- Home

- »

- Medical Devices

- »

-

Bronchoscopes Market Size & Share Analysis Report, 2025GVR Report cover

![Bronchoscopes Market Size, Share & Trends Report]()

Bronchoscopes Market Size, Share & Trends Analysis Report By Use (Reusable, Disposable), By Type (Flexible (Video, Fiberoptic, Hybrid), Rigid), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-192-4

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Healthcare

Report Overview

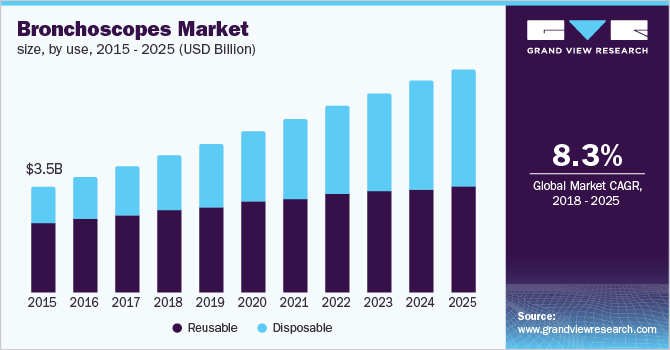

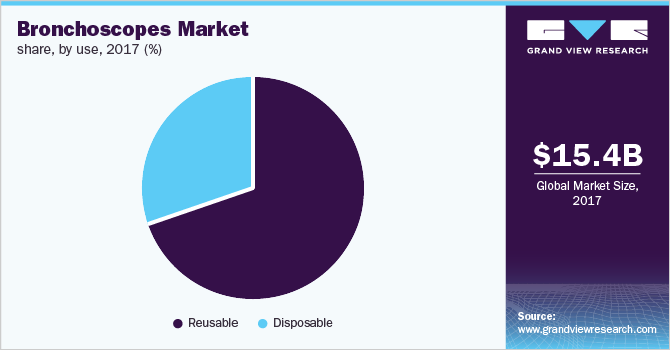

The global bronchoscopes market size was valued at USD 15.4 billion in 2017 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2018 to 2025. Demand for bronchoscopes has been on a rise due to the increasing prevalence of respiratory diseases, improving reimbursement policies, and technological advancements.

Bronchoscopes are primarily used for the assessment and management of multiple respiratory and airway diseases. Conditions such as blockages, chronic obstructive pulmonary diseases (COPD), bronchopulmonary hemorrhage, tumors, airway stenosis, and inflammatory conditions can be detected and diagnosed through these devices.

The increasing prevalence of various respiratory diseases is the most significant factor positively impacting the market growth. According to the World Health Organization (WHO), over 3.0 million people die from COPD every year. As per the American Cancer Society, over 234,030 new cases of lung cancer were reported in the U.S. at the end of 2018.

Furthermore, according to Cancer Research UK, around 46,400 new cases of lung cancer are diagnosed each year. Besides, according to the World Cancer Research Fund International, around 58.0% of lung cancer cases occurred in developing countries, which can be attributed to the alarming prevalence of a host of respiratory diseases. Thus, demand for bronchoscopes is expected to witness a major boost in the future.

Bronchoscopes Market Trends

The rising prevalence of respiratory tract disorders such as COPD (Chronic Obstructive Pulmonary Disease) or lung cancer owing to the increasing geriatric population is the primary driving factor for the bronchoscopes market. It is an endoscopic device used by health professionals to diagnose abnormalities in the lymph nodes in the chest, lungs, and airway, or to treat issues like a blockage or growth in the airway. According to the article published by WHO in May 2022, COPD is the third leading cause of death globally, consequently, it led to 3.23 million deaths in 2019.

Clinics, NGOs, private hospitals, and government health care centers such as Primary Health Centres (PHCs), Community Health Centres (CHCs), and District Hospitals (DHs) are the primary end-users of bronchoscopes. The increase in the number of clinics and hospitals worldwide is expected to offer growth opportunities to the bronchoscopes market. In addition, several initiatives are taken by governments of developing countries to provide better healthcare infrastructure in urban as well as rural areas, which is expected to result in better healthcare assistance and availability of the latest technology equipment at the disposal of the consumers. Consequently, it is projected to fuel the market further.

The prevalence of a high risk of infection due to the use of bronchoscopes is acting as an obstruction to the market. When the bronchoscope passes through the respiratory tract it is susceptible to carrying indigenous microbial flora attached to them inside the patient’s body. This is one of the factors that lead to consequences like the onset of a new infection, pseudo infection due to cross-contamination of the bronchoscope, and the spread of infection from one patient to another owing to the use of an un-sterilized bronchoscope.Type Insights

Based on type, the market is broadly bifurcated into rigid and flexible types. Flexible bronchoscopes are further segmented into video, fibreoptic, and hybrid. The flexible segment captured the largest share in terms of revenue due to high video quality and significant cost-effectiveness. The fibreoptic sub-segment has been dominating the flexible segment owing to the many benefits offered by it, such as high-quality videos, which results in easy identification of tumors and infections in deeper levels of bronchioles.

