- Home

- »

- Healthcare IT

- »

-

Cancer Registry Software Market Size & Share Report, 2030GVR Report cover

![Cancer Registry Software Market Size, Share & Trends Report]()

Cancer Registry Software Market Size, Share & Trends Analysis Report By Software (Standalone), By Deployment model (On-premise), By Component (Commercial), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-753-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cancer Registry Software Market Trends

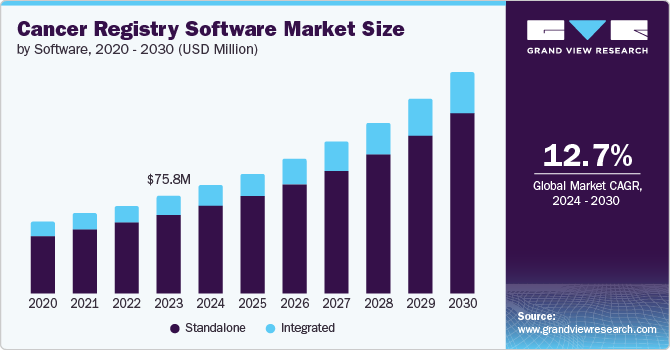

The global cancer registry software market size was valued at USD 75.8 million in 2023 and is projected to grow at a CAGR of 12.7% from 2024 to 2030. The increasing incidence of cancer and a growing number of accountable care organizations are among the factors driving the market growth. According to the World Health Organization (WHO), in February 2024, cancer accounted for around 9.7 million deaths globally and around 20 million new cases were diagnosed in 2022.

The adoption of cancer registry software is anticipated to increase shortly owing to various advantages such as efficient workflow management, ease of use, automated case registries, updates, and effective follow-up. The cancer registry software helps automate data collection for national and state registries, which further helps track the effectiveness of different treatment approaches. For instance, in February 2024, Radformation, Inc. partnered with Icon Group to enhance cancer care through innovative radiation oncology software solutions. This collaboration aims to revolutionize treatment workflows and improve patient outcomes with cutting-edge technology.

As per NIH, cancer is a national burden and is the second leading cause of death in the U.S. Cancer cost an estimated USD 208.9 billion in 2020 for healthcare expenditures and lost productivity from illness & death every year. The rising adoption of EHR and patient engagement solutions is further anticipated to boost the demand for cancer registry software.

Hospital cancer registry can help clinicians evaluate therapy results and plan treatment accordingly. Developed and developing countries are working toward implementing the software in all hospitals to track the disease and provide a framework for assessing and controlling the impact.

Software Insights

Standalone software dominated the market and accounted for a share of 80.8% in 2023 attributed to its advanced features and easy-to-use tools. Moreover, it allows the processing of registry data and multiple system usages, further boosting the market. The automatic upgrade feature of standalone software helps reduce IT overhead costs.

Integrated software is expected to grow at the fastest CAGR over the forecast period, owing to the increasing need for integrating software with a regional oncology network. This is expected to help track affected geographic locations and evaluate the clinical intervention. For instance, in October 2023, Jamaica was expected to be the first Caribbean country and the second globally to implement the DHIS2 health information management platform for cancer reporting through its National Cancer Registry. This initiative, funded by a Bloomberg Philanthropies grant, aims to enhance cancer data systems in low-resourced countries. The project, "Using DHIS2 to Strengthen Cancer Registration Data Systems," is a collaboration between the Jamaican Ministry of Health and the Caribbean Public Health Agency.

Deployment Model Insights

The on-premise model segment dominated the market and accounted for a share of 59.8% in 2023. The increase in the adoption of on-premise solutions by hospitals and research institutes due to their various benefits, such as the lower risk of external attacks and high data security against breaches, is boosting revenue. For instance, Apollo Hospitals partnered with IBM and adopted IBM Watson for oncology to make data-driven cancer care decisions.

The cloud-based segment is expected to grow at the fastest CAGR of 13.0% over the forecast period owing to reduced installment charges and IT overhead costs. Cloud-based software mostly provides a platform-as-a-service solution. Major advantages of a cloud-based system include real-time data analysis and integration by standard guidelines. Companies are working toward increasing the data safety of this model, which is expected to propel market growth soon. For instance, in November 2023, Health Catalyst acquired Electronic Registry Systems, Inc. (ERS), cancer registry software and services provider. This acquisition aims to enhance Health Catalyst's data and analytics capabilities in the healthcare sector.

Component Insights

The commercial segment dominated the market and accounted for a share of 75.0% in 2023 owing to its advantage of data safety as compared to the public database. The segment is driven by increasing cancer incidence rates, rising demand for efficient data management, and the need for comprehensive patient tracking and outcomes analysis. Technological advances and a growing emphasis on personalized medicine further fuel the market growth. In addition, regulatory requirements for accurate reporting and data transparency boost the adoption of such software solutions.

