- Home

- »

- IT Services & Applications

- »

-

Business Process Management Market Size Report, 2030GVR Report cover

![Business Process Management Market Size, Share & Trends Report]()

Business Process Management Market Size, Share & Trends Analysis Report By Solution (Automation, Process Modelling), By Application, By Deployment, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-040-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

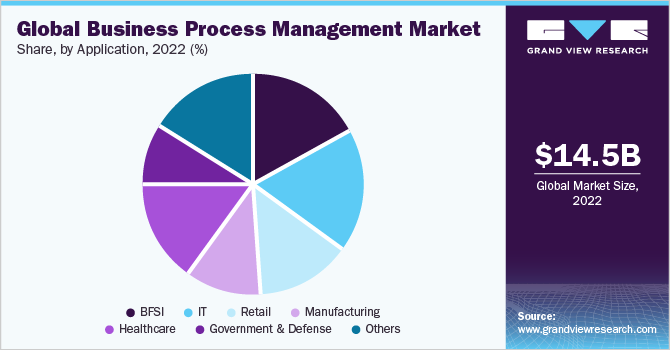

The global business process management market size was valued at USD 14.46 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 19.9% from 2023 to 2030. The benefits of deploying business process management (BPM) include improved business agility, complete visibility, increased efficiency, ensuring compliance and security, continuous improvement, and effortless transfer of business knowledge. Moreover, the companies offering BPM solutions include Accenture, Genpact, and International Business Machines Corporation (IBM), with a presence worldwide. The benefits of employing BPM and the easy availability of the solution worldwide combined have contributed to the growth of the BPM market.

The integration of AI into BPM has been a significant boost to the growth of the BPM market. The benefits of integrating AI include automation of repeated tasks, predictive analysis, improving customer experience, cost-effectiveness, and decision-making capabilities, among others. Moreover, the companies have been taking various initiatives toward artificial intelligence.

For instance, in November 2022, Infosys BPM announced the launch of the center for AI and automation in Poland in partnership with IBM. This center showcases a growing portfolio of AI and data solutions designed to accelerate and automate the hybrid cloud journey of businesses. Moreover, the center will complement Infosys BPM services offering, built with a design thinking approach. Such initiatives from the companies operating in the business process management market toward AI will drive the growth of the business process outsourcing market during the forecast period.

Many companies have been involved in various strategic initiatives such as partnerships, collaborations, and mergers acquisition, among others. These initiatives help companies offer BPM solutions with enhanced capabilities and reach a wider audience.

For instance, in September 2022, iGrafx, LLC. ( a U.S.-based BPM solution provider) announced its partnership with Zeitworks Technologies, Inc. (a U.S.-based software solution provider) to deliver AI-powered intelligent process management. The partnership enables the creation of a comprehensive process intelligent platform by linking task mining, process mining, predictive analysis, and discrete event simulation. Such initiatives are seen widely in the BPM market, thereby driving the growth.

The adoption of BPM in the healthcare industry is another factor that has been a major contributor to the growth of the BPM market from 2023-2030. The benefits of employing BPM in the healthcare industry includes enhancing clinical processes, streamlining administrative tasks, ensuring compliance, improving operational efficiency, minimizing errors and delays, and improving patient care. The large number of companies offering BPM solutions for healthcare functions, including Infosys Limited, Kissflow Inc., and BP Logix, Inc., among others, has paved the way for the market growth.

Moreover, governments worldwide have been increasing their spending on digitalization of the healthcare function, accelerating the growth of business process management in the healthcare industry. For instance, in May 2022, Tasmanian Liberal Government announced an investment of USD 150 million to upgrade their digital health infrastructure. The government will allocate the amount over the four years since the announcement; with the investment, the government plans include easy and convenient access to healthcare among local communities, reduced waiting time for services, less duplication of forms and care, and improved communications about the appointment.

Solution Insights

The automation segment is projected to witness the highest growth from 2023 to 2030. The growth of this segment can be attributed to the rising need for automation, owing to its benefits which include expanded productivity, incorporated framework, reduced probability of mistakes, reduced time in execution, decreased operating costs, and better internal communication, among others.

