- Home

- »

- Advanced Interior Materials

- »

-

Calcium Carbonate Market Size, Share, Industry Report 2033GVR Report cover

![Calcium Carbonate Market Size, Share & Trends Report]()

Calcium Carbonate Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Ground Calcium Carbonate, Precipitated Calcium Carbonate), By Application (Automotive, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-296-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Calcium Carbonate Market Summary

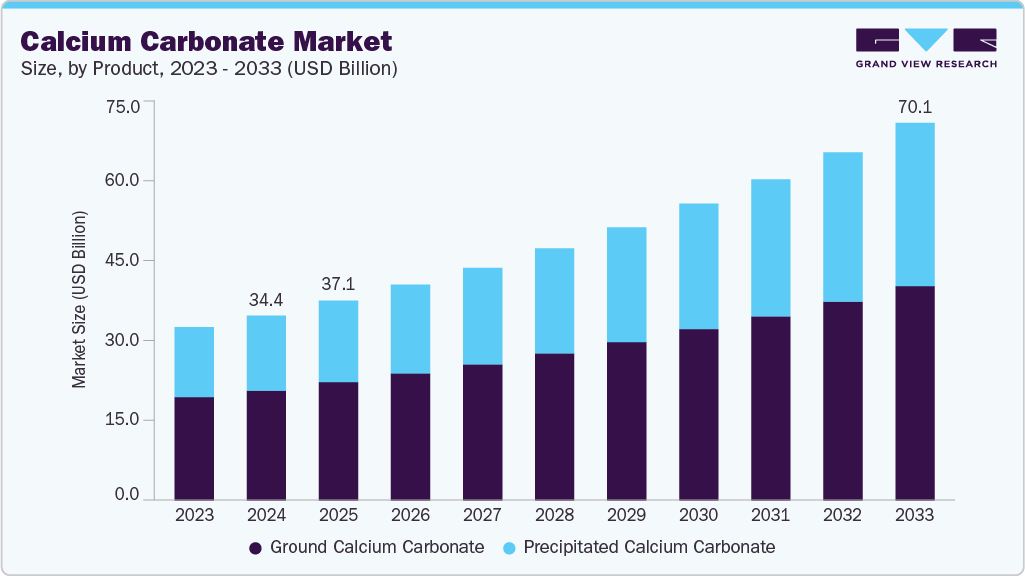

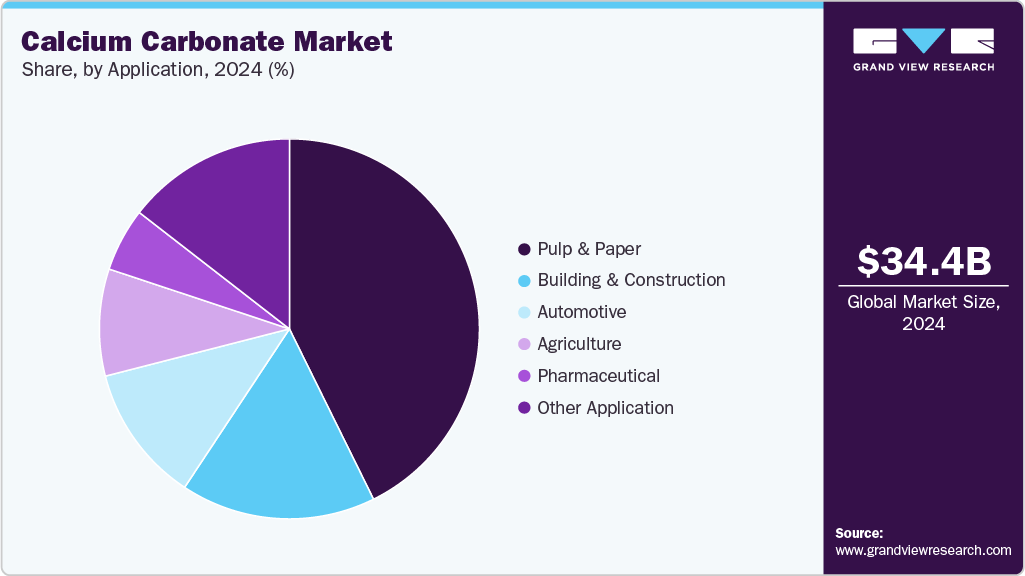

The global calcium carbonate market size was estimated at USD 34.4 billion in 2024 and is projected to reach USD 70.1 billion by 2033, growing at a CAGR of 8.3% from 2025 to 2033. The market is expanding steadily as industries increasingly rely on versatile, cost-effective raw materials.

Key Market Trends & Insights

- North America is expected to grow fastest with a CAGR of 8.6% from 2025 to 2033.

- The ground calcium carbonate segment dominated the market and accounted for the largest revenue share of 59.5% in 2024.

- The automotive segment is expected to grow fastest with a CAGR of 9.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 34.4 Billion

- 2033 Projected Market Size: USD 70.1 Billion

- CAGR (2025-2033): 8.3%

- Largest Region: Asia Pacific

Its filler, neutralizing agent, and opacity enhancer role makes it essential in construction, paper, plastics, and agriculture. Availability from natural sources like limestone ensures a steady supply, supporting consistent industrial use and long-term market growth. Market growth is influenced by the availability of high-quality natural reserves and advancements in processing methods. Producers focus on improving particle size distribution, surface treatment, and purity levels to meet diverse industrial needs. Efficient extraction and processing enhance the quality and consistency of products, which in turn strengthens adoption across various applications. Supply stability and production efficiency remain critical to sustaining long-term growth.Regulatory frameworks and environmental considerations also shape market dynamics. Sustainable sourcing and responsible mining practices impact production strategies, while innovations in manufacturing processes help reduce energy consumption and waste. Companies that optimize production while maintaining compliance gain competitive advantages. This balance between environmental responsibility and operational efficiency contributes to market resilience and encourages the development of higher-value products.