Public segment is expected to grow at the fastest CAGR of 13.5% over the forecast period owing to the increasing cancer research programs. This database is used for specific research tasks or projects. Due to the growing disease burden, an increasing number of research institutes in developed countries is further propelling growth. Registry Plus is a public database registry launched by the CDC to collect and process cancer registry data for any specific project. Its latest version was released in April 2024. Such constant upgrades and improvements augment segmental growth.

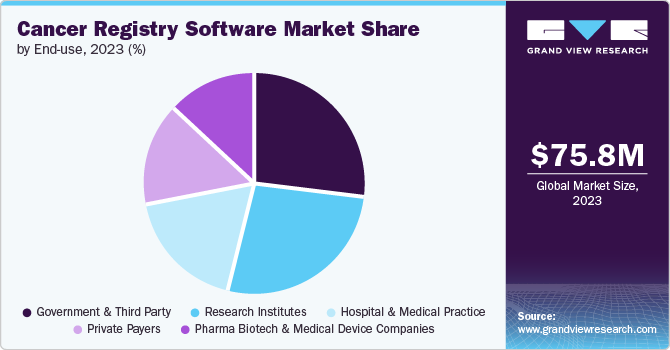

End-use Insights

The government & third-party segment dominated the market and accounted for a share of 27.2% in 2023. Governments of both developed and developing countries are increasingly implementing this software to reduce the cancer burden, fueling the market growth. Using this registry, governments can easily track the most affected areas and take preventive measures. Moreover, increasing government funding in hospitals to implement software boosts segment revenue. For instance, Web Plus is used for facility submissions of data files in the North American Association of Central Cancer Registries (NAACCR) format, which the Texas Cancer Registry uses. This software simplifies secure file transfers to TCR by eliminating the need to install and maintain file transfer tools manually on individual desktops. Web Plus streamlines the submission process, ensuring efficient and secure data management.

Research institutes segment is expected to grow at the fastest CAGR of 13.2% over the forecast period due to increasing research initiatives undertaken by government & private organizations to address the increasing incidence of cancer. These institutes use software to track patients for clinical trials and check the efficacy of treatment programs. The pharmaceutical, biotechnology, & medical devices companies segment is also expected to exhibit significant growth over the forecast period owing to increasing R&D by these companies for better treatment outcomes.

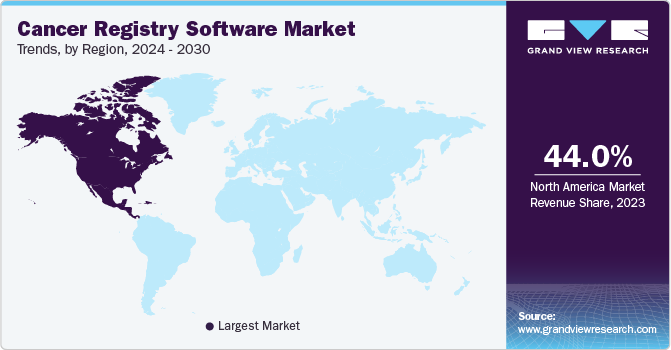

Regional Insights

North America cancer registry software market accounted for the largest revenue share of 44.0% in the in 2023, owing to the presence of developed infrastructure. The increasing incidence of cancer in this region due to tobacco smoking and lack of physical activity, among others, is propelling the market growth. According to the data published by the National Cancer Institute (NCI) in May 2024, there will be an estimated 2,001,140 new cases of cancer in the U.S. in 2024. Moreover, the presence of key industry players, increasing investments in healthcare IT, and high adoption of this software are among the factors further fueling growth.

U.S. Cancer Registry Software Market Trends

The U.S. cancer registry software market dominated the North America with a share of 79.2% in 2023 due to the availability of explicit data storage platforms and the adoption of technology in the region. For instance, the Texas Cancer Registry is one of the largest cancer registries in the U.S. It joined the National Cancer Institute's Surveillance, Epidemiology, and End Results (SEER) program in 2021. To maintain premium quality cancer data and contribute to cancer patient diagnosis, treatment, and survival. Several organizations are trying to bring new advanced registries to bridge the current gaps. For instance, the GO2 Foundation for Lung Cancer launched the Global Lung Cancer Registry using IQVIA's platform. This registry was expected to provide rich data on lung cancer across the globe to identify trends and expose better treatment options.

Europe Cancer Registry Software Market Trends

Europe cancer registry software market was identified as a lucrative region in this industry and is anticipated to grow significantly in the coming years. The presence of leading players in the region, government initiatives, fundraising, and investments in developing the cancer registry system are major factors driving the market growth. For instance, according to the article published by the European Network of Cancer Registries (ENCR), the European Commission has plans to reserve USD 14.2 million in 2024 under the EU4Health program to improve and support the European Cancer Information System. This was expected to improve the quality and completeness of cancer registry data across the region.

