- Home

- »

- Medical Devices

- »

-

Breast Pads Market Size & Share, Industry Report, 2030GVR Report cover

![Breast Pads Market Size, Share & Trends Report]()

Breast Pads Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Reusable, Disposable, Hydrogel, Silicone), By Distribution Channel (Retail, Wholesale, E-commerce), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-933-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Breast Pads Market Size & Trends

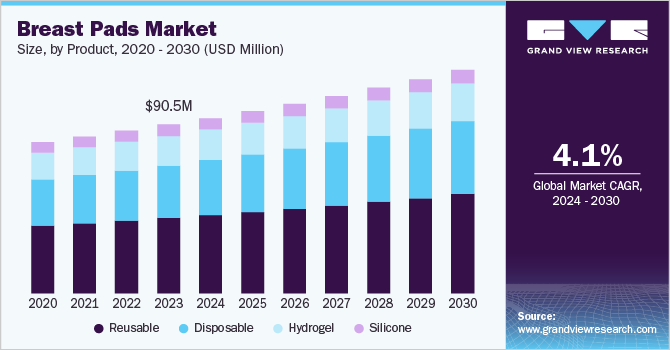

The global breast pads market size was valued at USD 90.5 million in 2023 and is expected to grow at a CAGR of 4.1% from 2024 to 2030. An increase in women’s employment is expected to be a high-impact rendering driver in the market. Working women have a relatively high disposable income and less time to breastfeed their babies, and thus, are ideal customers for breast pads and related accessories.

Growing consumer awareness and supportive government initiatives are anticipated to propel the global demand for breast pads. Also, governments of various countries are encouraging mothers to breastfeed babies up to the age of 6 months. Additionally, many international agencies are arranging campaigns to raise awareness regarding breastfeeding. Thus, the rising awareness and the introduction of easy-to-use and convenient nursing products are also expected to propel market growth in the near term. In addition, the growing trend of delayed parenthood is anticipated to increase the spending on premium baby products, which is expected to influence market growth positively.

Furthermore, various market players such as Medela, Newell Brands, and Ameda, Inc., and universities, including Washington University & Fudan University, are raising awareness among women about breastfeeding and its benefits by arranging campaigns and providing informative magazines. In addition, social media platforms such as YouTube, Facebook, and Instagram have enabled individuals to access information about breast pads. Several companies provide information on these platforms. Moreover, a few new trends with the growing popularity of ultra-thin washable nursing breast pads, new product launches with better technologies, and the presence of several social media platforms are expected to drive a considerable demand for breast pads over the forecast period. For instance, Medela’s Tender Care Hydrogel Pads combine instant cooling relief with a comfortable, contoured shape for easy use and instant comfort.

The growing global population and rising birth rates in emerging and underdeveloped economies with large untapped opportunities are expected to serve this market as a high-impact rendering driver. An increase in the global population and birth rates are clear indicators of a constantly widening consumer base for breast pads. Therefore, this is expected to drive the market over the forecast period.

Product Insights

The reusable segment dominated the market and held highest market revenue share of 44.6% in 2023. Reusable breast pads are relatively softer and better for the environment. These are washable and a more affordable long-term option. Moreover, as these are made usually from natural fibers, they provide improved air circulation, ventilation, and breathability, which is essential for the healing of a sore nipple. In addition, organic bamboo fabric is becoming popular for use in the production of reusable nursing pads since it is associated with greater absorption capabilities and is ultra-soft, resulting in increased sales of reusable nursing pads. Cotton and polymer are two more prominent textiles utilized to meet the need for reusable nursing pads. The market's leading producers of reusable nursing pads are also selling reusable nursing pads that are latex and gluten-free. These factors contribute to segment growth.

The disposable segment is expected to grow at the fastest CAGR from 2024 to 2030. Disposable nursing pads, like sanitary napkins, comprise a thin absorbent material and are available in various absorbencies. They usually have a sticky back to adhere them to the bra, which can be convenient. These are majorly preferred by working women as they are hidden under clothing and are a comfortable option while traveling. These pads are packaged in separate wrappers, making them easy to carry in purses, kits, or even pockets when out. It can be used for long hours due to its convenience and moisture-locking abilities. Moreover, these pads are the softest. Therefore, it is less likely to get painful nipples, breast infections, or itching.

