- Home

- »

- Consumer F&B

- »

-

Caffeine Gummies Market Size, Share, Growth Report, 2030GVR Report cover

![Caffeine Gummies Market Size, Share & Trends Report]()

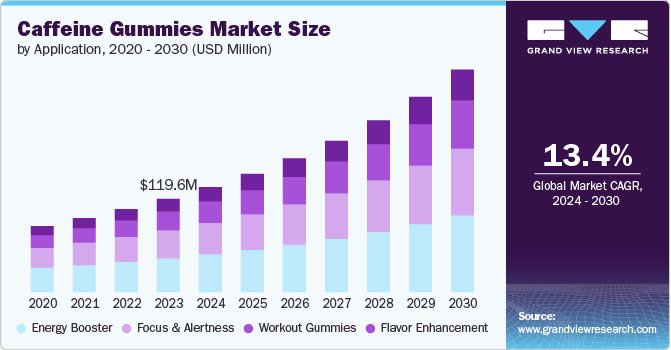

Caffeine Gummies Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Energy Booster, Workout Gummies, Focus & Alertness, Flavor Enhancement), By Distribution Channel (Pharmacies, Specialty Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-346-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Caffeine Gummies Market Summary

The global caffeine gummies market size was estimated at USD 119.6 million in 2023 and is projected to reach USD 285.8 million by 2030, growing at a CAGR of 13.2% from 2024 to 2030. Growing awareness of health has resulted in consumers preferring food products with added benefits, such as vitamins, proteins, and minerals.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, the energy booster accounted for a revenue of USD 119.6 million in 2023.

- Energy Booster is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 119.6 Million

- 2030 Projected Market Size: USD 285.8 Million

- CAGR (2024-2030): 13.2%

- North America: Largest market in 2023

Various awareness campaigns regarding healthy eating by government agencies, non-governmental organizations, and companies worldwide have helped consumers understand the importance of nutritional benefits, including those offered by dietary supplements. This increased awareness is projected to fuel the growth of the caffeine gummies market in the coming years.

Caffeine gummies, as part of the nutraceutical category, are gaining popularity as they offer both preventive and performance-enhancing benefits. They are likely to complement or even replace traditional caffeine sources in managing and enhancing energy levels, cognitive function, and overall alertness. The convenience and controlled dosage of caffeine gummies make them an appealing alternative for consumers seeking a quick and efficient energy boost.

In the U.S., gummy supplements, including caffeine gummies, are gaining high traction among consumers. This trend contributes to increased sales and signals a growing preference for functional and convenient supplement formats. As consumers continue to prioritize health and wellness, caffeine gummies are poised to succeed in the market, leveraging the broader trend toward functional foods and dietary supplements.

Caffeine gummies are experiencing a significant rise in popularity compared to other gummy supplements due to their unique value proposition and alignment with current consumer trends. In an increasingly fast-paced world, consumers are seeking convenient, effective, and enjoyable ways to maintain energy levels and mental alertness throughout the day.

Caffeine gummies cater to this need by providing a quick and controlled dose of caffeine, making them an attractive alternative to traditional sources like coffee and energy drinks. Their portability and ease of consumption appeal to busy professionals, students, and fitness enthusiasts who require a reliable energy boost without the hassle of preparation or the potential digestive discomfort associated with other caffeine products.

Additionally, the pleasant taste and chewable format of caffeine gummies enhance user experience, promoting adherence and repeated use. As the demand for functional and on-the-go nutritional products continues to grow, caffeine gummies are well-positioned to capitalize on this trend, driving their rapid market expansion and outpacing other gummy supplement categories.

The consumption of dietary supplements has surged in response to the increasing prevalence of heart diseases, cancer, and diabetes. These supplements can enhance overall health, prevent chronic conditions, increase life expectancy, support bodily functions, and delay aging. The busy lifestyles of individuals have encouraged on-the-go eating habits and driven the trend of replacing meals with smaller nutritional snacks, thereby increasing the consumption of functional foods and dietary supplements. This shift towards alternative forms of nutrients is expected to fuel the demand for caffeine gummies.

Caffeine gummies, a convenient and effective alternative to traditional caffeine sources, are poised to benefit from this trend. The rising number of fitness centers, health clubs, and gymnasiums, coupled with growing awareness of wellbeing among young people, are expected to boost the market. Additionally, the geriatric population, which often faces difficulties swallowing pills or tablets, is likely to drive demand for gummies due to their soft, gel-like consistency.

Furthermore, the increasing number of working professionals is expected to boost demand for easy-to-consume supplement forms. Caffeine gummies offer a convenient solution for busy professionals, as they are easy to chew and can be consumed on the go. According to World Bank data, the global labor force grew from 3.153 billion in 2010 to 3.387 billion in 2020. Consequently, caffeine gummies, infused with energy-boosting properties, are likely to witness high demand from this demographic, capitalizing on the trend towards functional and convenient supplement formats.

Application Insights

Energy Booster caffeine gummies accounted for a revenue share of around 36% in 2023. This segment targets individuals seeking a quick, convenient, and effective energy boost throughout their busy days. Consumers, including students, professionals, and travelers, appreciate the portability and rapid effect of these gummies, making them a popular choice for maintaining alertness and productivity.

Workout caffeine gummies are estimated to grow at a CAGR of 14.5% over the forecast period. These gummies are specifically designed for fitness enthusiasts, provide a pre-exercise energy surge, enhancing performance and endurance. These gummies often include additional ingredients like amino acids or electrolytes, catering to the needs of athletes and gym-goers looking to optimize their training sessions.

