- Home

- »

- Medical Devices

- »

-

Breast Pump Market Size & Share, Industry Report, 2033GVR Report cover

![Breast Pump Market Size, Share & Trends Report]()

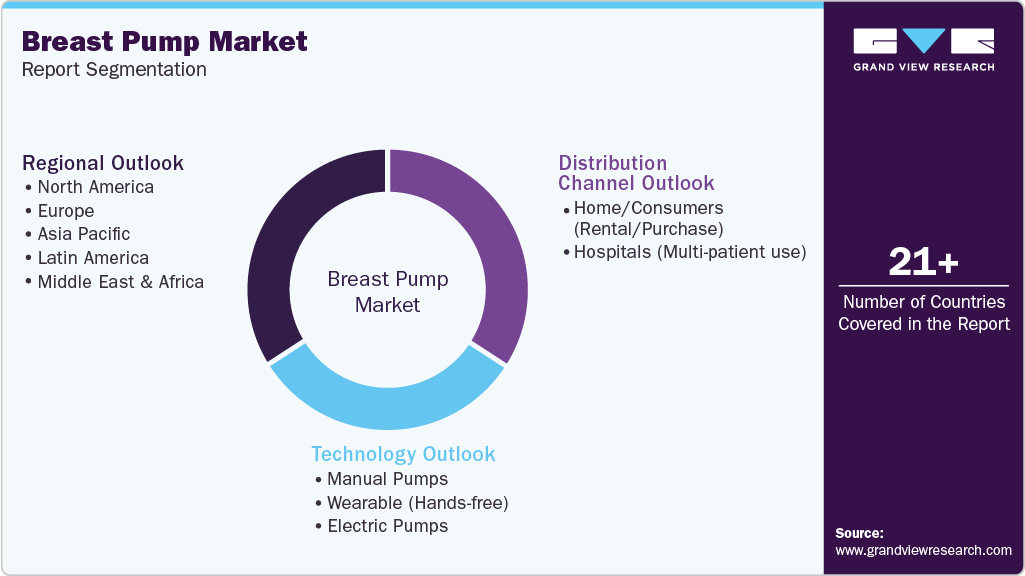

Breast Pump Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Manual Pumps, Wearable (Hands-free), Electric Pumps), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-215-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Breast Pump Market Summary

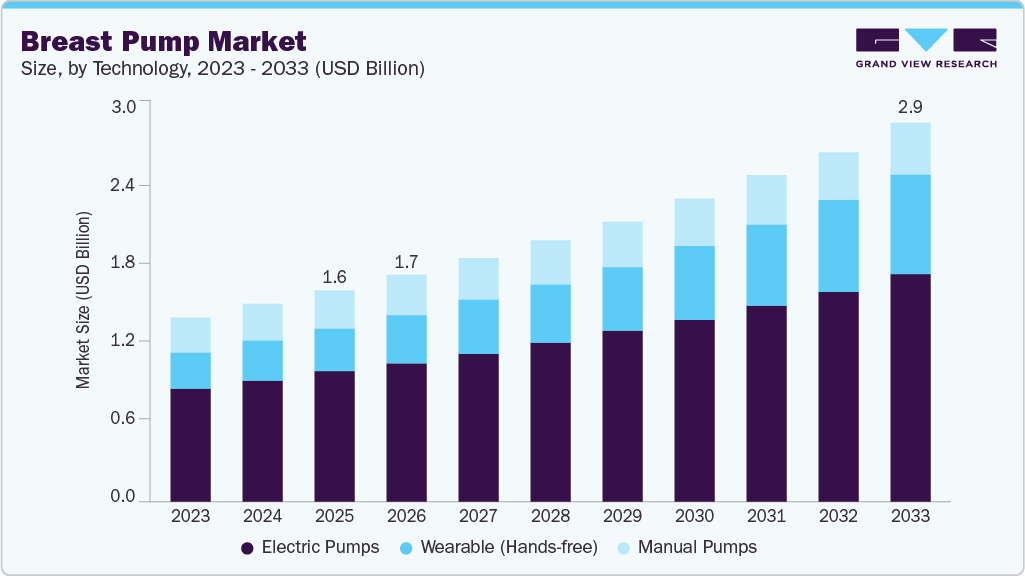

The global breast pump market size was estimated at USD 1.64 billion in 2025 and is projected to reach USD 2.92 billion by 2033, growing at a CAGR of 7.55% from 2026 to 2033. The key factors driving the market growth include the rising global women's employment rates, improved healthcare infrastructure in emerging economies, and government initiatives to support working mothers.

Key Market Trends & Insights

- North America dominated the breast pump market with the largest revenue share of 53.61% in 2025.

- The breast pump industry in the U.S. led North America with the largest revenue share of 80.70% in 2025.

- By technology, the electric pumps devices segment led the market with the largest revenue share of 61.46% in 2025.