Emerging opportunities are present in industries seeking environmentally responsible, high-performance materials. As end-users look to reduce manufacturing costs without compromising quality, calcium carbonate provides a reliable solution. Expanding use in pharmaceuticals, food additives, and coatings creates avenues for product diversification. Continuous adaptation to industrial needs and sustained supply from natural reserves position the market for steady expansion and long-term investment potential, supported by practical demand rather than speculative growth.

Market Concentration & Characteristics

The calcium carbonate industry is moderately consolidated, with several established producers and numerous regional suppliers operating globally. Market is characterized by the coexistence of large-scale manufacturers and smaller players, which creates a competitive environment focused on quality, consistency, and cost efficiency. Firms often differentiate themselves through product purity, particle size, and surface treatments, catering to diverse industrial requirements while maintaining steady supply chains.

Market characteristics reflect a balance between abundant natural resources and evolving industrial demands. Production is heavily influenced by the availability of raw materials and processing capabilities, while sustainability and regulatory compliance shape operational practices. Demand is consistent due to its widespread applicability, and manufacturers continually innovate to meet changing standards and preferences. Flexibility in product offerings, combined with reliable supply, ensures resilience in the market and allows players to capitalize on emerging opportunities across different applications.

Product Insights

The ground calcium carbonate segment dominated the market and accounted for the largest revenue share of 59.5% in 2024. Its dominance stems from abundant natural availability, cost-effectiveness, and extensive use across manufacturing processes requiring bulk fillers. GCC’s consistent quality, ease of processing, and suitability for construction materials, paper coating, and polymer reinforcement support its strong market position. The segment continues to benefit from stable demand in large-scale industrial applications.

The precipitated calcium carbonate segment is growing with a CAGR of 9.1% from 2025 to 2033, driven by its controlled particle size, high purity, and superior brightness compared to natural forms. Industries such as plastics, paints, and pharmaceuticals increasingly prefer PCC for its performance-enhancing properties. Continuous innovation in surface treatment and fine particle technology allows manufacturers to tailor PCC for specialized applications, reinforcing its position as a high-value material in advanced production processes.

