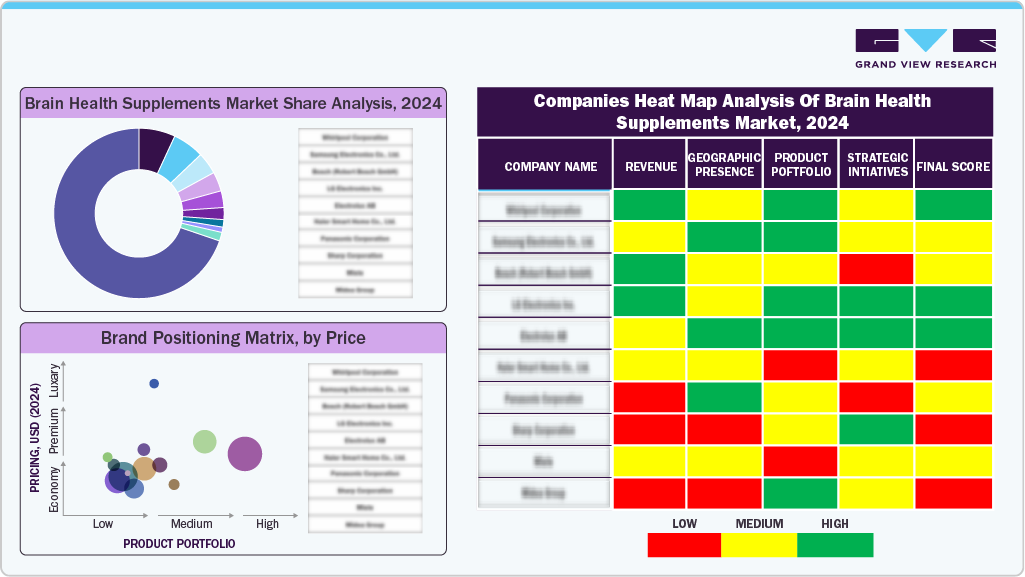

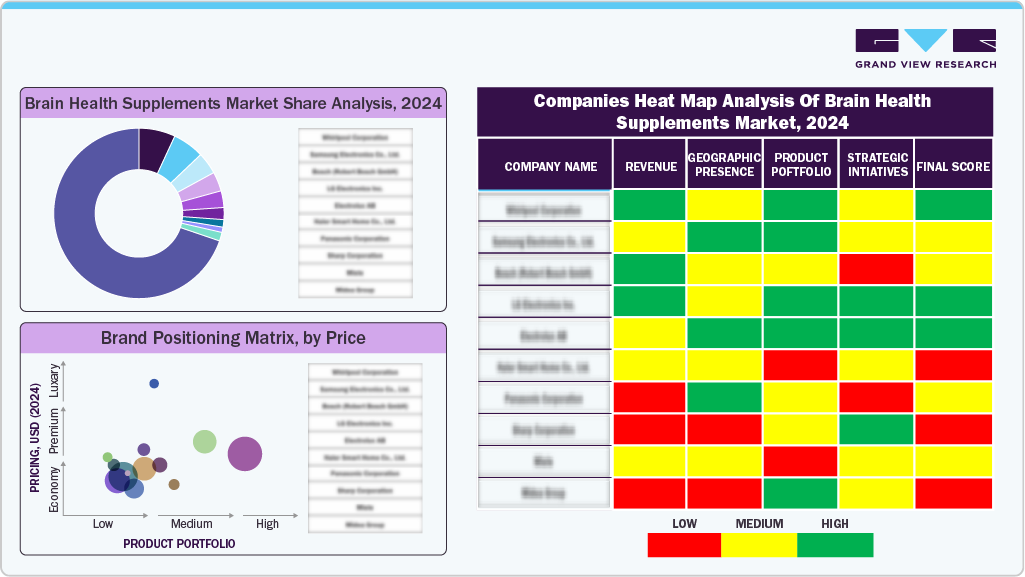

Key Brain Health Supplements Company Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of the brain health supplements industry. Players in the market are diversifying their service offerings to maintain market share.

-

Natural Factors Nutritional Products Ltd, one of the largest manufacturers of nutritional products in North America. The company owns an organic farm and controls the selection of non-hybrid and non-GMO seeds. Natural Factors offer various brain health supplements, including Phosphatidyl Choline, Memory Optimizer, PS.IQ Memory, Coenzyme Q10, RxOmega-3, and others. The company has manufacturing operations in British Columbia and Washington State (U.S.) and employs around 5,000 people at its different manufacturing facilities.

