- Home

- »

- Next Generation Technologies

- »

-

Call Center AI Market Size & Share, Industry Report, 2030GVR Report cover

![Call Center AI Market Size, Share & Trends Report]()

Call Center AI Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Component, By Application (Predictive Call Routing, Journey Orchestration), By Deployment, By Enterprise Size, By Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-957-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Call Center AI Market Summary

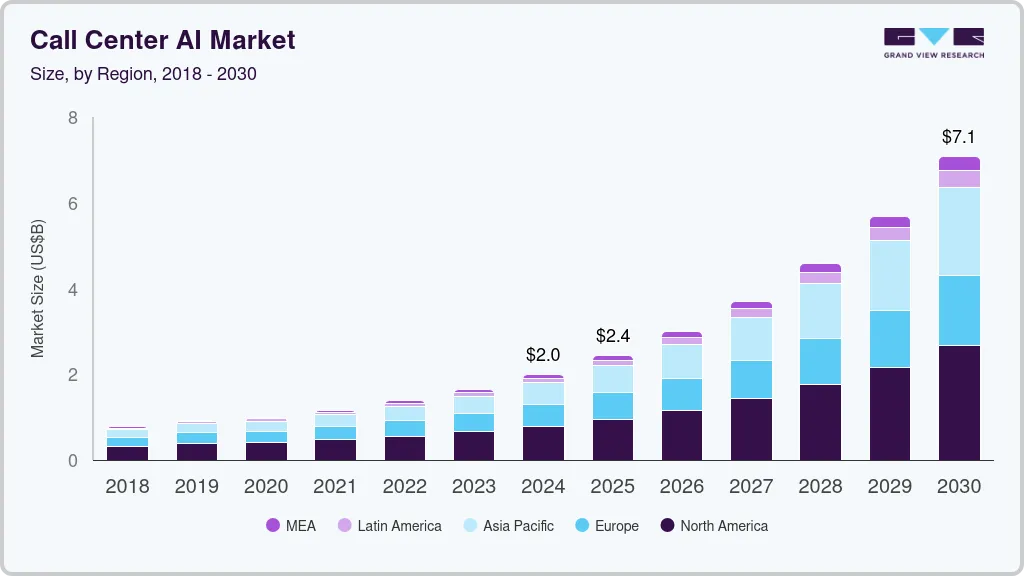

The global call center ai market size was estimated at USD 1.99 billion in 2024 and is projected to reach USD 7.08 billion by 2030, growing at a CAGR of 23.8% from 2025 to 2030. Various factors, such as rising demand for enhanced customer experience, cost reduction and operational efficiency, omnichannel engagement, growing use of chatbots and virtual assistants, and increased adoption of cloud-based solutions, are primarily driving the growth of the industry.

Key Market Trends & Insights

- North America call center AI market dominated the global industry with a revenue share of over 39% in 2024.

- The call center AI market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030.

- By component, the solution segment led the market in 2024, accounting for over 74.0% share of the global revenue.

- By application, the predictive call routing segment accounted for the largest market revenue share in 2024.

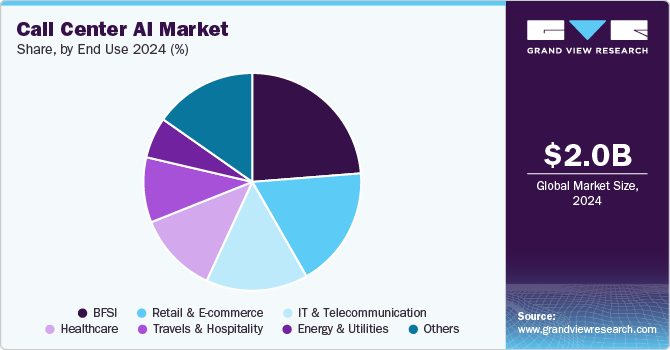

- By the, BFSI segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.99 Billion

- 2030 Projected Market Size: USD 7.08 Billion

- CAGR (2025-2030): 23.8%

- North America: Largest market in 2024

The growing demand for high-quality customer service is expected to accelerate the adoption of AI-driven solutions to enhance call center operations. Companies are increasingly focused on strengthening customer relationships by offering omnichannel engagement platforms and delivering superior service experiences. This shift from present call center methods to AI-powered solutions presents significant growth opportunities for the call center artificial intelligence (AI) industry.