Application Insights

The pulp & paper segment dominated the market and accounted for the largest revenue share of 42.7% in 2024. Its leading position is driven by calcium carbonate’s filler and coating material, enhancing brightness, smoothness, and print quality. The material’s cost-effectiveness and ability to improve paper durability make it highly preferred. Consistent demand in printing and packaging paper supports steady market growth and long-term adoption.

The automotive segment is expected to grow fastest with a CAGR of 9.1% from 2025 to 2033. Growth is fueled by increasing use of calcium carbonate as a lightweight filler in plastics, coatings, and composite materials, helping to reduce vehicle weight and improve fuel efficiency. Rising production of electric and hybrid vehicles and stricter environmental standards drive demand for high-performance, eco-friendly materials in automotive manufacturing.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 43.0% in 2024. Strong manufacturing bases, large-scale infrastructure projects, and expanding paper and plastic production support the region’s growth. Abundant limestone reserves and low production costs enhance regional competitiveness. Increasing investments in construction materials and rising demand for consumer goods continue to drive consistent calcium carbonate consumption across major economies such as China, India, and Japan.

China Calcium Carbonate Market Trends

The calcium carbonate market in China dominates production and consumption due to abundant limestone resources, extensive industrial capacity, and high domestic demand across construction, paper, and polymer manufacturing. The government’s emphasis on industrial modernization and cleaner production processes supports large-scale calcium carbonate utilization. Growing paper and packaging exports and cost-efficient raw material availability continue to reinforce China’s position as a global hub for ground and precipitated calcium carbonate production.

North America Calcium Carbonate Market Trends

The calcium carbonate market in North America is expected to grow fastest with a CAGR of 8.6% from 2025 to 2033, driven by rising demand for high-purity calcium carbonate in advanced applications such as pharmaceuticals, food processing, and specialty polymers. The region benefits from technological innovation, improved production efficiency, and a strong focus on sustainable material sourcing. Growing investment in eco-friendly manufacturing and value-added product development positions North America as a key growth center for the forecast period.

The U.S. calcium carbonate market shows steady growth due to strong demand from industries such as plastics, paper, and construction materials. The country’s focus on sustainable production and advanced material engineering drives innovation in high-purity and specialty calcium carbonate. Increasing investment in environmentally responsible manufacturing and the presence of established end-user industries support stable consumption, while regulatory emphasis on product quality and recycling strengthens domestic market performance.

Europe Calcium Carbonate Market Trends

The calcium carbonate market in Europe benefits from stringent environmental regulations encouraging sustainable sourcing, high product purity, and energy-efficient processing. Demand is driven by the region’s advanced paper, plastics, and coatings industries, which emphasize recyclability and eco-friendly formulations. Continuous innovation in fine particle production and the shift toward renewable materials further enhance market growth, making Europe a leader in sustainable calcium carbonate applications.

Latin America Calcium Carbonate Market Trends

The calcium carbonate market in Latin America is expanding due to increasing infrastructure development, growth in agricultural applications, and rising demand for affordable industrial materials. Abundant natural limestone reserves in Brazil and Mexico support domestic production, reducing import dependency. Growing industrialization and government initiatives promoting local manufacturing capacity create favorable conditions for sustained regional market growth.

Middle East & Africa Calcium Carbonate Market Trends

The calcium carbonate market in the Middle East & Africa is witnessing gradual growth supported by expanding construction activities, rising investment in infrastructure, and growing demand for calcium carbonate in paints, plastics, and coatings. Abundant limestone deposits in countries such as Egypt and the United Arab Emirates provide a reliable raw material base for local production. Industrial diversification efforts, particularly in Gulf economies, encourage greater domestic manufacturing while increasing agricultural development across Africa, further enhancing regional consumption potential.

