- Home

- »

- Medical Devices

- »

-

BRIC Oral Care Market Size, Share Analysis, Report, 2030GVR Report cover

![BRIC Oral Care Market Size, Share & Trends Report]()

BRIC Oral Care Market Size, Share & Trends Analysis Report By Product (Toothbrush, Toothpaste, Mouthwash/Rinse, Dental Products, Dental Accessories), By Distributional Channels, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-207-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

BRIC Oral Care Market Size & Trends

The BRIC oral care market size was valued at USD 11.2 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. This growth is attributed to the high degree of awareness about oral health, technological advancement in oral care products, surge in demand for dental services, and rising disposable income.

The higher availability of professional dentists, cost-effective dental treatment, provision of government insurance plans and rising awareness about oral health are the potential driving factors for the overall BRIC market’s growth.

The government authorities are highly focusing on dental health by providing favorable health insurance plan with dental services. Russian insurance plan includes certain dental procedures such as preventive care, restorative treatment, and certain types of surgical procedures. Moreover, private insurance plans in Russia may offer more comprehensive coverage for dental care, including coverage for cosmetic procedures and orthodontic treatment. Such government moves are likely to enhance demand of oral care products in market.

Market Concentration & Characteristics

The market is characterized by a high degree of merger and acquisition activities undertaken by key players in the country. The market is also highly influenced by technological innovation and new oral care products. This is due to the increasing preference of consumers for innovative products and the rising importance of oral care.

Several oral care companies are expanding their product portfolio, featuring the significance of oral care products and innovation. For instance, in February 2024, Unilever announced the acquisition of the premium haircare K18 brand to expand its geographical existence and company portfolio.

The market is also witnessing a high degree of new product development and technological advancement. For instance, in November 2023, Kent Brushes launched its SONIK electric toothbrush. These toothbrushes are designed to provide deeper cleaning using ultrasonic pulses, high-quality bristles, a super-fast charging facility, and lightweight waterproof designs.

Furthermore, regulatory authorities of the country help with the market growth. For instance, in Russia, the Federal Service regulates dental care for Surveillance in Healthcare (Roszdravnadzor). This agency provides licensing and certification to dentists and dental service providers.

Several key players focus on expanding the product portfolio to engage more consumers and improve product sales. For instance, in April 2022, Phillips India launched a unique range of Sonicare toothbrushes with innovative features for product expansion. This aims to provide three to seven times more protection than manual toothbrushes with high-grade technology advancement.

Product Insights

Based on products, the toothpaste segment dominated this market with a revenue share of about 25.4% in 2023. This growth is attributed to rising awareness of oral health and innovative product launches in BRIC countries. Moreover, the presence of modernized features and higher efficiency of these products results in greater adoption of these products. For instance, in March 2023, Colgate-Palmolive launched innovative toothpaste in the market. Colgate’s Total Plaque Pro toothpaste fights against plaque bacteria using smart foam technology.

Furthermore, the toothbrush segment is expected to witness the fastest CAGR from 2024 to 2030. Increasing awareness about oral care, rising usage of novel technology based oral care products and its multiple applications, is likely to fuel market growth. Moreover, key manufacturers in the oral care market aims to focus on the advanced technology and innovation to offer high quality and efficiency products to consumers. For instance, in January 2023, Indian oral care company, Perfora launched first oscillating toothbrush with unique design and features. This toothbrush consists of rotating head and innovative brushing technique.

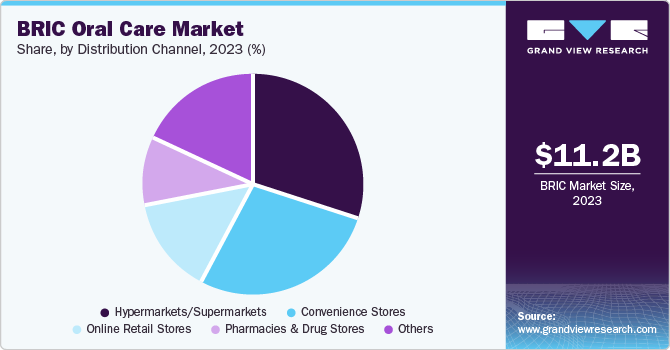

Distribution Channels Insights

Based on the distribution channels, supermarkets/hypermarkets dominated the market share in 2023 owing to the availability of widely spread supermarkets and hypermarkets in the region. Moreover, robust discounts of stores reduce the cost burden of retailers and consumers, in turn leading to market growth. This strategic move aims to make it affordable for low-income families.

