- Home

- »

- Next Generation Technologies

- »

-

Business Intelligence Software Market Size Report, 2030GVR Report cover

![Business Intelligence Software Market Size, Share & Trends Report]()

Business Intelligence Software Market (2024 - 2030) Size, Share & Trends Analysis Report By BI Technology (Cloud BI, Mobile BI, Social BI), By Function, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-921-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Business Intelligence Software Market Summary

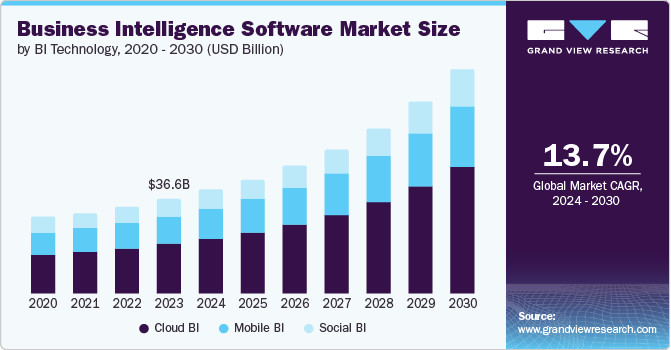

The global business intelligence software market size was valued at USD 36.60 billion in 2023 and is projected to reach USD 86.69 billion by 2030, growing at a CAGR of 13.7% from 2024 to 2030. Real-time analytics allows organizations to monitor their operations continuously, detect irregularities, respond to emerging opportunities, and mitigate risks.

Key Market Trends & Insights

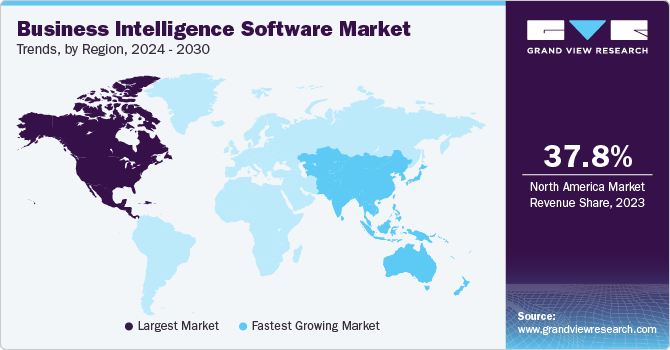

- The North America business intelligence software market dominated the market and accounted for a revenue share of 37.8% in 2023.

- The U.S. business intelligence software market accounted for the largest revenue share in 2023.

- By BI technology, the cloud BI technology dominated the market and accounted for a market share of 52.5% in 2023.

- Based on function, the executive management segment accounted for the largest market share in 2023.

- By deployment, the cloud segment accounted for the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 36.60 Billion

- 2030 Projected Market Size: USD 86.69 Billion

- CAGR (2024-2030): 13.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

BI tools equipped with real-time data processing capabilities enable businesses to stay competitive, enhancing their ability to adapt to market changes and customer demands. The availability of BI tools that conduct thorough data analysis allows users to enhance their comprehension of the market's current business dynamics.

Modern BI tools leverage AI and machine learning to provide advanced analytics capabilities such as predictive and prescriptive analytics. These technologies enable businesses to understand and predict future outcomes and prescribe actions to optimize results. For instance, in June 2024, Databricks launched an AI-powered business intelligence (BI) product. This product aims to give organizations access to analytics and insights, enabling anyone within the organization to make data-driven decisions. It features interactive dashboards and a conversational interface, Genie. Additionally, adopting cloud-based BI solutions offers scalability, flexibility, and cost-effectiveness, allowing businesses of all sizes to access analytics without significant investments in infrastructure.

As digitalization grows, businesses generate large amounts of data from every process. This includes data from customer interactions, transaction records, social media activities, and IoT sensors, leading to extensive information for organizations. This massive data necessitates robust BI solutions to manage, analyze, and derive actionable insights. This rising digitalization and growth of data volumes drive the demand for Business Intelligence (BI) software.

BI Technology Insights

The cloud BI technology dominated the market and accounted for a market share of 52.5% in 2023. Cloud BI solutions allow businesses to scale their data processing and analytics capabilities according to their needs without significant investments in hardware or infrastructure. This flexibility enables organizations of different sizes to access advanced BI tools and adapt quickly to changing business requirements. Whether increasing the company's data volume or requiring additional analytical capabilities, cloud BI solutions adapt to these changes, driving their demand in the market.

