- Home

- »

- Medical Devices

- »

-

Brain Implants Market Size & Share, Industry Report, 2030GVR Report cover

![Brain Implants Market Size, Share & Trends Report]()

Brain Implants Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Chronic Pain, Epilepsy, Parkinson’s, Depression, Essential Tremor, Alzheimer’s), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-311-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Brain Implants Market Summary

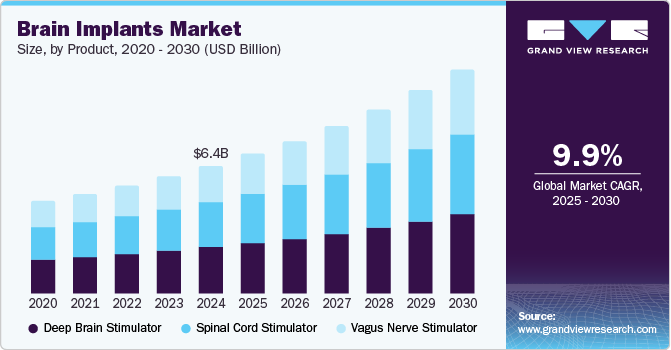

The global brain implants market size was estimated at USD 6.38 billion in 2024 and is projected to reach USD 11.20 billion by 2030, growing at a CAGR of 9.9% from 2025 to 2030. Technological advancements and growing awareness drive brain implant market growth, with innovations such as neuroimaging and minimally invasive techniques increasing adoption, while investments, such as Japan’s USD 16 billion, and patient education further boost demand.

Key Market Trends & Insights

- North America brain implants market dominated the global market with a revenue share of 41.5% in 2024.

- The brain implants market in the U.S. dominated the North America brain implants market with a revenue share of 75.1% in 2024.

- By product, deep brain stimulators (DBS) dominated the market and accounted for a share of 36.6% in 2024.

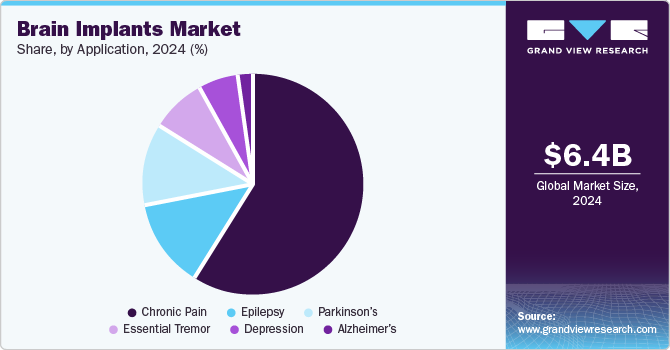

- By application, the chronic pain segment led the market and accounted for a share of 59.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.38 Billion

- 2030 Projected Market Size: USD 11.20 Billion

- CAGR (2025-2030): 9.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing prevalence of neurological disorders significantly fuels market expansion worldwide. As the global population ages, the incidence of conditions such as Alzheimer’s, Parkinson’s disease (PD), epilepsy, and depression continues to rise. According to Alzheimer’s Research UK, approximately 850,000 individuals were living with dementia in 2023 in the UK, with Alzheimer’s disease representing nearly 62% of these cases. Further projections from a November 2023 University College London study estimate over 1.7 million people in England and Wales with dementia by 2040, indicating growing demand for innovative treatments such as brain implants.

Technological advancements in neuroscience and neurotechnology are also pushing the boundaries of medical science and driving market growth. Innovations in neuroimaging techniques, such as functional magnetic resonance imaging (fMRI) and electroencephalography (EEG), have improved the understanding of the brain’s neural networks, leading to more sophisticated and targeted brain implant technologies. Moreover, the development of minimally invasive implantation techniques and wireless communication systems represents a significant opportunity in the market. These advancements are expected to increase the adoption of brain implants, particularly in countries such as Brazil, where minimally invasive procedures are projected to rise by over 25% by 2024.

The growing awareness about advanced neurological treatments and increasing healthcare expenditure are also driving demand for brain implants. Moreover, positive clinical trial results have built confidence among physicians and patients, leading to increased adoption rates. Patient education and advocacy initiatives are helping to expand the market by promoting understanding and acceptance of brain implants. Furthermore, continued public and private investments in research and development are crucial for developing novel implantable devices and therapies. In 2024, Japan’s MEXT allocated approximately USD 16 billion towards neuroscience research within its science and technology budget. This funding supported brain science advancement, young researchers, and international collaboration.