In addition to the above-mentioned advantages, flexible bronchoscopes are convenient for doctors as well as patients. Recovery time after flexible bronchoscopy is significantly lesser as compared to rigid bronchoscopy. Moreover, the narrow size of these devices allows for a deeper reach into small lumens.

Use Insights

Based on use, the market is segmented into reusable and disposable devices. The reusable segment captured the largest market share in 2017 in terms of revenue. Multi-usage and cost-effectiveness are the key advantages these devices offer. As a result, more than 500 bronchoscopy procedures are performed in a year. This is sure to drive the market at a lucrative rate during the forecast period.

Disposable devices are likely to emerge as the fastest-growing segment in the bronchoscopes market. Affordability is one of the major advantages these devices offer, especially those recently launched in the market. Medical facilities that perform fewer than 500 procedures a year save a significant margin as compared to costs incurred through reusable bronchoscopes. Furthermore, factors such as no cross-contamination, instant availability, and no reprocessing cost are some other factors contributing to market growth.

Regional Insights

North America is the most developed market, followed by Europe. Increasing cases of lung cancer and the presence of a large number of well-established players are contributing to the growth of this market. The U.S. is the largest market for bronchoscopes across the world. These devices are widely adopted in the country, which can be primarily attributed to favorable reimbursement policies by state and federal governments.

The Asia Pacific market is expected to witness remarkable growth throughout the forecast period owing to extensive growth opportunities in Japan, China, and India. Factors such as mandatory healthcare insurance, rising technological advancements, increased healthcare expenditure, and an increasing number of global companies looking to cater to high unmet medical needs in these countries are driving the market.

Key Companies & Market Share Insights

Key strategies adopted by major players include collaborations, mergers and acquisitions, new product launches, and partnerships to strengthen their position in the market. For instance, in May 2014, Olympus launched two new endoscopes for peripheral and small anatomy bronchoscopy: the BF-190 and BF-XP190 bronchoscopes. Some of the prominent players in the global bronchoscopes market include:

-

Teleflex Incorporated

-

Olympus Corporation

-

Ambu A/s

-

Karl Storz

-

Fujifilm Holdings Corporation

-

Boston Scientific Corporation

- Cogentix Medical

Recent developments

-

In July 2023, Ambu launched the Ambu® VivaSight™ 2 SLT, the company’s latest solution for intubation and one lung ventilation (OLV) procedures, completing its unique VivaSight™ one lung ventilation portfolio. The portfolio comprises single- and double-lumen tubes with integrated cameras, an endobronchial blocker and differently sized single-use bronchoscopes.

-

In September 2022, Fujifilm announced the expansion of its pulmonology solutions portfolio with the launch of the EB-710P Slim Bronchoscope at the European Respiratory Society (ERS) International Congress in Barcelona. The expanded product portfolio includes the FDR Nano X-ray system, which is a lightweight, compact, and highly portable digital X-ray machine.

Bronchoscopes Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 20.2 billion

Revenue forecast in 2025

USD 29.6 billion

Growth rate

CAGR of 8.3% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD million and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Use, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Netherlands; Switzerland; France; Russia; Spain; Sweden; China; India; Japan; Indonesia; South Korea; Thailand; Malaysia; Singapore; Australia; Philippines; Brazil; Mexico; Argentina; Turkey; Saudi Arabia; Nigeria; Iran; South Africa

Key companies profiled

Teleflex Incorporated; Olympus Corporation; Ambu A/s; Karl Storz; Fujifilm Holdings Corporation; Boston Scientific Corporation; Cogentix Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bronchoscopes Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global bronchoscopes market report based on use, type, and region:

-

Use Outlook (Revenue, USD Million, 2014 - 2025)

-

Reusable

-

Disposable

-

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Rigid

-

Flexible

-

Video

-

Fiberoptic

-

Hybrid

-

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

The Netherlands

-

Switzerland

-

France

-

Russia

-

Spain

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

South Korea

-

Thailand

-

Malaysia

-

Singapore

-

Australia

-

Philippines

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

Turkey

-

South Africa

-

Saudi Arabia

-

Nigeria

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global bronchoscopes market size was estimated at USD 18.5 billion in 2019 and is expected to reach USD 20.2 billion in 2020.

b. The global bronchoscopes market is expected to grow at a compound annual growth rate of 8.3% from 2018 to 2025 to reach USD 29.6 billion by 2025.

b. Flexible bronchoscopes segment dominated the bronchoscopes market with a share of 71.1% in 2019. This is attributable to high video quality and significant cost effectiveness.

b. Some key players operating in the bronchoscopes market include Teleflex Incorporated; Olympus Corporation; Ambu A/s; Karl Storz; Fujifilm Holdings Corporation; Boston Scientific Corporation; and Cogentix Medical.

b. Key factors that are driving the market growth include increasing demand for bronchoscopes due to increasing prevalence of respiratory diseases, improving reimbursement policies, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."