The online retail segment is projected to witness the fastest CAGR over the forecast years. The driving factors of the market include the provision of online platform to offer orthodontic services and digital guidance to the consumers. Moreover, some of the key players collaborating with dental professionals to serve digital orthodontic services, thereby leveraging the growth of this segment. For instance, in February 2023, Grin started providing digital orthodontic platform with association with local dentists in Brazil. This platform offers remote monitoring for teeth straightening and oral care services.

Country Insights

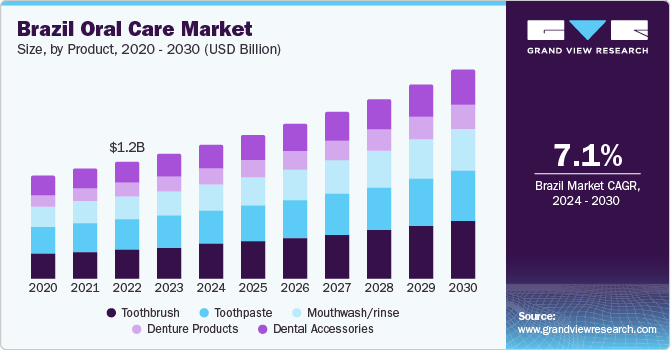

Brazil Oral Care Market Trends

Brazil dominated market with revenue share of with 11.5% in 2023. This is owing to presence of high number of dentists and dental services. According to the Federal Council of Dentistry, Brazil consists of more than 3,80,000 dentists, out of which 30,000 are orthodontist specialists. Moreover, Brazil has the world’s largest number of dentists, equivalent to almost 20.0% worldwide. Presence of well structure dental services and professionals serve driving force to surge the market growth.

Russia Oral Care Market Trends

Oral Care Market in Russia is expected to grow with fastest CAGR from 2024 to 2030. Rising consequences of Dental conditions and support provided by government, is likely to impact market growth. The Russian government bodies undertake various initiative to improve access to dental care and to educate the public about the importance of oral hygiene. According to latest data of WHO, the dental caries is highly prevalent in Russia with 63% of adults of 35-44 years of age. Moreover, the availability of well-skilled dentists and cost-effective treatment is likely to witness growth over the forecast period.

India Oral Care Market Trends

India oral care market is projected to grow with highest CAGR rate over the forecast years. This growth can be attributed to rising innovative products, escalating awareness of dental health amongst population, and dentists’ recommendations of dental services. Moreover, higher adoption of oral healthcare practices and initiatives undertaken by the government to improve dental hygiene. For instance, in March 2023, the National Oral Health Program was launched to prevent-control-and manage the oral disease burden in India.

China Oral Care Market Trends

Oral Care Market in China is expected to grow at the fastest CAGR over the forecast period, due to growing awareness of oral health in the younger generation and government policies to promote good health. As per the 2018 report published by Nature, government of China launched plan of The Healthy China 2030 Blueprint, which showcased the importance of developing comprehensive oral care hygiene in the local population.

Key BRIC Oral Care Market Company Insights

The leading companies in BRIC oral market include Fresh Up Italia, The Procter & Gamble Company, Colgate-Palmolive, Johnson & Johnson, Dental-S (RUS)Dent-a-Med (RUS), Colgate Palmolive, Hindustan Lever Limited, and Dabur India, Unilever PLC., Guangzhou Weimeizi Industrial Co. Ltd., Oral Essentials Inc, SaarGummi Group among others.