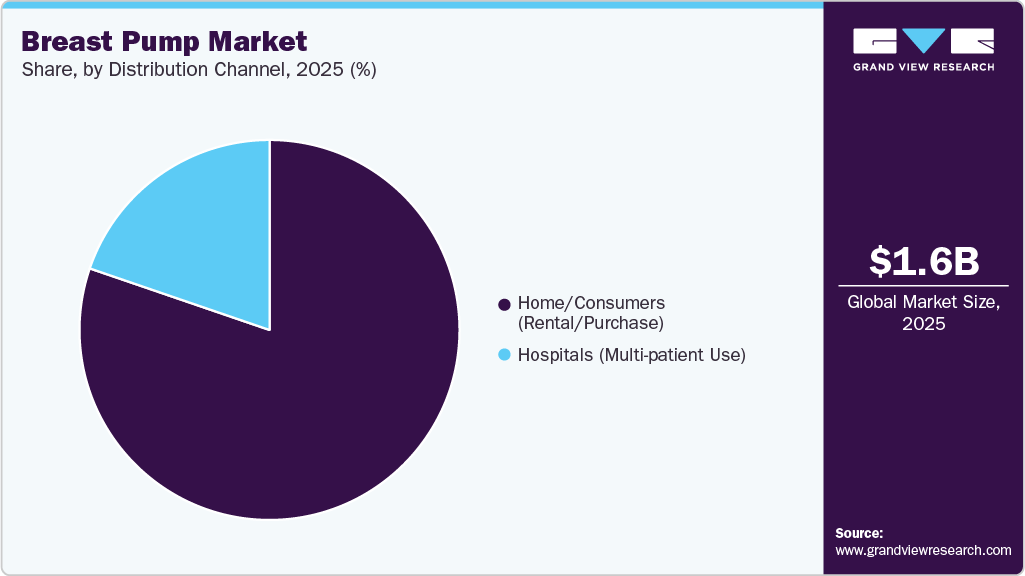

- By distribution channel, the home/consumers (rental/purchase) segment led the market with the largest revenue share of 80.25% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.64 Billion

- 2033 Projected Market Size: USD 2.92 Billion

- CAGR (2026-2033): 7.55%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

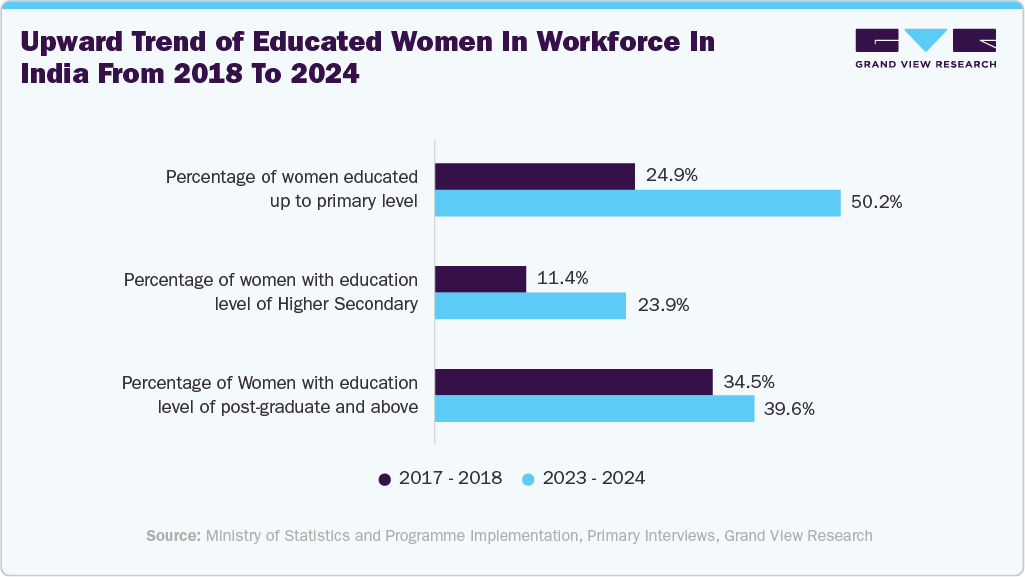

The significant rise in female labor force participation in India, as highlighted by the Economic Survey 2025, which reported an 18.4% increase over the past five years, serves as a key driver for the breast pump industry. As more women join or return to the workforce, especially new mothers, the demand for convenient and efficient breastfeeding solutions has surged significantly. Breast pumps enable working mothers to maintain their breastfeeding routines while managing professional commitments, offering flexibility, improved infant nutrition, and emotional reassurance.

Furthermore, increasing breastfeeding complications amongst women is expected to create demand for breast pumps in the near term. Breastfeeding complications include poor attachment, breast engorgement, and nipple pain in women. Thus, breastfeeding becomes more difficult because of these issues among women. According to Nemours, a non-profit children's health organization, most women discontinue breastfeeding their newborn babies too soon, resulting in an increase in the need for breast pumps.

