- Home

- »

- Homecare & Decor

- »

-

Camping Furniture Market Size, Share & Growth Report 2030GVR Report cover

![Camping Furniture Market Size, Share & Trends Report]()

Camping Furniture Market Size, Share & Trends Analysis Report By Product (Chairs & Stools, Tables, Cots & Hammocks), By Distribution Channel (Offline, Online), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-652-3

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Camping Furniture Market Size & Trends

The global camping furniture market size was valued at USD 263.0 million in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2030. The market growth can be credited to the increasing popularity of camping as a recreational activity. The expanding number of people seeking outdoor adventures and experiences has led to a higher demand for camping furniture that enhances comfort and convenience while camping. This trend is particularly noticeable among younger demographics, such as millennials and Gen Z, who are increasingly drawn to nature and outdoor activities.

Moreover, the rising disposable incomes have significantly contributed to the market growth. With more financial resources at their disposal, consumers have become increasingly willing to invest in high-quality camping furniture that offers durability, comfort, and portability. This trend is further supported by the growing awareness of the benefits of spending time in nature, which has led to an increased interest in camping and outdoor leisure activities.

In addition, technological advancements in the design and functionality of camping furniture have played a crucial role in market growth. Manufacturers, including The North Face and Big Agnes, have responded to the surging demand by continuously innovating to create lightweight, portable, and easy-to-assemble furniture that caters to the needs of modern campers. Features such as foldable chairs, compact tables, and ergonomic sleeping cots have become increasingly popular, providing convenience and comfort without compromising on space.

Product Insights

Chairs and stools held a dominant market share of 50.5% in 2024. With more people spending time in nature, the market witnessed a surging demand for comfortable and portable seating options. Chairs and stools designed specifically for camping are lightweight, foldable, and easy to transport, which makes them ideal for outdoor adventures. Furthermore, the market was driven by the rising trend of glamping that combines the rustic experience of camping with the luxury and comfort of home-like amenities. This trend has increased demand for high-quality, stylish, and comfortable chairs and stools that enhance the camping experience. Additionally, modern camping furniture is often made from durable, weather-resistant materials that can withstand outdoor conditions. Features such as ergonomic designs, adjustable heights, built-in cup holders, and padded seating have enhanced the user experience and driven consumer demand.

Tables are expected to emerge as the fastest-growing segment during the forecast period owing to the rising demand for functional and portable camping tables. These tables provide a convenient surface for cooking, dining, and organizing gear, enhancing the overall camping experience. Manufacturers have innovated camping tables from lightweight, durable materials such as aluminum and high-density polyethylene, which can withstand outdoor conditions. Additionally, features such as foldable and adjustable legs, compact storage options, and integrated cup holders have enhanced the functionality and convenience of camping tables, making them more appealing to consumers.

Distribution Channel Insights

Offline channels accounted for a prominent share in 2024. The market growth can be attributed to consumers' continuous preference to physically verify the quality and functionality of camping furniture before making a purchase. This hands-on approach allows buyers to assess the durability, comfort, and design of the products, ensuring they meet their specific needs and expectations. Additionally, the immediate availability of products without the need for shipping or waiting for delivery has been a major advantage for consumers who require camping furniture for upcoming trips.

Online distribution channels are projected to grow at a CAGR of 5.3% over the forecast period. The convenience of browsing and purchasing products and the ability to compare prices and read reviews has made online platforms highly popular among consumers. This trend is particularly strong among tech-savvy younger demographics who are accustomed to shopping online for a wide range of products, including camping furniture.

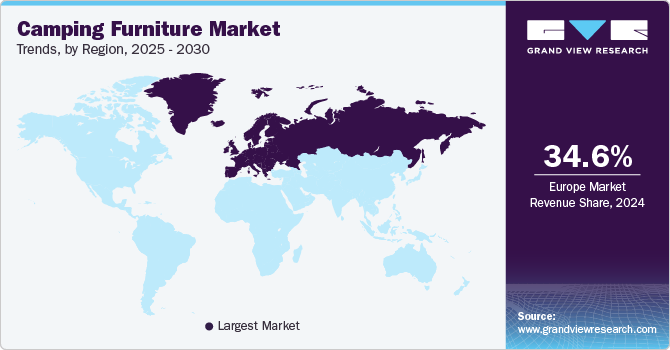

Regional Insights

The Europe camping furniture market dominated the market with a 34.6% share in 2024. The growing interest in outdoor activities such as camping, glamping, hiking, and nature-based travel has increased demand for high-quality, durable, and portable camping furniture. Europeans, particularly in Northern and Western regions, have increasingly prioritized outdoor experiences as part of a lifestyle shift towards wellness and sustainability. They have sought camping furniture that combines comfort, functionality, and style. Innovations, including foldable and lightweight designs, compact storage options, and modular setups, have appealed to users looking for convenience without sacrificing comfort.