The competition between key leading players is likely to increase due to new product launches with technological advancement, geographical expansion, mergers and acquisitions through collaborations, and strategic initiatives. For instance, in February 2022, Colgate- Palmolive launched public health initiative to introduce global oral health quotient amongst population. This initiative aimed to help consumer to understand oral health and its significance.

Key BRIC Oral Care Companies:

- The Procter & Gamble Company

- Fresh

- Condor Sa

- Colgate-Palmolive

- Johnson & Johnson

- Hindustan Unilever (HUL)

- Dabur

- Patanjali

- Pfizer

- Dentsply Sirona

- Henry Schein

- SaarGummi Group

- Guangzhou weimeizi Industrial Co. Ltd

- Oral Essentials inc.

Recent Developments

-

In January 2024, Dr. Dento, an emerging oral care company in India announced the launch of its new range of products. The new range of products aim to focus on the natural ingredients to provide high degree of oral health and protection from tooth gums. These products include electric toothbrushes, toothpaste, and mouthwash with GMP certification and advanced technology.

-

In September 2023, Chinese brand Usmile announced the launch of Y10 Pro sonic electric toothbrush in U.S. This toothbrush possess 24/7 reminder, real-time brushing tracker and long-term runtime and timer. It has six-axis gyroscope sensor that offer responsive brushing experience to consumers.

-

In June 2023, three leading players of Brazil including Shofu Inc., Sun Medical Co., Ltd., and Mitsui Chemicals, Inc collaborated and announced launch of “Super-Bond” dental adhesives in market. The Super-Bond dental adhesives can be used to fix mobile teeth, to create bonded bridges and to adhere brackets and ceramic prosthetics.

BRIC Oral Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.9 billion

Revenue Forecast in 2030

USD 18.6 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Product, distribution channels, region

Country scope

Brazil; Russia; India; China

Key companies profiled

The Procter & Gamble Company; Fresh; Condor Sa; Colgate-Palmolive; Johnson & Johnson; Hindustan Unilever (HUL); Dabur; Patanjali

Pfizer; Dentsply Sirona; Henry Schein; SaarGummi Group; Guangzhou weimeizi Industrial Co. Ltd; Oral Essentials inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

BRIC Oral Care Market Report Segmentation

This report forecasts revenue growth at and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the BRIC oral care market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Toothbrush

-

Manual

-

Electric (Rechargeable)

-

Battery-powered (Non-rechargeable)

-

Others

-

-

Toothpaste

-

Gel

-

Polish

-

Paste

-

Powder

-

-

Mouthwash/rinse

-

Medicated

-

Non-medicated

-

-

Denture Products

-

Cleaners

-

Fixatives

-

Floss

-

Others

-

-

Dental Accessories

-

Cosmetic Whitening Products

-

Fresh Breath Dental Chewing Gum

-

Tongue Scrapers

-

Fresh Breath Strips

-

-

Others

-

Oral Irrigators

-

Countertop

-

Cordless

-

-

Mouth Freshener Sprays

-

-

-

Distribution Channels Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Pharmacies and drug stores

-

Convenience Stores

-

Online retail stores

-

Other

-

Frequently Asked Questions About This Report

b. The BRIC oral care market size was estimated at USD 11.2 billion in 2023 and is expected to reach USD 11.9 billion in 2024.

b. The BRIC oral care market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 18.6 billion by 2030.

b. Based on products, the toothpaste dominated the market with a revenue share of about 25.4% in 2023. This growth is attributed to the rising awareness or oral health and innovation product launches in BRIC countries

b. The leading players of BRIC oral market include Fresh Up Italia, The Procter & Gamble Company, Colgate-Palmolive, Johnson & Johnson, Dental-S (RUS)Dent-a-Med (RUS), Colgate Palmolive, Hindustan Lever Limited, and Dabur India, Unilever PLC., Guangzhou Weimeizi Industrial Co. Ltd., Oral Essentials Inc, SaarGummi Group among others.

b. The higher availability of professional dentists, cost-effective dental treatment, provision of government insurance plans and rising awareness about oral health are the potential driving factors for the overall market growth in BRIC.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."