- Home

- »

- Pharmaceuticals

- »

-

Breast Cancer Drugs Market Size & Share Report, 2023-2030GVR Report cover

![Breast Cancer Drugs Market Size, Share & Trends Report]()

Breast Cancer Drugs Market Size, Share & Trends Analysis Report By Therapy (Targeted, Hormonal), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By Cancer Type (Hormone Receptor, HER2+), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-041-5

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Breast Cancer Drugs Market Size & Trends

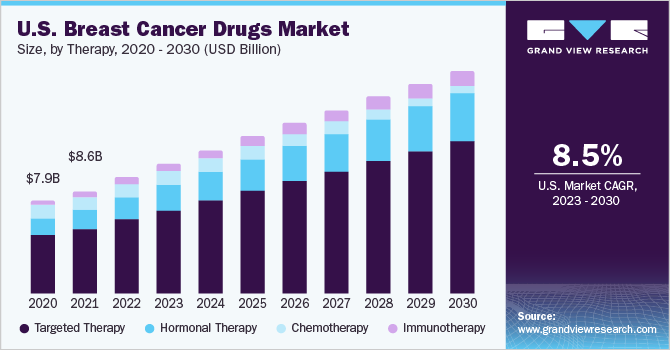

The global breast cancer drugs market size was valued at USD 29.26 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.09% from 2023 to 2030. The market is being driven by several factors, including the increasing incidence of breast cancer, advancements in technology, growing demand for personalized medicine, government initiatives, and increasing healthcare expenditure. Similarly, the growing drug pipeline for treatment is increasing the competition and driving investment in the market. As research continues to advance, new drugs and treatment options will likely continue to emerge, further driving the growth of the market. For instance, in April 2023, thousands of breast cancer patients in England are to be offered the first-of-its-kind oncology drug, developed to target a hereditary genetic fault.

Olaparib has been approved for women with HER2-negative, high probability of breast cancer at an early stage who have genetic faults in their BRCA2 or BRCA1 genes. The drug is expected to reduce the risk of the disease returning within 4 years by nearly one-third. The drug’s approval and subsequent availability to thousands of breast cancer patients in England are expected to increase the demand for targeted therapies and encourage other pharmaceutical companies to develop similar drugs to compete in the market.The COVID-19 pandemic has had a significant impact on the market. Due to the pandemic, there have been disruptions in the supply chain, reduced access to healthcare facilities, and delays in diagnosis and treatment, which have affected the market.

One of the major impacts of COVID-19 on the drug market was the delays in clinical trials, which slowed down the development of new drugs. Clinical trials were postponed or canceled due to the pandemic, which affected the timelines for drug development and regulatory approval. In addition, high drug prices can limit their use and affect the demand for the drugs thereby could slow down the market growth. For instance, in February 2023, pharmaceutical companies, such as Pfizer Inc., Novartis AG, and Eli Lilly & Co., raised the list prices of 983 prescription drugs used for arthritis, cancer, and other ailments, with an average increase of 5.6%.

These increases were somewhat restrained due to the industry facing a new federal law aimed at lowering medical costs. Moreover, the cost of developing new oncology drugs is high, and pharmaceutical companies often recoup their investment by pricing the drugs high. This can make the drugs unaffordable to many patients, particularly those in developing countries. As a result, many patients may not receive the most effective treatments, leading to poorer health outcomes and reduced demand for the drugs.

Therapy Insights

The targeted therapy segment captured the largest share of 63.65% in 2022 and is expected to maintain dominance during the forecasted period. The development of targeted therapies for HER2-positive and hormone receptor-positive breast cancers has revolutionized treatment, and new drugs targeting other cellular pathways involved in breast cancer growth and survival are showing promise in clinical trials. In January 2023,targeted therapy for hard-to-treat advanced breast cancers has been approved by the U.S. FDA as a result of research and advocacy by professionals fromDuke University and Duke University Health System.

Elacestrant, the newly approved drug, has been developed to address a significant unmet need. It is the first and only treatment approved to specifically combat breast cancers with mutations in the estrogen receptor ESR1, which can cause it to become resistant to standard endocrine therapy. Furthermore, immunotherapy is one of the fastest-growing areas of therapy in the market. Immunotherapy drugs, such as checkpoint inhibitors, have shown significant efficacy in improving outcomes for patients with triple-negative breast cancer. Vaccines targeting specific proteins overexpressed in breast cancer cells are also showing promise in clinical trials. As research in this field continues, immunotherapy is likely to become an increasingly important component of treatment.

Cancer Type Insights

In 2022, the hormone receptor segment was a significant contributor to the global market. The segment accounted for the largest share of 65.47% in 2022. Hormone therapy, including SERMs, aromatase inhibitors, and LHRH agonists, is a commonly used treatment for hormone receptor-positive breast cancer. Hormone receptors, including Estrogen Receptors (ER) and Progesterone Receptors (PR), are proteins found on the surface of breast cancer cells that interact with hormones in the body, promoting the growth of these cells. Therefore, hormone therapy is a commonly used treatment for hormone receptor-positive breast cancer, which represents a significant proportion of all incidence cases. Similarly, the HER2+ segment is estimated to show significant growth during the forecast period.

The increasing number of strategic initiatives by pharmaceutical companies for developing drugs for HER2+ cancer types are positively impacting the market growth. For instance, in February 2023, Gilead Sciences announced that Trodelvy has received approval from the U.S. FDA for a third indication. This approval provides patients with an additional treatment option for the most common type of breast cancer. Trodelvy was originally approved for use in patients with advanced breast cancer, specifically those with a subtype called HR-positive/HER2-negative, who had previously undergone at least two systemic therapies and stopped responding to hormone-based therapy. Gilead, which acquired the therapy through the acquisition of Immunomedics for USD 21 billion in 2020, estimates that approximately 6,000-8,000 patients in the U.S. will be eligible for Trodelvy annually under the expanded approval.

