- Home

- »

- Plastics, Polymers & Resins

- »

-

Breathable Films Market Size & Share, Industry Report, 2033GVR Report cover

![Breathable Films Market Size, Share and Trends Report]()

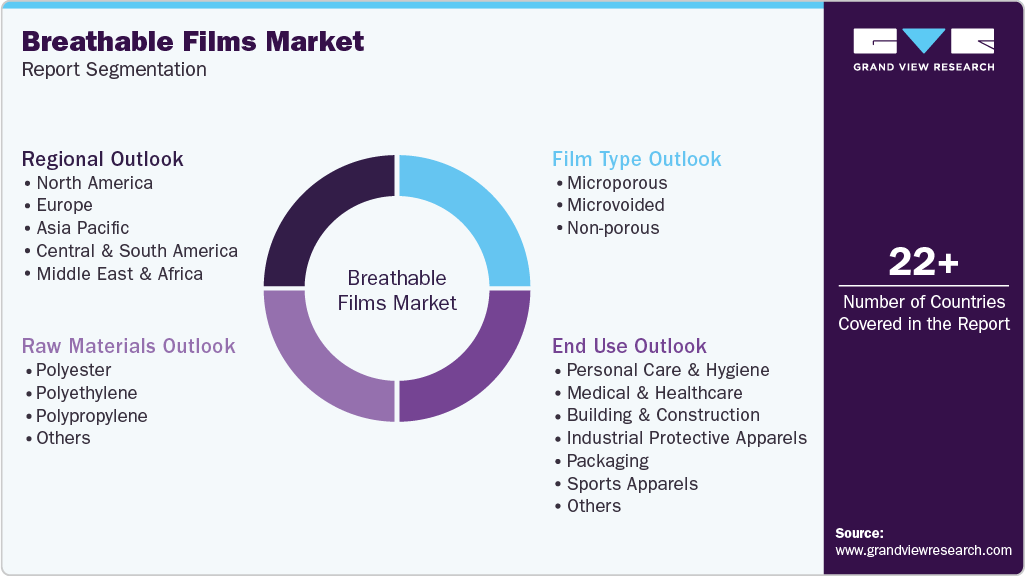

Breathable Films Market (2025 - 2033) Size, Share and Trends Analysis Report By Raw Material (Polyester, Polyethylene, Polypropylene), By Film Type (Microporous, Microvoided, Non-porous), By End Use (Personal Care & Hygiene), By Region And Segment Forecasts

- Report ID: GVR-1-68038-072-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Breathable Films Market Summary

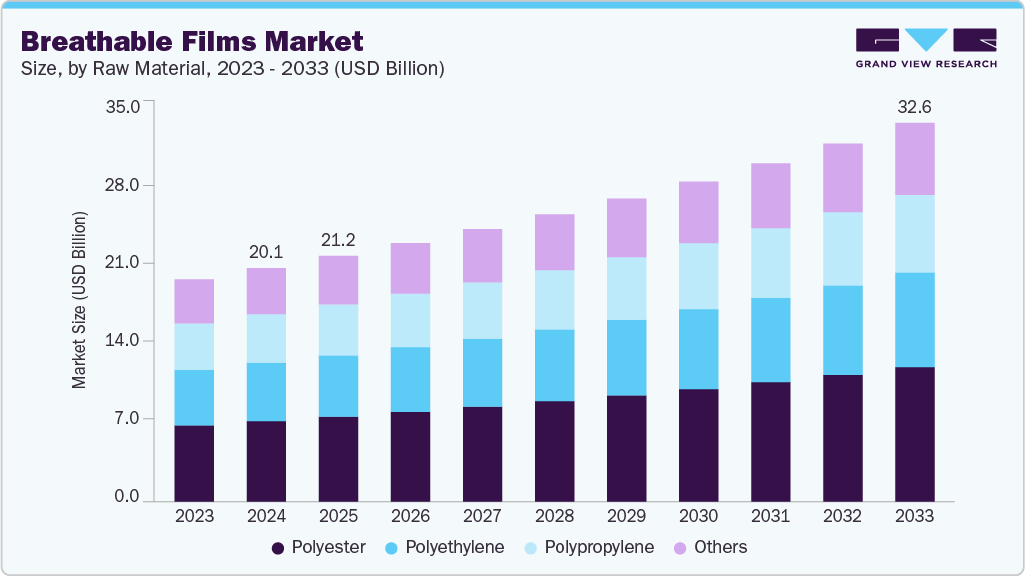

The global breathable films market size was estimated at USD 20.12 billion in 2024 and is projected to reach USD 32.65 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The increase in consumer preferences for hygienic products across the globe is expected to propel the market in the coming years.