Mobile BI technology is expected to experience a significant CAGR during the forecast period. Mobile devices' accessibility and convenience enable employees to access critical business data and insights on the go. This widespread usage facilitates real-time data analysis and decision-making, which is essential for businesses that require fast responses to market changes. The ability to retrieve and analyze data anytime and anywhere increases productivity and enhances the efficiency of business operations.

Function Insights

The executive management segment accounted for the largest market share in 2023. BI software supports organizational change and promotes innovation by providing data-driven insights highlighting the need for change and the potential impact of innovative initiatives. Executives use BI tools to identify inefficiencies, discover new business opportunities, and predict future trends. This approach to change management and innovation ensures that the organization remains responsive to growing market demands.

The human resource segment is anticipated to register the fastest CAGR over the forecast period. BI software offers HR tools for tracking key performance indicators (KPIs), enabling executives to evaluate the effectiveness of various business processes and initiatives. These tools provide visual dashboards and reports highlighting critical metrics, making it easier for executives to identify areas of improvement and implement corrective actions. Effective performance monitoring ensures the organization remains on track to achieve its objectives and drive its market demand.

Deployment Insights

The cloud segment accounted for the largest market share in 2023. Cloud deployment enhances accessibility, enabling users to access BI tools and data from remote locations with an internet connection. This is important in the increasing trend towards remote work and global teams. Cloud BI supports collaboration across geographically distributed teams, allowing them to share real-time insights, reports, and dashboards. Additionally, cloud-based BI operates on a subscription model, reducing capital expenditure and allowing businesses to convert these costs into operational expenses.

The on-premise segment is anticipated to register a significant CAGR over the forecast period. Organizations with strict data security requirements often prefer securing their data within their infrastructure to maintain complete control. This control is essential for finance, healthcare, and government industries, where sensitive data must comply with strict regulatory standards. By deploying BI on-premise, businesses implement customized security measures and protocols depending on their specific needs, reducing the risk of data breaches and unauthorized access.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2023. Large enterprises are extensively using BI software to improve their internal and external business procedures. Advanced analytical engines and real-time data compilation tools are increasing the need for BI software in big corporations. Furthermore, large organizations depend on scalability to handle continuously increasing data volumes and user bases. The increased focus on distributing resources and making strategic decisions is also anticipated to boost the expansion of the segment for large companies.

The small and medium-sized enterprises (SMEs) segment is projected to grow at the fastest CAGR over the forecast period. Modern BI software offers affordable and scalable solutions that fit the financial requirements of smaller businesses. Cloud-based BI tools provide cost-effective access with subscription-based pricing models that eliminate the need for significant upfront investments in hardware and software. This affordability allows SMEs to access advanced analytics capabilities without exceeding their financial resources, driving the demand for BI software to improve operational efficiency and decision-making.

End Use Insights

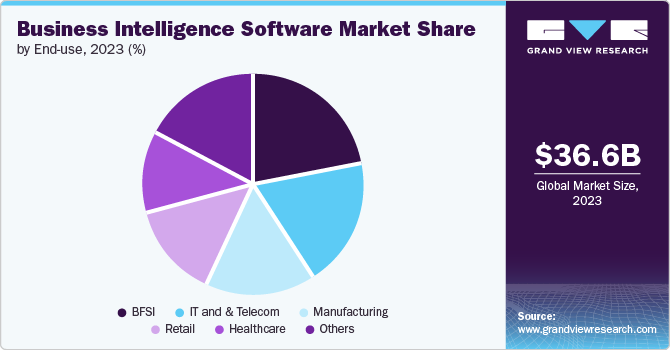

The BFSI sector accounted for the largest market share in 2023. The BFSI sector has complex operations that require efficient management to ensure profitability and competitiveness. BI software enables streamlined operations by providing insights into various processes, such as loan processing, claims management, and transaction handling. By identifying inefficiencies and problems, BI tools enable BFSI institutions to optimize workflows, reduce costs, and enhance productivity. This improved operational efficiency leads to better service delivery, faster processing times, and higher customer satisfaction.

The healthcare segment is anticipated to register the fastest CAGR over the forecast period. BI tools enable healthcare providers to analyze patient data comprehensively, identifying trends and patterns that inform clinical decisions. By leveraging data from electronic health records, patient surveys, and treatment outcomes, healthcare organizations develop evidence-based treatment plans, predict patient needs, and improve care delivery. This data-driven approach ensures patients receive personalized, effective, and timely care, leading to better health outcomes.

Regional Insights

The North America business intelligence software market dominated the market and accounted for a revenue share of 37.8% in 2023. The region's widespread availability of high-speed internet, cloud computing resources, and modern IT infrastructure support the BI tool's efficient deployment and integration. Companies in North America leverage these technological advancements to collect, store, and analyze vast amounts of data efficiently. This infrastructure ensures organizations utilize BI software to its full potential, facilitating data-driven decision-making and operational improvements.

