- Home

- »

- Medical Devices

- »

-

Breast Milk Storage Products Market Size Report, 2030GVR Report cover

![Breast Milk Storage Products Market Size, Share & Trends Report]()

Breast Milk Storage Products Market Size, Share & Trends Analysis Report By Product (Bottles, Bags), By Sales Channel (Hospital Pharmacy, Retail Store, E-Commerce), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-985-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Breast Milk Storage Products Market Trends

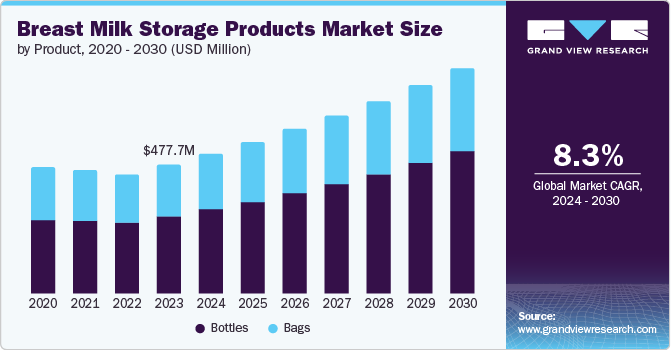

The global breast milk storage products market size was valued at USD 477.7 million in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030. This growth is attributed to the increasing number of working women who necessitate convenient breastfeeding solutions. As maternity leaves are often short, many mothers return to work soon after childbirth, prompting a demand for breast pumps and storage products. Furthermore, rising awareness about the nutritional benefits of breast milk and the establishment of more milk banks further contribute to market growth.

Over the past 20 years, the International Labor Organization (ILO) has spearheaded initiatives such as the 2030 UN Agenda, which aims to promote the rights of women and girls to productive employment and equal rights. As a result, there have been visible changes in employment patterns and gender equality. The ILO's latest reports indicate that women's labor force participation globally stands at 47%, while for men, it is 72%, resulting in a 25% difference. In some regions, such as North Africa and the Middle East, this gap exceeds 50%. These changes have led to an increasing number of working women, necessitating convenient solutions for breastfeeding, as many mothers return to work soon after childbirth due to short maternity leaves. Furthermore, rising awareness about the nutritional benefits of breast milk and the establishment of more milk banks contribute to market growth.

Health initiatives for breastfeeding and pregnancy with increased government and non-profit organizations might create new opportunities for industries. Late parenting trends are expected to boost high-end breastfeeding accessories sales. Furthermore, consumers’ income and living standards have risen in developing countries, and with high disposable income, there is an expected surge in the demand for breastfeeding products in these countries.

Technological advancement is also a major factor in shaping the market in upcoming years. Breast milk storage bags are enhanced with features such as QR code technology and barcode scanning, which eases the process of monitoring temperature and enables tracking, thus assisting in easing the process for women. Furthermore, breast milk storage bags are now designed with attached breast pumps, reducing spillage and contamination and removing the additional transfer procedure. These technological advancements are driving the market significantly.

Product Insights

The bottle dominated the market and accounted for the largest revenue share of 59.6% in 2023. This growth is attributed to the demand for solutions to store breast milk safely and for as long as possible, which has increased the demand for R&D and technological advancement. With technological advancement, there have been new bottle designs with enhanced features, including the breast milk integrity retaining design that allows pumping the breast milk directly into the bottle from the breast pump, preventing leakage, which is one of the major facilitators to users.

The bags are expected to grow at a CAGR of 6.9% over the forecast years. Breast milk storage bags are used for storing, carrying, and using warm breast milk when away from the children. In addition, these bags are BPA-free and hygienically ‘pre-sealed’ to protect children from infection and avoid leakage. They are double-sealed and reinforced. These bags are also cost-effective compared to alternatives, and these features are expected to grow significantly in this segment in the upcoming years.

