- Home

- »

- Medical Devices

- »

-

Bunion Correction Systems Market Size & Trends Report, 2030GVR Report cover

![Bunion Correction Systems Market Size, Share & Trends Report]()

Bunion Correction Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Implants & Accessories, Wearables), By End Use (Hospitals, Ambulatory Centers, Specialty Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-990-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

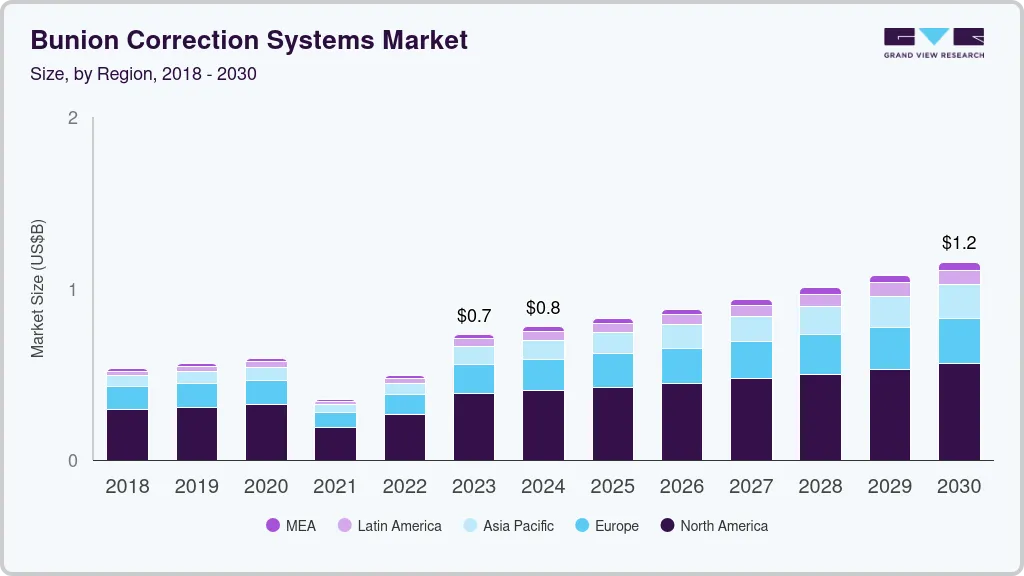

The global bunion correction systems market size was valued at USD 730.4 million in 2023 and is expected to reach USD 1.15 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030. Bunion correction products help to treat bunion which is a foot deformity that affects the metatarsophalangeal joint. Bunion or hallux valgus is a common foot disorder in the adult population with 1 in 3 Americans suffering from the condition. Most common causes of the condition include prolonged use of ill-fitting and narrow shoes, foot injuries and inherited foot problems.

According to a study published by NCBI, 63% to 74% of the participants used improper-fitting shoes that did not accommodate either the length or width of the foot, which increases the risk of developing foot disorders such as deformity, calluses, and bunions. The condition is more common in the older population especially women due to weaker connective tissues and the use of tight and heeled shoes. According to American Orthopedic Foot and Ankle Society, about one-third of women suffer from bunion.

Rising prevalence of arthritis is expected to positively contribute to the growth of the market during the forecast period. Inflammatory arthritis such as rheumatoid arthritis increases the risk of bunions. Patients suffering from Rheumatoid Arthritis have an increased likelihood of suffering from foot problems. 90% of the patients with rheumatoid arthritis suffer from foot problems globally according to an article by Vittori. Rheumatoid arthritis causes the body to mistakenly attack the linings of the big toe which increases the risk of bunion. Moreover, the symptoms of both conditions include swelling and mobility issues in the affected joint, which is expected to contribute to the growth of the market.

Availability of a wide variety of various surgical and non-surgical techniques to manage the condition such as PROstep MIS, which is a non-invasive procedure, is anticipated to be a key factor that is expected to boost the market growth. Treatment of bunion generally involves the use of orthopedic implants, bunion pads and tapings, pain relievers, surgery, injections, and physical therapy. The rising number of treatment procedures for the condition is expected to boost the growth of the market, for instance, in the U.S. about 150,000 surgeries are performed every year according to an article by San Mateo Podiatry Group. Moreover, an increasing number of product approvals by the FDA is expected to further drive market growth.