Product Insights

Deep brain stimulators (DBS) dominated the market and accounted for a share of 36.6% in 2024. Deep brain stimulators devices are experiencing heightened demand due to increasing prevalence of neurological disorders such as PD, epilepsy, and essential tremors. For instance, according to an April 2024 study published by the American Association of Neurological Surgeons, approximately 250,000 individuals in the U.S. had dystonia. This neurological movement disorder, characterized by involuntary muscle contractions, impacted people of all ages and ethnicities, resulting in abnormal postures and movements. Advancements in technology, minimally invasive procedures, clinical efficacy, and regulatory approvals contribute to the market growth. The approval of new DBS devices by regulatory bodies such as the FDA has expanded treatment options.

Vagus nerve stimulators (VNS) are expected to grow at the fastest CAGR of 10.3% over the forecast period. The prevalence of neurological disorders, including epilepsy, depression, and migraines, fuels the demand for VNS, the market share of which is growing, and the adoption of which is increasing. VNS devices are gaining popularity as a treatment option, driven by their effectiveness in managing various conditions, including epilepsy, depression, migraines, and sleep apnea.

Application Insights

The chronic pain segment led the market and accounted for a share of 59.0% in 2024. Recent advancements in brain implant technology are driving increased adoption for chronic pain management. A November 2023 study by the Guardian highlighted promising results in the UK and Europe. Research shows that deep brain stimulation effectively alleviates chronic pain conditions such as neuropathic pain and phantom limb pain, which affects a significant portion of the global population. For instance, in July 2024, Boston Scientific announced positive five-year data for its Intercept system at the American Society of Pain & Neuroscience conference in Florida, U.S., for heterogenic low back pain treatment. Technological innovations, including closed-loop systems, enhance treatment efficacy, and patient demand is rising for minimally invasive procedures. Increased awareness, research investments, and the growing shift towards these technologies are all contributing to the adoption rates of brain implants.

Parkinson’s is projected to grow at the fastest CAGR of 10.6% over the forecast period. According to the American Parkinson Disease Association, the rising global prevalence of PD was evident in the U.S., with over 8.5 million people affected, including 90,000 new U.S. cases. The country is experiencing an increased need for effective treatments such as brain implants, aiding heightened awareness and research among healthcare professionals. Technological advancements such as improved electrode design and R&D investments have driven the adoption of DBS worldwide. Consequently, according to a 2024 study by the National Library of Medicine, patients with PD who did not respond to medication had a 70% increase in quality of life.

Regional Insights

North America brain implants market dominated the global market with a revenue share of 41.5% in 2024. In 2023, an estimated 6.7 million Americans aged 65 and older were living with Alzheimer’s dementia, with projections to reach 13.8 million by 2060, highlighting the high prevalence of neurological conditions. This demand is supported by a well-established healthcare infrastructure and significant investments in R&D, which are fostering advancements in brain implant technologies. Innovations, such as minimally invasive procedures, enhance safety and efficacy, driving patient and provider interest. In June 2023, Cognixion’s noninvasive brain-computer interface, the Cognixion ONE Axon, received the FDA Breakthrough Device designation, further validating the company’s technology. This support and a well-established healthcare infrastructure and R&D investments drive demand for brain implants. Growing awareness among healthcare professionals and advocacy initiatives are also promoting the acceptance of these devices.

U.S. Brain Implants Market Trends

The brain implants market in the U.S. dominated the North America brain implants market with a revenue share of 75.1% in 2024. In the U.S., factors such as rising neurological disorder prevalence, increased treatment awareness, skilled physicians, and robust healthcare are boosting demand for DBS devices. For instance, in August 2024, the Parkinson’s Foundation granted over USD 1 million for PD programs supporting health, wellness, and education. These investments allowed scientists to conduct investigations into various PD-related areas, aiming to develop new therapies and treatments for the approximately 10 million individuals worldwide affected by this challenging neurological condition.

Europe Brain Implants Market Trends

Europe brain implants market held substantial market share in 2024, driven by the rising prevalence of neurological disorders such as PD and Alzheimer’s. The UK sees approximately 4,400 new spinal cord injury cases annually. Recent analysis, in association with the National Spinal Cord Injury Database, indicates a significant increase in spinal cord injury (SCI) cases. The analysis reveals a substantial increase in the affected individuals, totaling 105,000 living with SCI. This shift suggests a broader scope of inclusion for both traumatic and non-traumatic injuries, alongside better data collection. Advancements in targeted stimulation and personalized programming are enhancing implant effectiveness. Patients now benefit from improved quality of life, symptom management, and reduced caregiver burden. Moreover, there is an upsurge in demand for minimally invasive devices, a shift from traditional medication to electrical stimulation of nerves.