Key Market Trends & Insights

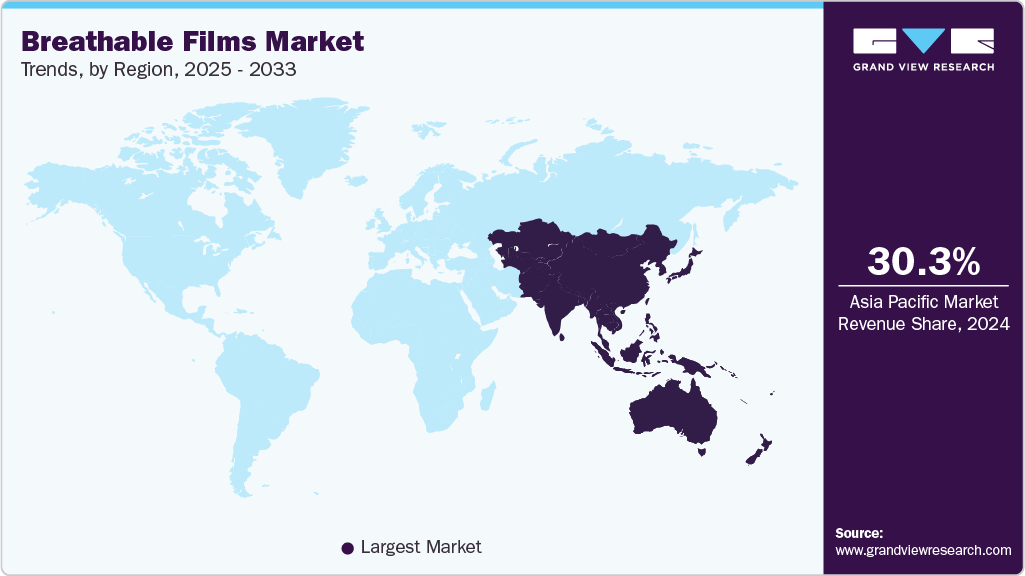

- Asia Pacific dominated the breathable films market with the largest revenue share of 30.35% in 2024.

- The breathable films market in China is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033.

- By raw material, the polyester segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue.

- By end use, packaging dominated the end-use segment with a revenue share of 40.47% in 2024, and is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 20.12 billion

- 2033 Projected Market Size: USD 32.65 billion

- CAGR (2025 - 2033): 5.6%

- Asia Pacific: Largest market in 2024

Breathable films are mainly used in various applications such as feminine hygiene, adult incontinence products, surgical drapes, and diapers. It is used in various end-use industries such as food packaging, medical, construction, sports apparel, and others, owing to its properties, including UV stability, dispersion, extended shelf life, processability, and breathability levels. Moreover, the transition to sustainable packaging options is promoting the adoption of breathable films in both food and industrial packaging, especially for products sensitive to moisture. Innovations in film production technologies, including co-extrusion and microporous film technology, are also driving product development, improving breathability while maintaining barrier performance.

Breathable films are primarily produced using materials like polyethylene (PE), polypropylene (PP), and thermoplastic polyurethane (TPU), with PE holding a significant share due to its affordability and excellent moisture vapor transmission characteristics. Microporosity in the film structure is often achieved by adding calcium carbonate (CaCO₃) as a filler. Microporous PE films are prevalent in hygiene products because of their soft feel and high flexibility. Films made from TPU are increasingly popular in the medical and protective clothing industries due to their outstanding elasticity, water resistance, and breathability.

The availability, cost, and recyclability of these polymers and fillers play crucial roles in market trends. As sustainability becomes increasingly important, manufacturers are more frequently investigating bio-based and recyclable polyolefins to meet changing regulatory and consumer expectations.

Moreover, the increasing focus on comfort, infection prevention, and skin health in medical settings is boosting demand. Moreover, the trend towards breathable packaging materials that maintain product freshness while reducing condensation is promoting use in food and industrial sectors. Regulatory guidelines that advocate for product safety and skin compatibility are also driving innovation in film formulations worldwide.