AI solutions are helping businesses meet regulatory requirements by securely handling customer data, providing automated compliance monitoring, and reducing errors in sensitive transactions. AI-driven call center solutions help reduce operational costs by automating routine tasks, such as answering common queries and routing calls, which frees up human agents for more complex tasks. The adoption of AI-based chatbots and virtual assistants is increasing as these technologies can handle high volumes of inquiries, provide instant responses, and reduce the need for human intervention.

Component Insights

The solution segment led the market in 2024, accounting for over 74.0% share of the global revenue. AI solutions analyze vast amounts of customer data to offer actionable insights, predict customer needs, and provide proactive support. This allows call centers to anticipate issues before they occur and enhance problem-resolution efficiency. AI solutions help call centers comply with stringent regulations such as the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) by ensuring that customer interactions are logged, monitored, and secure. AI also aids in detecting fraud or security breaches in real time, boosting trust in the system.

The services segment is predicted to foresee significant growth in the call center AI industry. Various companies prefer outsourcing the management of AI systems to specialized service providers, reducing the burden of maintaining complex AI infrastructures in-house. Managed AI services offer continuous monitoring, updates, and optimization of AI tools, ensuring seamless operations without needing internal expertise. As AI systems become more advanced, the need for specialized services to design, deploy, and maintain these systems grows. AI service providers offer expertise in handling complexities such as multi-language processing, omnichannel integration, and advanced analytics in call centers.

Application Insights

The predictive call routing segment accounted for the largest market revenue share in 2024. Various factors such as enhancement of customer experience, increased operational efficiency, advancements in artificial intelligence and machine learning are primarily driving the growth of the segment in the call center AI industry. Predictive call routing leverages real-time data analytics, assessing factors such as customer history, interaction patterns, and agent performance. AI models continuously update, leading to improved call-routing accuracy based on changing customer behavior and preferences.

The sentiment analysis segment is predicted to foresee significant growth in the coming years. Sentiment analysis allows call centers to assess customer emotions during interactions, enabling real-time adjustments to agents' responses. This leads to more personalized and empathetic customer service, which enhances satisfaction and loyalty. Moreover, by identifying negative sentiment early in a conversation, sentiment analysis helps agents address issues before they escalate, improving first-call resolution (FCR) rates and reducing customer churn. Thus, there is high growth of the segment.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. The cloud segment is growing rapidly because interactive voice response (IVR) solutions for quickly resolving queries over phone calls are becoming increasingly popular. Customers can use software to resolve product-related issues instead of calling customer service. Furthermore, increased workplace integration of new systems with existing ones and a rapid increase in demand for the implementation of new call center software are expected to fuel the growth of this segment.

The on-premises segment is anticipated to witness significant growth in the coming years. On-premises deployment of AI solutions and services enables enterprises to customize and implement AI models tailored to their specific needs. This approach also ensures robust data security practices, safeguarding consumer information and creating a more secure operational environment. Moreover, on-premises call center AI solutions offer companies greater control over customization to tailor AI features to their specific needs. These include the ability to integrate with legacy systems, proprietary software, or internal workflows without relying on external vendors’ cloud platform

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. Large enterprises are increasingly adopting call center AI software due to its cost-effectiveness, increased sales deals, identifying urgent calls, boosting security, auto-recording, and more. Auto-recording allows an agent's cumulative performance calculation over time and provides feedback as needed for performance measurement. In the event of a call-related dispute, listening to the recording can help one decide what course of action to take. The above factors are expected to boost demand for call center software in large enterprises.

The SME segment is anticipated to exhibit the highest CAGR over the forecast period. AI-driven call center solutions help SMEs reduce costs by automating routine tasks such as answering common inquiries, routing calls, and managing customer interactions. This reduces the need for large customer support teams and minimizes labor costs.

