- Home

- »

- Healthcare IT

- »

-

Burial Insurance Market Size, Share & Growth Report, 2030GVR Report cover

![Burial Insurance Market Size, Share & Trends Report]()

Burial Insurance Market Size, Share & Trends Analysis Report By Coverage Type (Level Death Benefit, Guaranteed Acceptance), By Age Of End-user (Over 50, 60, 70, 80), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-959-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

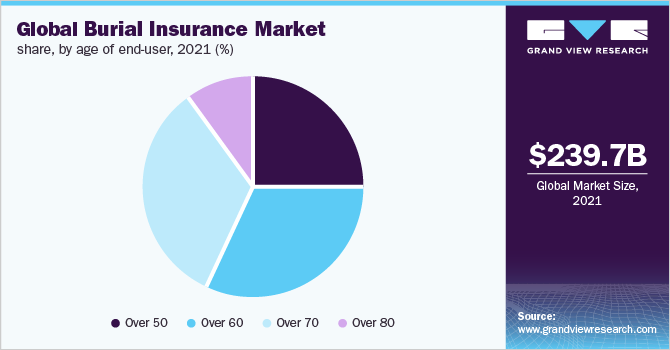

The global burial insurance market size was estimated at USD 239.66 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030. The growing demand for funeral services and their accompanying costs, which are one of the most significant difficulties confronting health insurance companies and other private payers in developed countries like Canada and the U.S., have led to a spectacular global development of the burial insurance market. Furthermore, the growing health insurance sector, as well as rising internet usage and digitalization, are positively influencing the overall burial insurance market.

The global COVID-19 outbreak has boosted the market for funeral insurance. The insurance sector as a whole, and burial insurance, in particular, experienced a rise in interest from policy seekers looking for insurance coverage choices in response to the COVID-19 pandemic.

This is given the rise in demand among people wishing to purchase insurance policies that also cover funeral costs brought on by the growing price of such expenses. Additionally, most of the major impacted countries-including the U.S., China, Spain, and Italy-have a shortage of sites for individuals to be buried. This has heightened awareness of the issue as well as highlighted the issue of paying for funeral expenditures.

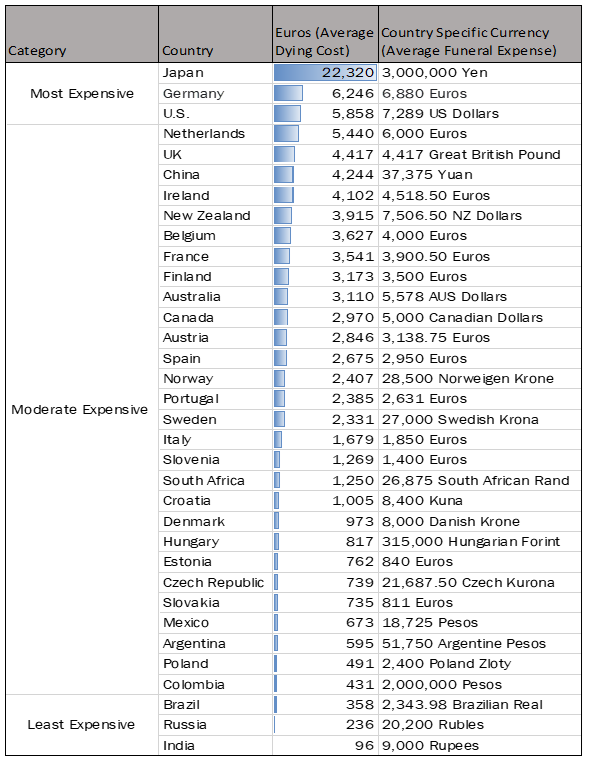

The cost of funeral expenditures has been a significant marker for insurance companies, such as SunLife Limited, which has extensively discussed it in its reports as well. The table below shows the average cost of funeral expenses and its related factors.

The average cost of funeral expenses and cost of dying worldwide chart, for the year 2020

In addition, noteworthy government initiatives have been put in place, such as those in Canada, to ensure that everyone receives acceptable end-of-life care regardless of their circumstances. As a result, the general market will expand as more people become aware of such initiatives along with this insurance company focusing more on offering end-to-end policies to policyholders.