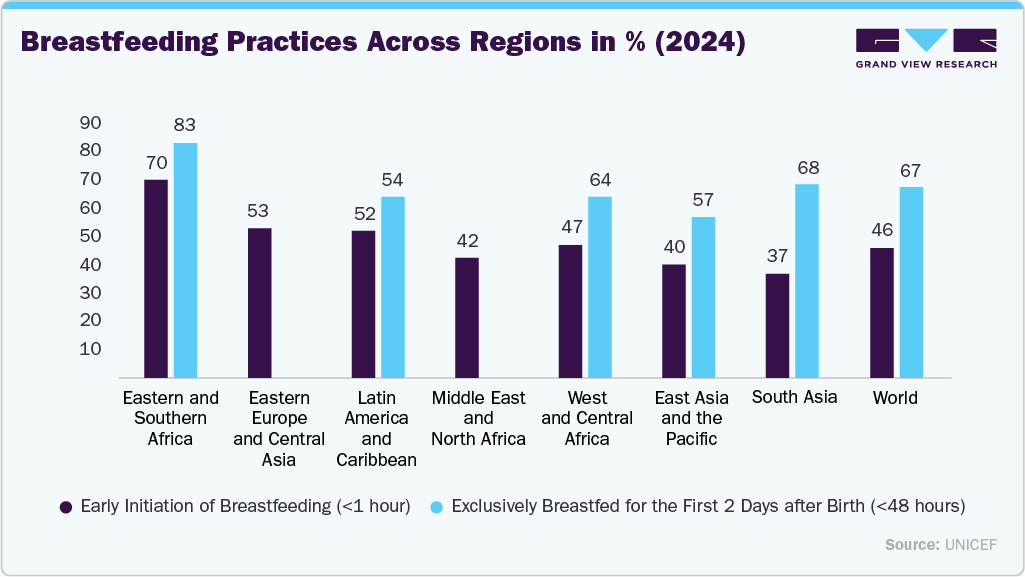

Growing consumer awareness and supportive government initiatives are anticipated to propel the global demand for breast pumps. For instance, The Baby Friendly Hospital Initiative (BFHI), which promotes evidence-based practices for breastfeeding success, was established by the United Nations Children's Fund (UNICEF) and the World Health Organization (WHO) to enhance breastfeeding rates and assist families in achieving their breastfeeding goals. Similarly, in August 2024, Momcozy launched a campaign to empower mothers and break breastfeeding barriers. This initiative included a comprehensive webinar series covering topics such as pumping, breastfeeding, and transitioning back to work confidently. During this campaign, Momcozy partnered with several organizations, including the American College of Nurse-Midwives. These initiatives by industry players to raise awareness among new mothers about breast pumping and the use of breast pumps are expected to drive demand for these products in the coming years.

"In the U.S., new mothers receive very little support, and we are too often caught in judgmental 'mommy wars' over the right way to feed r baby. What new moms need is encouragement to thrive on their real feeding journeys, most new mothers want to breastfeed, and the reality is most moms will introduce pumping, sometimes exclusively, for various reasons. And they deserve to feel proud of their journey. It's time for our breastfeeding conversations to be more inclusive of pumping and aligning with real experiences."Said Sarah O'Leary, mom of two and CEO of Willow

Governments of various countries are encouraging mothers to breastfeed babies up to the age of 6 months. Moreover, many international agencies are arranging campaigns to raise awareness about breastfeeding. Various market players, such as Medela LLC, Laura & Co., Newell Brands, and Ameda, as well as universities like Washington University & Fudan University, are raising awareness among women about breastfeeding and its benefits by organizing campaigns and providing informative magazines. These factors are expected to drive the market.

Breast pumps help improve accessibility to perform the everyday tasks. A breast pump is covered under Medicare, but it does not cover disposable items. Medicare Part B beneficiaries pay 20% of the approved cost of the product, and the remaining 80% is paid by Medicare. Better coverage and reimbursement policies for breast pump products are also likely to help drive growth in the breast pump market. In addition, the rising number of elderly care centers due to the increasing geriatric population base across the globe is projected to drive the market growth.

Moreover, the growing employment rate of women is anticipated to propel the demand for breast pumps in the coming years. Countries such as Canada and India are witnessing significant growth in women's employment. For instance, according to the data published by the Periodic Labour Force Survey (PLFS) undertaken by the Ministry of Statistics and Programme Implementation in November 2024, the Female Labour Force Participation Rate (LFPR) in India has grown significantly by 23 percentage points between 2017-18 and 2023-24, demonstrating an increasing contribution of females to rural production.

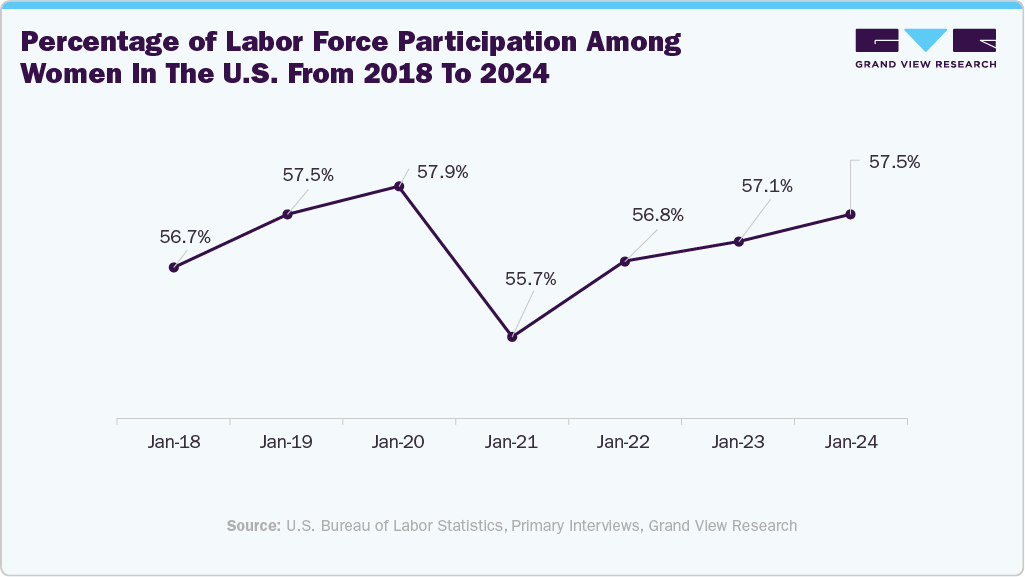

Furthermore, according to the Labour Force Survey data published by Statistics Canada in October 2023, 9.6 million women were employed in Canada in September 2023, representing a 2.7% increase from September 2022. Moreover, the labor force participation rate among U.S. women is also on the rise. According to the data published by the U.S. Bureau of Labor Statistics, the labor force participation rate among U.S. women increased from 56.7% in January 2018 to 57.5% in January 2024. Working women have a relatively high disposable income and less time to breastfeed their babies, making them ideal customers for breast pumps. Thus, increasing women's employment is anticipated to drive the market growth.

