- Home

- »

- Medical Devices

- »

-

Branched Stent Grafts Market Share Report, 2021-2028GVR Report cover

![Branched Stent Grafts Market Size, Share & Trends Report]()

Branched Stent Grafts Market (2021 - 2028) Size, Share & Trends Analysis Report By Type (Iliac Stent), By Application (EVAR), By Region (North America, APAC), And Segment Forecasts

- Report ID: GVR-4-68039-399-7

- Number of Report Pages: 156

- Format: PDF

- Historical Range: 2021

- Forecast Period: 2022 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

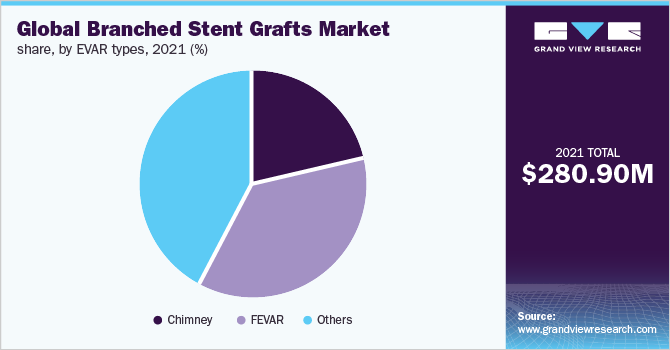

The global branched stent grafts market size was valued at USD 280.9 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2021 to 2028. The market holds many growth opportunities owing to a rise in the number of Endovascular Aneurysm Repair (EVAR) procedures being performed, rising advancements in technology, and enhanced quality of patient care. However, the COVID-19 pandemic has led to deferred or postponed elective surgeries, a decline in sales, and dampened growth rate, among others, which adversely affected the overall market. The decrease in surgical procedures drastically reduced the demand for devices and products required for EVAR procedures. Although urgent vascular surgeries were performed, there was a steep decline in the total number of procedures.

The shortage of ICU beds and surgical rooms was also reported. Companies involved in the vascular stents market witnessed slow growth and low net sales. When hospitals redistributed resources to ICUs, elective surgeries were low on priority and most of them were postponed, affecting the product demand. Endovascular repair of major aortic pathology, such as traumatic rupture, aneurysms, & dissections, has gained wide patient and surgeon acceptance due to lower mortality and morbidity.

In addition, a rapid revolution in the exercise of vascular surgery has also had a substantial impact on the provision of intensive and anesthesia care. EVAR, since its introduction in the early 1990s, has been established as a feasible treatment for AAAs. The practice of EVAR increased rapidly after its approval with the number of AAA treated endovascular, increasing to 74% in 2010 from 5% in 2000.

Branched Stent Grafts market impact: Over 45% decline in demand

Pandemic Impact

Post COVID Outlook

The earlier projections depicting approximately 10% YoY growth was countered by the pandemic resulting in the difference of ~188.92 USD million revenue in the earlier and recent estimations

The market is expected to recover after 2020 and account for USD 280.90 million in 2021

Medtronic experienced a decline of 7% in its Aortic, Peripheral, & Venous segment’s revenue from 2019 to 2020

Market players are expected to experience high demand for EVAR procedures, and hence the demand for stent grafts will also increase

Market players also experienced operational hurdles and disruptions in their supply chain

Upcoming product approvals, such as approval for Cook Medical’s Zenith Fenestrated + Endovascular Graft (ZFEN), are expected to boost the market growth after 2020

The population aged 60 years & above, which is at a higher risk of developing AAA, is increasing globally, making it a high-impact rendering driver for market growth over the forecast period. An aortic aneurysm is the 13th leading cause of death in the U.S. In 2017, the global population aged 60 years & above was 962 million, which is more than double compared to the 1980s. This number is likely to double by 2050.

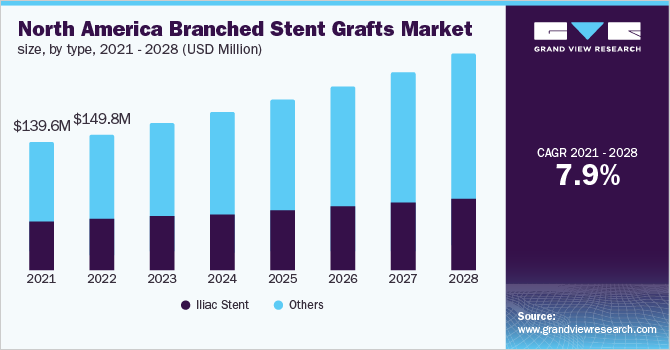

Type Insights

Iliac stents accounted for a considerable share of over 38% in 2021 and are expected to grow at a CAGR of 5.9% during the forecast period. The increase in the incidence of Cardiovascular Diseases (CVDs) around the world is the key factor driving the segment growth. Rapid technological advancements and widespread acceptance of stenting procedures are also expected to boost the segment growth over the forecast period.