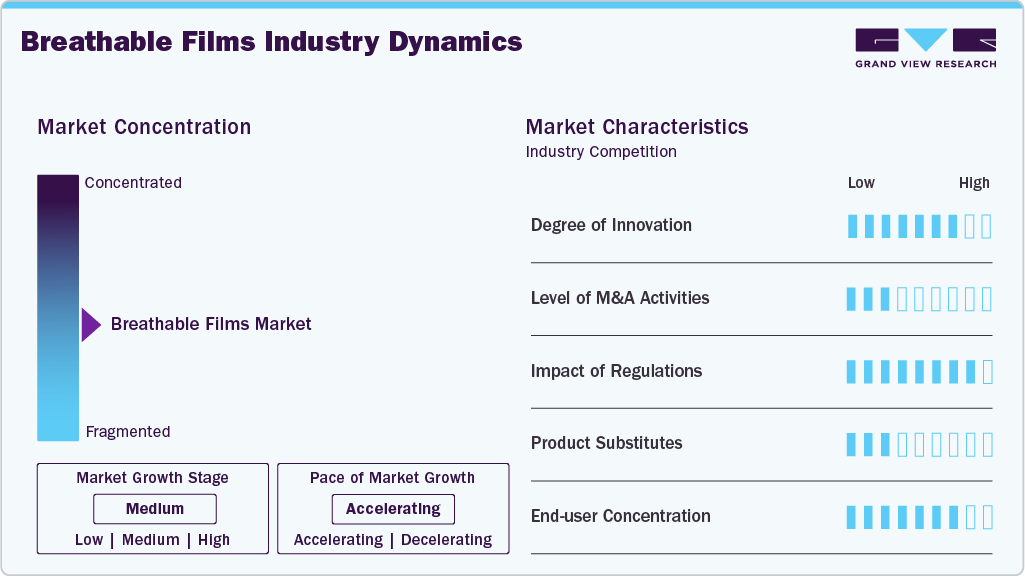

Market Concentration & Characteristics

The market growth stage of the breathable films market is high, and the pace is accelerating. The market exhibits slight market fragmentation, with key players dominating the industry landscape. Major companies like Schweitzer-Mauduit International, Inc., Arkema, Berry Global, Inc., Fatra, a.s., Kimberly-Clark, Nitto Denko Corporation, Rahil Foam Pvt. Ltd., RKW North America, Inc., SILON s.r.o., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

The market for breathable films is projected to demonstrate a moderate-to-high level of consolidation, with significant strategic mergers and acquisitions (M&A) being crucial for enhancing geographic reach, diversifying product lines, and incorporating advanced film technologies. Major players are targeting niche manufacturers to bolster their presence in rapidly growing sectors such as medical and hygiene applications.

Regulatory policies, particularly in North America and Europe, are majorly influencing the market, with stringent compliance requirements regarding skin sensitivity, recyclability, and chemical safety (such as REACH and FDA guidelines) fostering material innovation and sustainable practices. These regulations are anticipated to further spur the advancement of eco-friendly and biodegradable breathable films.

However, non-breathable films and woven/nonwoven fabrics may offer limited competition in applications focused on cost or lower performance; however, breathable films maintain a leading position where comfort, moisture control, and skin safety are paramount. The market shows a moderate level of concentration among end-users, especially in the hygiene and medical sectors, where a handful of major multinational companies and OEMs hold a significant portion of the demand. These buyers have a strong impact on supplier specifications, pricing, and sustainability criteria. Therefore, it is essential for suppliers to align with shifting end-user preferences and regulatory requirements to stay competitive in the long run.

Raw Materials Insights

Polyester resin dominated the overall market with a revenue share over 34% of the total demand in 2024. Polyester exhibits moisture resistance, durability, and strength, making it suitable for use in the manufacturing of diapers, sanitary napkins, masks, and others.

Polyethylene (PE) is another segment that is expected to grow at a steady pace over the forecast period. Polyethylene films are mainly used in building and construction, medical, and sports apparel. Furthermore, advancements in the research and development (R&D) sector and manufacturing technology across the major regions of construction sites are expected to fuel the polyethylene (PE) demand in the breathable films market.

Another raw material majorly used is polypropylene (PP), which is mostly known for its properties including heat & fatigue resistance, rigidity, and low density, making it suitable for applications related to medical, industrial, and construction.