In addition, social media platforms, such as YouTube, Facebook, and Instagram, have enabled individuals to access information about breast pumps and related accessories. Several companies provide information on these platforms. For instance, Spectra Baby USA runs a page called Spectra Baby USA - Pumping for Mom Support, which supports and provides information about breast pumps. Thereby, such factors are expected to boost the demand for breast pumps during the forecast period.

The rise in novel product launches is significantly driving the breast pump market by introducing more advanced, efficient, and user-friendly products that cater to the evolving needs of modern parents. For instance, in July 2024, KISSBOBO launched the M1, a new era in breast pumping. The M1 Breast Pump offers 19 adjustable suction levels, allowing mothers to personalize their pumping experience and find the most comfortable and effective strength. These factors are expected to propel the breast pumps market over the forecast period.

Technological Advancements

Company Name

Product Launch

KOLs

Medela

In May 2025, Medela launched its latest innovation in breast pump technology: the Magic InBra, a next-generation wearable breast pump. Designed to deliver hospital-grade performance, the Magic InBra features FluidFeel Technology, offering superior comfort, high efficiency, and hands-free convenience. This launch reflects Medela’s continued commitment to providing advanced, user-centric solutions for breastfeeding mothers.

"Magic InBra is the culmination of our more than sixty years of advancing lactation science," said Thomas Golücke, CEO of Medela. "Building on our legacy of innovation-from our clinically validated 2-Phase Expression technology to our breakthrough 105° breast shields-we've now introduced FluidFeel Technology, once again reimagining the pumping experience. This milestone underscores our scientific commitment to advance breastfeeding and pumping, combining our deep understanding of infant feeding behaviors, lactation physiology, and mothers' needs. We refused to compromise on any aspect-performance, comfort, or ease of use-because we believe that's what mothers deserve. The result is our most advanced breast pump yet, bringing together everything we've learned to create a solution that exceeds expectations in both performance and comfort."

Willow

In January 2025, Willow announced the launch of its latest innovations-the Silicone Wearable Breast Pump, Glass Breast Milk Pitcher, and Breast Milk Storage Bags-demonstrating its ongoing commitment to developing solutions that enhance and support the maternal journey for every parent.

"Our mission has always been to build products that are reflective of mom’s real life and create tools that are easier to use and more efficient,” said Sarah O’Leary, CEO of Willow and mom of two. “Willow pioneered a new approach to breastfeeding by creating the first all-in-one wearable pump, empowering moms to feed on their terms without putting their lives on hold. Expanding our pumping and feeding essentials is an extension of that approach to help more mothers navigate their feeding journeys with even more convenience."

Source: Medela, Willow, Grand View Research

Clinical Trials

Study Title

Conditions

Interventions

Sponsor

Enrollment

Completion Date

Locations

A Randomized Controlled Trial of Impact of Wearable, Wireless Breast Pumps on Frequency and Efficacy of Milk Expression in Mothers of Premature Infants

Premature Birth

DEVICE: Wearable wireless breast pump

University of Texas at Austin

30

2025-06

Ascension Seton Medical Center, Austin, Texas, 78705, United States

Engineering Evaluation of a Breast Pump Device

Healthy|Breast Pumping

DEVICE: Prototypes of breast shield and Freedom Double Electric Breast Pump

Momtech Inc.

48

9/30/2024

Blur Product Development, Cary, North Carolina, 27513, United States

Source: Clinical Trials

Market Characteristics

The breast pump market is witnessing a substantial degree of innovation driven by rapid technological advancements and the increasing adoption of advanced products. Ongoing advancements in breast pump technology, such as the development of electric and battery-operated pumps, dual pumps for simultaneous expression, and smart pump features, have made breast pumping more convenient and efficient, driving market growth. For instance, in March 2024, Willow Innovations, Inc. introduced Willow 360, a new and improved wearable breast pump system designed to enhance the breastfeeding experience.

With enhanced leak-proof technology, a user-friendly app, and personalized services, Willow 360 empowers moms with greater freedom and support. Moreover, the integration of smart technology into breast pumps enables mothers to track their pumping sessions, milk production, and feeding patterns through mobile apps. These apps also provide tips, reminders, and personalized insights. Lately, wearable breast pumps have gained popularity, offering mothers the flexibility to pump discreetly and without being tethered to a traditional pump. These devices are often compact, quiet, and allow for hands-free pumping, enhancing convenience for on-the-go mothers. As technology continues to advance, more improvements and innovations are likely to emerge in the breast pump market.