The COVID-19 pandemic had a negative impact on the market due to the cancellation of elective procedures and a lower number of patients undergoing treatment for bunion. The market also had a negative impact due to the shortages of healthcare professionals and restrictions on the movement imposed by the governments in order to curb the spread of the virus. Most of the hospitals and outpatient rehabilitation services worked at reduced capacity which further negatively impacted market growth.

Product Insights

By product, the wearables segment held the largest revenue share of 51.9% in 2022. The rising prevalence of bunion is a key factor that is expected to drive the market. According to data published by Disabled Population, about 36% of the study population suffered from the condition. Moreover, the availability of wearables for different groups such as the adult, pediatric, and geriatric populations is expected to further drive the segment growth. The wearables are used generally to support the joint in order to prevent malpositioning as well as to manage the pain. However, the wearables do not treat bunion.

The implants and accessories segment is anticipated to witness the fastest growth of 7.3% during the forecast period. Factors such as the rising number of people undergoing corrective surgeries to treat the condition is expected to positively impact the segment growth. The availability of minimally invasive implants, which help to treat the source of the bunion is expected to be a key factor responsible for the growth of the segment. For instance, MINIBunion, a non-invasive implant by CrossRoads Extremity Systems spares the joint capsule. The implant allows to repair bunion through a 15mm incision on the side of the foot and reduces the recovery time after the procedure.

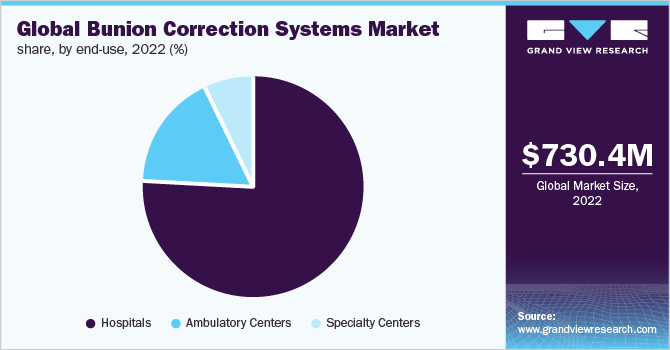

End-use Insights

By end use, the hospitals segment held the largest revenue share of 76.2% in 2022. The rising number of patients undergoing correction surgeries at the hospitals contributed positively to the market growth. Moreover, the availability of minimally invasive surgery options for the condition is expected to further boost segment growth during the forecast period. The surgical procedures generally involve removing the swollen tissue, and realigning and straightening the bones in the foot, which helps to reduce the pain and swelling in the foot.

The segment is expected to grow at a lucrative rate of 7.2% during the forecast period. Factors such as the availability of various surgery options such as Exostectomy, Osteotomy and Arthrodesis for bunion correction is expected to boost the number of patients undergoing treatment for the condition at the hospitals. Moreover, the availability of skilled physicians at the hospitals is expected to boost segment growth.

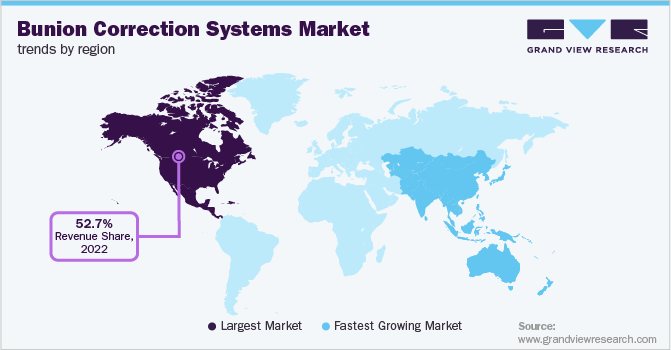

Regional Insights

North America dominated the market in 2022 with a share of 52.7%. The higher prevalence of the condition in the region combined with the availability of treatment facilities for correction procedures are some of the key factors that contributed to the growth of the market in the region. For instance, according to an article by the Ontario Society of Chiropodists, about 6% of the Canadian population suffers from bunions, foot injuries, and fallen arches or flat feet every year. Moreover, the presence of key players such as Stryker Corporation, Arthrex, Inc., Zimmer Biomet Holdings, Inc. and DuPey Synthes in the region further contributed to the growth of the market.