The brain implants market in Germany is expected to grow rapidly over the forecast period. Germany’s robust healthcare infrastructure and supportive reimbursement policies have facilitated the adoption of brain implants. In past years, increased R&D investments drove advancements in surgical techniques and device designs, improving effectiveness for neurological disorders such as Parkinson’s and Alzheimer’s, which are prevalent in Germany due to its aging population. Growing awareness and acceptance further encourage using brain implants to manage these and other conditions.

Asia Pacific Brain Implants Market Trends

Asia Pacific brain implants market is anticipated to witness the fastest growth of 11.1% over the forecast period. The region is witnessing a surge in neurological disorders due to its aging population, with approximately 6 million patients with Alzheimer’s reported in China in 2023. To address this, countries are developing their healthcare infrastructure, and R&D investments are driving innovations in brain implant technologies, such as DBS and spinal cord stimulators. The region is also seeing predictive brain implants, smart helmets for monitoring brain activity, and brain implants designed for long-term monitoring such as Carbon Cybernetics’ implant. An Australian study reported on the impact of intelligent BCI devices on patient experience, informing the global brain implant market and aiding ethical recommendations to guide future clinical BCI applications. These advancements, along with growing awareness and acceptance, are expected to transform treatment approaches and improve the quality of life for patients. Governments are implementing supportive policies, and healthcare providers are adopting these technologies to improve outcomes.

The brain implants market in Japan is projected to grow at the fastest rate of 13.1% over the forecast period in the Asia Pacific market. According to a study by the Japan Neurological Society, DBS is a potential treatment for psychiatric disorders such as OCD. While approved in Europe and the US, its use in Japan remains restricted, hindering access to care. The authors advocate for a reevaluation of DBS’s potential in Japan based on scientific evidence and understanding. Furthermore, Japan continues the established use of DBS for neurological conditions such as Parkinson’s. Innovative research from Japanese teams has also yielded wireless optical neural stimulators and AI breakthroughs, including image reconstruction from brain activity with over 75% accuracy. Moreover, ongoing clinical trials explore cranial implants for conditions such as ALS, reflecting Japan’s commitment to advancing brain implant technology.

Key Brain Implants Company Insights

Some key companies operating in the market include Medtronic, Boston Scientific Corporation, and Abbott, among others. The market is competitive and features numerous manufacturers dominating market share. Strategic initiatives such as product launches, acquisitions, and innovation are key for global expansion and sustained growth. For instance, in November 2024, Neuralink launched a feasibility trial in the U.S. using its brain implant and experimental robotic arm, assessing the device’s safety and effectiveness in patients with quadriplegia.

-

Boston Scientific specializes in neuromodulation, offering the Vercise DBS system for precise neural targeting in conditions such as PD, tailoring systems to individual patient needs.

-

LivaNova PLC develops innovative neuromodulation therapies for neurological disorders. Their offerings include the VNS Therapy System for epilepsy and depression and the THN Sleep Therapy device, improving patient outcomes.

Key Brain Implants Companies:

The following are the leading companies in the brain implants market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Boston Scientific Corporation

- Abbott

- NeuroPace, Inc.

- ALEVA NEUROTHERAPEUTICS

- LivaNova PLC

- SceneRay Co., Ltd.

Recent Developments

-

In August 2024, Medtronic received FDA approval for Asleep DBS surgery. This marked the first approval, providing new options for Parkinson’s and essential tremor patients in the United States, enhancing patient comfort and surgical efficiency.

-

In January 2024, Abbott launched the Liberta RC DBS system in the U.S., the world’s smallest rechargeable device with remote programming for movement disorders, featuring NeuroSphere Virtual Clinic and infrequent recharging.

Brain Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.97 billion

Revenue forecast in 2030

USD 11.20 billion

Growth rate

CAGR of 9.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Boston Scientific Corporation; Abbott; NeuroPace, Inc.; ALEVA NEUROTHERAPEUTICS; LivaNova PLC; SceneRay Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brain Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global brain implants market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Deep Brain Stimulator

-

Spinal Cord Stimulator

-

Vagus Nerve Stimulator

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Pain

-

Epilepsy

-

Parkinson’s

-

Depression

-

Essential Tremor

-

Alzheimer’s

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.