- Home

- »

- Medical Devices

- »

-

Breast Pads Market Size & Share Report, 2022 - 2030GVR Report cover

![Breast Pads Market Size, Share & Trends Report]()

Breast Pads Market Size, Share & Trends Analysis Report By Type (Reusable, Disposable), By Distribution Channel (Retail, Wholesale, E-commerce), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-933-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

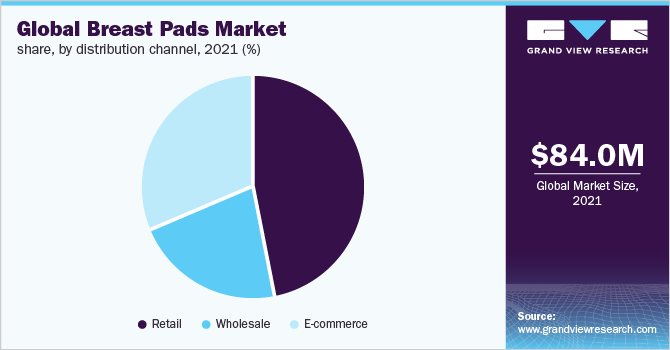

The global breast pads market size was valued at USD 84.04 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030. An increase in women’s employment is expected to be a high-impact rendering driver in the market. Working women have a relatively high disposable income and less time to breastfeed their babies, and thus, are ideal customers for breast pads and related accessories. The following table illustrates women’s employment rates in the world:

Women’s employment rates

Country/region

2018 (%)

Developing countries

69.3

Emerging countries

45.6

Developed countries

52.4

Northern Africa

21.9

Sub-Saharan Africa

64.7

Latin America and the Caribbean

51.5

Northern America

55.8

Arab States

18.9

Eastern Asia

59.1

South-Eastern Asia and the Pacific

56.5

Southern Asia

27.6

Northern, Southern and Western Europe

51.6

Eastern Europe

51.8

Central and Western Asia

45.1

Thus, the rising number of working women is expected to surge the demand for breast pads, thereby driving the market.

Growing consumer awareness and supportive government initiatives are anticipated to propel the global demand for breast pads. For instance, in August 2017, Scotland’s Baby Box scheme is a Scottish Government initiative to offer a free Baby Box for all babies due in Scotland. The box comprises items such as newborn clothes, nursing pads, thermometer, and nappies. Moreover, the governments of various countries are encouraging mothers to breastfeed babies up to the age of 6 months. Additionally, many international agencies are arranging campaigns to raise awareness regarding breastfeeding. Thus, the rising awareness and the introduction of easy-to-use and convenient nursing products are also expected to propel the market growth in the near term.

In addition, the growing trend of delayed parenthood is anticipated to increase the spending on premium baby products, which is expected to positively influence the market growth. Furthermore, various market players such as Medela LLC, Laura & Co., Newell Brands, and Ameda and universities including Washington University & Fudan University are raising awareness among women about breastfeeding and its benefits by arranging campaigns and providing informative magazines. In addition, social media platforms such as YouTube, Facebook, and Instagram have enabled individuals to access information about breast pads. Several companies provide information on these platforms.

Moreover, a few new trends with the growing popularity of ultra-thin washable nursing breast pads, new product launches with better technologies, and the presence of several social media platforms are expected to drive a considerable demand for breast pads over the forecast period. For instance, Medela’s Tender Care Hydrogel Pads combine instant cooling relief with a comfortable, contoured shape for easy use and instant comfort.

The growing global population and rising birth rates in emerging and underdeveloped economies with large untapped opportunities are expected to serve this market as a high-impact rendering driver. An increase in the global population and birth rates are clear indicators of a constantly widening consumer base for breast pads, and therefore, this is expected to significantly drive the market over the forecast period.

Population growth by continent, 2010 to 2050 (Million)

Year

World

Africa

North

America

South

America

Asia

Europe

Oceania

2010

6,853

1,015

539

396

4,133

734

35

2020

7,597

1,261

595

440

4,531

731

39

2030

8,259

1,532

648

477

4,841

718

43

2040

8,820

1,827

695

504

5,049

698

46

2050

9,284

2,138

739

520

5,167

671

49

Furthermore, government initiatives such as the CDC providing information on COVID-19 and growing awareness regarding breastfeeding practices are expected to fuel the growth of the market. Furthermore, the birth rate is likely to rise following the pandemic. For instance, researchers at the University of Michigan estimate a rise in the number of births following the pandemic. As a result, the market for breastfeeding accessories such as breast pads is predicted to grow gradually.COVID-19 had a negligible impact on the market, and the market is expected to witness a gradual surge post-pandemic period. Moreover, many companies undertook initiatives and issued new guidelines to support breast milk during this period. For instance, Medela AG conducted research on the effects of COVID-19 on breast milk feeding practices and introduced a set of guidelines, named Preserving Breastfeeding in the Age of COVID-19, to support breastfeeding practices.Type Insights

