- Home

- »

- IT Services & Applications

- »

-

Broadcast Scheduling Software Market, Industry Report 2030GVR Report cover

![Broadcast Scheduling Software Market Size, Share & Trends Report]()

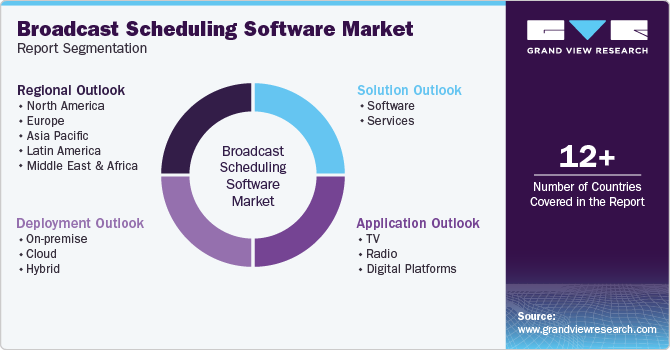

Broadcast Scheduling Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Software, Services), By Deployment (On-premise, Cloud, Hybrid), By Application (TV, Radio, Digital Platforms), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-466-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Broadcast Scheduling Software Market Summary

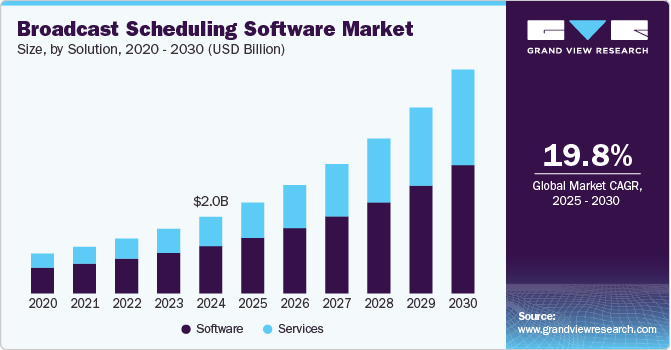

The global broadcast scheduling software market size was estimated at USD 2.01 billion in 2024 and is projected to reach USD 5.88 billion by 2030, growing at a CAGR of 19.8% from 2025 to 2030. As consumers transition from traditional TV viewing to on-demand digital streaming services, broadcasters are required to manage complex schedules that integrate live TV, pre-recorded content, and multi-platform distribution.

Key Market Trends & Insights

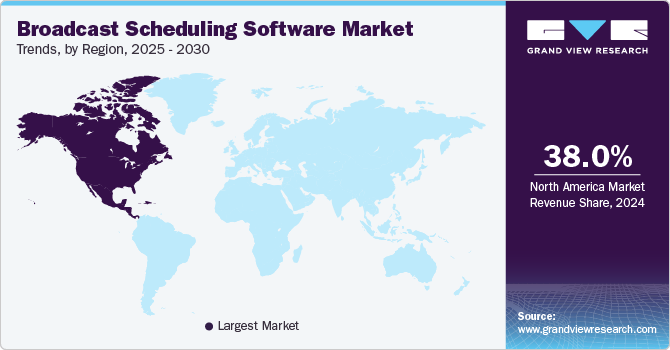

- North America broadcast scheduling software market held the largest share of over 38.0% in 2024.

- The broadcast scheduling software market in the U.S. is expected to grow significantly at a CAGR of 16.4% from 2025 to 2030.

- In terms of solution, the software segment dominated the market and accounted for a revenue share of around 62.0% in 2024.

- In terms of deployment, the cloud segment accounted for the largest revenue share of over 51.0% in 2024.

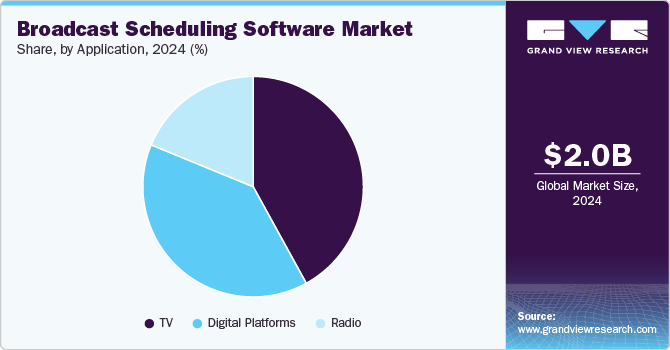

- In terms of application, the TV segment accounted for the largest revenue share of over 42.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.01 Billion

- 2030 Projected Market Size: USD 5.88 Billion

- CAGR (2025-2030): 19.8%

- North America: Largest market in 2024

This complexity necessitates advanced scheduling solutions to ensure seamless content delivery, boosting the demand for broadcast scheduling software. The rising adoption of AI and automation technologies within the media sector contributes to the growth of the broadcast scheduling software industry. Broadcast scheduling software that integrates AI capabilities can predict viewer preferences, optimize ad placements, and ensure efficient allocation of airtime, significantly enhancing operational efficiency and viewer engagement.