-

Onnit Labs, Inc. was established in 2010 and is headquartered in Texas, U.S. The company manufactures supplements, food, and sports products. The company serves the brain health supplement market as a brand of Unilever, post its acquisition announcement in April 2021. Its product portfolio includes supplements, nutrition, fitness, and apparel.

Key Brain Health Supplements Companies:

The following are the leading companies in the brain health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Natural Factors

- Onnit Labs, Inc.

- Purelife bioscience Co., Ltd.

- Intelligent Labs

- Accelerated Intelligence, Inc.

- NOW Foods

- HVMN Inc.

- Teva Pharmaceutical Industries Ltd.

- Reckitt Benckiser Group PLC

- Alternascript

Recent Developments

-

In May 2025, DKSH’s Healthcare unit formed a strategic partnership with Hong Kong-based INFItech to bring the company’s brain health supplements to consumers in Hong Kong and Macau.

-

In December 2024, Fenix Health Science announced the launch of new products that offer advanced formulations with its Omega, Neuro, and Mineral ranges, designed to support brain health. The new line, featuring advanced formulations.

-

In October 2024, Monteloeder (through its Suannutra arm) released MINDREVIVE, a nootropic blend combining sage, Japanese pagoda tree extract, and rutin. This reflects a trend toward multi-component botanical blends aimed at supporting short-term memory and cognitive performance.

-

In September 2024, Solaray introduced SharpMind Memory, a formula enhanced with Cognivia, a clinically studied sage extract blend. The launch illustrates current interest in herbal/plant-based, clinically validated nootropic ingredients.

Brain Health Supplements Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 12.37 billion

Revenue Forecast in 2030

USD 23.52 billion

Growth Rate (Revenue)

CAGR of 13.7% from 2025 to 2030

Actual data

2021 - 2024

Forecast period

2025 - 2030

Quantitative (Revenue) units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application, distribution channel, region

Regional Scope

North America; Europe; Asia-Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; UK; Spain; China; India; South Korea; Japan; Australia & New Zealand; Thailand; Taiwan; Malaysia; Brazil; South Africa

Key companies profiled

Natural Factors; Onnit Labs, Inc.; Purelife bioscience Co., Ltd.; Intelligent Labs; Accelerated Intelligence, Inc.; NOW Foods; HVMN Inc.; Reckitt Benckiser Group PLC; Teva Pharmaceutical Industries Ltd.; Alternascript

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brain Health Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global brain health supplements market based on product, form, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Molecules

-

Acetyl-L-Carnitine

-

Alpha-GPC

-

Citicoline

-

DHA

-

Pre/Pro/Postbiotics

-

Others (EPA, Conezyme q10, MCT, Resveratrol, Phosphatidylserine, etc.)

-

-

Herbal Extract

-

Ginseng

-

Gingko Biloba

-

Curcumin

-

Others (Bacopa, Ashwagandha, Gotu Kola, Lemon Balm, etc.)

-

-

Vitamins & Minerals

-

Vitamin B

-

Vitamin C & E

-

Others (Magnesium, Zinc, etc.)

-

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Tablets

-

Softgels

-

Powders

-

Gummies

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Memory Enhancement

-

Attention & Focus

-

Depression & Mood

-

Sleep & Recovery

-

Anti-aging & Longevity

-

Stress & Anxiety

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drug Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Australia & New Zealand

-

Thailand

-

Taiwan

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global brain health supplements market size was estimated at USD 10.95 billion in 2024 and is expected to reach USD 12.37 billion in 2025.

b. The global brain health supplements market is expected to witness a compound annual growth rate of 13.7% from 2025 to 2030 to reach USD 23.52 billion by 2030.

b. North America dominated the brain health supplements market with a share of 39.0% in 2024. This is attributed to the increasing number of product launches having herbal and natural ingredients and growing consumer awareness regarding a healthy lifestyle.

b. Key players include in the brain health supplements market are Natural Factors Nutritional Products Ltd, Onnit Labs, Inc., Purelife Bioscience Co., Ltd, Intelligent Labs, Accelerated Intelligence Inc., NOW Foods, HVMN Inc., Teva Pharmaceutical Industries Ltd., Peak Nootropics, Alternascripts.

b. Key factors that are driving the brain health supplements market growth include rising concerns among consumers over brain health issues such as memory enhancement, alertness, creativity, motivation, and attention, along with an increase in the adoption of herbal and natural products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.