End Use Insights

The BFSI segment accounted for the largest market revenue share in 2024. Implementing AI solutions in the banking ecosystem augments the quality and efficiency of call center interactions, thus enabling banks to offer better customer services. The ability of banking applications on mobile phones to contact call center agents according to customer needs is prompting banking institutions to deploy AI voice assistants and AI chatbots. This helps them prioritize customer queries, thus reducing the workload of call center agents and aiding them in focusing on more critical customer queries.

The healthcare segment is anticipated to exhibit the highest CAGR in the call center AI industry over the forecast period. Healthcare organizations deal with highly sensitive patient data and must comply with strict regulations such as the Health Insurance Portability and Accountability Act in the U.S., the General Data Protection Regulation in Europe, and various other regional healthcare laws. Call center AI solutions allow healthcare providers to maintain full control over data security and ensure compliance, avoiding the risks associated with cloud storage. AI-driven automation in call centers can handle routine inquiries, appointment scheduling, and post-treatment follow-ups. Call center AI enhances the patient experience by offering personalized services and reducing wait times. This leads to greater patient satisfaction while allowing healthcare staff to focus on more complex tasks.

Channel Insights

The phone segment accounted for the largest market revenue share in 2024. AI tools, such as emotional intelligence systems, assist customer service representatives in real time during calls. Call center technology providers can incorporate sentiment analysis to better understand customer needs and offer tailored recommendations. Advanced interactive voice response (IVR) technology enables the management of multiple call center locations efficiently. Furthermore, integrating IVR with CRM and Unified Communications as a Service (UCaaS) platforms is expected to drive the growth of the industry.

The chat segment is anticipated to exhibit the highest CAGR over the forecast period. Video chat and automated chats are becoming leading call center technologies. Moreover, social media is likely to gain traction in the coming years, and AI can create social media posts and draft and target social ads. Additionally, it automates monitoring and handles customer queries. Due to the increasing social media network, AI usage has significantly reduced human costs and quickened processes. It has become imperative for companies to upgrade the way consumers reach and address their queries on social media platforms.

Regional Insights

North America call center AI market dominated the global industry with a revenue share of over 39% in 2024. The dominant revenue share can be accredited to the highly functional e-commerce industry in the region, which offers growth opportunities for deploying AI-specific call center solutions. The rapid development of AI-based technology solutions in the U.S., owing to favorable government initiatives, also provides a conducive ecosystem for the growth of the regional call center artificial intelligence market.

U.S. Call Center AI Market Trends

The call center AI market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The call center industry in the U.S. faces ongoing challenges with labor shortages and rising wages, pushing companies to adopt AI to automate routine tasks, such as handling frequently asked questions and routing customer queries. AI-driven automation helps reduce the dependency on human agents and lowers operational costs.

Europe Call Center AI Market Trends

The call center AI market in Europe is expected to witness significant growth over the forecast period. European countries are placing increased emphasis on sustainability and green IT practices. AI solutions that optimize call center operations by reducing energy consumption, improving efficiency, and enabling remote work are gaining traction in the region as businesses align with environmental regulations and corporate sustainability goals.

Asia Pacific Call Center AI Market Trends

The call center AI market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. Various countries in the Asia-Pacific region, including China, India, Japan, and South Korea, are undergoing rapid digital transformation. Businesses across sectors are adopting AI-driven call center solutions to improve operational efficiency, automate customer interactions, and offer enhanced customer experiences.

Key Call Center AI Company Insights

Some key players, such as Amazon Web Services, Inc., Google Cloud, and Microsoft dominate the industry due to their advanced AI technologies, strong cloud infrastructure, and ability to integrate with existing business systems. Their solutions help businesses automate customer service processes, improve customer interactions, and optimize operational efficiency.

-

Google Cloud’s Contact Center AI (CCAI) utilizes natural language processing, speech recognition, and machine learning to support the integration of AI-driven virtual agents, sentiment analysis, and intelligent routing in contact centers. Its AI and machine learning capabilities, along with integration into cloud-based services, provide businesses with scalable AI solutions for managing customer interactions.

-

Amazon Web Services, Inc.’s robust cloud infrastructure, combined with AI and machine learning services, offers flexible and scalable solutions for businesses of all sizes. Moreover, Amazon Web Services, Inc.’s Amazon Connect, a cloud-based contact center platform, is enhanced by AI tools such as Amazon Lex for chatbots, Amazon Polly for speech synthesis, and Amazon Transcribe for real-time transcription. These tools automate and streamline customer service operations.

