- Home

- »

- Pharmaceuticals

- »

-

Branded Generics Market Size, Industry Report, 2033GVR Report cover

![Branded Generics Market Size, Share & Trends Report]()

Branded Generics Market (2026 - 2033) Size, Share & Trends Analysis Report By Drug Class (Alkylating Agents, Antimetabolites), By Application (Oncology, Cardiovascular Diseases), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-943-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Branded Generic Market Summary

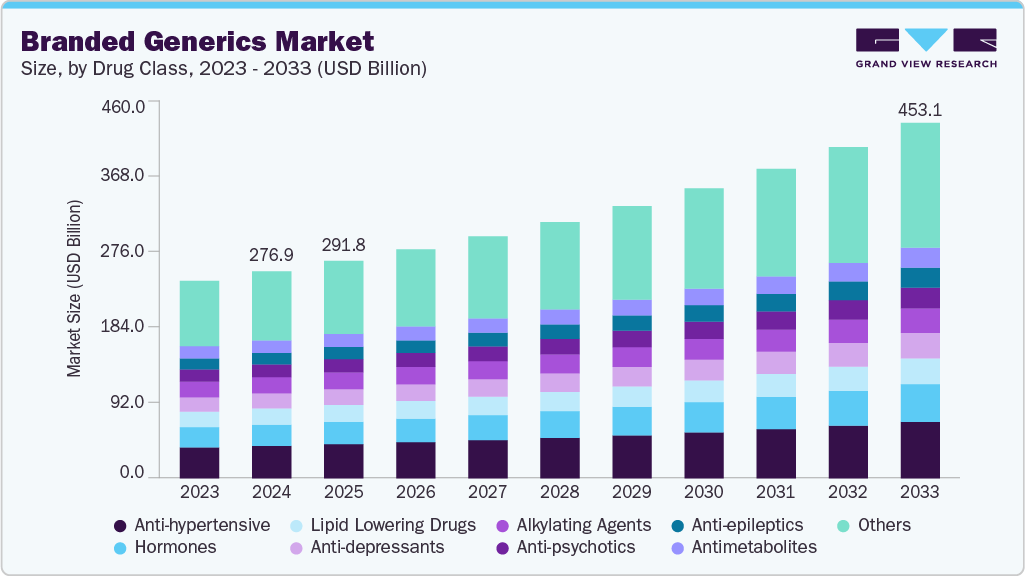

The global branded generics market size was estimated at USD 276.98 billion in 2025 and is projected to reach USD 453.05 billion by 2033, growing at a CAGR of 6.5% from 2026 to 2033. The market continues to be shaped by strong demand in emerging economies, where prescription behavior favors named generics supported by physician familiarity and retail-driven distribution.

Key Market Trends & Insights

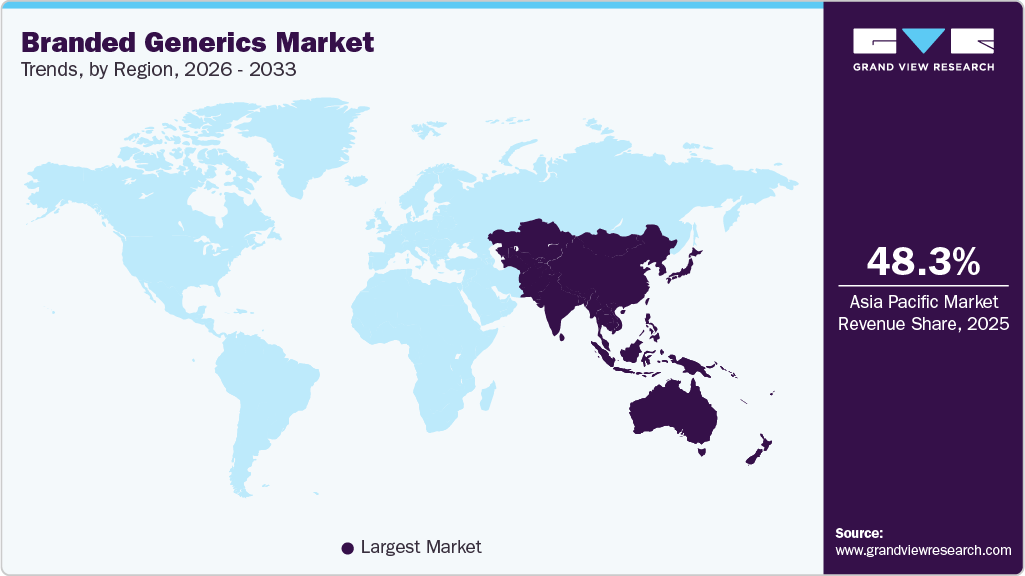

- Asia Pacific branded generics industry held the largest share of 48.32% of the global market in 2025.