Automation reduces human errors and simplifies the management of vast content libraries, making it a vital tool for broadcasters aiming to stay competitive in a dynamic market. For instance, in December 2024, Amagi, an India-based provider of cloud-based SaaS solutions for broadcast and connected TV (CTV), acquired Argoid AI, a U.S.-based AI company specializing in automation for OTT platforms. This strategic move enhances Amagi’s ability to offer advanced tools for content planning, distribution, and monetization. By incorporating Argoid AI’s cutting-edge algorithms into its platform, Amagi aims to elevate the capabilities of its Amagi NOW and CLOUDPORT products, enabling media companies to streamline and personalize content scheduling on a larger scale.

The global expansion of broadcasting networks also fuels the market. Emerging markets, particularly in Asia-Pacific and Africa, are witnessing a surge in new broadcasting channels and regional content creation. These markets require robust scheduling software to manage multilingual and culturally diverse programming, driving demand for scalable and customizable solutions.

Solution Insights

The software segment dominated the market and accounted for a revenue share of around 62.0% in 2024. With the rise of over-the-top (OTT) platforms and digital streaming, broadcasters need scheduling software capable of managing real-time updates and synchronizing content across multiple platforms. Software solutions that can handle the complexities of linear TV, digital, and social media content delivery are increasingly preferred, boosting demand in this segment.

The service segment is expected to grow at a significant CAGR of 22.0% over the forecast period. Many broadcasters, especially small and mid-sized operations, are turning to managed services for end-to-end management of their scheduling needs. This trend is driven by a lack of in-house expertise and the growing complexity of managing schedules across multiple platforms, time zones, and audience demographics. Managed services providers offer ongoing support, updates, and maintenance, enabling broadcasters to focus on content creation and delivery.

Deployment Insights

The cloud segment accounted for the largest revenue share of over 51.0% in 2024. Cloud solutions offer robust data backup and disaster recovery features, ensuring that broadcasters can quickly recover from outages or disruptions. This reliability is a critical factor for broadcasters who need to maintain uninterrupted operations, particularly during live events or high-profile programming.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. In regions or industries where broadcasting is subject to stringent regulations, on-premise solutions offer a controlled environment that makes it easier to ensure compliance. Organizations can store, process, and audit data locally, simplifying adherence to data sovereignty laws and industry standards

Application Insights

The TV segment accounted for the largest revenue share of over 42.0% in 2024. The adoption of technologies such as 4K and 8K broadcasting, virtual reality (VR), and augmented reality (AR) content in TV broadcasting is driving the demand for sophisticated scheduling tools. These tools help allocate resources and airtime efficiently to support high-tech programming and new content formats.

The digital platforms segment is expected to grow at a significant CAGR over the forecast period. The emergence of niche digital platforms catering to specific genres or audiences, such as fitness, education, or children’s programming, drives the need for specialized scheduling tools. These platforms rely on software to optimize unique content offerings and address the needs of targeted viewer groups.

Regional Insights

North America broadcast scheduling software market held the largest share of over 38.0% in 2024, driven by the shift toward OTT and streaming platforms. With the rapid growth of services like Netflix, Hulu, and Disney+, the traditional TV broadcasting model is evolving. Digital platforms require sophisticated scheduling solutions to manage content across multiple devices and channels. Scheduling software plays a crucial role in ensuring that content is delivered consistently across these platforms, while also allowing for real-time updates and dynamic scheduling, which are essential in the fast-paced digital media environment.

U.S. Broadcast Scheduling Software Market Trends

The broadcast scheduling software market in the U.S. is expected to grow significantly at a CAGR of 16.4% from 2025 to 2030, owing to the adoption of advanced broadcasting technologies, including cloud computing, artificial intelligence (AI), and 4K/8K broadcasting. These technologies are transforming how broadcasters in the U.S. manage their operations and content delivery. Broadcast scheduling software that integrates AI and data analytics helps broadcasters optimize content schedules based on real-time viewer behavior, ensuring a more personalized viewing experience that enhances audience engagement and retention.

Europe Broadcast Scheduling Software Industry Trends

The broadcast scheduling software market in Europe is anticipated to register considerable growth from 2025 to 2030. Europe has strict broadcasting regulations that broadcasters must adhere to, including content quotas, advertising limits, and consumer protection rules. Scheduling software helps ensure that programming schedules comply with these rules by automating compliance tasks. This includes managing the airing of content that meets regulatory requirements, ensuring proper ad placements, and maintaining the appropriate timing for audience protection.

The U.K. broadcast scheduling software market is expected to grow rapidly in the coming years. As live sports broadcasting continues to be a major part of the U.K. media landscape, scheduling software becomes crucial for managing live events. This includes handling real-time schedule changes, managing broadcast interruptions, and ensuring that events are broadcast without delays. Live sports events often require quick adjustments due to unpredictable outcomes, and scheduling software ensures that these changes are made efficiently, with minimal disruption to other programming.