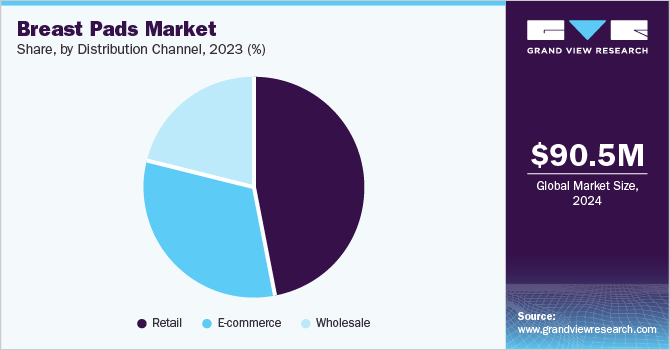

Distribution Channel Insights

The retail segment dominated the market and accounted for the largest revenue share in 2023 owing to the rising number of retail stores providing varieties of nursing pads. The market has seen a surge in demand throughout the retail channels. These mass merchandisers provide consumers with more convenience, dedicated mother-care product areas, bundling deals, schemes, and a simple shopping experience all under one roof. Furthermore, such distribution channels are intended to serve as a "one-stop-shop" for breast care products. These are usually located near a residential area in order to be accessible to the customers. Thus, owing to the aforementioned factors, this segment is expected to maintain its lead over the forecast period.

The e-commerce segment is expected to grow at the fastest CAGR during the forecast period. The increasing availability of postpartum items via the Internet and e-commerce is expected to boost market growth. End users may compare and pick appropriate items based on their kind, brand, price, and point of sale through the e-commerce channel. For example, Amazon.com,Inc., Walmart, Motherhood, and www.FirstCry.com are among the most popular online retailers. Moreover, the online platform offers benefits such as offers, discounts, free delivery, and a wide range of products. Furthermore, major firms like Koninklijke Philips N.V., Medela, and Ameda, Inc. have started to provide a wide selection of postpartum items through online channels. The sales strategies such as buy-one-get-one offers, discounts, and complimentary products attract more consumers. This is likely to drive the sales of postpartum products through this channel.

Regional Insights

North America breast pads market is expected to grow at significant CAGR over forecast period due to increasing adoption of breast pads in the region, increasing women's participation in the labor force, developed retail infrastructure, innovation & product development, high disposable income, and presence of manufacturers. According to the U.S. Bureau of Labor Statistics, in 2021, 56.1% of all women participated in the labor force. Thus, working mothers generally prefer using breast pads to prevent leakage. Moreover, a well-established retail network, including supermarkets, specialty stores, convenience stores, and online platforms, ensures the widespread availability of breast pads. A higher disposable income allows consumers to spend more on premium and convenience-oriented products, propelling the market's growth.

U.S. Breast Pads Market Trends

The U.S. breast pads market held a significant market share in North America in 2023 owing to developed retail infrastructure, a strong consumer base for innovative technologically advanced products, and strong marketing and branding by manufacturers. In addition, targeted marketing through e-commerce and online shopping platforms increased breast pad sales. The Fair Labor Standards Act mandates employers give nursing mothers reasonable breaks to pump breast milk for one year after childbirth. These breaks should occur whenever the employee needs to pump. Additionally, employers must offer a private, non-bathroom pumping space shielded from others.

Europe Breast Pads Market Trends

Europe breast pads market is expected to grow at a significant CAGR from 2024 to2030 due to the growing female population in the workforce, new births, awareness among females about the products due to social media and various mediums, government initiatives and a well-developed distribution network in the region including supermarkets, and convenience stores. Marketing activities by organizations and growing e-commerce are driving market growth. Government initiatives to protect breastfeeding women at workplaces are contributing to the market growth.

UK breast pads market held a substantial market share in 2023 owing to increasing awareness in parents about breastfeeding and the nutritional needs of their infants. In addition, the UK government mandates employers to provide suitable facilities for breastfeeding mothers, including private rooms for expressing milk, and requires risk assessments to ensure a safe environment for breastfeeding at work increasing demand for breast pads at workplaces.

