Calcined Anthracite Market Size & Trends

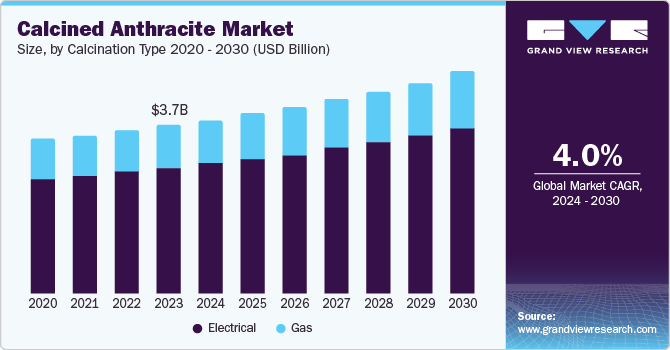

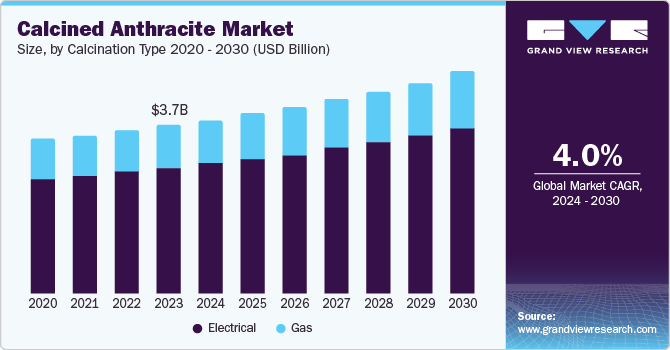

The global calcined anthracite market size was valued at USD 3.70 billion in 2023 and is projected to grow at a CAGR of 4.0% from 2024 to 2030. Factors such as the increasing use of calcined anthracite in various applications such as electric arc furnaces, pulverized coal injection, and steel manufacturing are expected to push the market growth forward. It is used in the steel industry during the manufacturing process. The high carbon content with minimum impurities makes it an ideal material for various applications.

Calcined anthracite is an alternative to pet coke as many countries impose regulations on pollution control and environmental sustainability. Infrastructural developments in several countries lead to an increasing demand for steel influences the demand for calcined anthracite. Moreover, the growing dominance of steel in the construction, and automotive sectors and the use of battery casings as an important filler component positively impacts the market growth. Furthermore, continuous research and development for new applications contribute to market growth.

With the emerging trend of electric vehicles worldwide, the need for high-performance batteries drives the interest in electrically calcined anthracite. The demand for carbon content with high levels of conductivity both electrical and thermal has fueled the need for carbon electrode paste in the EV industry. In the steel industry, gas calcined anthracite is an ideal component for applications that involve cast iron or steel, mainly for its dense properties. It is perceived as one of the best sources of high-quality carbon. Therefore, the calcined anthracite market is poised to grow steadily in the forecast period.

Calcination Type Insights

The electrical segment accounted for the largest market share of 74.8% in 2023. Factors such as the increasing demand in the aluminum industry and electrically calcined anthracite are widely used as a smelting additive due to its high purity and quality. The rising steel manufacturing and technological advancements have resulted in enhancements in battery technology which is further poised to drive the segment growth. In addition, the increasing infrastructure developments are anticipated to contribute to the growth.

The gas segment is projected to witness the fastest-growing CAGR of 3.8% in the forecast period. Gas applications in various industries are prominent due to the need for high-quality carbon materials especially in the steel and aluminum industries. Technological advancements drive the efficiency and effectiveness of gas calcined anthracite. Gas calcined anthracite is perceived as more environmentally friendly when compared to its alternatives. In addition, the stringent government policies centering around clean technologies are further anticipated to encourage the use of eco-friendly gaseous chemicals.