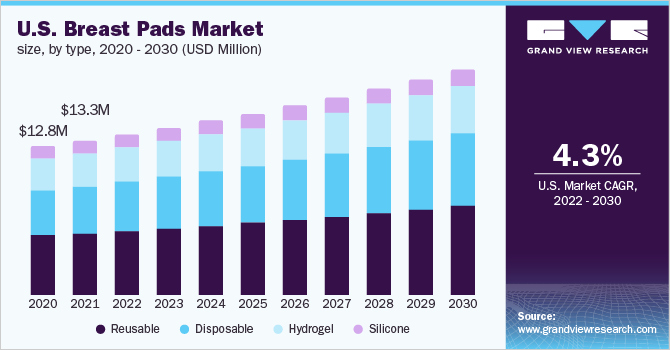

The reusable segment held the largest revenue share of over 40.0% in terms of revenue, in 2021. Reusable breast pads are relatively softer and better for the environment. These are washable and a more affordable long-term option. Moreover, as these are made usually from natural fibers, they provide improved air circulation, ventilation, and breathability, which is essential for the healing of a sore nipple. Thus, owing to the above-mentioned advantages, coupled with its cost-effectiveness, their demand is high as compared to other breast pads.

In addition, organic bamboo fabric is becoming popular for use in the production of reusable nursing pads since it is associated with greater absorption capabilities and is ultra-soft, resulting in the increased sales of reusable nursing pads. Cotton and polymer are two more prominent textiles utilized to meet the need for reusable nursing pads. The market's leading producers of reusable nursing pads are also selling reusable nursing pads that are latex and gluten-free. These factors contribute to segment growth.

Disposable breast pads are expected to register the fastest CAGR of 4.75% over the forecast period. Disposable nursing pads, like sanitary napkins, comprise a thin absorbent material and are available in a variety of absorbencies. They usually have a sticky back to adhere them to the bra, which can be convenient. These are majorly preferred by working women as they are hidden under clothing and are a comfortable option while traveling. They are available under a number of popular brands with the packaging of about ranging from 50 to 200 or more.

These pads are ingeniously packaged in separate wrappers, making them easy to carry in purses, kits, or even pockets when out and about. These pads are very convenient and moisture-locking, allowing them to be used for extended hours at a time. Moreover, these pads are the softest, therefore it is less likely to get painful nipples, breast infection, or itching. Thus, owing to the aforementioned advantages, this segment is expected to witness rapid growth in the forthcoming years.

These pads include absorbent chemical substances that come into contact with your skin that obstruct breathability. They also have poor air circulation, which can cause discomfort and moisture buildup. Moreover, if there is more leakage, it might need to breast infections. Besides, there will also be a frequent need of changing these pads, which will, in turn, be costly. These factors are likely to impede the segment growth.

Distribution Channel Insights

The retail segment held the largest revenue share of over 45.0% in 2021 owing to the rising number of retail stores providing varieties of nursing pads. The market has seen a surge in demand throughout the retail channels. These mass merchandisers provide consumers with more convenience, dedicated mother-care product areas, bundling deals, schemes, and a simple shopping experience all under one roof. Furthermore, such distribution channels are intended to serve as a "one-stop-shop" for breast care products. These are usually located near a residential area in order to be accessible to the customers. Thus, owing to the aforementioned factors, this segment is expected to maintain its lead over the forecast period.

The e-commerce segment is anticipated to register the fastest growth rate of 4.72% over the forecast period. The increasing availability of postpartum items via the internet and e-commerce is expected to boost market growth. End-users may compare and pick appropriate items based on their kind, brand, price, and point of sale through the e-commerce channel. For example, Amazon, Belly Bandit Walmart, Motherhood Maternity, The Moms Co., and First Cry are among the most popular online retailers. Moreover, the online platform offers benefits such as offers, discounts, free delivery, and a wide range of products.