North America Camping Furniture Market Trends

The camping furniture market in North America held 28.3% of the market share in 2024, owing to the ongoing trend toward outdoor recreation, spurred by heightened awareness of mental and physical health benefits. In addition, North American campers have prioritized lightweight, foldable, and easily transportable furniture due to the popularity of diverse camping styles, including backpacking and car camping. Products that are compact and easy to set up yet durable enough for repeated use have been particularly appealing to consumers.

U.S. Camping Furniture Market Trends

The U.S. camping furniture market is anticipated to be driven by the continued rise in camping and outdoor recreation over the forecast period. This trend has spanned various age groups, with millennials and older generations showing interest in camping, hiking, and RV (recreational vehicle) travel, all requiring high-quality camping furniture. The popularity of RV travel in the U.S. has led to increased demand for camping furniture that is compact, durable, and easy to store.

Asia Pacific Camping Furniture Market Trends

The camping furniture market in the Asia Pacific (APAC) region held 19.7% share in 2024. Camping, hiking, and outdoor recreation have gained popularity in the region, driven by a rising middle class and growing interest in leisure activities. Countries including China, Japan, Australia, and South Korea have experienced a surge in demand for camping gear, including furniture, as more people seek outdoor experiences for relaxation and wellness.

Key Camping Furniture Company Insights

The global camping furniture market features key players such as The Coleman Company, Inc., ALPS Mountaineering, Oase Outdoors ApS, and others. These players have increasingly focused on product innovations for optimum comfort with ergonomic designs and foldability, mergers, and acquisitions to continue their dominant foothold in the market. For instance, in 2021, MacNeill Pride Group, a global manufacturer of outdoor products acquired GCI Outdoor, a prominent designer of portable, built-to-last outdoor recreation equipment.

-

The Coleman Company, Inc. is a renowned American brand specializing in outdoor recreation products. The company is best known for its durable and innovative camping gear, including lanterns, stoves, coolers, sleeping bags, and tents. Over the years, Coleman has expanded its product line to include a wide range of outdoor equipment, catering to both casual campers and serious adventurers.

-

ALPS Mountaineering is a family-owned outdoor gear designer specializing in manufacturing camping gear such as tents, backpacks, sleeping bags, and furniture. The company has built a reputation for producing reliable and affordable outdoor equipment, making it a popular choice among campers and hikers.

Key Camping Furniture Companies:

The following are the leading companies in the camping furniture market. These companies collectively hold the largest market share and dictate industry trends.

- The Coleman Company, Inc.

- ALPS Mountaineering

- Oase Outdoors ApS

- JOHNSON OUTDOORS INC.

- GCI Outdoor

- Kamp-Rite

- Helinox

- Recreational Equipment, Inc.

- TREKOLOGY

- Thule Group

- CampTime.com

Recent Developments

-

In October 2023, Johnson Outdoors Inc., a global innovator of recreation equipment, announced its exit from Eureka product lines. The existing products are expected to be available on sale, as the company plans to fulfill all consumer orders by the end of 2024.

-

In July 2022, REI Co-op and Airstream collaborated to design an exclusive edition Basecamp travel trailer based on the Airstream Basecamp model. The trailer has helped explore environment-friendly manufacturing practices and materials to prioritize sustainability.

Camping Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 276.0 million

Revenue forecast in 2030

USD 351.0 million

Growth Rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Australia, South Korea, Brazil, UAE

Key companies profiled

The Coleman Company, Inc.; ALPS Mountaineering; Oase Outdoors ApS; JOHNSON OUTDOORS INC.; GCI Outdoor; Kamp-Rite; Helinox; Recreational Equipment, Inc.; TREKOLOGY; Thule Group; CampTime.com

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Camping Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global camping furniture market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Chairs & Stools

-

Tables

-

Cots & Hammocks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."