The others segment is expected to hold the largest market share by 2028 growing at the fastest CAGR from 2021 to 2028. The segment comprises renal, celiac, gastric, femoral, fenestrated/branched, super mesenteric stent graft systems. The increasing geriatric population across the globe, which has a high incidence of the stomach or digestive diseases, is the key factor supporting the segment growth.

Application Insights

Branched stent-grafts find their application in EVAR procedures. EVAR is further sub-segmented into chimney, Fenestrated Endovascular Aortic Aneurysm Repair (FEVAR), and others. The others segment is accounted for the largest market share of more than 40% in 2021. Recent developments in branched stent grafts have created a way to treat multifaceted aortic aneurysms including visceral arteries.

Moreover, new generation iliac bifurcated devices exhibit favorable intraoperative performance and long-term outcomes, thus supporting market growth. The chimney EVAR segment is expected to grow at the fastest CAGR of more than 8% during the forecast period. Patient demand for endovascular aortic repair procedures is rapidly growing across the globe. For treatment of about 80% of aortic aneurysm cases, endovascular stent grafts are the preferred choice in the U.S. This is expected to promote market growth.

Regional Insights

In 2021, North America held the largest revenue share of more than 49%. This can be attributed to the presence of well-developed healthcare infrastructure, key players, and reimbursement coverage in the region. In addition, the regional market is highly competitive due to the strong presence of major market players. On the other hand, Asia Pacific is anticipated to be the fastest-growing regional market with a CAGR of more than 9% over the forecast period.

This growth can be credited to the rising spending on healthcare and the rapidly expanding medical tourism sector in the Asia Pacific region. The APAC regional market consists of developing economies, such as China, Japan, India, and Australia. The presence of better-quality healthcare infrastructure, convenience, and availability of affordable treatment options in these countries are also expected to propel the growth of the regional market.

Key Companies & Market Share Insights

Vendors are investing in product launches, geographical expansions, collaborative agreements, and acquisitions, to sustain in the market. For instance, in March 2021, Cook Medical received Breakthrough Device Designation for Zenith Fenestrated + Endovascular Graft (ZFEN+) from the U.S. FDA. However, the product is not yet commercially accessible. In December 2020, Terumo released mid-term results of the use of the RELAY PLUS thoracic stent graft system. This study was aimed at reporting real-world outcomes of patients undergoing TEVAR in the U.S. Some prominent players in the global branched stent grafts market include:

-

Medtronic

-

Biotronik

-

Alvimedica

-

Endocor GmbH

-

Eucatech AG

-

Merit Medical Systems

-

Abbott

-

Cook Medical

-

Cardinal Health (Cordis)

-

Boston Scientific Corp.

-

Terumo Corp.

Branched Stent Grafts Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 280.9 Million

Revenue forecast in 2028

USD 477.5 Million

Growth rate

CAGR of 7.9% from 2021 to 2028

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; The Netherlands; Greece; Russia; Japan; China; India; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Medtronic; Biotronik: Alvimedica; Endocor GmbH; Eucatech AG; Merit Medical Systems; Abbott; Cook Medical; Cardinal Health (Cordis); Boston Scientific Corp.; Terumo Corp.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2028. For the purpose of this study, Grand View Research has segmented the global branched stent grafts market report on the basis of type, application, and region:

-

Type Outlook (Volume, Units; Revenue, USD Million, 2021 - 2028)

-

Iliac Stent

-

Others

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2021 - 2028)

-

EVAR

-

FEVAR

-

Chimney

-

Others

-

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2021 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Greece

-

The Netherlands

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global branched stent grafts market size was estimated at USD 280.9 million in 2021 and is expected to reach USD 477.5 million by 2028.

b. The global branched stent grafts market is expected to grow at a compound annual growth rate of 7.9% from 2021 to 2028 to reach USD 477.5 million by 2028.

b. North America dominated the branched stent grafts market with a share of 49.70% in 2021. This is attributable to the presence of well-developed healthcare infrastructure, key players, and reimbursement coverage in the region.

b. Some key players operating in the branched stent grafts market include Medtronic, BIOTRONIK, Alvimedica, ENDOCOR GmbH, Eucatech AG, Merit Medical Systems, Abbott, Cook, Cardinal Health (Cordis), Boston Scientific Corporation, BD, and Terumo Corporation, among others.

b. Key factors driving the branched stent grafts market growth include increased adoption of EVAR procedures, the global rise in the geriatric population, high demand for minimally invasive surgeries, and a rise in the incidence of aortic aneurysms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.