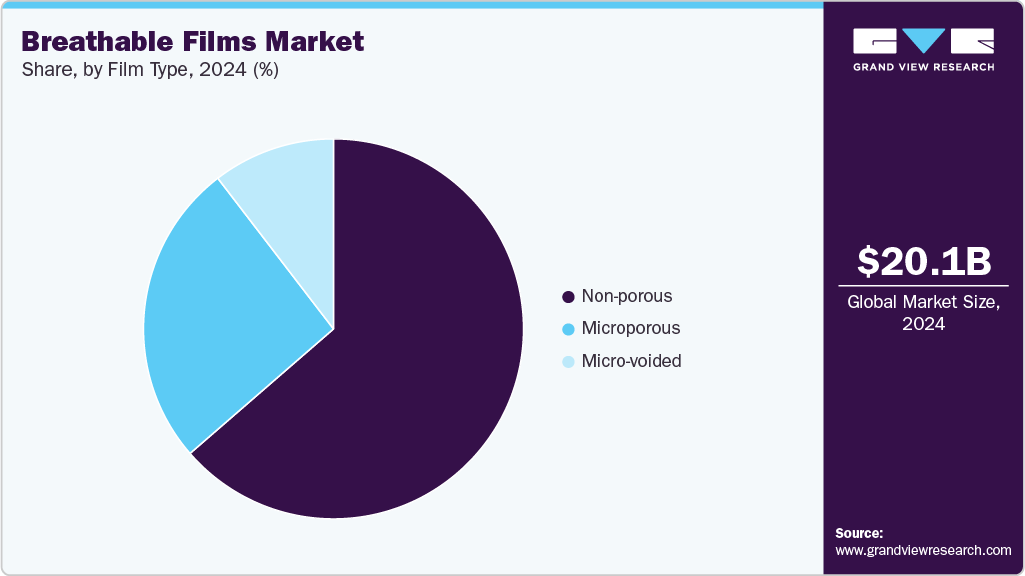

Film Type Insights

Non-porous films emerged as the dominant application segment for the breathable films market, accounting for 63.62% revenue share in 2024. Such significant consumption can be attributed to usage in products such as diapers, napkins, sanitary products, and clothing apparel. The properties of non-porous films, such as high permeability, strength, vapor transmission, and bacteria & virus resistance, make it widely preferable over microporous and micro-voided films.

Microporous film is predicted to witness a steady growth rate over the forecast period. Due to their versatile properties, such as low thermal connectivity and interconnected pores, there is an increasing demand for microporous film materials across industries such as consumer goods and medical. These materials are suitable for the manufacturing of sports apparel, gym wear, and hygiene products.

End Use Insights

Packaging emerged as the dominant end-use segment for the breathable films market, accounting for 40.47% revenue share in 2024. Breathable films find usage in food packaging, medical instruments, and consumer goods, among others. Breathable films are widely used in the packaging of beverage bottles, apparel, food preparations, electronic components, and other areas where moisture control is a requisite.

Another end-use segment is the medical and healthcare industry, which is expected to grow at a steady pace over the forecast period. The market for breathable films in the medical and healthcare sector is anticipated to experience steady growth, propelled by a rising demand for innovative wound care, infection control, and solutions aimed at enhancing patient comfort. Breathable films are commonly utilized in surgical gowns, drapes, and wound dressings due to their capability to provide a barrier against liquids and pathogens while permitting moisture vapor transmission. An increase in surgical procedures, particularly among aging populations and those managing chronic diseases, is driving the need for high-quality medical films.

Furthermore, the heightened focus on preventing hospital-acquired infections (HAIs) is prompting healthcare providers to implement protective apparel and drapes that feature superior barrier properties. Advances in technology related to breathable film lamination and microporous film designs are enabling manufacturers to produce lightweight, skin-friendly, and hypoallergenic products that align with patient-centered care standards. In addition, rigorous healthcare regulations and product quality certifications are promoting the adoption of certified breathable films that comply with both safety and performance criteria.

Regional Insights

Asia Pacific is characterized by a rapidly evolving landscape for heavy manufacturing, food & beverages, clothing & apparel, and healthcare consumables. The region accounted for 30.35% of the global revenue share in 2024 and shall grow at a CAGR of 6.0% over the forecast period. Additionally, strengthening of supply chain logistics for various commodities in Southeast Asia shall provide impetus for the growth in demand for breathable films in packaging applications.

China Breathable Films Market Trends

China's market for breathable films is expected to experience substantial growth, driven by rapid urban development, rising disposable income, and increased awareness of health and hygiene. The escalating consumption of disposable diapers for babies, feminine hygiene products, and adult incontinence supplies in both urban and rural areas is propelling demand. Moreover, improvements in China's medical infrastructure and the surge in surgical procedures are enhancing the need for breathable films in applications like wound care, gowns, and drapes.