- The branded generics industry in the U.S. is expected to grow significantly over the forecast period.

- By drug class, the anti-hypertensive segment held significant market share of 15.73% in 2025.

- By route of administration, the oral segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 276.98 Billion

- 2033 Projected Market Size: USD 453.05 Billion

- CAGR (2026-2033): 6.5%

- Asia Pacific: Largest market in 2025

Asia Pacific remains the operational core, with manufacturers sustaining volumes through established brands in chronic therapies while selectively enhancing portfolios via fixed dose combinations and reformulations. In parallel, developed markets maintain limited but stable relevance for branded generics in segments where continuity of therapy and controlled substitution remain clinically important. For instance, in June 2024, Teva Pharmaceutical Industries Ltd. launched a generic version of Novo Nordisk’s Victoza, targeting a diabetes segment that had generated approximately USD 1.6 billion in annual sales prior to market transition toward newer GLP 1 therapies. The launch illustrates how branded generic players continue to capture residual value from off patent molecules with established prescribing bases.

At the same time, the operating environment is becoming more constrained due to expanding tender based procurement, tighter pricing controls, and increasing regulatory compliance costs. These factors are gradually narrowing price differentiation between branded and unbranded generics, compelling manufacturers to focus on scale, portfolio selectivity, and complex generics to sustain profitability. Overall, the market reflects a balance between persistent demand for trusted brands and structural pressure toward commoditization.

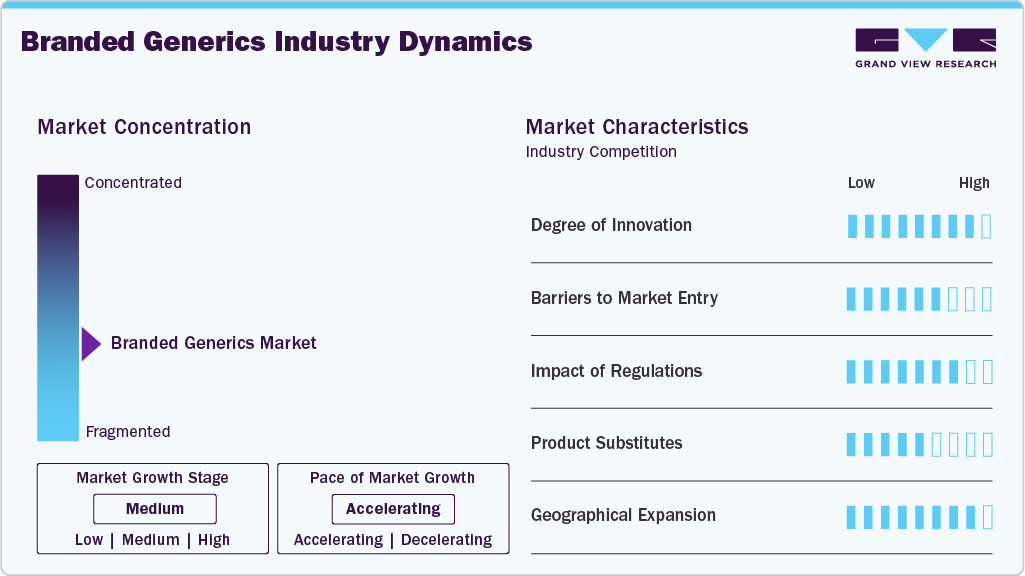

Market Concentration & Characteristics

The branded generics industry is characterized by incremental and process-driven innovation rather than novel molecule development. Innovation is primarily focused on formulation optimization, fixed dose combinations, modified release profiles, and improved stability to enhance patient adherence and lifecycle value of off-patent molecules. Companies also invest in packaging differentiation and line extensions to support brand recall in competitive retail environments. While R&D intensity is lower than innovator pharmaceuticals, sustained investment is required to meet evolving regulatory standards, support bioequivalence upgrades, and develop complex generics that are less exposed to rapid commoditization and price erosion.