The broadcast scheduling software market in Germany held a substantial share in 2024. As viewers in Germany increasingly demand personalized viewing experiences, broadcasters are turning to advanced data analytics to refine their programming schedules. Scheduling software with integrated analytics helps broadcasters understand viewer preferences, allowing them to deliver more tailored content. By analyzing factors such as audience demographics, viewing habits, and preferences, broadcasters can optimize their content lineup, improving both viewer engagement and retention.

Asia Pacific Broadcast Scheduling Software Industry Trends

The broadcast scheduling software market in Asia Pacific is expected to grow significantly at a CAGR of 22.6% from 2025 to 2030. The APAC region is seeing a rise in demand for niche content catering to specific genres, communities, or local interests. Broadcast scheduling software helps manage specialized content, such as news, entertainment, or sports programming for niche audiences. In countries with large rural populations like India and China, broadcasters need software that can schedule regional content at specific times to ensure it reaches the target audience. This trend is expected to continue as broadcasters tailor content offerings to meet the needs of specific demographic groups.

Japan broadcast scheduling software market is expected to grow rapidly in the coming years. There is a growing demand for specialized content tailored to different demographic groups, such as anime fans or specific regional audiences. Broadcast scheduling software plays a critical role in ensuring that content is scheduled appropriately for niche groups and is available at optimal times. This is particularly important as Japanese broadcasters are focusing more on specialized programming to cater to particular interests and create unique, engaging content for various audience segments.

The broadcast scheduling software market in China held a substantial share in 2024. As China embraces the digital transformation of its media sector, automation is playing a larger role in content management. Broadcast scheduling software that incorporates AI and machine learning is gaining traction, as these technologies enable broadcasters to optimize programming schedules and predict audience preferences. AI-driven scheduling tools can analyze large volumes of data to identify peak viewing times, suggest optimal programming slots, and predict viewer behavior. This automation reduces manual intervention, making the scheduling process more efficient while improving content delivery and viewer engagement.

Key Broadcast Scheduling Software Company Insights

Key players operating in the broadcast scheduling software industry are Imagine Communications, WideOrbit, Marketron Broadcast Solutions, Mediagenix Nieuwe Gentsesteenweg, and AxelTech. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, Mediagenix Nieuwe Gentsesteenweg acquired Spideo, a French company specializing in humanized content recommendations, transparent personalization, and enhanced catalog discovery. This acquisition is a strategic move to strengthen Mediagenix's position in the competitive streaming landscape, enabling it to offer advanced content discovery solutions. By combining Mediagenix’s capabilities with Spideo’s innovative technology, the partnership aims to empower media companies with tools to optimize audience engagement and drive revenue growth.

-

In March 2024, Imagine Communications introduced Aviator Automation, an automation solution designed to streamline the operation of hybrid on-premises and cloud-based playout systems. This innovative tool enables media companies to efficiently manage channel origination across multiple sites and platforms, offering a unified control system for playout, master control, and live integration. With Aviator Automation, companies can seamlessly coordinate operations for both linear and connected TV (CTV) channels, regardless of where the resources are located, significantly improving efficiency and flexibility in channel management.

Key Broadcast Scheduling Software Companies:

The following are the leading companies in the broadcast scheduling software market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Broadcast Services Limited (ABS Broadcast)

- AMC Networks Inc.

- AxelTech

- BroadView Software Inc.

- Chetu Inc.

- Imagine Communications

- Mediagenix Nieuwe Gentsesteenweg

- Marketron Broadcast Solutions

- Schedule it Ltd.

- WideOrbit

Broadcast Scheduling Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.38 billion

Revenue forecast in 2030

USD 5.88 billion

Growth Rate

CAGR of 19.8% from 2025 to 2030

Actual data

2018 - 2023

Base year for estimation

20244

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Kingdom of Saudi Arabia, and South Africa

Key companies profiled

Advanced Broadcast Services Limited (ABS Broadcast), AMC Networks Inc., AxelTech, BroadView Software Inc., Chetu Inc., Imagine Communications, Mediagenix Nieuwe Gentsesteenweg, Marketron Broadcast Solutions, Schedule it Ltd., and WideOrbit

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Broadcast Scheduling Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the broadcast scheduling software market report based on solution, deployment, application, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

Hybrid

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

TV

-

Radio

-

Digital Platforms

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global broadcast scheduling software market size was estimated at USD 2.01 billion in 2024 and is expected to reach USD 2.38 billion in 2025.

b. The global broadcast scheduling software market is expected to grow at a compound annual growth rate of 19.8% from 2025 to 2030 to reach USD 5.88 billion by 2030.

b. North America accounted for the largest revenue share of more than 38.5% in 2024 in the broadcast scheduling software market. The region's dominance can be attributed to the early adoption of advanced broadcasting technologies and solutions and the existence of key market players in this region.

b. Some key players operating in the broadcast scheduling software market include Advanced Broadcast Services Limited, Schedule it Ltd., WideOrbit, Marketron Broadcast Solutions, Imagine Communications, Chetu Inc., AMC Networks Inc., and AxelTech, among others.

b. The growing complexity of broadcast media planning and the increased adoption of cloud-based solutions are the key factors expected to drive market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.