For instance, the Canadian province offers government funeral aid in Ontario, Saskatchewan, Nova Scotia, British Columbia, Alberta, and some other major areas where it has established a fund to assist individuals who are unable to pay for basic funeral expenses.

Coverage Type Insights

Based on coverage type, the market is segmented into three types - level death benefit, guaranteed acceptance, and modified or graded death benefit. The modified or graded death benefit market held the largest revenue share of over 46% in 2021. This is mainly because rates for modified life insurance change over time, frequently 5 to 10 years after the policy's commencement date. Although the death benefit insurance has not changed, the rates have. For the term of the insurance, rates often remain constant when they increase. Premium hikes often happen just once. Unlike level life insurance plans, which have premiums that are fixed over time and are locked in.

Furthermore, like all other policies, this modified or graded death benefit has its downsides but is still a good option for individuals with a range of health problems. The insurance company carries a lot of risk as a result. Thus, this market segment is anticipated to grow over the forecast period, driven by an increase in the number of persons with serious illnesses adopting such policies that cover funeral costs as well.

Basic differences among the different coverage types

Coverage Type

Level

Guaranteed Acceptance

Modified

Applicant Health

Excellent

Minor health conditions(s)

Serious health condition(s)

Benefits Eligibility

Immediately after death

Waiting Period (2- years)

Waiting Period (2- 3 years)

Cost

Lowest

Medium

High

On the other hand, an insurance policy has a level death benefit alternative that guarantees the same life insurance policy for the whole term period of the policy. Whether the insured individual passes away within the first or final years of the policy's term, doesn't matter.

Additionally, this kind of level of death benefit coverage promptly distributes the whole death benefit in the event of a death. Furthermore, this is the only form of final expense insurance that offers the insured immediate and total coverage. Due to the comparatively low rates, level depth benefit plan acceptance would increase quickly from the consumer perspective, driving the segment's total growth.

By Age Of End-user Insights

Based on coverage type, the market is segmented into four types - over 50, over 60, over 70, and over 80. The segment of people aged over 60 and over 70 is dominating the market and accounted for the largest revenue share of around 32% and 33% respectively in 2021 and is expected to maintain its dominance throughout the forecast period.

Age is one of the key factors that affect how much a policy will cost. Since funeral costs are relatively higher in developed countries like the U.S. and Europe and can burden families when loved ones pass away, policyholders who are senior in particular start looking for policies that tend to cover all elements of expenses, including burial costs. Thus, including a benefit for funeral expenses in policyholder policies provides significant assistance to both the individual policyholder and their family.

For instance, the International Database for Population by Age for the U.S. from the U.S. Census Bureau showed that people between the ages of 60 to 69 are substantially more numerous than those in other older age groups. This suggests that since the U.S. is one of the more developed and health-aware nations, where people are generally aware of their health status and the value of health insurance, people in that age range may be more likely to select these types of policies. This is because, on the demand side, given the size of the population, they are even more likely to be policy seekers in this age group, which ultimately raises demand, supporting the market growth over the forecast period.

Below are the average estimates for policyholders over 60

Gender & Plan Type

Death Benefit Amount

Female

5,000

10,000

15,000

20,000

Guaranteed Acceptance

25 - 37

51 - 73

76 - 109

101 - 145

No Waiting Period

18 - 27

32 - 50

47 - 74

61 - 97

Tobacco User & No Waiting Period

24 - 36

45 - 70

66 - 104

87 - 137

Male

Guaranteed Acceptance

32 - 48

63 - 96

95 - 145

126 - 193

No Waiting Period

31 - 48

59 - 94

87 - 140

116 - 186

Tobacco User & No Waiting Period

32 - 48

63 - 96

95 - 145

126 - 193

On the other hand, people who are close to or over 70 are probably classified as having a risk condition, which is why the price of premium is often higher for those above 70. Furthermore, the majority of people by this age are expected to have a policy, particularly in developed nations, thus the rate of policy extensions is higher than the rate of new policy purchases. For example, according to a 2016 article in the National Library of Medicine, 95 percent of people over 65 in France have voluntary health insurance. This may further suggest that people with health insurance may be updated to include funeral expenses or may already have funeral expense coverage built into their plans, further supporting the overall expansion of the market.