Sales Channel Insights

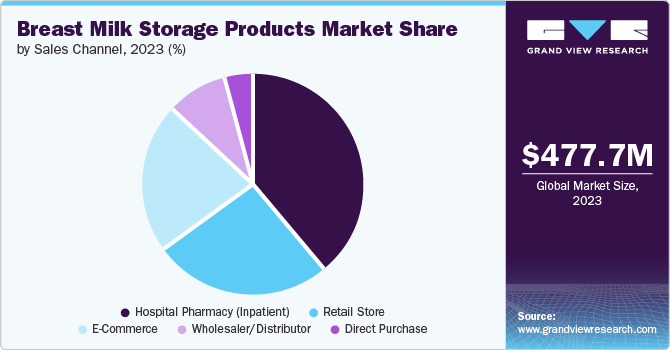

The hospital pharmacy (inpatient) segment dominated the market and accounted for the largest revenue share of 38.6% in 2023. This growth is driven by the growing pregnancy rate across the world and the surge in the demand for post-delivery products for new mothers. In addition, for safety reasons, consumers rely on hospital pharmacies while purchasing children's and mothers' products. Furthermore, an increasing number of healthcare experts and professionals with better healthcare infrastructure in developing and developed nations are also giving assurance to parents. These factors are expected to grow the segment significantly in the upcoming years.

E-commerce is expected to grow at a CAGR of 9.2% over the projected years owing to rapid technological advancement, which enables consumers to browse and purchase products anywhere with enhanced payment gateways, which ease the transaction process and innovative logistics and supply chain management; the products are delivered at home, which increases the convenience for the consumers, the marketing strategies used by the e-commerce platforms such as social media advertising, personalized email campaigns, influencer partnerships, and other strategies are effectively increasing their sales.

Regional Insights

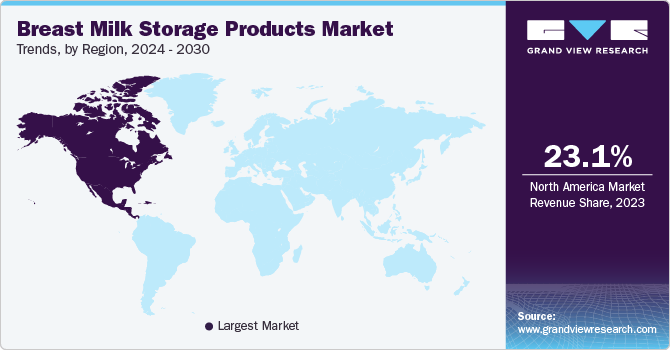

The North America breast milk storage products market and accounted for the largest revenue share of over 23.13% in 2023. This growth is attributed to the increasing number of working women and growing awareness of breastfeeding benefits, which increases the demand for storage solutions to maintain breastfeeding routines. Supportive government policies and initiatives that promote breastfeeding and establishments of human milk banks across the region, which facilitate the collection, storage, and distribution of milk to ill or premature children, are also growing the market in the region significantly.

U.S. Breast Milk Storage Products Market Trends

The breast milk storage products market in the U.S. dominated the North American market with a share of 80.4% in 2023 owing to the growth of e-commerce platforms, which has made it easier for new mothers to receive the products, rising birth rates in the country, which is directly increasing the demand for the children related products, and support from healthcare providers such as pediatricians and lactation consultants to increase the awareness of the products are expected to grow the market in the country significantly.

Canada breast milk storage products market is expected to grow significantly with a CAGR of 7.5% from 2024 to 2030. This growth is attributed to the rising awareness of breastfeeding benefits in the region through educational campaigns, technological advancement in storage solutions, and a cultural shift towards recognizing the importance of breastfeeding in Canadian society, which are expected to grow the market in the country significantly in the upcoming years.

Europe Breast Milk Storage Products Market Trends

Europe breast milk storage products market is expected to grow at the fastest CAGR of 10.9% from 2024 to 2030. The growth is attributed to the growing milk banks, which have enhanced safety storage options, the increasing focus on infant health, rising disposable incomes among consumers, which increases families' investment in high-quality milk storage solutions, and the growing number of working women. These factors are growing the market in the region significantly.

The breast milk storage products market in the UK is expected to grow rapidly over the projected years owing to cultural shifts towards parenting practices, expansion of e-commerce platforms, supportive government policies to promote breastfeeding, technological advancements that have improved material quality and ensured safety and convenience, rising disposable incomes, and changing consumer behavior towards nutrition and health. These factors are expected to grow the market in the country in the upcoming years.