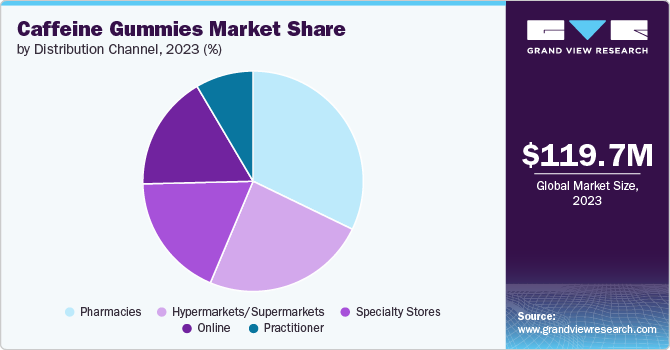

Distribution Channel Insights

The pharmacies segment accounted for a revenue share of around 32% in 2023. Pharmacies serve as a trusted retail channel for caffeine gummies, attracting health-conscious consumers who seek reliable and safe supplementation. The presence of knowledgeable pharmacists who can provide guidance and recommendations further boosts the credibility and sales of caffeine gummies in this segment.

The online segment is estimated is projected to grow at a CAGR of 15.7% over the forecast period. The convenience and accessibility of online shopping have significantly contributed to the growth of caffeine gummy sales. E-commerce platforms offer a wide variety of brands and formulations, enabling consumers to easily compare products, read reviews, and make informed purchasing decisions from the comfort of their homes.

Regional Insights

The caffeine gummies market in North America held 35% of the global revenue in 2023. The North American market is driven by the region's high consumption of functional foods and dietary supplements. Consumers' busy lifestyles and the growing trend of on-the-go nutrition have fueled demand, with a particular emphasis on convenience and performance-enhancing products.

U.S. Caffeine Gummies Market Trends

The caffeine gummies market in the U.S. emerged and accounted for a revenue share of around 77% in 2023. In the U.S., caffeine gummies are particularly popular due to the high prevalence of busy, active lifestyles and the widespread acceptance of dietary supplements. Strong marketing campaigns, a well-established retail infrastructure, and innovation in product formulations contribute to the robust growth of the caffeine gummies market in this country.

Asia Pacific Caffeine Gummies Market Trends

Asia Pacific caffeine gummies market is expected to grow at a CAGR of 15.0% from 2024 to 2030. The Asia-Pacific region is witnessing rapid growth, spurred by rising disposable incomes, urbanization, and the adoption of Western dietary habits. The expanding fitness and wellness industry, along with a younger demographic seeking energy-boosting supplements, is further propelling demand.

Europe Caffeine Gummies Market Trends

The caffeine gummies market in Europe is projected to grow at a CAGR of 12.7% from 2024 to 2030. The market is expanding due to increasing health consciousness and the rising popularity of alternative caffeine sources. Regulatory support for nutraceuticals and a growing focus on wellness and preventive health measures are key factors driving market growth in this region.

Key Caffeine Gummies Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Caffeine Gummies Companies:

The following are the leading companies in the caffeine gummies market. These companies collectively hold the largest market share and dictate industry trends.

- Man Matters

- HVMN

- Dry Brew

- TopGum, Ltd

- Gummy Cube

- Fuwei Fruits & Nuts Manufacturing Co., Ltd.

- Energy Bytes

- Punch’d Energy

- Hilo Gummies

- Seattle Gummy Company

Recent Developments

-

In May 2023, TopGum, a leading gummy supplement manufacturer, introduced a new range of caffeinated gummies, leveraging its innovative microencapsulation technology to ensure effective and controlled absorption. The Israeli-based company unveiled its 'Gummiccino' line at Vitafoods last week, showcasing espresso, cappuccino, and mocha flavors that utilize an extract of robusta coffee beans.

-

In May 2023, Seattle Gummy Company announced the launch of ‘PERFORMANCE GUMMIES’ for athletes requiring absorption of active ingredients for pre- and post-training. The company’s pre-workout gummies provide athletes with a controlled release of caffeine and carbohydrates, which helps increase the blood glucose levels required during high-intensity workouts and endurance sports.

Caffeine Gummies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 134.8 million

Revenue forecast in 2030

USD 285.8 million

Growth rate

CAGR of 13.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy;, Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Man Matters; HVMN; Dry Brew; TopGum, Ltd; Gummy Cube; Fuwei Fruits & Nuts Manufacturing Co., Ltd.; Energy Bytes; Punch’d Energy; Hilo Gummies; Seattle Gummy Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Caffeine Gummies Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caffeine gummies market based on the application, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Booster

-

Focus & Alertness

-

Workout Gummies

-

Flavor Enhancement

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global caffeine gummies market was estimated at USD 119.7 billion in 2023 and is expected to reach USD 134.8 billion in 2024.

b. The global caffeine gummies market is expected to grow at a compound annual growth rate of 13.4% from 2024 to 2030 to reach USD 285.8 billion by 2030.

b. North America dominated the caffeine gummies market with a share of around 35% in 2023. Consumers' busy lifestyles and the growing trend of on-the-go nutrition have fueled demand, with a particular emphasis on convenience and performance-enhancing products.

b. Some of the key players operating in the caffeine gummies market include Man Matters; HVMN; Dry Brew; TopGum, Ltd; Gummy Cube; Fuwei Fruits & Nuts Manufacturing Co., Ltd.; Energy Bytes; Punch’d Energy; Hilo Gummies; Seattle Gummy Company

b. Key factors that are driving the caffeine gummies market growth include a growing preference for functional and convenient supplement formats, and rising number of fitness centers, health clubs, and gymnasiums, coupled with growing awareness of wellbeing among young people, are expected to boost the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.