Furthermore, major firms like Koninklijke Philips N.V., Medela LLC, and Ameda have started to provide a wide selection of postpartum items through online channels. The sales strategies such as buy one get one offers, discounts, and complimentary products attract more consumers. This is likely to drive the sales of postpartum products through this channel as they are always in high demand among consumers.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 30.0% in 2021 and is expected to witness the fastest growth over the forecast period. This is mainly attributed to the presence of a large population base, high birth rates, and rising breastfeeding rates. According to the data published on Global Economy.com, the number of crude births per 1000 people, each year in Asia: The average for 2019 based on 47 countries was 17.94 births per 1000 people. The highest value was in Afghanistan, i.e. about 31.8 births per 1000 people. Moreover, as per the article published in Hindustan Times, around 64.9% are exclusively breastfed for the first six months.

Furthermore, the growing number of specialist hospitals providing support services to lactating mothers and efforts and programs educating the public about the value and need of breastfeeding are expected to boost the demand for breast pads. Furthermore, the development of the sector will profit from the spread of breastfeeding assistance to rural regions through the implementation of various initiatives. Therefore, the aforementioned factors are contributing to the market growth in this region.

The North American market is expected to grow at a significant pace over the forecast period owing to the increasing women’s employment rates. According to the U.S. Bureau of Labor Statistics, in 2019, 57.4% of all women participated in the labor force, which was up from 57.1% in 2018. Thus, working mothers generally prefer using breast pads to prevent leakage. Moreover, breastfeeding is encouraged in the U.S., and several states have legislation allowing mothers to do so in public. In addition, 25 states have laws protecting the right to breastfeed at the workplace. According to the WHO, approximately 74% of U.S. children have been breastfed, of which 33.1% have been exclusively breastfed through the age of four months and only 13.6% have been solely breastfed through the age of six months. This could be related to the large number of working women in the U.S. who return to work after a relatively short maternity leave of 12 weeks.

Furthermore, rising initiatives undertaken by government and nonprofit organizations are further adding to the market growth. For instance, in August 2021, Pan America Health Organization, along with World Alliance for Breastfeeding Action, carried out a World Breastfeeding Week campaign in 2021, in which they informed people about the importance of breastfeeding, galvanized people into taking action related to breastfeeding and breast milk, and recommended standard infant breast milk feeding guidelines and benefits during COVID-19. Thereby, such factors are contributing to the regional market growth.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as mergers & acquisitions, partnerships, and the launch of new products to strengthen their foothold in the market. They are significantly investing in research and development to manufacture technologically advanced products. For instance, in February 2018, Cache Coeur launched its new brand Curve. They are guaranteed leak-resistant, undetectable, and washable. These breast pads are made up of four layers, the first of which is a micro-perforated antibacterial and anti-odor spacer that allows for quick leak evacuation. The second central layer is an ultra-absorbent multi-fiber core; the third layer is a protective membrane, a waterproof and breathable film; and the fourth outer layer is a skin-colored textile veil that is undetectable beneath clothes. Some prominent players in the global breast pads market include:

-

Medela AG

-

Cardinal Health

-

Lansinoh Laboratories, Inc.

-

Magento, Inc. (Ameda)

-

NUK USA LLC

-

Pigeon Corporation

-

Bamboobies

-

LilyPadz

-

Cache Coeur

-

KINDRED BRAVELY

-

Koninklijke Philips N.V.

Breast Pads Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 87.16 million

Revenue forecast in 2030

USD 119.8 million

Growth Rate

CAGR of 4.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Medela AG; Cardinal Health; Lansinoh Laboratories, Inc.; Magento, Inc. (Ameda); NUK USA LLC; Pigeon Corporation; Bamboobies; LilyPadz; Cache Coeur; KINDRED BRAVELY; Koninklijke Philips N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global breast pads market report on the basis of type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

Hydrogel

-

Silicone

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Wholesale

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The breast pads market size was estimated at USD 84.04 million in 2021 and is expected to reach USD 87.16 million in 2022.

b. The breast pads market is expected to grow at a compound annual growth rate of 4.1% from 2022 to 2030 to reach USD 119.81 million by 2030.

b. The Asia Pacific dominated the breast pads market in 2021 during the forecast period and is expected to witness a growth rate of 4.73% over the forecast period. This can be attributed to the presence of a large target audience and increasing awareness campaigns in this region.

b. Prominent key players operating in the breast pads market are Medela AG, Cardinal Health, Lansinoh Laboratories, Inc., Magento, Inc. (Ameda), NUK USA LLC, Pigeon Corporation, Bamboobies, LilyPadz, Cache Coeur, KINDRED BRAVELY and Koninklijke Philips N.V.

b. Key factors that are driving the breast pads market growth include the rise in the global women’s employment rate. Furthermore, an increase in awareness campaigns by government and market players regarding the availability of breastfeeding accessories such as nursing pads is anticipated to impel the market growth during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."