Asia Pacific Breast Pads Market Trends

The Asia Pacific breast pads market held the highest revenue market share of 34.0% in 2023. This is mainly attributed to a large population base, high birth rates, and rising breastfeeding rates. According to the data published by The World Bank Group, the number of crude births per 1000 people was highest in Afghanistan, i.e. about 35 births per 1000 people. Moreover, as per the recommendations by the World Health Organization mothers should breastfeed for the first six months to the child propelling the growth of maternal care products including breast pads.

India's breast pad market is expected to grow significantly due to the number of births and the increasing contribution of the female population to the workforce. Moreover, western influence and changing lifestyles are increasing the demand for personal care, including maternal care products, and the growing middle class has contributed to the market's growth. Rapid urbanization has led to the adoption of improved lifestyles and the increasing adoption of breast pads. Moreover, the growing middle class with disposable income is driving demand for premium and imported maternal care products, including breast pads.

Key Breast Pads Company Insights

Some of the key companies in the breast pads market include Medela, Cardinal Health, Lansinoh Laboratories, Inc., Ameda, Inc., NUK USA LLC Koninklijke Philips N.V., and others. Organizations are focusing on nursing pad offerings to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Madela medical devices manufacturer offers research-based breast milk feeding and baby products alongside healthcare solutions for hospitals in maternity. Its Safe & Dry Disposable Nursing Pads are designed for heavy breast leaking, especially soon after childbirth allowing mothers to spend comfortable day at workplace.

-

KINDRED BRAVELY caters to maternity and nursing wear, supporting moms as they transition from pregnancy to breastfeeding and beyond. It offers Fearless Leakproof reusable nursing pads which are antibacterial and washable allowing mothers to reuse it. It also offers nursing pads made from organic bamboo.

Key Breast Pads Companies:

The following are the leading companies in the breast pads market. These companies collectively hold the largest market share and dictate industry trends.

- Medela

- Cardinal Health

- Lansinoh Laboratories, Inc.

- Ameda, Inc.

- NUK USA LLC

- Pigeon Corporation

- Bamboobies

- LilyPadz

- Cache Coeur

- KINDRED BRAVELY

- Koninklijke Philips N.V.

Recent Developments

-

In April 2024, Moogco introduced its innovative Silver Nursing Cups with Silicone Pads, aiming to significantly enhance breastfeeding comfort for new mothers. These nursing cups are crafted from high-quality silver, known for their natural antibacterial and anti-inflammatory properties, which help prevent infections and soothe sore nipples. Adding silicone pads provides extra comfort and protection, ensuring a gentle and secure fit.

-

In December 2023, Lunnie, a maternity and nursing wear brand, announced its partnership with Kettering Health to support new mothers by providing high-quality nursing bras. This collaboration aims to enhance the postpartum experience for new moms, offering them comfortable and functional nursing bras designed to meet their unique needs.

Breast Pads Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 94.0 million

Revenue forecast in 2030

USD 119.8 million

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, and South Africa

Key companies profiled

Medela; Cardinal Health; Lansinoh Laboratories, Inc.; Ameda, Inc.; NUK USA LLC; Pigeon Corporation; Bamboobies; LilyPadz; Cache Coeur; KINDRED BRAVELY and Koninklijke Philips N.V.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Pads Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breast pads report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

Hydrogel

-

Silicone

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Wholesale

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The breast pads market size was estimated at USD 84.04 million in 2021 and is expected to reach USD 87.16 million in 2022.

b. The breast pads market is expected to grow at a compound annual growth rate of 4.1% from 2022 to 2030 to reach USD 119.81 million by 2030.

b. The Asia Pacific dominated the breast pads market in 2021 during the forecast period and is expected to witness a growth rate of 4.73% over the forecast period. This can be attributed to the presence of a large target audience and increasing awareness campaigns in this region.

b. Prominent key players operating in the breast pads market are Medela AG, Cardinal Health, Lansinoh Laboratories, Inc., Magento, Inc. (Ameda), NUK USA LLC, Pigeon Corporation, Bamboobies, LilyPadz, Cache Coeur, KINDRED BRAVELY and Koninklijke Philips N.V.

b. Key factors that are driving the breast pads market growth include the rise in the global women’s employment rate. Furthermore, an increase in awareness campaigns by government and market players regarding the availability of breastfeeding accessories such as nursing pads is anticipated to impel the market growth during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.