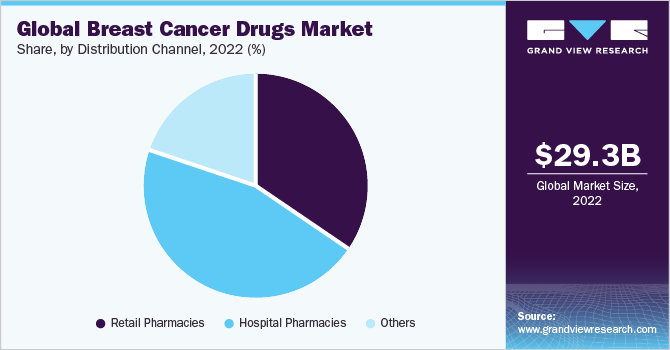

Distribution Channel Insights

The hospital pharmacies segment held a significant revenue share of 65.47% in 2022. Hospital pharmacies play a critical role in the treatment, as they are responsible for preparing and dispensing chemotherapy drugs and other treatments to patients. In addition, hospital pharmacies are also responsible for managing the inventory and storage of these drugs, ensuring that they are stored and handled in accordance with strict regulations.

The others segment is categorized into online distribution channel and specialty stores. Online and specialty stores playa significant role in the market. These platforms offer convenience and accessibility for patients, particularly those living in remote areas or those who have difficulty accessing traditional brick-and-mortar pharmacies.This has resulted inincreased competition and fragmentation in the market, with online and specialty stores capturing a significant share of the market.

Regional Insights

North America was the dominant region in the market with a revenue share of 37.56% in 2022. In the U.S., breast cancer is the secondmost common cancer among women. As a result, the market in the U.S. is substantial, with a wide range of drugs available for the treatment of the disease. Some of the key players in the North America regional market include Pfizer, Roche, Novartis, AstraZeneca, and Eli Lilly, among others.

These companies are focused on developing innovative therapies and expanding their product portfolios to address the evolving needs of patients and healthcare providers.Asia Pacific is the fastest-growing market owing to several factors, including increasing awareness and its treatment options, growing healthcare expenditures, and improving access to healthcare services. In addition, the rising incidence and prevalence of breast cancer in the region are also contributing to the market growth.

Key Companies & Market Share Insights

The global market is highly competitive due to the presence of a large number of players. These companies have a strong presence in the market, extensive product portfolios, broad geographic reach, and strong distribution networks. In addition, many of these companies have invested heavily in research and development to stay ahead of the competition and offer their customers the most advanced and innovative testing. For instance, in March 2023, Pfizer acquired Seagen for USD 43 billion, which would enhance its access to cancer medications.

Seagen already has four treatments that are available in the market, and it has a portfolio of drugs in the developmental phase, including potential remedies for advanced breast and a type of lung cancer. Seagen has a partnership with Pfizer’s Array BioPharma for the manufacture, development, and sale of Tukysa, a breast, and colorectal cancer medication. Tukysa generated USD 353 million in sales for Seagen in 2022. Some of the key players in the global breast cancer drugs market include:

-

Novartis AG

-

Pfizer Inc.

-

Merck KGaA

-

Janssen Pharmaceuticals, Inc.

-

Celgene Corporation, Inc.

-

Genzyme Corp.

-

F. Hoffmann-La Roche Ltd.

-

AstraZeneca

-

AbbVie Inc.

-

Bristol-Myers Squibb Company

-

Macrogenics, Inc.

-

Celldex Therapeutics

-

Onyx Pharmaceuticals Inc.

Breast Cancer Drugs Market Report Scope

Report Attributes

Details

The market size value in 2023

USD 32.94 billion

Revenue forecast in 2030

USD 58.69 billion

Growth rate

CAGR of 9.09% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, cancer type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Novartis AG; Pfizer Inc.; Merck KgaA; Janssen Pharmaceuticals, Inc.; Celgene Corp., Inc.; Genzyme Corp.; F. Hoffmann-La Roche Ltd.; AstraZeneca; AbbVie Inc.; Bristol-Myers Squibb Company; Macrogenics, Inc.; Celldex Therapeutics; Onyx Pharmaceuticals Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Cancer Drugs Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the breast cancer drugs market based on therapy, cancer type, distribution channel, and region:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Targeted Therapy

-

Abemaciclib

-

Ado-Trastuzumab Emtansine

-

Everolimus

-

Trastuzumab

-

Ribociclib

-

Palbociclib

-

Pertuzumab

-

Olaparib

-

Others

-

-

Hormonal Therapy

-

Selective Estrogen Receptor Modulators (SERMs)

-

Aromatase Inhibitors

-

Estrogen Receptor Down regulators (ERDs)

-

-

Chemotherapy

-

Immunotherapy

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormone Receptor

-

HER2+

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast cancer drugs market size was estimated at USD 29.26 billion in 2022 and is expected to reach USD 32.94 billion in 2023.

b. The global breast cancer drugs market is expected to grow at a compound annual growth rate of 9.09% from 2023 to 2030 to reach USD 58.69 billion by 2030.

b. North America dominated the breast cancer drugs market with a share of 37.56% in 2022. This is attributable to increasing awareness and presence of established R&D infrastructure in the region.

b. Key players operating in the breast cancer drugs market are Janssen Global Services, LLC.; AbbVie, Inc.; AstraZeneca; F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; Novartis AG; Merck & Co., Inc.; Celgene Corporation; Genzyme Corporation; Macrogenics, Inc.and Celldex Therapeutics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."