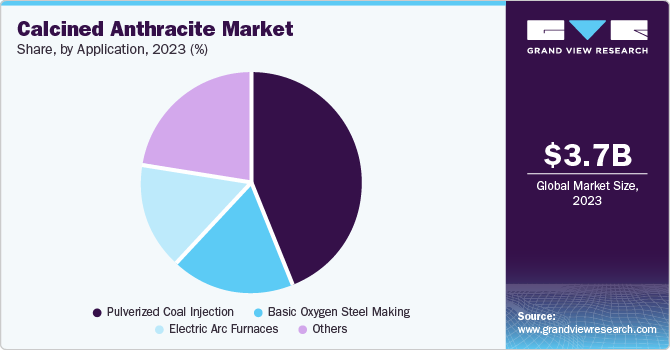

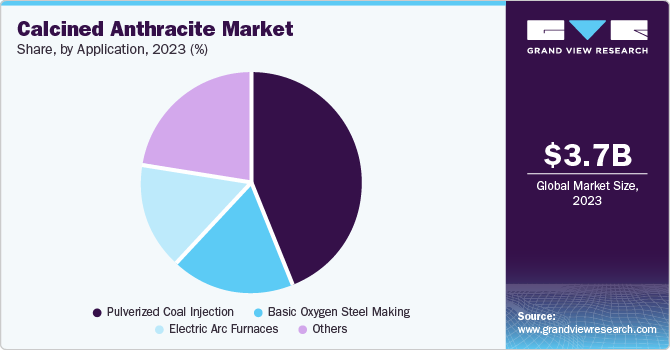

Application Insights

The pulverized coal injection segment held the largest market share of 44.0% in 2023, Pulverized coal reduces coke consumption and improves the overall steel production efficiency. Additionally, it decreases dependency on metallurgical coke and helps in energy conservation further enhancing steel and iron production. With the government’s support for clean energy, the authorities offer financial incentives and subsidies for implementing clean energy and systems. These factors are expected to catalyze the segment growth in the forthcoming years. In addition, the price stability of pulverized coal in the past few years has increased their demand.

The electric arc furnaces is expected to be the fastest-growing segment with a CAGR of 4.5% over the forecast period. Increasing emphasis on sustainable manufacturing practices as electric arc furnaces are more sustainable than traditional blast furnaces. The innovations and developments enhance operational efficiency and reduce energy consumption. Besides, the capital required for installing an electric arc furnace compared to its alternatives is low, resulting in cost-efficiency. In addition, the increasing industrialization in countries such as India, Japan, and China will further contribute to market developments.

Regional Insights

North America accounted for the global market share of 8.4% in 2023. Factors such as the increasing emphasis on environmentally friendly practices in the U.S., and Canada have fueled the use of calcined anthracite. The shift in trend from traditional blast furnaces to electric arc furnaces has significantly contributed to the regional market growth. Other factors such as the increase in steel consumption and emphasis on cleaner production practices drive the market growth.

Asia Pacific Calcined Anthracite Market Trends

Asia Pacific held the largest market share of 75.8% in 2023. The increasing number of steel industries in India, China, and Japan supplement the regional market developments. In addition, the increase in aluminum production due to increasing investments in production facilities across the region, and the infrastructural developments boosts the regional developments. The increasing trend of lightweight materials in the automotive industry has increased the demand for calcined anthracite.

Europe Calcined Anthracite Market Trends

Europe held a significant market share of 11.5% in 2023. The growing demand for steel in the region has resulted in a surge in demand for calcined anthracite, increasing environmental regulations are influencing the industries to adopt cleaner production practices and technological advancements that exhibit enhanced efficiency and reduce costs.

Key Calcined Anthracite Company Insights

Some of the key players in the calcined anthracite market are Rheinfelden Carbon Products GmbH., Asbury Carbons, and other companies. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, the key players are undertaking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Rheinfelden Carbon Products is a German multinational company among the leading manufacturers, especially in gas calcined anthracite.

-

Asbury Carbons is a U.S.-based company offering diverse product offerings and has established partnerships with global suppliers to ensure a consistent supply of raw materials.

Key Calcined Anthracite Companies:

The following are the leading companies in the calcined anthracite market. These companies collectively hold the largest market share and dictate industry trends.

- Rheinfelden Carbon Products GmbH.

- JH CARBON PTY LTD

- RESORBENT, s.r.o.

- Absury Carbons

- Rheinbraun Brennstoff

- Ningxia Carbon Valley International Co., Ltd

- Ningxia Coalician Carbon & Coke Co Ltd

- Dev Energy

- Carbon Resources

- Singhania International Limited

Global Calcined Anthracite Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 3.82 billion

|

|

Revenue forecast in 2030

|

USD 4.83 billion

|

|

Growth rate

|

CAGR of 4.0% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD billion/million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Calcination type, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India

|

|

Key companies profiled

|

Rheinfelden Carbon Products GmbH.; JH CARBON PTY LTD; RESORBENT; Asbury Carbons; Rheinbraun Brennstoff; Ningxia Carbon Valley International Co., Ltd; NingXia Coalician Carbon & Coke Co Ltd; Dev Energy; Carbon Resources; Singhania International Limited

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

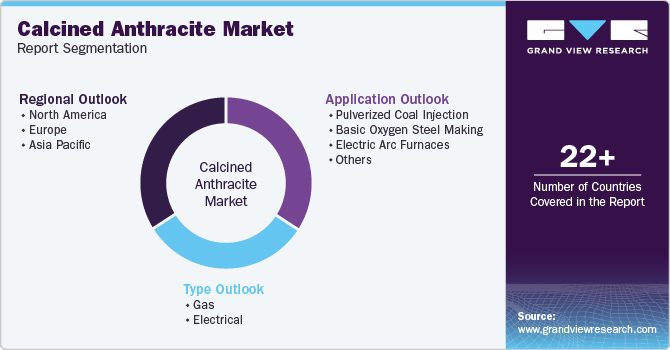

Global Calcined Anthracite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global calcined anthracite market report based on calcination type, application, and region:

-

Calcination Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

Asia Pacific