North America Breathable Films Market Trends

The North American market for breathable films is expected to grow steadily, driven by strong demand in the hygiene, medical, and industrial sectors. This region demonstrates high per capita consumption of disposable hygiene products, such as baby diapers, feminine hygiene items, and adult incontinence solutions, which is bolstered by an aging population and increased consumer awareness of comfort and skin health. In the healthcare sector, the growing number of surgical procedures, stringent infection control regulations, and the demand for breathable barrier materials in gowns, drapes, and wound care products are propelling market expansion. Furthermore, compliance with FDA and EPA regulations ensures consistent quality and safety standards, encouraging the use of innovative breathable films.

The U.S. breathable films market dominated the North American region with over 62% revenue share in 2024. The market in the U.S. is anticipated to expand due to robust demand from the hygiene and medical industries, propelled by elevated healthcare expenditure, an older demographic, and a consumer inclination towards premium, skin-friendly options. The stringent regulatory landscape in the country, which includes FDA regulations for medical films and consumer safety, fosters the use of high-performance, breathable materials. Moreover, a growing emphasis on sustainability and domestic production is stimulating advancements in recyclable and bio-based film alternatives, which supports ongoing market development.

Europe Breathable Films Market Trends

The market for breathable films in Europe is projected to grow consistently, backed by robust regulatory measures that encourage safety, sustainability, and product effectiveness, especially in hygiene and healthcare sectors. The increasing need for environmentally friendly and skin-sensitive materials in baby diapers, adult incontinence items, and medical textiles is a major factor, influenced by consumer awareness and stringent adherence to REACH and CE certification standard.

Key Breathable Films Company Insights

The key players operating in the breathable films market include Schweitzer-Mauduit International, Inc., Arkema, Berry Global, Inc., Fatra, a.s., Kimberly-Clark, Nitto Denko Corporation, Rahil Foam Pvt. Ltd., RKW North America, Inc., SILON s.r.o, SKYMARK, Daika Kogyo, and others, owing to the presence of top regional players.

Governmental support in various countries focused on environmental concerns, as well as evolving consumer-enterprise transactions in the textiles, automotive, and packaging industries, has forced industry players to focus on consumer-specific positioning strategies for higher penetration in the local markets.

Key Breathable Films Companies:

The following are the leading companies in the breathable films market. These companies collectively hold the largest market share and dictate industry trends.

- Schweitzer-Mauduit International, Inc.

- Arkema

- Berry Global, Inc

- Fatra, a.s.

- Kimberley - Clark

- Nitto Denko Corporation

- Rahil Foam Pvt. Ltd.

- RKW North America, Inc.

- SILON s.r.o

- SKYMARK

- Daika Kogyo

- American Polyfilm

- Innovia Films

- Mitsui Chemicals, Inc.

- Omya AG

Breathable Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.16 billion

Revenue forecast in 2033

USD 32.65 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in tone, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw materials, film type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Brazil; GCC Countries

Key companies profiled

Schweitzer-Mauduit International, Inc.; Arkema; Berry Global, Inc; Fatra, a.s.; Kimberley - Clark; Nitto Denko Corporation; Rahil Foam Pvt. Ltd.; RKW North America, Inc.; SILON s.r.o; SKYMARK; Daika Kogyo; American Polyfilm; Innovia Films; Mitsui Chemicals, Inc.; Omya AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breathable Films Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global breathable films market report based on the raw materials, film type, end use, and region:

-

Raw Materials Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Polyester

-

Polyethylene

-

Polypropylene

-

Others

-

-

Film Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Microporous

-

Microvoided

-

Non-porous

-

-

End Use Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Personal Care & Hygiene

-

Medical & Healthcare

-

Building & Construction

-

Industrial Protective Apparels

-

Packaging

-

Sports Apparels

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global breathable films market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 32.65 billion by 2033.

b. The packaging application segment dominated the breathable films market with a share of 40.47% in 2024. This is attributed to the rising product demand from various applications such as food & beverages, pharmaceuticals, cosmetics, and others.

b. Some key players operating in the breathable films market include Arkema, Fatra, a.s., Kimberley-Clark Corporation, Nitto Denko Corporation, Rahil Foam Pvt. Ltd., RKW Group, SILON s.r.o, Skymark, Megaplast, and Berry Global, Inc.

b. Key factors that are driving the market growth include breathable films application for convenience food & beverage packaging, sports, and protective apparels such as masks and gloves.

b. The global breathable films market size was estimated at USD 20.12 billion in 2024 and is expected to reach USD 21.16 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.