The companies are also coming up with solutions that have enhanced capabilities, which further exceed to drive the growth of the automation segment. For instance, in March 2021, Red Hat, Inc. introduced the latest update of the Red Hat process automation, an open-source business automation platform. The solution combines case management, business process management, resource planning, and business rules management, among others, which enables it to offer a comprehensive solution.

The process modeling segment occupied more than 25% of the revenue share in 2022. The segment's growth can be attributed to its benefits, which include improving communications, aligning operations with business strategy, improving operational efficiencies, increasing consistency and control, and gaining a competitive advantage.

Moreover, the market players have been coming p with solutions to facilitate identifying and modeling crucial business processes. For instance, in June 2020, iGrafx, LLC.a U.S.-based BPM solution provider, announced the availability of a new solution to support business continuity initiatives by facilitating the identification and modeling of critical business processes. The solution includes specialized properties, customized services, online assessment, and an automated accelerator for conducting business impact analysis, among others.

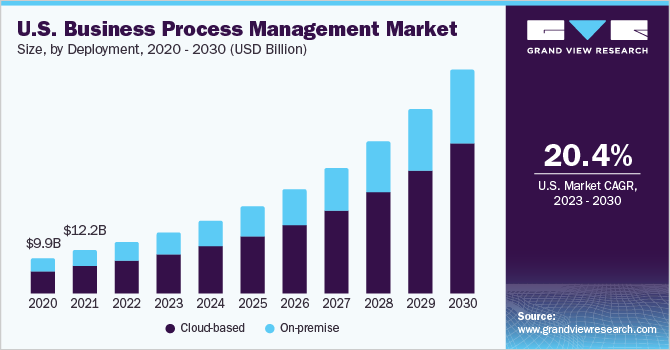

Deployment Insights

The cloud-based segment is projected to witness the highest CAGR from 2023 to 2030. Many companies engage in various strategic initiatives to offer cloud-based business process management solutions, including partnerships, collaborations, mergers, and acquisitions. For instance, in December 2021, Globals Inc. (an India-based cloud technology solution provider) announced its partnership with Axelor SAS (a French BPM solution provider). The partnership is aimed at accelerating the digital transformation of the customer of Globals Inc. by utilizing Axelor SAS’s BPM, CRM, and ERP solutions.

The on-premise segment occupied more than 35% of the revenue share in 2022, which can be attributed to the benefits that on-premises deployment offers, including control security and cost, among others. The backbone of the growth of this segment is the large enterprises dealing with sensitive data opting out for on-premises over cloud-based BPM solutions, owing to attributes such as data being firmly entrenched behind a firewall enabling better security. Resistance to change from on-premises deployment towards the cloud, especially among big companies, has also been a major factor attributing to the growth of the on-premise segment.

End-user Insights

The SMEs segment is projected to witness the highest CAGR of more than 20% from 2023 to 2030. The growth can be attributed to the presence of top companies in the market that offers specialized solutions for SMEs, which are also in a price range that the SMEs can afford.

Some significant benefits of SMEs adopting BMP include avoiding back-and-forth emails, tracking processes through complicated files, automating repetitive tasks, easy collaboration and communication, identifying bottlenecks, and incorporating transparency. The major companies offering the BPM for SMEs include Kissflow Inc. and Cavintek, Inc. The benefits of deploying BPM and the availability of specialized solutions for SMEs have contributed to this growth during the forecast period.

The large Enterprise segment is expected to occupy more than 70% of the market by end-user, which can be attributed to the rising need to stay ahead in the competition for the large business in the market. This competition has resulted in large enterprises going to almost all the available solutions which can be used to optimize the business processes and improve productivity, among others. Moreover, the rapid adoption of the latest technology among other large businesses has also accelerated the growth of the large enterprise segment.

Application Insights

The BFSI segment is projected to witness a CAGR of more than 16% from 2023 to 2030. The benefits gained post-implementation of BPM in the fiancé industry have been a significant factor in the segment's growth. The benefits include offering better customer, safety, and security, improved business agility and flexibility, efficiency, and better visibility.