Regulations play a crucial role in shaping the breast pumps market, ensuring the safety, efficacy, and quality of these devices. Regulatory agencies set standards and requirements to ensure the safety and quality of breast pumps. Manufacturers must comply with these standards to obtain regulatory approval or certification for their products. This helps build trust among consumers regarding the safety and reliability of breast pumps.Stringent regulatory requirements can act as barriers to entry for new companies in the market.

Compliance with regulations often involves significant investments in research, development, and testing to meet the specified safety and performance standards. Regulatory requirements drive innovation in breast pump design and technology. Companies often invest in research and development to create products that not only meet regulatory standards but also offer additional features to enhance user experience and clinical efficacy. Furthermore, regulations need to adapt to emerging technologies, such as smart breast pumps with connectivity features. Issues related to data privacy, security, and usability become subjects of regulatory consideration as these technologies advance.

Pump Type

Class

Manual

Class I

Electricals

Class II

Source: Code of Federal Regulations

Companies are actively acquiring development-stage firms to broaden their service portfolios, catering to a larger patient base. Major companies acquire smaller firms to strengthen their market position, expand product portfolios, or gain access to new technologies. In January 2023, International Biomedical announced the acquisition of Ameda, Inc. The company is expected to hire for operations roles as it consolidates the acquisition and develops new growth initiatives.

The breast pumps market faces moderate substitution threats from alternatives, such as infant formula feeding, which offers convenience for mothers who are unable to breastfeed or choose not to. Manual expression (hand expression) remains a low-cost, equipment-free option, particularly in low-resource settings. Additionally, wet nursing and human milk banks are substitutes in specific cultural or clinical contexts. Supplemental Nursing Systems (SNS) and nipple shields reduce reliance on pumps by supporting direct breastfeeding in challenging cases. Despite these options, growing awareness of breast milk’s benefits and advancements in pump technology continue to drive market demand.

The market exhibits a high degree of end-use concentration, primarily driven by individual consumers, particularly working mothers and lactating women, who seek convenience and flexibility in infant feeding. Hospitals and maternity clinics also account for a significant share, using breast pumps for postnatal care, premature births, and lactation support. Moreover, breast milk banks and nonprofit organizations contribute to demand by facilitating milk collection and distribution. With overlapping clinical and personal use cases, this concentrated user base significantly influences product development trends, such as portability, noise reduction, and hands-free functionality, in breast pump technologies.

Technology Insights

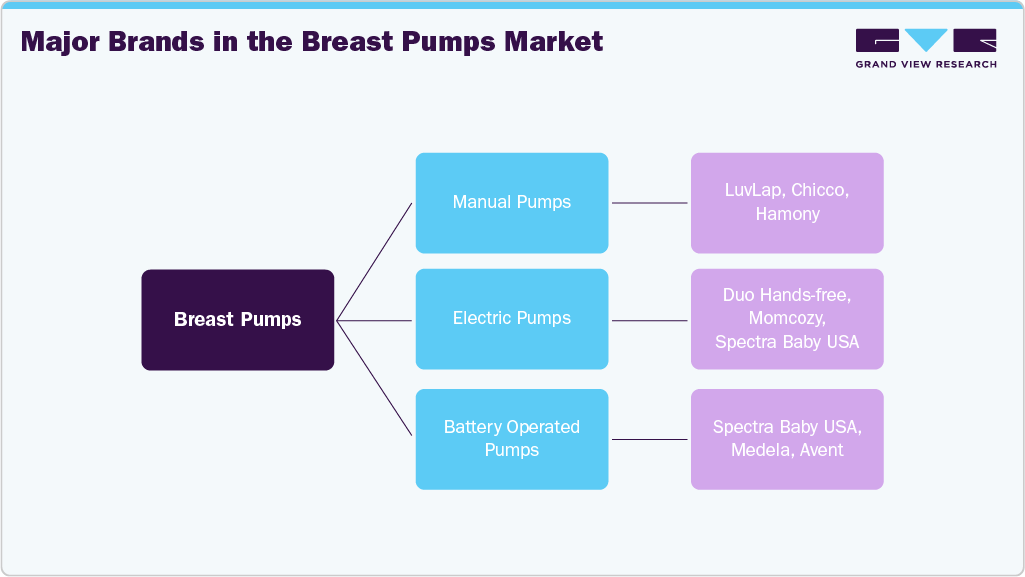

The electric pumps segment held the largest share of the breast pump market in 2025 and is expected to witness the fastest growth rate during the forecast period. Electric breast pumps are powered by a motor and supply suction through plastic tubing to a horn that fits over the nipple. It provides a lot more suction, making pumping significantly faster, and allows pumping of both breasts at the same time. As a result, the growing presence of working mothers is anticipated to boost the growth of the electric breast pump segment in the coming years.

The group represented 11 countries, encompassing a wide range of occupations, and utilized various breast pump types, including manual, electric, semi-wearable, and wearable models. Fields marked “-” indicate information not provided.

Names

Country

Occupation

Pump Type in Use

Pumping Space

Mila

Belgium

Academic

-

Personal office

Hannah

U.S.

Occupational therapist

Battery-operated (hands-free)

Car

Jane

Switzerland

Researcher

Wearable

Shared office and meeting rooms

Maggie

U.S.

Marketing manager

Battery-operated (hands-free)

Designated lactation room

Nina

Denmark

Consultant

Electric and Manual

Accessibility restroom

Michelle

U.S.