Below are the average estimates for policyholders over 70

Gender & Plan Type

Death Benefit Amount

Female

5,000

10,000

15,000

20,000

Guaranteed Acceptance

38 - 82

75 - 165

112 - 247

150 - 329

No Waiting Period

28 - 48

52 - 93

77 - 138

102 - 183

Tobacco User & No Waiting Period

37 - 63

72 - 123

106 - 182

141 - 242

Male

Guaranteed Acceptance

50 - 103

99 - 205

148 - 307

197 - 415

No Waiting Period

36 - 66

69 - 129

102 - 192

135 - 255

Tobacco User & No Waiting Period

50 - 86

98 - 171

146 - 255

194 - 339

Regional Insights

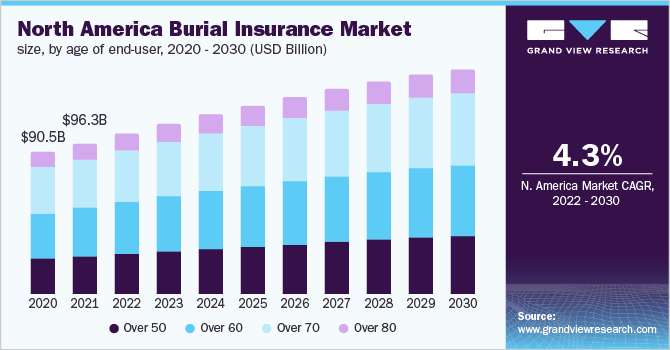

Due to the existence of several insurance providers who offer combined health, life, and death insurance, North America held the largest revenue share of over 35.0% in 2021. Additionally, the Affordable Care Act in the U.S. makes having comprehensive coverage necessary, which will serve as one of the key drivers for the US industry, supporting the expansion of the overall North American market throughout the forecast period. Furthermore, according to a White House press release, on April 5, 2022, US President Joe Biden indicated that his administration plans to expand the Affordable Care Act (ACA) in order to increase access to coverage and lower prices, potentially increasing the proportion of people in the US who are insured. As a result, individuals in the U.S. may choose to have funeral expenses covered by their health insurance policies, resulting in rising demand for burial insurance over the forecast period.

Furthermore, government funeral aid in Canada in the form of funeral coverage is also anticipated to further support the expansion of the North American market. For instance, the Saskatchewan Government in Canada offers a basic amount to cover funeral costs for a person whose estate is unable to afford burial or cremation charges. By helping people through these types of policies/coverage, the Saskatchewan Government is aiding the growth of the overall funeral insurance market throughout the forecast period.

With increased awareness of funeral expenses, Asia Pacific (APAC), Europe, and Latin America (LATAM) are expected to be the fastest-growing region in the overall Burial Insurance Market.

In the Europe region, for instance, one of the key factors propelling the UK market for funeral insurance is the rising cost of funeral expenditures. For example, a report by SunLife Limited, a provider of financial planning, life insurance, health insurance, and other services, found that in 2021, 17% of families had significant financial difficulties when paying for a funeral, indicating a substantial need for funeral insurance over the forecast period.

On the other hand, Italy has one of the notable concentrations of old people in Europe, with 22.8 percent of the population being over 65, according to World Bank data. This elderly group could be the market-growth driver for burial insurance over the forecast period.

Furthermore, over the forecast period, increased awareness may be necessary, which is likely to fuel market expansion. For instance, according to SunLife Insurance's 2020 report, 44% of people who had recently made funeral arrangements were not aware of the direct cremation option, which appears to be the least expensive one provided by burial insurance policies. Thus, increased awareness would result in increased market growth.

In the Asia Pacific region, factors such as the aging population, prevalence of chronic diseases, large population, and rising costs are all contributing to Asia's strong growth over the forecast period. Additionally, lucrative development potential in developed countries like China and Japan, as well as to some extent in developing countries like India, are likely contributing to the global burial insurance industry's expansion.

Key Companies & Market Share Insights

The companies in this market are expanding the market through strategic alliances. For instance, on June 9, 2022, in Argentina, Nacional Seguros, an insurance provider, and Rio Uruguay Seguros, another insurance provider, collaborated strategically to launch Ayllu. Ayllu is unique in the nation and will offer affordable coverage that includes - funeral and burial costs, medical expenses, and financial assistance for families in the event of accidental death. The launch of such products that cover migrant funeral costs demonstrates the company's obvious strategy to pay all costs for individuals regardless of whether they are residents or migrants, thereby supporting the market growth over the forecast period.