Entry barriers in the branded generics industry are moderate and largely operational in nature. Regulatory approvals, manufacturing compliance, and quality assurance systems represent the primary thresholds for new entrants. In emerging markets, physician access, distribution reach, and brand-building capabilities create additional structural barriers that favor established players. Scale economies in manufacturing and procurement further disadvantage smaller entrants as pricing pressure intensifies. While molecule-level barriers are limited to post patent expiry, the commercial barriers associated with portfolio breadth, field force strength, and retail penetration remain significant.

The regulatory environment for branded generics is increasingly stringent and conversing with standards applied to unbranded generics. Authorities emphasize bioequivalence, pharmacovigilance, data integrity, and supply chain traceability, raising compliance costs across markets. In developed regions, substitution policies and centralized pricing frameworks limit pricing flexibility, while emerging markets are tightening manufacturing and quality oversight. Regulatory harmonization initiatives improve cross-border market access but also reduce tolerance for non-standardized practices. Overall, regulation favors compliant, well-capitalized manufacturers with robust quality systems and global regulatory experience.Unbranded generics represent the primary substitute threat to branded generics, particularly in markets where pharmacist-led substitution and tender-based procurement dominate. Biosimilars and newer therapeutic classes also act as indirect substitutes by displacing older small-molecule therapies. In chronic disease segments, therapeutic switching driven by updated clinical guidelines can rapidly reduce demand for legacy branded generics. Despite these pressures, branded generics retain relevance where brand continuity, patient trust, and prescribing habits limit substitution. The degree of substitution risk varies significantly by therapy area and healthcare system structure.

Geography plays a critical role in shaping branded generics demand and profitability. Emerging markets in Asia Pacific, Latin America, and parts of the Middle East form the demand backbone due to high out-of-pocket spending and brand-oriented prescribing. In contrast, North America and Western Europe exhibit selective adoption, mainly in complex or specialty generics. Local manufacturing presence, regulatory alignment, and distribution infrastructure influence competitive positioning at the country level. Geographic diversification allows manufacturers to balance pricing pressure in regulated markets with volume growth in less centralized systems.

Drug Class Insights

Anti‑hypertensive held the largest revenue share of 15.75% in 2025 due to the high global prevalence of hypertension and the sustained demand for affordable long-term treatment options. According to WHO, approximately 1.4 billion adults aged 30-79 had hypertension in 2024, which drives the need for anti‑hypertensive therapies. The growth in this segment is supported by the increasing use of fixed‑dose combinations and adherence to clinical guidelines. In addition, the FDA approved multiple generic versions of amlodipine in January 2024, contributing to the expansion of cost-effective treatment alternatives for hypertension, reflecting the segment's leading position in the market.

Others segment‑based drugs are expected to be the fastest‑growing drug class over the forecast period, because it encompasses niche, specialty, and complex off‑patent therapies that benefit from rising unmet medical needs, personalized treatment approaches, and broader adoption of affordable alternatives to originator biologics and small molecules. Growth in this category is supported by a general increase in branded generics uptake globally, driven by higher chronic disease prevalence, patent expiries, and healthcare cost containment strategies. According to the FDA’s 2024 First Generic Drug Approvals report, CDER approved a wide range of new generic products in 2024, increasing therapeutic options that feed into the “others” category. In addition, Indian pharma’s role as a key global supplier of generics, fulfilling about 20 % of global demand by volume, strengthens availability and uptake of diverse branded generics.

Application Insights

Cardiovascular diseases held the largest revenue share of 16.88% in 2025 because it addresses a high global disease burden requiring long‑term pharmacotherapy, including management of heart failure, coronary artery disease, and stroke risk factors. Cardiovascular diseases remain the leading cause of death worldwide, with an estimated 19.8 million deaths annually, reflecting sustained treatment demand and broad prescriber reliance on generics where available. Chronic risk factors such as hypertension and dyslipidemia further amplify medication use. According to the WHO, in July 2025, cardiovascular diseases accounted for a significant proportion of global mortality, underscoring their clinical and economic impact. In addition, FDA generic approvals in 2025 for cardiovascular agents have expanded branded generics offerings, reinforcing market share.

Oncology segment by application is forecasted to be the fastest‑growing in the branded generics industry (2025-2033) because rising global cancer incidence fuels demand for cost‑effective therapies, while patent expiries increase opportunities for generic and biosimilar entrants. Cancer remains a major global health burden, with over 35 million new cases projected by 2050 due to population ageing and lifestyle risk factors, driving long‑term treatment needs. Expanded availability of oncology treatment options also supports this trend: according to the FDA, in 2025 multiple oncology therapeutics were approved, including fam‑trastuzumab deruxtecan‑nxki for metastatic breast cancer in January 2025 and other indications through December 2025, underscoring continued innovation that generics can follow.

