- Home

- »

- Consumer F&B

- »

-

Brain Health Supplements Market Size & Growth Report, 2030GVR Report cover

![Brain Health Supplements Market Size, Share & Trends Report]()

Brain Health Supplements Market Size, Share & Trends Analysis Report By Product (Natural Molecules, Vitamins & Minerals), By Application (Memory Enhancement, Attention & Focus), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-866-4

- Number of Pages: 83

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global brain health supplements market was valued at USD 8.63 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.3% from 2023 to 2030. The growth is attributed to rising awareness regarding mental health issues, such as lack of attention and focus, declining memory, anxiety, and depression. Moreover, the increasing adoption of natural and herbal health products is anticipated to fuel the industry's growth over the forecast period. Rising demand for multi-efficacy drugs that work as energy boosters, antidepressants, brain enhancers, and resist anxiety is expected to drive greater R&D activities in this industry. Moreover, increasing demand by the sports industry to improve the brain efficacy of players is also expected to generate growth opportunities for the global market.

People associated with academic and professional arenas are expected to contribute to the demand for the brain health supplements industry over the next few years. In addition, these products are likely to gain high acceptance among people suffering from various brain ailments such as depression, dementia, anxiety, and insomnia, to name a few.

According to an article by the World Health Organization (WHO), in September 2021, approximately 280 million people of all ages suffered from depression globally. In the U.S., anxiety disorder is one of the most common mental illnesses.

As per an article published by the Anxiety & Depression Association of America in October 2022, approximately 19.1% of the adult population, i.e., 40 million people, in the U.S. suffer from anxiety. Increasing awareness about mental illnesses is expected to widen the scope of application for brain health supplements in the near future.

Moreover, these products are employed to treat other cognitive and age-related disorders, including hyperactivity and Parkinson's disease. Growing concern concerning mental health wellness and cognitive development is expected to augment the growth of the brain health supplements market.

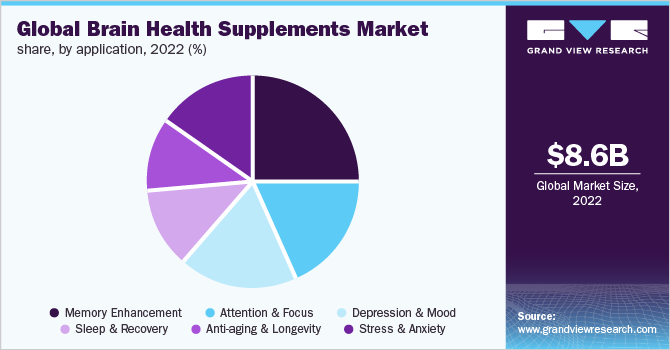

Brain health supplements for memory enhancement registered the highest market penetration in 2022. Growing competition in academic and professional fields has been driving the growth of these products. Moreover, the increasing need for memory improvement among the older population was also one of the driving factors for such supplements.

In addition, the cost-effectiveness, as well as easy accessibility to these products, is expected to boost product adoption among consumers. Such factors are likely to contribute to segment growth.

For the last few years, supplements for enhancing cognitive function have mostly focused on aging baby boomers to help slow down or prevent cognitive disorders. With the development and awareness about these products, they are now more closely targeted at millennials, as this demographic is under constant pressure to increase its productivity.

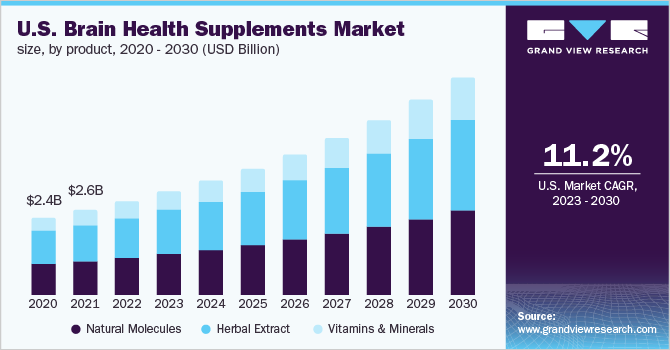

Product Insights

The vitamins & minerals segment is expected to witness a prominent CAGR of 14.3% over the forecast period from 2023 - 2030. Increasing awareness of the benefits of vitamins and minerals is expected to grow the demand for this segment. Vitamins and minerals are vital in preventing age-related cognitive decline and developmental disorders, including Alzheimer's disease and dementia.

The herbal extract segment of the brain health supplements industry held a revenue share of 43.2% in 2022. Increasing preference for herbal products in developing nations such as China and India will positively impact the demand for herbal extract brain health supplement products. According to a 2022 report by the World Health Organization, about 80% of the global population relies on traditional medicine for primary health concerns.

Application Insights

The memory enhancement application segment held the largest share of more than 25.2% in 2022. Rising competition in the academic sector has fueled the demand for memory enhancers and brain health supplements among students. Increasing preference for natural and herbal extract supplements is expected to generate growth opportunities for key players in the upcoming years.

In addition, the product is gaining importance among the aging population, who are suffering from weak memory and Alzheimer's disease in developed countries of North America and Europe. The Alzheimer's Association suggests that in 2022 almost one in five Americans will face mild cognitive impairment, which can be associated with the early onset of Alzheimer's. Moreover, in 2022, an estimated 6.5 million Americans aged 65 and above were living with the disease.