Clinical Social Worker

Electric

Personal office

Alice

Switzerland

Pattern Maker

Electric

Designated lactation room

Celine

Singapore

Teacher

Electric and Wearable

Open seating space

Branca

Sweden

Academic

Battery-operated (not hands-free)

Personal office

Talia

Luxembourg

Marketing manager

Wearable

Meeting rooms and calling booths

Diana

South Africa

Receptionist

Semi-wearable

Reception desk

Fia

U.S.

Pediatrician

Battery-operated (hands-free)

Personal office, patient rooms

Garima

Thailand

Counselor

Battery-operated (not hands-free)

Personal office

Amelia

Canada

Nurse

Battery-operated (hands-free)

Shared office

Shuchi

India

Software Developer

Manual pump

Designated lactation room

Emma

U.S.

Teacher

Battery-operated (not hands-free)

Shared office

Noah

U.S.

Manager

Battery-operated (not hands-free)

Designated lactation room

Joanna

U.S.

Military pay technician

Electric pump

Designated lactation room

Tina

India

Software Developer

Manual pump

Designated lactation room

Source: Digital Library

Working mothers generally prefer to use electric pumps because they can easily extract more milk in a short amount of time. The double-pumping model reduces the time required compared to a standard pump. Often, electric pumps can be quite heavy and noisy; however, manufacturers continue to utilize advanced technology, which enables the creation of lighter pumps that generate less noise. Electric pumps are also available for rent for mothers who cannot afford to buy a new pump and require one for a short term.

Some key brands operating in this segment include Purely Yours Ultra Breast Pump by Ameda AG and Isis iQ Duo Breast Pump by Philips AVENT, respectively. Technological advancements, including the introduction of portable instruments such as the Platinum electric breast pump by Ameda and the Electric Swing breast pumps by Medela, are expected to drive market growth over the next few years.

Wearable (hands-free) pumps are expected to dominate the forecast period due to their unmatched convenience, mobility, and discreet use, which align with the lifestyle needs of modern mothers. These pumps allow women to express milk while working, commuting, or performing daily tasks without being stuck to a traditional device, making them especially attractive for employed and active mothers. Advances in compact motor technology, quieter operation, and leak-resistant collection systems have further boosted adoption. Furthermore, the growing social acceptance of hands-free pumping in public settings, combined with strong promotion through e-commerce and influencer channels, is accelerating their preference over conventional electric pumps. As a result, wearable pumps are becoming the preferred choice for both first-time and experienced mothers, driving their dominance in the forecast period.

Distribution Channel Insights

The home/consumer (rental and purchase) segment dominates the breast pump industry because it offers affordable, convenient, and safer-feeling options for most mothers compared to hospital-grade, multi-user pumps. Consumer electric and wearable pumps are significantly more affordable, making them easier to purchase or rent without a substantial financial burden. Many women also prefer home-use pumps because they offer a higher level of privacy and comfort, enabling mothers to express milk discreetly on their own schedule. In addition, home pumps are typically single-user devices, eliminating concerns about hygiene risks, potential cross-contamination, and improper reprocessing associated with shared hospital pumps. This combination of lower cost, personal ownership, infection-control reassurance, and convenience has made the home/consumer channel the leading segment.

The hospital segment is expected to experience significant growth over the forecast period, as healthcare facilities prioritize high-quality lactation support for new mothers. Hospitals are expanding the availability of advanced, multi-user electric pumps to improve postpartum milk initiation, especially for preterm or medically fragile infants who rely on expressed milk. Rising adoption of lactation programs, improved reimbursement for hospital-grade pumps, and the integration of dedicated breastfeeding support teams are also fueling demand. Furthermore, the emphasis on early breastfeeding initiation within maternity units and NICUs is driving hospitals to invest in durable, efficient pumps, contributing to rapid market expansion in this segment.

Regional Insights

North America dominated the breast pump market with the largest revenue share of 53.61% in 2025. The rapid adoption of advanced equipment in the U.S. has enabled the region to capture a larger market share. The presence of leading manufacturers and the rapid adoption of advanced products are projected to further boost the region’s growth. The region is continuously developing cost-efficient and advanced devices for the patients to capture a huge share of the market. Additionally, the rise in the number of hospitals and the growing geriatric population are factors contributing to regional market growth.

U.S. Breast Pump Market Trends

The U.S. held the largest share of the North America breast pump industry in 2025. Some of the factors contributing to its dominance include increasing awareness about the availability of breast pumps, the growing number of employed women, and high disposable income. For instance, as per a report by the U.S. BUREAU OF LABOR STATISTICS, the unemployment rate of women in the U.S. has decreased from 13.9% in 2020 to 3.3% in 2023.