Route Of Administration Insights

The oral segment by route of administration has the largest revenue share of 59.22% in 2025 because oral dosage forms are non‑invasive, easier for patients to self‑administer, and widely used across chronic and acute therapies, enhancing prescription volumes and adherence. Patient preferences studies show oral administration is the most preferred route, with about 71 % of respondents favoring oral medications due to ease of use and convenience, which can support adherence and repeat prescriptions. Broad regulatory support for generic approvals also reinforces oral availability: according to the FDA, in October 2024, generic oral drugs such as prucalopride tablets and doxycycline capsules were approved in 2024, expanding oral treatment options and reinforcing their dominant market presence.

Parenteral segment by route of administration is forecasted to be the fastest‑growing because injectable therapies are increasingly used for biologics, complex molecules, and hospital‑administered treatments that cannot be given orally. Rising prevalence of chronic and serious conditions such as cancer, autoimmune disorders, and infectious diseases boosts demand for parenteral formulations with rapid bioavailability and targeted delivery. According to the FDA, in August 2025, multiple parenteral generics including cangrelor powder for injection and iron sucrose injections were approved, expanding injectable options. In addition, global injectable drug demand is growing, reflecting preference for parenteral delivery in acute care and specialty settings.

Distribution Channel Insights

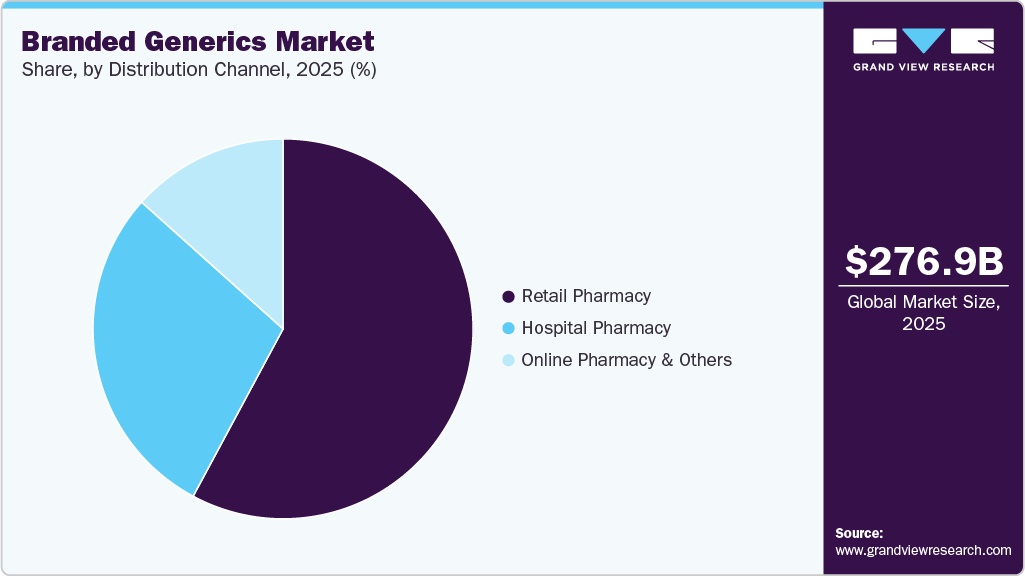

The retail pharmacy segment has the largest revenue share of 57.85% in 2025 because retail pharmacies provide broad geographic accessibility and immediate access to medications for outpatient care, especially for chronic and common conditions treated with generics. Their extensive networks support high prescription dispensing volumes and patient convenience, reinforcing demand for branded generics. Retail pharmacies also engage directly with consumers, fostering adherence and repeat purchases. Widespread chronic disease prevalence and cost‑sensitive healthcare systems further strengthen retail pharmacies’ central role in delivering branded generic medicines.

The online pharmacy & others segment is forecasted to be the fastest‑growing segment in the market (2025-2033) because increasing internet penetration, digital health adoption, and consumer preference for convenient home delivery are shifting medication purchases from traditional outlets to online platforms. Online channels also improve access in underserved areas and support e-prescriptions and telemedicine integration, boosting branded generics sales through digital fulfillment. Online pharmacies accounted for a significant share of generic drug sales in 2025, reflecting this trend in prescription fulfillment and home delivery preferences.