U.S. Business Intelligence Software Market Trends

The U.S. business intelligence software market accounted for the largest revenue share in 2023. Cloud-based BI tools offer flexibility, scalability, and cost-effectiveness, making them affordable options for organizations of all sizes. These solutions allow businesses to access BI capabilities without substantial upfront investments in hardware and infrastructure. The shift towards cloud computing accelerates the adoption of BI software as companies deploy, scale, and manage these tools more efficiently.

Asia Pacific Business Intelligence Software Market Trends

Asia Pacific business intelligence software market is expected to witness the fastest CAGR over the forecast period. BI tools enable organizations to analyze customer data, understand preferences, and customize products and services to meet customer needs. By leveraging customer insights, companies improve marketing strategies, personalize interactions, and increase customer satisfaction and loyalty. This focus on customer-centric strategy drives the adoption of BI software as businesses pursue differentiation in competitive markets.

China business intelligence software market is expected to witness significant growth over the forecast period. The shift towards data-driven decision-making has led to a growing demand for BI software as companies pursue informed decisions based on comprehensive data analysis. Organizations across various industries, including finance, healthcare, retail, and manufacturing, invest in BI tools to enhance their strategic planning, operational efficiency, and customer insights. This focus on data-driven strategies drives demand for business intelligence software.

Europe Business Intelligence Software Market Trends

The Europe business intelligence software market is expected to witness significant growth over the forecast period. Analyzing customer data enables organizations to gain insights into customer preferences, behaviors, and feedback. BI tools allow businesses to develop targeted marketing campaigns, customize product offerings, and improve customer service. The emphasis on delivering personalized experiences and enhancing customer satisfaction drives the adoption of BI software as companies pursue better understanding and engagement with their customers.

The UK business intelligence software market is expected to witness significant growth over the forecast period. BI tools provide insights into various operational aspects, such as supply chain management, workforce productivity, and financial performance. By analyzing these data points, organizations identify inefficiencies, streamline processes, and optimize resource allocation. Improved operational efficiency leads to cost savings, enhanced productivity, and better overall performance, driving the adoption of BI solutions.

Key Business Intelligence Software Company Insights

Some of the key companies in the business intelligence software market include IBM, Microsoft, Tableau Software, LLC (Salesforce, Inc.), Oracle, Sisense Ltd, and others.

-

IBM Corporation is a global technology and consulting company with a diverse product and service portfolio. It offers a wide range of solutions, including cloud computing, artificial intelligence (AI), analytics, and quantum computing, to the finance, healthcare, and manufacturing industries.

-

Microsoft Corporation is a leading company that offers products and services. Its solutions include the Windows operating system, the Microsoft Office suite, and Azure, its cloud computing platform. Its product offerings include Microsoft 365, which integrates productivity tools such as Word, Excel, and Teams.

Key Business Intelligence Software Companies:

The following are the leading companies in the business intelligence software market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Microsoft

- Tableau Software, LLC (Salesforce, Inc.)

- Oracle

- Sisense Ltd

- Yellowfin International Pty Ltd (Yellowfin)

- QlikTech International AB,

- SAP SE

- Board International

- MicroStrategy Incorporated.

Recent Developments

-

In June 2024, MicroStrategy released an update that allows enterprises to layer AI-driven data insights directly into any web and mobile application. This update enables organizations to leverage AI technology to enhance their data analysis and decision-making processes.

-

In February 2024, MyDigitalOffice (MDO) rebranded as Otelier and announced the launch of IntelliSight, a Unified Business Intelligence Platform. IntelliSight allows hoteliers to collect cross-functional data for insights and analysis. This solution enables hoteliers to make data-driven decisions, increase efficiency, and optimize operations.

Business Intelligence Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.15 billion

Revenue forecast in 2030

USD 86.69 billion

Growth rate

CAGR of 13.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

BI technology, function, deployment, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, and South Africa

Key companies profiled

IBM Corporation; Microsoft; Tableau Software, LLC (Salesforce, Inc.); Oracle; Sisense Ltd; Yellowfin International Pty Ltd (Idera, Inc.); QlikTech International AB,; SAP SE; Board International; MicroStrategy Incorporated.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Intelligence Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global business intelligence software market report based on BI technology, function, deployment, enterprise size, end use, and region:

-

BI Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud BI

-

Mobile BI

-

Social BI

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Executive Management

-

Marketing

-

Sales

-

Operations

-

Finance

-

Human Resources

-

Supply Chain

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Manufacturing

-

Healthcare

-

Retail

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.