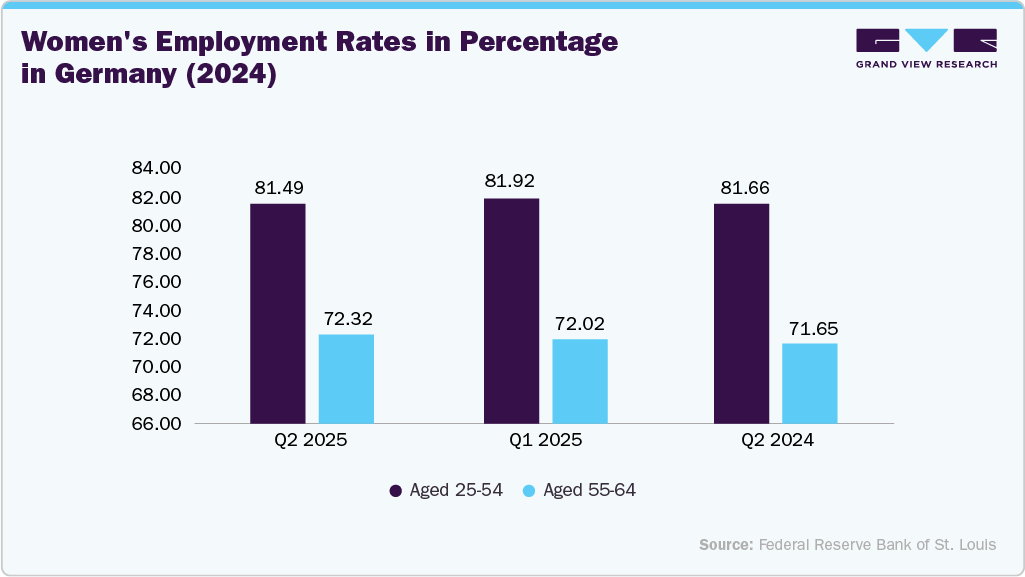

Europe Breast Pump Market Trends

The Europe breast pump industry is growing with a significant CAGR over the forecast period, owing to the growing birth rate coupled with rising women's employment in the region. Working women face challenges in managing and providing necessary nutrition to their babies, which increases neonatal mortality if not properly catered to. Breast pumps make it easier for working mothers to feed their babies properly. Moreover, rising awareness among target consumers, i.e., lactating mothers, about the benefits of breastfeeding, is expected to create growth opportunities for the European breast pump market in the coming years. High disposable income, combined with technological advancements, is also a prominent driving factor for the regional market.

The UK breast pumps market is still in the nascent stage and thus has many growth opportunities owing to increasing awareness and supportive government initiatives. Various initiatives, including the Baby Friendly Initiative (BFI) Annual and Neonatal Conferences, bring healthcare professionals together to exchange knowledge, network, and engage with new ideas and evidence-based approaches in infant feeding and relationship-focused care. Moreover, an increasing number of milk banks in the UK is also expected to boost the demand for breast pumps. For instance, according to data published by the European Milk Bank Association (EMBA), there are approximately 15 breast milk banks in the UK, which provide donor milk to premature infants.

Collaboration among various stakeholders has played a crucial role in the growth and development of the breast pump market in the UK. This collective effort encompasses partnerships among manufacturers, online platforms, healthcare professionals, government bodies, and consumer advocacy groups, fostering a robust ecosystem that promotes innovation, awareness, and accessibility. For instance, in March 2024, Boots, the UK's health and beauty retailer, announced its partnership with Momcozy, the ultra-popular M5 Wearable Breast Pump maker, and a wide range of maternity care products.

The breast pump market in Germany is experiencing significant growth, driven by the high rate of working mothers who are encouraged to breastfeed while balancing professional responsibilities. Wearable pumps enable discreet and hands-free pumping, making them an attractive solution. Germany offers ample maternity leave and parental support, encouraging mothers to breastfeed for longer durations. This creates a demand for convenient solutions such as breast pumps.

The rising employment rate among women is contributing significantly to the market growth. As more women return to work after childbirth, the need for efficient milk-expression solutions increases, driving demand for electric, wearable, and portable pumps. This shift in workforce participation directly supports market expansion.

Asia Pacific Breast Pump Market Trends

The Asia Pacific breast pump industry is expected to grow at the fastest CAGR of 13.60% from 2026 to 2033, driven by a combination of cultural shifts, increasing awareness of the benefits of breastfeeding, and rising disposable incomes. Countries like China, India, and Japan are experiencing a surge in demand for breast pumps as working mothers seek convenient solutions for breastfeeding. In urban areas, where women are joining the workforce, the adoption of breast pumps is becoming more common due to the need for flexibility and efficiency. Additionally, governments and healthcare organizations across the region are promoting breastfeeding and maternal health, which further drives market growth.

The China breast pump market is expected to grow over the forecast period. China is a key player in the Asia Pacific market, with significant growth anticipated over the forecast period. China is witnessing significant growth. As more women in China join the workforce, the demand for convenient and efficient breastfeeding solutions has surged. Wearable breast pumps provide the flexibility and discretion that working mothers need, allowing them to continue breastfeeding while balancing professional commitments. In 2023, China's female labor force participation rate was 60.5%. China's growing middle class has increased disposable incomes, allowing families to invest in premium products such as breast pumps.

Latin America Breast Pump Market Trends

The Latin America breast pump industry is experiencing steady growth, driven by the increasing number of working mothers and growing awareness of the importance of breastfeeding. Countries like Brazil, and Argentina are seeing a rise in demand for breastfeeding solutions, especially as urbanization increases and more women enter the workforce. Access to modern healthcare and an increasing focus on maternal and child health have also contributed to the adoption of breast pumps.

Middle East & Africa Breast Pump Market Trends

The Middle East & Africa breast pump industry is witnessing growth, driven by increasing urbanization, changing social dynamics, and rising awareness of the benefits of breastfeeding. In countries such as Saudi Arabia, the UAE, and South Africa, an increasing number of women are entering the workforce, resulting in a higher demand for breastfeeding solutions that offer convenience and flexibility. Healthcare initiatives and government campaigns promoting maternal health and breastfeeding are also encouraging the adoption of breast pumps.