The stress and anxiety segment is anticipated to have the highest CAGR of more than 14% over the forecast period. Changing lifestyle coupled with a hectic working schedule has led to an increase in the number of mental fatigue-related issues such as stress and anxiety. As a result, many working professionals are seeking brain health supplements to enhance their focus and attention, as these products help alleviate stress and relax the mind.

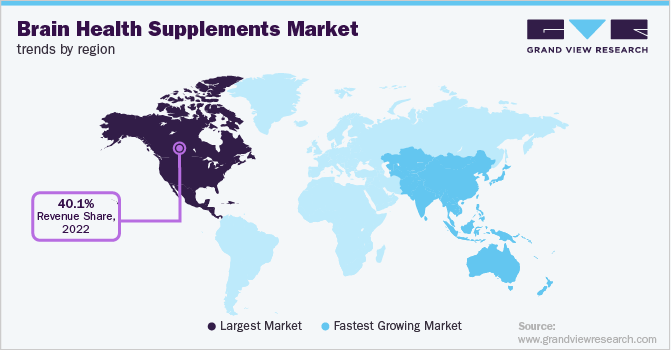

Regional Insights

North America dominated the global market with a share of more than 40.1% in 2022. The demand for brain health supplements in North America has grown substantially in recent years, driven by rising consumer demand for products that improve cognitive health, backed by the growing trend of health consciousness, especially among the young population.

According to a survey conducted by the American Association of Retired Persons (AARP) on brain health and dietary supplements in June 2019, Americans aged 50 and older are regularly consuming large amounts of brain health supplements owing to increasing concerns over their brain and cognitive health.

Asia Pacific is expected to register the highest CAGR of 15.8% from 2023 to 2030. The brain supplements market has shown exceptional penetration in the Asia Pacific, especially in China, India, and Japan, on account of increasing consumer awareness regarding the benefits of these supplements, rising preference for natural supplements over pharmaceuticals, and the growing prevalence of Alzheimer's.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of the brain health supplements industry. Players in the market are diversifying their service offerings to maintain market share.

-

Onnit Labs, Inc. added a new study to its portfolio of clinical trials to understand the effects of its product, the 'new mood serotonin booster'. The supplement was designed to help regulate mood and daily stress. The test group consisted of college students who face regular stressors such as post-graduation plans and academic performance.

-

Intelligent Labs launched Lion's Mane Mushroom Extract capsules that improve cognitive function and elevate concentration, memory, and learning. The launch was aimed at helping the company expand its brain health supplement business.

Some prominent players in the global brain health supplements market include:

-

Natural Factors Nutritional Products Ltd

-

Onnit Labs, Inc.

-

Purelife Bioscience Co., Ltd

-

Intelligent Labs

-

Accelerated Intelligence Inc.

-

NOW Foods

-

HVMN Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Peak Nootropics

-

Alternascript

Brain Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.70 billion

Revenue forecast in 2030

USD 23.41 billion

Growth rate

CAGR of 13.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; China; Japan; India; Australia; Brazil; South Africa

Key companies profiled

Natural Factors Nutritional Products Ltd; Onnit Labs, Inc.; Purelife Bioscience Co., Ltd; Intelligent Labs; Accelerated Intelligence Inc.; NOW Foods; HVMN Inc.; Teva Pharmaceutical Industries Ltd.; Peak Nootropics; Alternascript

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Brain Health Supplements Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global brain health supplements market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Natural Molecules

-

Acetyl-L-Carnitine

-

Alpha-GPC

-

Citicoline

-

DHA

-

Pre/Pro/Postbiotics

- Others

-

-

Herbal Extract

-

Ginseng

-

Gingko Biloba

-

Curcumin

-

Others

-

-

Vitamins & Minerals

-

Vitamin B

-

Vitamin C & E

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Memory Enhancement

-

Attention & Focus

-

Depression & Mood

-

Sleep & Recovery

-

Anti-aging & Longevity

-

Stress & Anxiety

-

-

Regional Outlook (Revenue, USD Million, 2017 -2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global brain health supplements market size was estimated at USD 8.63 billion in 2022 and is expected to reach USD 9.70 billion in 2023.

b. The global brain health supplements market is expected to witness a compound annual growth rate of 13.3% from 2023 to 2030 to reach USD 23.41 billion by 2030.

b. North America dominated the brain health supplements market with a share of 40.1% in 2022. This is attributed to the increasing number of product launches having herbal and natural ingredients and growing consumer awareness regarding a healthy lifestyle.

b. Key players include in the brain health supplements market are Natural Factors Nutritional Products Ltd, Onnit Labs, Inc., Purelife Bioscience Co., Ltd, Intelligent Labs, Accelerated Intelligence Inc., NOW Foods, HVMN Inc., Teva Pharmaceutical Industries Ltd., Peak Nootropics, Alternascripts.

b. Key factors that are driving the brain health supplements market growth include rising concerns among consumers over brain health issues such as memory enhancement, alertness, creativity, motivation, and attention, along with an increase in the adoption of herbal and natural products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."