Regional Insights

The North American branded generics industry remains dominant, accounting for the largest share of global sales due to the region's strong healthcare infrastructure, extensive insurance coverage, and policies encouraging generic adoption. Rising healthcare costs and patent expirations are key drivers, with generics providing affordable alternatives to high-priced branded drugs. The U.S., in particular, benefits from an efficient regulatory pathway under the FDA’s ANDA (Abbreviated New Drug Application) system, which has led to significant approval of generics. In April 2024, the FDA approved several new generic versions of oncology and cardiovascular drugs, highlighting the shift towards generics. The U.S. also boasts one of the highest rates of generic adoption globally, with 90% of prescriptions being filled with generics. These factors support North America's market leadership.

U.S. Branded Generics Market Trends

The U.S. branded generics industry continues to expand, driven by a combination of patent expirations, increased public health initiatives, and a growing preference for affordable medications. Key therapeutic areas such as oncology, cardiovascular disease, and diabetes contribute significantly to the market's growth. The Affordable Care Act has also played a role in increasing generic drug accessibility through insurance programs that favor cost-effective treatments. A notable development was the FDA’s approval of generic Truvada for HIV prevention, making it more affordable for patients. The U.S. government’s initiatives to promote generic use through programs like Medicare Part D have also contributed to the growth of branded generics. The market continues to see high prescription volume as patients shift towards generics due to lower out-of-pocket costs.

Europe Branded Generics Market Trends

In Europe, the branded generics industry is gaining momentum due to a growing emphasis on healthcare cost management across the region. European governments actively encourage the use of generics through policies such as reference pricing and generic substitution laws, which help reduce public health expenditure. The European Medicines Agency (EMA) also facilitates the approval of branded generics, accelerating their market entry. Europe’s aging population and the increasing prevalence of chronic diseases like hypertension, cardiovascular diseases, and diabetes are major factors fueling demand for generics. In 2024, the EMA’s Committee for Medicinal Products for Human Use (CHMP) recommended several oncology medicines for approval at its June 2024 meeting, illustrating ongoing regulatory activity in cancer treatments. In addition, EMA‑approved generic oncology medicines - such as Apexelsin (generic paclitaxel), Pomalidomide Zentiva, Enzalutamide Viatris, and Nilotinib Accord - demonstrate the agency’s role in authorising generics in complex therapeutic areas. These factors support Europe’s continued expansion of generic drug use, driven by both regulatory and market forces.

The UK branded generics industry is seeing a strong uptake driven by National Health Service (NHS) reforms aimed at reducing drug spending. The NHS's commitment to cost-effective treatment, especially for chronic conditions such as cardiovascular disease and mental health disorders, supports the use of generics. The UK has a robust system for generic substitution, where doctors are encouraged to prescribe generics as a first-line option. The NHS Long Term Plan, introduced in 2019, focuses on improving access to affordable medicines, making branded generics a critical part of this strategy. In addition, in April 2024, the NHS issued guidelines aimed at further increasing the use of branded generics, particularly in chronic care settings, such as diabetes management. These measures ensure branded generics remain a significant part of the UK pharmaceutical landscape.

Germany’s branded generics industry benefits from a strong healthcare cost containment system in which mandatory generic substitution plays a key role. The government’s statutory health insurance system helps control drug spending, and fixed reference prices for generic drugs further promote their use. In 2024, the Federal Joint Committee (G-BA) in Germany approved several branded generics for oncology and autoimmune disease treatments, contributing to market growth. The German Pharmaceutical Market is also growing as local manufacturers have ramped up production, making generics widely accessible. In addition, the country’s ageing population and the increasing burden of chronic diseases such as diabetes and cardiovascular conditions are contributing to the rising demand for branded generics. These factors underscore Germany's position as a leader in the European generic drugs market.

France's branded generics industry is supported by government initiatives designed to reduce healthcare spending and improve access to medications. The French government’s national health insurance system offers incentives for doctors to prescribe generics, especially for chronic conditions like diabetes and hypertension. As part of its healthcare reforms, France introduced measures to encourage the use of generics and reduce drug prices, which benefits branded generics. In May 2024, the French Ministry of Health approved several branded generics for cancer treatment and antibiotics, which are expected to significantly reduce costs for patients and the healthcare system. These measures have driven the growth of generics, with an increasing market share in the hospital and outpatient sectors.

