- Home

- »

- Medical Devices

- »

-

Brazil Bone Graft And Substitutes Market Share Report, 2030GVR Report cover

![Brazil Bone Graft And Substitutes Market Size, Share & Trends Report]()

Brazil Bone Graft And Substitutes Market Size, Share & Trends Analysis Report By Material Type (Allograft, Synthetic), By Application (Craniomaxillofacial, Dental, Foot & Ankle, Joint Reconstruction, Long Bone), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-001-4

- Number of Report Pages: 121

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The Brazil bone graft and substitutes market size was valued at USD 110.27 million in 2022 and is expected to exhibit a CAGR of 4.7% over the forecast period. Increasing Incidences of orthopedic conditions, rising companies’ initiatives to tap opportunities in the Brazilian market and strengthening distribution networks are a few of the key factors driving the market growth. Furthermore, Brazil’s Bone Grafts and Substitutes Market is growing due to companies engaging in strategic collaborations and partnerships with local distributors. For instance, in March 2016, NuVasive, Inc., a leading manufacturer of medical devices, acquired Mega Surgical, the exclusive Brazilian distributor of NuVasive technologies, with the goal of revolutionizing spine surgery with minimally invasive, procedurally-integrated solutions.

The purchase of Mega Surgical strengthened NuVasive's leadership in the spine market and expanded its presence internationally. It is an important step for the company toward realizing its goal to revolutionize healthcare through game-changing technologies. Moreover, this acquisition offered new opportunities in the Latin American market as well as direct entry to a large, expanding market for quick share gains, including a fresh chance to compete in Brazil's sizable public healthcare market. Furthermore, it will enable direct interaction with surgeons and key opinion leaders around the country, where direct relationships are required.

Due to shutdown restrictions and disruptions in logistics management, the COVID-19 pandemic severely impacted the medical device market. For instance, a well-known market player like Straumann announced in its annual financial report of 2020 that organic sales between 2019 and 2020 fell by -5.6% annually. The pandemic had a higher impact on the company's overall revenue in Latin America (including Brazil) in 2020 than it did in other regions, such as Asia Pacific, where it dropped by -5%. Moreover, Straumann reported a revenue increase in the Latin America region of 111.40% in Q3 2020 compared to Q2 2020 due to the resumption of non-urgent treatment, notably dental care, and demand for previously postponed treatments

Furthermore, the stringent regulations and lengthy regulatory processes, cost constraints, has a limited market impact. For instance, Brazil is one of the most affected countries in Latin America with an increase in the cost of imported products in the coming years, owing to stringent laws and lengthy regulatory processes, which might limit accessible supply in the country; this trend is further supported by growing demand for dental biomaterials.

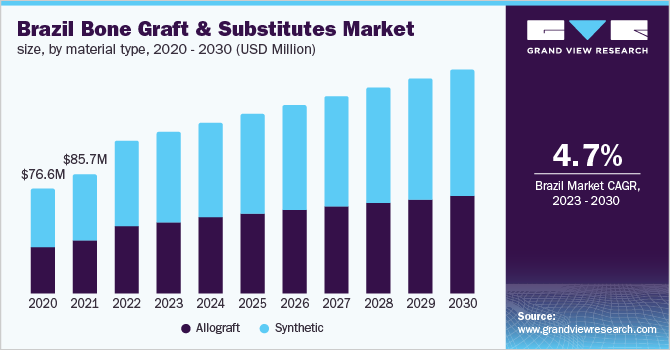

Material Type Insights

Allografts and synthetic bone substitutes are the two broad categories based on the material type segment. Allografts are further subdivided into the demineralized bone matrix and others. Ceramics, composites, polymers, and bone morphogenetic proteins are examples of synthetic bone grafts. In surgery, the usage of bone replacements is growing. Allografts, or banked bone, are osteoconductive and mildly osteoinductive. This sub-segment still faces challenges in pricing, donor availability, and residual infections. Bone grafting is the second most common tissue transplant, immediately after a blood transfusion.

Moreover, synthetic material types account for more than 55% of the revenue market share in 2022, with the expansion of this segment being aided by rising demand for ceramic material types. For instance, according to the responses of the study published by Acta Odontológica Latinoamericana in December 2020, it was found that ceramic compositions were the most frequently recommended, followed by composite compositions.