Asia Pacific is projected to witness a growth of 10.1% during the forecast period owing to factors such as the higher prevalence of bunions among the adult population. For instance, according to an article by Australian Journal of General Practice, bunion is a common foot deformity in women in the country. Of the total population visiting general practitioners, 82.3% of the patients are women. The article also states that the overall prevalence of bunion in adult population in Australia is about 23%. Further growing geriatric population in countries such as China, Japan, and India and rising healthcare tourism is expected to positively contribute to the growth of the regional market.

Key Companies & Market Share Insights

High competition in the market owing to innovative product offerings by key players and the entry of new players has led to high market growth. For instance, in January 2021, CrossRoads Extremity Systems launched DynaBunion Lapidus System, a 4D minimally invasive surgical bunion repair system that restores the normal foot anatomy in 4 different dimensions through small incisions. Some prominent players in the global bunion correction systems market include:

-

Stryker Corporation

-

Arthrex, Inc.

-

Zimmer Biomet Holdings, Inc.

-

Wright Medical Technology, Inc.

-

Extremity Medical, LLC.

-

Acumed, LLC.

-

De Puy Synthes

-

Biomet, Inc.

-

CrossRoads Extremity Systems

-

BioPro, Inc.

-

Orthofix Holdings Inc.

-

OrthoHelix Surgical Designs

Bunion Correction Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 775.7 million

Revenue forecast in 2030

USD 1.15 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific, Latin America, Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Stryker Corporation; Arthrex, Inc.; Zimmer Biomet Holdings, Inc.; Wright Medical Technology, Inc.; Extremity Medical, LLC.; Acumed, LLC.; De Puy Synthes, Biomet, Inc.; CrossRoads Extremity Systems; BioPro, Inc.; Orthofix Holdings Inc.; OrthoHelix Surgical Designs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bunion Correction Systems Market Segmentation

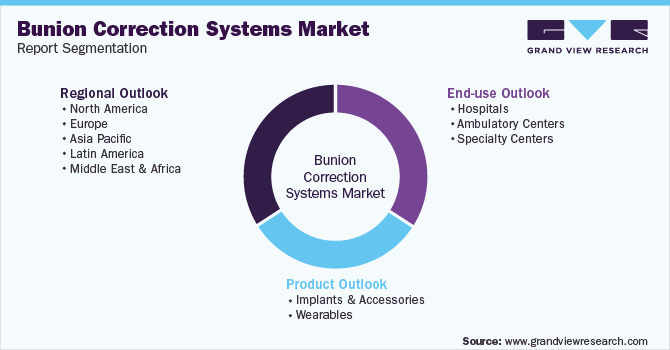

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global bunion correction systems market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Implants & Accessories

-

Wearables

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Ambulatory Centers

-

Specialty Centers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bunion corrections system market size was estimated at USD 730.4 million in 2022 and is expected to reach USD 775.5 million in 2023.

b. The global bunion corrections system market is expected to grow at a compound rate of 6.9% from 2022 to 2030 to reach USD 1.2 billion in 2030.

b. North America dominated the global bunion corrections system market with a market share of 52.7% in 2022. This is attributable to higher prevalence of the condition in the region combined with availability of treatment facilities for correction procedures.

b. Some of the key players operating in global bunion corrections system market include Stryker Corporation, Arthrex, Inc., Zimmer Biomet Holdings, Inc., Wright Medical Technology, Inc., Extremity Medical, LLC., Acumed, LLC., De Puy Synthes, Biomet, Inc., CrossRoads Extremity Systems, BioPro, Inc., Orthofix Holdings Inc.

b. Key factors that are driving the global bunion corrections system market includes rising prevalence of arthritis and availability of wide variety of various surgical and nonsurgical techniques to manage the condition.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.