Asia-Pacific Branded Generics Market Trends

Asia-Pacific branded generics industry is rapidly becoming a significant market for branded generics, driven by increased healthcare access, rising chronic disease burdens, and expanding local manufacturing in countries like India and China. The region benefits from government-led initiatives to enhance generic drug availability, particularly in oncology, cardiovascular, and infectious diseases. India, one of the largest producers of generics, continues to lead in branded generics manufacturing, while China has seen accelerated approvals for generics from its National Medical Products Administration (NMPA). In March 2024, China approved several generic versions of high-demand drugs, including oncology treatments, further fueling market expansion. Asia-Pacific is expected to experience rapid growth, with strong regulatory support and competitive pricing driving demand.

Japan’s branded generics industry is evolving, with the government pushing for increased use of generics to reduce healthcare expenditures. The country has witnessed a rise in generic penetration, particularly in chronic care and oncology treatments. Japan’s Ministry of Health, Labour and Welfare (MHLW) has long pursued policies to increase the use of generic medicines, with prior government planning aimed at reaching high generic share targets across prefectures. Recent industry data indicates that Japan’s volume‑based generic drug use rate reached approximately 86.5% in fiscal year 2024, reflecting strong adoption of generics within the healthcare system. Regulatory reforms are underway to strengthen generic prescribing and patient‑level incentives, which are expected to support further market expansion and cost containment.

China’s branded generics industry is expanding rapidly due to government reforms, rising healthcare access, and growing demand for chronic disease management. The China National Medical Products Administration (NMPA) has been accelerating the approval process for branded generics, particularly in oncology, autoimmune, and cardiovascular treatments. China’s National Medical Products Administration (NMPA) has approved multiple biosimilar versions of monoclonal antibodies used in oncology, such as rituximab and trastuzumab, helping patients in China access more affordable alternatives to branded cancer therapies. These approvals, which occurred prior to 2024, contribute to a growing biosimilar landscape in oncology and other therapeutic areas. Continued regulatory emphasis on biosimilars and generic drug availability is expected to support market expansion and improve affordability of treatments in China.

Latin America Branded Generics Market Trends

The Latin American branded generics industry is expanding due to a combination of rising healthcare needs, government regulations, and increasing generic drug penetration. Countries like Brazil and Mexico have benefited from public health programs promoting generics for chronic diseases and infectious diseases. Brazil, a key player, is increasing local production of branded generics to meet domestic demand. Brazil’s generic drug regulatory system under ANVISA continues to register new generic medicines, including antihypertensive products such as perindopril + indapamide, promoting broader access to essential therapies at lower cost. The policy environment supports generic availability and affordability, contributing to increased access to medicines that address chronic disease and other major health needs.

Brazil’s branded generics industry is influenced by local production and government initiatives aimed at improving access to affordable medications. The Brazilian Ministry of Health has been expanding access to branded generics through public procurement initiatives and partnerships with pharmaceutical companies. In 2024, ANVISA continued to register and maintain a large portfolio of generic medicines in Brazil, supporting broader access to essential therapies including treatments in cardiovascular and oncology therapeutic areas. By January 2024, almost 3,900 generic products were registered in Brazil, reflecting the agency’s ongoing role in facilitating access to cost‑effective alternatives that assist the public health system in controlling drug costs.

Middle East & Africa Branded Generics Market Trends

The Middle East and Africa (MEA) branded generics industry is seeing increased growth, driven by rising healthcare demand and government initiatives to promote access to affordable medicines. In Saudi Arabia and the UAE, public procurement policies are increasingly favoring generics, particularly for chronic diseases. In South Africa, generics and branded generics are widely recognized tools in reducing the cost burden of medicines, supported by longstanding policies that encourage generic substitution and prescribing across public and private healthcare settings. These policies help expand access to essential treatments and contain pharmaceutical expenditures.

Saudi Arabia’s branded generics industry is growing due to the Kingdom’s Vision 2030 healthcare transformation goals. The government’s commitment to lowering healthcare costs by promoting generic alternatives, especially for oncology and cardiovascular treatments, is driving market growth.