Asia Pacific Breast Milk Storage Products Market Trends

Asia Pacific breast milk storage products market is anticipated to witness significant growth with a CAGR of 8.1% from 2024 to 2030. This growth is driven by the increased awareness of breastfeeding benefits, technological advancement, increasing urbanization in the region, growing e-commerce supportive government policies to promote breastfeeding, and rising disposable incomes in the developing countries of the region, which leads to growing investment by families to ensure safe and high-quality milk for their children are growing the demand for the market significantly in the region.

The breast milk storage products market in China held a substantial market share of 20.5% in 2023 owing to the increasing number of working mothers necessitating convenient storage solutions for breast milk, as they often return to work shortly after childbirth. In addition, heightened awareness of the nutritional benefits of breast milk and the importance of breastfeeding is fostering demand. Furthermore, technological advancements in storage products and the rise of milk banks further support market expansion, aligning with broader trends in maternal and infant health.

Japan breast milk storage products market is expected to grow fastest in the region, with a CAGR of 9.0% over the forecast years. This growth is attributed to the expansion of e-commerce platforms, increasing birth rates in specific regions and communities due to government initiatives to have large families, growing demand for the product, rising disposable income of the consumers, and cultural shift towards the encouragement of breastfeeding through healthcare professionals and organizations.

Key Breast Milk Storage Products Company Insights

Some of the key companies in the Breast Milk Storage Products Market include Microsoft Corporation, IBM Corporation, Amazon.com, Inc.; Clarifai, Inc.; Ayasdi AI LLC, H2O.ai, HyperVerge, Inc., and Google LLC (Alphabet Inc.). Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Magento, Inc., a subsidiary of Ameda, offers diverse portfolios such as portable double breast pumps with rechargeable and quiet features and 6-ounce milk storage bags. In partnership with DME, the company also provides insurance-covered breast pump solutions.

-

Koninklijke Philips N.V. is a technology company and a prominent industry player in the breast milk storage product market with extensive clinical research with healthcare with products in breast pumps such as comfort twin electric breast pump, comfort manual breast pump, among others.

Key Breast Milk Storage Products Companies:

The following are the leading companies in the breast milk storage products market. These companies collectively hold the largest market share and dictate industry trends.

- Medela

- Magento, Inc.

- Ardo Medical AG

- Koninklijke Philips N.V.

- Pigeon Corporation

- Spectra Baby USA

- LaVie Mom.

- Motif Medical

- Mayborn Group Limited

- Chicco

View a comprehensive list of companies in the Breast Milk Storage Products Market

Recent Developments

-

In February 2024, Medela launched a new smartwatch app designed for new parents aimed at enhancing the breastfeeding experience. The app allows parents to track feeding times, monitor breast milk storage, and receive reminders, facilitating better organization and support. This innovative tool reflects Medela's commitment to leveraging technology to assist parents in managing their breastfeeding journey effectively.

Breast Milk Storage Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 517.4 million

Revenue forecast in 2030

USD 834.1 million

Growth Rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sales, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa

Key companies profiled

Medela; Magento, Inc.; Ardo medical AG; Koninklijke Philips N.V.; Pigeon Corporation; Spectra Baby USA; LaVie Mom.; Motif Medical; Mayborn Group Limited; Chicco

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Milk Storage Products Market Report Segmentation

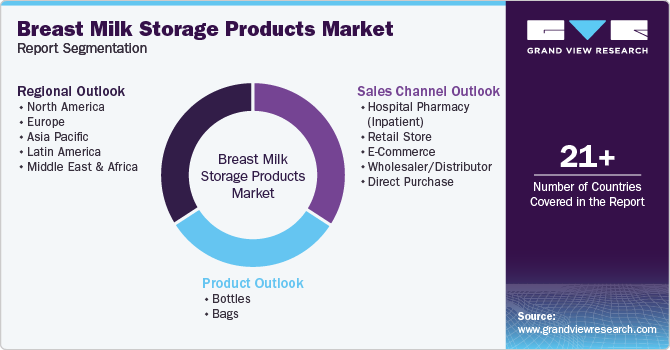

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breast milk storage products market report based on product, sales channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Bags

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy (Inpatient)

-

Retail Store

-

E-Commerce

-

Wholesaler/Distributor

-

Direct Purchase

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."