Furthermore, in order to stay competitive and outperform their rivals in terms of income, companies such as in Australia, are driving the market by bringing unique insurance solutions through distributor partners that can cover all areas of human expenses. According to the company website, Choosi Pty Ltd, for instance, operates as a distributor and a strategic partner to some of the organizations offering insurance across several areas, such as human health insurance, pet insurance, etc. Additionally, according to the company's website highlights, its funeral insurance product, called Australian Seniors, has been recognized historically from 2015 to 2020 as the Reader's Digest Highly Commended Trusted Brand under the category of Funeral Insurance Some of the prominent players in the burial insurance market include:

-

Foresters Life Insurance and Annuity Company (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’)

-

Royal Neighbors of America

-

Gerber Life Insurance Company

-

Zurich Insurance

-

Globe Life Inc. (Globe Life and Accident Insurance Company)

-

Mutual of Omaha

-

Fidelity Life Association

-

Allianz Life

-

Colonial Penn

-

The Baltimore Life

-

Generali

Burial Insurance Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 259.72 billion

Revenue forecast in 2030

USD 416.07 billion

Growth Rate

CAGR of 6.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage type, age of end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; Australia; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Foresters Life Insurance and Annuity Company (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’), Royal Neighbors of America, Gerber Life Insurance Company, Zurich Insurance, Globe Life Inc. (Globe Life and Accident Insurance Company), Mutual of Omaha, Fidelity Life Association, Allianz Life, Colonial Penn, The Baltimore Life, Generali

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Burial Insurance Market Segmentation

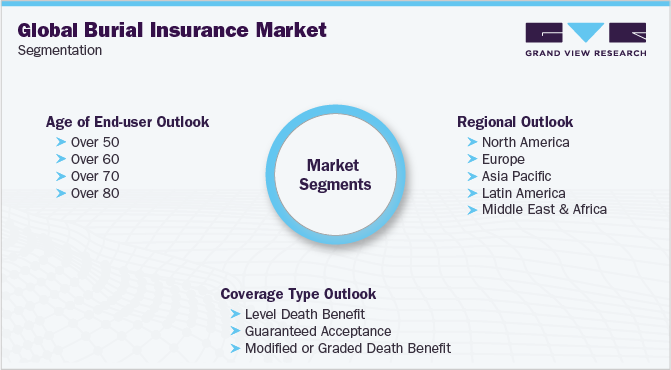

This report forecasts revenue growth at global, regional, & country levels, and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global burial insurance market based on coverage type, age of end-user, and region:

-

Coverage Type Outlook (Revenue, USD Billion; 2017 - 2030)

-

Level Death Benefit

-

Guaranteed Acceptance

-

Modified or Graded Death Benefit

-

-

Age of End-user Outlook (Revenue, USD Billion; 2017 - 2030)

-

Over 50

-

Over 60

-

Over 70

-

Over 80

-

-

Regional Outlook (Revenue, USD Billion; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 outbreak boosted the market for funeral insurance. The insurance sector as a whole, and burial insurance, in particular, experienced a rise in interest from policy seekers looking for insurance coverage choices in response to the COVID-19 pandemic. This is given the rise in demand among people wishing to purchase insurance policies that also cover funeral costs brought on by the growing price of such expenses.

b. The global burial insurance market size was estimated at USD 239.66 billion in 2021 and is expected to reach USD 259.724 billion in 2022.

b. The global burial insurance market is expected to grow at a compound annual growth rate of 6.1% from 2022 to 2030 to reach USD 416.072 billion by 2030.

b. North America dominated the burial insurance market with a share of 40.2% in 2021. This is due to the availability of several insurance providers, growing public awareness of funeral insurance, and subsequent government initiatives and associated laws to cover burial expenses.

b. Some key players operating in the burial insurance market include Foresters Financial Services Inc (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’); Royal Neighbors of America; Gerber Life Insurance Company; Zurich Insurance; Globe Life Inc. (Globe Life and Accident Insurance Company); Mutual of Omaha; Fidelity Life Association; Allianz Life; Colonial Penn; The Baltimore Life; Generali.

b. Key factors that are driving the burial insurance market growth include rising government initiative to offer dignified end-of-life care, the rising cost of funeral expenditure, growing awareness of funeral insurance, growing competition and related collaboration to bring in a better product for the policy seekers, and growing aging population and digitization.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."