Key Calcium Carbonate Company Insights

The two key dominant manufacturers in the market are Gulshan Polyols Ltd. and Carmeuse Group.

-

Gulshan Polyols Ltd. specializes in producing high-quality calcium carbonate for diverse industrial applications. The company focuses on consistent product performance, offering tailored solutions to meet the requirements of the plastics, coatings, and paper industries. Its commitment to quality and innovation allows it to maintain a strong presence across multiple sectors, supporting long-term growth and adoption.

-

Carmeuse Group is a global leader in calcium carbonate production, emphasizing sustainable extraction and processing methods. The company develops products for industrial and construction applications, prioritizing material efficiency, durability, and environmental responsibility in its offerings.

Key Calcium Carbonate Companies:

The following are the leading companies in the calcium carbonate market. These companies collectively hold the largest market share and dictate industry trends.

- Gulshan Polyols Ltd.

- Carmeuse Group

- Multi Minerals

- Kunal Calcium

- GLC Minerals

- Imerys

- J.M. Huber Corporation

- Minerals Technologies Inc.

- Indocal

- Whitegold Minerals

- NİĞTAŞ A.Ş.

- Ascom Carbonate and Chemicals Manufacturing (ACCM)

Recent Developments

-

In May 2025, MIDROC Investment Group inaugurated Ethiopia’s first coated calcium carbonate production plant in Awash 7 Kilo, Afar Region. The facility will produce coated calcium carbonate for plastics, water pipes, pharmaceuticals, shoe soles, sponges, and cable products, boosting industrial development.

-

In February 2025, CarbonFree began constructing a carbon-capture system at U.S. Steel’s Gary, Indiana, facility to produce carbon-neutral calcium carbonate from steel plant CO2 emissions. The SkyCycle™ process converts flue gas into high-purity CaCO3 using magnesium hydroxide and calcium-containing slag, providing a sustainable material for paints, coatings, adhesives, plastics, and food applications.

-

In December 2024, Izedon Carbonates (IzeCarb) inaugurated a calcium carbonate production plant in Lampese, Edo State, Nigeria. The facility, with a licensed dolomite quarry, produces high-quality calcium carbonate for PVC, paints, drilling fluids, and plaster, supporting import substitution and economic diversification.

Calcium Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.1 billion

Revenue forecast in 2033

USD 70.1 billion

Growth rate

CAGR of 8.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

Gulshan Polyols Ltd.; Carmeuse Group; Multi Minerals; Kunal Calcium; GLC Minerals; Imerys; J.M. Huber Corporation; Minerals Technologies Inc.; Indocal; Whitegold Minerals; NİĞTAŞ A.Ş.; Ascom Carbonate and Chemicals Manufacturing (ACCM)

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Calcium Carbonate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global calcium carbonate market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Ground Calcium Carbonate

-

Precipitated Calcium Carbonate

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Automotive

-

Building & Construction

-

Pharmaceutical

-

Agriculture

-

Pulp & Paper

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global calcium carbonate market size was estimated at USD 34.4 billion in 2024 and is expected to reach USD 37.1 billion in 2025.

b. The global calcium carbonate market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2033 to reach USD 70.1 billion by 2033.

b. The ground calcium carbonate segment dominated the market and accounted for the largest revenue share of 59.5% in 2024.

b. Some of the key players operating in the calcium carbonate market are Gulshan Polyols Ltd., Carmeuse Group, Multi Minerals, Kunal Calcium, GLC Minerals, Imerys, J.M. Huber Corporation, Minerals Technologies Inc., Indocal, Whitegold Minerals, NİĞTAŞ A.Ş., Ascom Carbonate and Chemicals Manufacturing (ACCM).

b. The market is expanding steadily as industries increasingly rely on versatile, cost-effective raw materials. Its role as a filler, neutralizing agent, and opacity enhancer makes it essential in construction, paper, plastics, and agriculture. Availability from natural sources like limestone ensures steady supply, supporting consistent industrial use and long-term market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.