Asia Pacific Cancer Registry Software Market Trends

Moreover, the shift of pharmaceutical companies to low-cost manufacturing countries such as China and India are further propelling the growth of the Asia Pacific market.

China cancer registry software market is anticipated to grow significantly over the forecast period. China is constantly trying to increase the efficient usage of cancer registries in various ways. For instance, the National Cancer Registry - Cancer Hospital, Chinese Academy of Medical Sciences & Peking Union Medical College (CICAMS), and National Cancer Center are organizing a conference in Beijing, China, to reflect on the use of big data in cancer control in November 2024.

Japan cancer registry software market was identified as one of the lucrative regions in the market in 2023. Japan's Ministry of Health, Labour, and Welfare has undertaken initiatives to improve the existing healthcare infrastructure. Various studies and research initiatives taken by pharmaceutical companies and universities in the region have increased the adoption of cancer registry software. For instance, according to an article published by Fujitsu in May 2023, the company conducted a joint research program with Takeda Pharmaceutical Company Limited and the National Cancer Center, Japan. This study was related to the ovarian cancer patients registered on electronic medical record.

Middle East and Africa Cancer Registry Software Market Trends

Middle East and Africa cancer registry software market is anticipated to grow significantly over the forecast period. Various strategic initiatives are being taken by the authorities in the region to strengthen cancer surveillance. According to the article published by Vital Strategies, Inc. in December 2022, three collaborating centers were launched in Kenya, South Africa, and Côte d’Ivoire under the Global Initiative for Cancer Registry Development (GICR) framework. This collaboration included other prominent partners to train, assist, and strengthen the cancer registry system, thus boosting the market growth.

Key Cancer Registry Software Company Insights

Some of the key companies in the cancer registry software market include Elekta, Oracle, ONCO, Inc., IBM, MCKESSON CORPORATION, Conduent, Inc., Ordinate Corporation, Volpara Health Limited, Health Catalyst, and Rocky Mountain Cancer Data Systems (RMCDS) (University of Utah Health). Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Elekta is a medical technology company specializing in precision radiation therapy and cancer treatment solutions. Their cancer registry software, part of their oncology informatics suite, enhances data management, streamlines workflows, and supports comprehensive patient care through advanced data analytics and integration capabilities.

-

Oracle's cancer registry software is a comprehensive solution that streamlines the collection, management, and analysis of cancer patient data, enhancing data accuracy and integration with other health systems. With powerful reporting and analytics tools, it supports high-quality research and public health initiatives while ensuring data security and compliance with international standards.

Key Cancer Registry Software Companies:

The following are the leading companies in the cancer registry software market. These companies collectively hold the largest market share and dictate industry trends.

- Elekta

- Oracle

- ONCO, Inc.

- IBM

- MCKESSON CORPORATION

- Conduent, Inc.

- Ordinate Corporation

- Volpara Health Limited

- Health Catalyst

- Rocky Mountain Cancer Data Systems (RMCDS) (University of Utah Health)

View a comprehensive list of companies in the Cancer Registry Software Market

Recent Developments

-

In May 2024, Elekta acquired Philips Healthcare's Pinnacle Treatment Planning System (TPS) patent portfolio and strengthened its Elekta ONE software. This was expected to help monitor cancer patients' treatment planning.

-

In March 2024, Elekta partnered with Merck & Co., Inc. to develop a platform for digital monitoring of patients suffering from advanced renal cell carcinoma (RCC). This partnership aims to enhance kidney cancer care using digital solutions.

-

In November 2023, ONCO, Inc. announced a strategic partnership with Oncora Medical to develop and launch advanced cancer registry, reporting, and analytics software. By combining their expertise, the companies can provide cancer centers with data automation capabilities and personalized patient care.

Cancer Registry Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 84.1 million

Revenue forecast in 2030

USD 172.4 million

Growth Rate

CAGR of 12.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Software, deployment model, component, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Elekta; Oracle; ONCO, Inc.; IBM; MCKESSON CORPORATION; Conduent, Inc.; Ordinate Corporation; Volpara Health Limited; Health Catalyst; Rocky Mountain Cancer Data Systems (RMCDS) (University of Utah Health)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cancer Registry Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cancer registry software market report based on software, deployment model, component, end-use, and region.

-

Software Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone

-

Integrated

-

-

Deployment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud Based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Public

-

-

End-use Outlook (Revenue, USD Million, 2018 -2030)

-

Government & Third Party

-

Private Payers

-

Hospital & Medical Practice

-

Pharma Biotech & Medical Device Companies

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."