Key Branded Generics Company Insights

The branded generics industry is characterized by a moderately fragmented competitive landscape, where a limited number of large pharmaceutical companies coexist with numerous regional and local players. Competition is primarily driven by portfolio depth in chronic therapies, brand recall among prescribers, field force reach, and the ability to sustain compliance and supply reliability under tightening regulatory standards. Leading companies focus on strengthening high-volume therapeutic segments while selectively expanding into faster-growing categories to balance revenue stability with growth.

Leading players such as Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Ltd., and Dr. Reddy’s Laboratories Ltd. anchor the market through strong branded portfolios in chronic and specialty therapies. Their strategies emphasize therapeutic leadership, brand consolidation, and selective expansion into non-cardiovascular segments such as respiratory, dermatology, and gastroenterology. Companies are increasingly prioritizing differentiated branded generics and complex formulations to mitigate pricing pressure and sustain margins. Overall, competitive positioning is defined less by molecule count and more by brand strength, execution scale, and alignment with evolving prescribing and regulatory environments.

Key Branded Generics Companies:

The following are the leading companies in the branded generics market. These companies collectively hold the largest market share and dictate industry trends.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Lupin Ltd.

- Aurobindo Pharma Ltd.

- Torrent Pharmaceuticals Ltd.

- Viatris Inc.

- Sanofi

- Abbott Laboratories

Recent Developments

-

In September 2025, Advent International divested its stake in Zentiva, a leading European branded generics company, transferring ownership to private equity firm GTCR. The transaction underscores sustained investor confidence in branded generics platforms supported by diversified product portfolios, established market positions, and predictable cash flow generation, highlighting the segment’s continued attractiveness as a stable and defensible pharmaceutical investment class.

-

In July 2025, Torrent Pharmaceuticals Ltd. agreed to acquire a controlling 46.39% stake in JB Chemicals & Pharmaceuticals Ltd from KKR, positioning itself as one of India’s largest pharmaceutical firms. This transaction enhances Torrent’s branded generics footprint and portfolio scale in chronic and acute therapies, further consolidating the competitive landscape.

-

In March 2025, Actinium Pharmaceuticals reported progress in the development of ATNM-400, an Actinium-225-based antibody radioconjugate, highlighting strong preclinical efficacy across multiple solid tumor models. The update reinforced the company’s focus on targeted alpha-emitter platforms with potential pan-tumor applicability.

-

In October 2024, SHINE Technologies announced advancements in collaborative preclinical research and isotope production capabilities, strengthening its position as a critical supplier supporting both diagnostic and therapeutic branded generics. The development underscored SHINE’s strategy to enable downstream innovation through reliable isotope access.

-

In July 2024, Telix reported continued progress in late-stage clinical development and global rollout of its PSMA-targeted imaging agents, while advancing therapeutic candidates designed to integrate seamlessly into radiotheranostic care pathways. The company emphasized diagnostics as a commercial and clinical entry point.

Branded Generics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 291.80 billion

Revenue forecast in 2033

USD 453.05 billion

Growth rate

CAGR of 6.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, application, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical Industries Ltd.; Cipla Ltd.; Dr. Reddy’s Laboratories Ltd.; Lupin Ltd.; Aurobindo Pharma Ltd.; Torrent Pharmaceuticals Ltd.; Viatris Inc.; Sanofi; Abbott Laboratories

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Branded Generics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global branded generics market report based on drug class, application, route of administration, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Alkylating Agents

-

Antimetabolites

-

Hormones

-

Anti-hypertensive

-

Lipid Lowering drugs

-

Anti-depressants

-

Anti-psychotics

-

Anti-epileptics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiovascular Diseases

-

Neurological Diseases

-

Gastrointestinal Diseases

-

Dermatological diseases

-

Acute and Chronic Pain

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Topical

-

Oral

-

Parenteral

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy & Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global branded generics market size was valued at USD 240.75 billion in 2022 and is anticipated to reach USD 253.39 billion in 2023.

b. The global branded generics market is expected to witness a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 375.95 billion by 2030.

b. Based on route of administration, the oral segment held the largest share of 59.29% in 2022, owing to a high preference for oral dosage form due to ease of use and a higher number of approved products.

b. Some key players operating in the branded generics market include Teva Pharmaceutical Industries Ltd.; Lupin; Sanofi; Sun Pharmaceutical Industries, Ltd.; Dr. Reddy's Laboratories Ltd.; Endo International plc; GlaxoSmithKline plc; and Pfizer, Inc.amongst others

b. Key factors driving the branded generics market growth include rising penetration of branded generic products, patent expiry of key drugs, and rising prevalence of chronic diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.