Initiatives from several organizations, including the government, towards the sustainable transition of the banking sector have helped drive the market's growth. For instance, in March 2023, BANCO BPM GRUPPO BANCARIO (Italian BPM solution provider) announced it's joining the Net-Zero Banking Alliance (a United Nations Initiative) to accelerate the sustainable transition of the banking systems, with a larger aim of achieving net-zero emission by 2050.

The government & defense segment is projected to witness the highest growth rate of more than 18%. The adoption of BPM among government agencies has been on the high side, and the same trend is expected to continue in the coming years. Some significant areas for which government agencies are adopting BPM include providing better public services, simplifying day-to-day work, controlling and auditing critical processes, and upgrading processes to meet new legislative guidelines.

Moreover, the number of companies offering BPM solutions for government agencies is also high, which has paved the way for its wider adoption across the globe. Some companies offering BPM solutions for government agencies include BP Logix, Inc., SAP Singnavio, and Comidor LTD.

Regional Insights

North America held the largest share of more than 35% in 2022. The growth of this region can be attributed to various factors, including the rapid adoption of the latest technology, the home to the world's largest economy, and the presence of major companies such as Appian Corporation, Genpact, and International Business Machine Corporation, among others. The U.S. is home to around 6.1 million employer firms, according to the latest data published by U.S. Census Bureau in 2019. Many businesses in the country have also enabled wide adoption of BPM, contributing to the growth of the North America region.

Asia Pacific is projected to witness the highest CAGR of more than 20% from 2023 to 2030. The growth of this region can be attributed to rising economies such as India, which is undergoing a massive transition in digitalization. Moreover, the region is home to significant economies in the world, including China, Japan, and South Korea, which have been keen on adopting new technology, thereby driving the market growth. China and India are among the manufacturing hub in the world, which has contributed to the adoption of BPM among manufacturing industries in the region, thereby driving the growth.

Key Companies Market Share Insights

To broaden their product offering, the key players utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. Some prominent players in the global business process management market include:

-

Accenture

-

Appian Corporation

-

BP Logix, Inc.

-

Genpact

-

Infosys Limited

-

International Business Machines Corporation

-

Kissflow Inc.

-

Nintex Global Ltd.

-

Open Text Corporation

-

Pegasystems Inc.

-

Red Hat, Inc.

-

SAP SE

-

Software AG

-

Tata Consultancy Services Limited

Business Process Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.18 billion

Revenue forecast in 2030

USD 61.17 billion

Growth rate

CAGR of 19.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, end-user, application region

Regional scope

North America, Europe, Asia Pacific, Middle East & Africa, Latin America

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Accenture; Appian Corporation; BP Logix, Inc.; Genpact; Infosys Limited; International Business Machines Corporation; Kissflow Inc.; Nintex Global Ltd.; Open Text Corporation; Pegasystems Inc.; Red Hat, Inc.; SAP SE; Software AG; Tata Consultancy Services Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Process Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global business process management market report based on solution, deployment, end-user, application, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Automation

-

Process Modeling

-

Content & Document Management

-

Monitoring & Optimization

-

Integration

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premise

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT

-

Retail

-

Manufacturing

-

Healthcare

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business process management market is expected to grow at a compound annual growth rate of 19.9% from 2023 to 2030 to reach USD 61.17 billion by 2030.

b. North America dominated the business process management market with a share of 38.70% in 2022. This is attributable to the continuously changing regulation in the healthcare sector, which requires changes in documenting the process and financial transactions.

b. Some key players operating in the business process management market include Accenture, SAP SE, Genpact, Kissflow Inc., Pegasystems Inc., and International Business Machines Corporation.

b. Key factors that are driving the market growth include to the surging need for automation to reduce the product or service cost and growing business necessity for the cross-functional collaboration among others.

b. The global business process management market size was estimated at USD 14.46 billion in 2022 and is expected to reach USD 17.18 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."