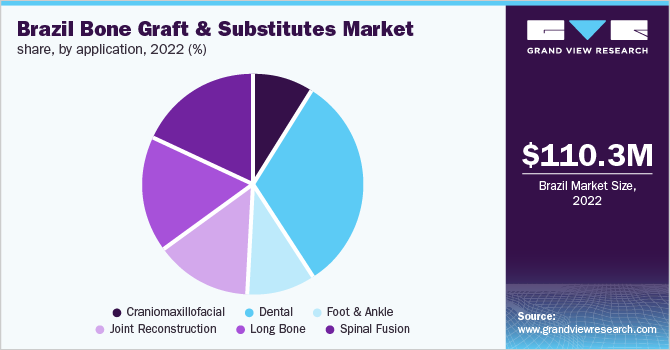

Application Insights

On the basis of application, dental is anticipated to dominate the market during the forecast period, with a maximum share of over 32% in 2022. T+his is attributed to dentists' increasing adoption of ceramics and other synthetic materials. Furthermore, the ceramic-based synthetic materials segment, which is anticipated to grow at the fastest CAGR of 5.1% throughout the forecast period, supports the dental application segment.

The majority of the market's space is controlled by the smaller rivals, many of which are Brazilian. Alongside the expansion of the manufacturing industry, new competitors are acquiring market share by offering competitive prices. The two exceptions to this trend, Geistlich and Straumann Group, are high-end, international businesses. As a result of the dentists' early exposure to their products during the training process, they have been able to maintain a strong presence through R&D and brand placement.

Key Companies & Market Share Insights

The Brazil bone graft and substitutes market is extremely fragmented, with numerous competitors aiming for a share of the total revenue. The industry is growing as a result of the increasing demand for better products in the population. Companies are employing strategies such as new product launches, technological improvements, and collaborations for sustaining the competition, and better market penetration. For instance, in May 2021, Ortho Development reported that the FDA approved its BKS and BKS TriMax implants with THINK Surgical's TSolution One TKA application. On the other side, Corin Group announced upgrades to its cloud-based digital ecosystem in May 2021, including a sizable software update for CorinConnect.

Furthermore, in response to the pandemic, companies emphasized offering online services to their clients. For instance, the Straumann Group’s H1 2020 press release stated that its eCommerce platform's features could assist clinicians, such as dental clinics, in stock replenishment & management. The company also established its eShop early in 2020, which provided all products sold under Straumann's various brands online, and the company reported that this portion of its business increased significantly in 2020. Some of the prominent players in the Brazil bone graft and substitutes market include:

-

Depuy Synthes (J&J)

-

Medtronic

-

Nuvasive, Inc.

-

Orthofix Medical, Inc.

-

Smith & Nephew, Inc.

-

Stryker

-

Zimmer Biomet

-

Geistlich Pharma AG

-

BAUMER

-

GMReis

-

Einco Biomaterial

-

Bionnovation

-

Ceramisys (Distributor: Asher Medical Products)

-

Osseocon Biomateriais

-

NEOORTHO

Brazil Bone Graft And Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 117.34 million

Revenue forecast in 2030

USD 162.23 million

Growth Rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Material type, application

Country Scope

Brazil

Key companies profiled

Depuy Synthes (J&J); Medtronic; Nuvasive, Inc.; Orthofix Medical, Inc.; Smith & Nephew, Inc.; Stryker; Zimmer Biomet; Geistlich Pharma AG; BAUMER; GMReis;Einco Biomaterial;Bionnovation; Ceramisys (Distributor: Asher Medical Products); Osseocon Biomateriais; NEOORTHO

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Brazil Bone Graft And Substitutes Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Brazil bone graft and substitutes market based on material type and application:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allograft

-

Demineralized Bone Matrix

-

Others

-

-

Synthetic

-

Ceramic

-

Hydroxyapatite (HAP)

-

Beta Tricalcium Phosphate (ß-TCP)

-

Alpha-Tricalcium Phosphate α-TCP

-

Bi-Phasic Calcium Phosphates (BCP)

-

Others (Calcium sulfates, etc)

-

-

Composites

-

Polymers

-

Bone Morphogenetic Proteins (BMP)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Craniomaxillofacial

-

Dental

-

Foot & Ankle

-

Joint Reconstruction

-

Long Bone

-

Spinal Fusion

-

Frequently Asked Questions About This Report

b. The Brazil Bone Grafts and Substitutes market size was estimated at USD 110.27 million in 2022 and is expected to reach USD 117.34 million in 2023.

b. The Brazil Bone Grafts and Substitutes market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 162.23 million by 2030.

b. Synthetic material types dominated the Brazil Bone Grafts and Substitutes market with a share of 55.58% in 2022. This is attributable to rising demand for ceramic material types.

b. Some key players operating in the Brazil Bone Grafts and Substitutes market include Depuy Synthes (J&J); Medtronic; Nuvasive, Inc.; Orthofix Medical, Inc.; Smith & Nephew, Inc.; Stryker; Zimmer Biomet; Geistlich Pharma AG; BAUMER; GMReis;Einco Biomaterial;Bionnovation; Ceramisys (Distributor: Asher Medical Products); Osseocon Biomateriais; NEOORTHO.

b. Key factors that are driving the Brazil Bone Grafts and Substitutes market growth include increasing incidences of orthopedic conditions, strengthening distribution network, and untapped opportunities in brazilian market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."