- Home

- »

- Pharmaceuticals

- »

-

Brucellosis Vaccine Market Size, Share, Growth Report 2030GVR Report cover

![Brucellosis Vaccine Market Size, Share & Trends Report]()

Brucellosis Vaccine Market Size, Share & Trends Analysis Report By Application (Sheep, Cattle, Goat), By Type (RB51 Vaccine, S19 Vaccine, B19 Vaccine), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-171-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Brucellosis Vaccine Market Size & Trends

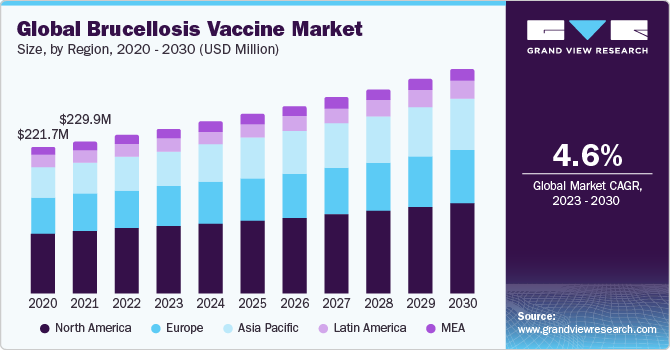

The global brucellosis vaccine market size was valued at USD 238.82 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.59% over the forecast period. This can be attributed to the rising incidence of brucellosis and vaccination campaigns. Furthermore, as more nations invest in their own national vaccination programs, the potential for growth in this brucellosis vaccine market is expanding globally. Globally, brucellosis is prevalent in the majority of nations. It has an impact on individuals of all ages and genders.

Direct contact with infected animals, consumption of contaminated animal products of sheep & goats, and inhalation of airborne agents are the major causes of infections in the general population. The main groups affected by this mode of disease transmission include farmers, hunters, butchers, lab workers, and veterinarians. Thus, rising awareness about disease and brucella vaccination benefits among these people is projected to fuel demand for vaccines in the coming years.

Furthermore, in contrast to low-income nations, brucellosis is less prevalent in developed countries like the U.S. owing to the availability of vaccines and awareness among people. However, the high rates of brucellosis is found in Yemen, Syria, and Kenya owing to a lack of awareness about the disease. Several research studies suggest vaccinations are among the most important ways to combat brucellosis as it may infect a person after immunization. Therefore, preventing animal illness is the most effective strategy to prevent its spread to people who work with animals, as currently, no vaccine is available for humans to prevent the disease.

It is anticipated that the growing use of strategies such as agreements and acquisitions by major companies will propel market expansion. For instance, in September 2020, Hester Biosciences Limited entered into an agreement with the Indian Veterinary Research Institute (IVRI) and the Indian Council of Agricultural Research (ICAR)-to acquire the vaccine technology required to research and develop the novel Brucella Abortus S19 Delta Per vaccine from IVRI Hester. The IVRI Hester produces the traditional Brucella Abortus S19 vaccine and distributes it to all the Indian states. A step towards creating a Brucella vaccine with improved immunogenicity and safety that guarantees lifetime protection against Brucellosis with a single dose of Brucella Abortus S19 vaccine in calfhood. Thus, growing research in the field of brucella vaccine is anticipated to drive market growth.

Application Insights

On the basis of the application, the market is segmented into sheep, cattle, goat, and others. The cattle segment held the largest market share in 2022. This can be attributed to the increasing number of cattle with brucellosis infection and the high demand for vaccines to prevent it. As per the study published by PLOS in 2022, the estimated seroprevalence of brucellosis in domestic ruminants was approximately 22.88% by cattle, followed by camels at 20%, goats at 15.48%, and sheep at 8.62% in Kenya. In addition, approximately 0.6% of the population of Baringo County was infected by brucellosis. Thus, the increasing prevalence of brucellosis in Kenya is anticipated to drive segment growth

Type Insights

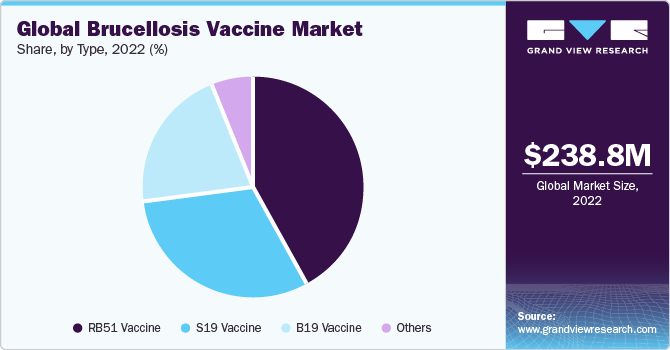

Based on the type, the brucellosis vaccine market is segmented into S19 Vaccine, RB51 Vaccine, B19 Vaccine, and Others (SR82 vaccine, 45/20 vaccine). The RB51 vaccine segment held the largest market share in 2022. This can be attributed to the high demand for the RB51 vaccine due to the rising incidence of brucellosis worldwide. In 2021, an article titled "Brucellosis: Epidemiology, Microbiology, Clinical Manifestations, and Diagnosis" stated that 500,000 cases of brucellosis are recorded annually worldwide, with an estimated 2.4 billion individuals at risk of contracting the disease. Thus, growing numbers of brucellosis cases are expected to boost demand for the RB51 vaccine in the coming years, driving segment growth.

Distribution Channel Insights

Based on the distribution channel, the brucellosis vaccine market is segmented into veterinary clinics & hospitals, retail channels, and others. The public segment held the largest market share in 2022. This can be attributed to increasing veterinary clinics & hospital visits to diagnose and treat brucellosis in animals in developed and developing countries. Furthermore, the government and non-governmental organizations to increase public knowledge of animal health, welfare, and disease prevention through various awareness programs is expected to fuel the segment’s expansion in the coming years.

Regional Insights

North America dominated the market in 2022. This can be attributed to the availability of skilled medical professionals and the large presence of key players engaged in developing and launching new brucella vaccines. According to the American Veterinary Medical Association, in 2022, 124,069 active veterinarians were available in the U.S. to diagnose and treat animals and related diseases.

Asia-Pacific is expected to witness the fastest CAGR over the forecast period. This region has witnessed a high demand for Brucellosis vaccines in the last few decades due to a large consumer base and increasing awareness about the Brucella vaccine among them.

Key Companies & Market Share Insights

Key players operating in the market are Merck & Co., Inc., Laboratories Tornel, and Hester Biosciences Limited, and Ceva, CZ Vaccines. In order to obtain access to new markets, the market participants are working towards joint ventures, launch of new products, mergers and acquisitions, and other strategic partnerships.

The following are some instances of strategic initiatives:

-

In April 2023, Cornell University College of Veterinary Medicine (CVM) scientists researched and developed a novel diagnostic test to identify Brucella canis. This test helps in the early diagnosis of this zoonotic disease, which can spread to humans through contact with infected dogs. This will boost vaccination in the course of time.

-

In April, 2022 -Ceva Santé Animale and Mitsui & Co., Ltd entered into a joint venture to boost the enlargement of the veterinary laboratory to Japan. This joint venture is expected to help in addressing the challenges associated with animal disease and food safety in Japan, thereby driving market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."