Key Breast Pump Company Insights

The breast pump markettrends are shaping the strategies of industry leaders. Heavy investments in research and development for technological innovations reflect a commitment to connected healthcare solutions. Top players are adapting to the shift towards user comfort through technological advancements, and innovative products. Technological advancements have been continuous, with the emergence of smart and connected devices. These innovative breast pumps enable users to monitor and manage their pumping sessions via mobile apps. The prevalence of Bluetooth connectivity, data tracking capabilities, and customizable features has been on the rise.

Key Breast Pump Companies:

The following are the leading companies in the breast pump market. These companies collectively hold the largest market share and dictate industry trends.

- Ameda (International Biomedical, Ltd.)

- Hygeia Health

- Medela AG

- Koninklijke Philips N.V.

- Lansinoh Laboratories, Inc. (Pigeon Corporation)

- Motif Medical

- Willow Innovations, Inc.

- Uzin Medicare (Spectra Baby)

- Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.)

- Tommee Tippee (Shanghai Jahwa United Co., Ltd)

- Haakaa

- Ardo Medical AG

- KISSBOBO

- Freemie

- LaVie Mom

- Annabella-Pump

- LuvLap

- Bellababy

- BabyBuddha Products (Shanghai Jahwa United Co., Ltd)

Recent Developments

-

In May 2025, Medela launched its latest innovation in breast pump technology: The Magic InBra, a next-generation wearable breast pump. Designed to deliver hospital-grade performance, the Magic InBra features FluidFeel Technology, offering superior comfort, high efficiency, and hands-free convenience. This launch reflects Medela’s continued commitment to providing advanced, user-centric solutions for breastfeeding mothers.

-

In January 2025, Willow announced the launch of its latest innovations-the Silicone Wearable Breast Pump, Glass Breast Milk Pitcher, and Breast Milk Storage Bags-demonstrating its ongoing commitment to developing solutions that enhance and support the maternal journey for every parent.

-

In July 2024, KISSBOBO launched the M1, a new era in breast pumping. The M1 Breast Pump offers 19 adjustable suction levels, allowing mothers to personalize their pumping experience and find the most comfortable and effective strength.

-

In March 2024, Willow Innovations, Inc. introduced Willow 360, a new and improved wearable breast pump system designed to enhance the breastfeeding experience. With enhanced leak-proof technology, a user-friendly app, and personalized services, Willow 360 empowers moms with greater freedom and support.

-

In January 2024, Annabella announced its seed funding of USD 8.5 million and its entrance into the U.S. market. Annabella has sold approximately 4,000 breast pumps in Israel since February 2023. This expansion demonstrates Annabella's product excellence, illustrated by its patented, FDA-cleared breast pump, which provides mothers with a product comparable to breastfeeding while emphasizing efficiency and comfort.

-

In November 2023, Pigeon officially unveiled the much-anticipated release of its second-generation GoMini Electric Breast Pump, known as the GoMini Plus.

-

In August 2023, Lansinoh introduced the Lansinoh Wearable Pump as part of their commitment to "Stand with the Mothers," offering support to new moms through products and resources to simplify their journey.

Breast Pump Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.76 billion

Revenue forecast in 2033

USD 2.92 billion

Growth rate

CAGR of 7.55% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Technology, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ameda (International Biomedical, Ltd.); Hygeia Health; Medela AG; Koninklijke Philips N.V.; Lansinoh Laboratories, Inc. (Pigeon Corporation); Motif Medical; Willow Innovations, Inc.; Uzin Medicare (Spectra Baby); Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.); Tommee Tippee (Shanghai Jahwa United Co., Ltd); Haakaa; Ardo medical AG; KISSBOBO; Freemie; LaVie Mom; Annabella-Pump: LuvLap, Bellababy, BabyBuddha Products (Shanghai Jahwa United Co., Ltd)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Pump Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global breast pump market report based on technology, distribution channel, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual Pumps

-

Wearable (Hands-free)

-

Electric Pumps

-

Double Pumps

-

Single Pumps

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Home/Consumers (Rental/Purchase)

-

Hospitals (Multi-patient use)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast pump market size was estimated at USD 1.64 billion in 2025 and is expected to reach USD 1.76 billion in 2026.

b. The global breast pump market is expected to grow at a compound annual growth rate of 7.55% from 2026 to 2033 to reach USD 2.92 billion by 2033.

b. North America dominated the breast pump market with a share of 53.61% in 2025. This is attributable to high women employment rates, healthcare expenditure, sophisticated healthcare infrastructure, and patient awareness levels.

b. Some key players operating in the breast pump market include Ameda (International Biomedical, Ltd.); Hygeia Health; Medela AG; Koninklijke Philips N.V.; Lansinoh Laboratories, Inc. (Pigeon Corporation); Motif Medical; Willow Innovations, Inc.; Uzin Medicare (Spectra Baby); Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.); Tommee Tippee (Shanghai Jahwa United Co., Ltd); Haakaa; Ardo medical AG; KISSBOBO; Freemie; LaVie Mom; Annabella-Pump: LuvLap, Bellababy, BabyBuddha Products (Shanghai Jahwa United Co., Ltd)

b. Key factors that are driving the breast pump market growth include a favorable change in reimbursement policies, technological advancements, increasing patient disposable income and awareness levels, and growing female employment rates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.