Key Call Center AI Companies:

The following are the leading companies in the call center AI market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Avaya LLC

- Cognigy

- Five9, Inc.

- Genesys

- Google Cloud

- IBM Corporation

- LivePerson

- Microsoft

- Nuance Communications

Recent Developments

-

In October 2024, Singtel, a telecommunications company, launched RE:AI, the new Artificial Intelligence Cloud Service (AI Cloud), which is designed to democratize AI by making it widely accessible to organizations. It provides enterprises and public sector customers with affordable access to AI technologies, allowing them to transform their operations without the need for in-house infrastructure or resources. This ready-to-use AI development and deployment platform combines advanced AI computing infrastructure, including graphics processing units (GPUs) and storage, AI workspaces and tools, alongside advanced networks such as 5G, fixed, or quantum-safe networks.

-

In June 2024, Microsoft introduced Micro soft Dynamics 365 Contact Center, a Copilot-first contact center solution that integrates generative AI across all customer engagement channels. Leveraging insights from its own Copilot usage and years of investment in voice and digital platforms, Dynamics 365 Contact Center seamlessly incorporates generative AI throughout the contact center workflow. This includes communication channels, self-service options, intelligent routing, agent-assisted services, and operations, enabling contact centers to resolve issues more quickly, empower agents, and lower costs.

-

In March 2024, Cognizant expanded its partnership with Google Cloud to optimize the software delivery lifecycle and boost developer productivity. Cognizant is deploying Gemini for Google Cloud through two primary approaches such as, by educating its associates on how to utilize Gemini for software development assistance and by incorporating Gemini's advanced features into its internal operations and systems. By utilizing Gemini for Google Cloud, Cognizant’s developers will be able to write, test, and deploy code more efficiently with the help of AI-driven tools, improving both the reliability and cost-efficiency of developing and managing client applications.

Call Center AI Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.44 billion

Revenue forecast in 2030

USD 7.08 billion

Growth Rate

CAGR of 23.8% from 2025 to 2030

Base year for estimation

2024

Actual data

2017 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, deployment, enterprise size, channel, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon Web Services, Inc.; Avaya LLC; Cognigy; Five9, Inc.; Genesys; Google Cloud; IBM Corporation; LivePerson; Microsoft; Nuance Communications

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Call Center AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global call center AI market report based on component, application, deployment, enterprise size, channel, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

Professional Services

-

Training and Consulting

-

System Integration & Implementations

-

Support & Maintenance

-

-

Managed Services

-

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Predictive Call Routing

-

Journey Orchestration

-

Quality Management

-

Sentiment Analysis

-

Workforce Management & Advanced Scheduling

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Retail & E-commerce

-

Energy & Utilities

-

Travels & Hospitality

-

Others

-

-

Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Phone

-

Social Media

-

Chat

-

Email or Text

-

Website

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global call center AI market size was estimated at USD 2.00 billion in 2024 and is expected to reach USD 2.44 billion in 2025.

b. The global call center AI market is expected to grow at a compound annual growth rate of 23.8% from 2025 to 2030 to reach USD 7.08 billion by 2030.

b. North America dominated the call center AI market with a share of 39.3% in 2024. The dominant revenue share can be accredited to the highly functional e-commerce industry in the region, which offers growth opportunities for deploying AI-specific call center solutions. The rapid development of AI-based technology solutions in the U.S., owing to favorable government initiatives, also provides a conducive ecosystem for the growth of the regional call center artificial intelligence market.

b. Some key players operating in the call center AI market include Amazon Web Services, Inc.; Avaya LLC; Cognigy; Five9, Inc.; Genesys; Google Cloud; IBM Corporation; LivePerson; Microsoft; and Nuance Communications.

b. Factors such as rising demand for enhanced customer experience, cost reduction and operational efficiency, omnichannel engagement, growing use of chatbots and virtual assistants, and increased adoption of cloud-based solutions are primarily driving the growth of the call center AI market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.