- Home

- »

- Animal Health

- »

-

Canine Orthopedics Market Size & Share Report, 2030GVR Report cover

![Canine Orthopedics Market Size, Share & Trends Report]()

Canine Orthopedics Market Size, Share & Trends Analysis Report By Application (TPLO, TTA, Joint Replacement, Trauma), By Product (Implants, Instruments), By End Use (Hospitals & Clinics), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-921-2

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

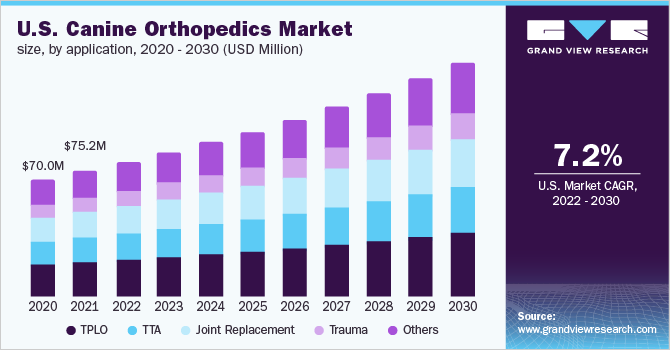

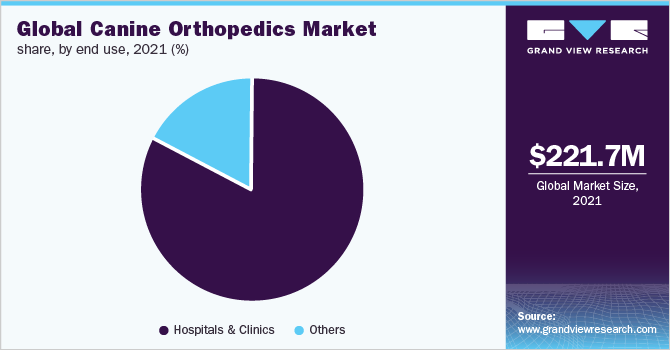

The global canine orthopedics market size was valued at USD 221.7 million in 2021 and is estimated to expand at a compound annual growth rate (CAGR) of 8.4% from 2022 to 2030. Growing pet dog ownership, adoption of dog insurance policies, initiatives by key market players, and the growing number of veterinary orthopedic surgeries are some of the key drivers of this market. According to the North American Pet Health Insurance Association (NAPHIA), the region had about 3.45 million insured pets in 2020. This number was notably higher than the 2.81 million insured pets insured in 2019.

The COVID-19 pandemic adversely impacted the market for canine orthopedics. This was because of movement restrictions, postponed or cancellation of elective veterinary orthopedic surgeries, and reduced veterinary visits leading to low demand and sales. Harmony Veterinary Center based in the U.S., for instance, suspended all veterinary elective procedures in March 2020. It was among the several veterinary services providers to do so. As per April 2020 survey by AVMA, 98% of the respondents comprising veterinarians reported a reduction in client contact owing to the pandemic. About two-thirds of the respondents stated that they had postponed at least some surgical procedures. The surgery volume gradually recovered due to supportive initiatives and guidelines helping the resumption of veterinary surgeries. Overall the COVID-19 pandemic resulted in dampened sales growth for the market participants. However, the market is expected to bounce back in the coming years.

Tightrope CCL is a veterinary orthopedic surgical approach for extracapsular stabilization of the canine CCL-deficient stifle joint using a minimally invasive procedure. The TightRope ligament method is a novel ligament replacement surgery for treating an uncertain CCL. Furthermore, over 200 knees have been tested, and the surgery has proven to be quite beneficial. In comparison to the TPLO or TTA, the TightRope CCL procedure is less invasive and more cost-effective, contributing to its increased adoption as a viable surgical technique in dogs. TightRope can be successfully performed in medium, big, and giant breed dogs. In addition, a MiniTightRope is also available for toy dogs and small breeds. Similar developments in technology and treatment procedures are estimated to drive the market for canine orthopedics.

Strategic initiatives by key companies are contributing to the growth of the market for canine orthopedics. Vimian Group, based in Sweden, for example, owns a portfolio of companies including Indical Bioscience (Veterinary Diagnostics), VetFamily (Veterinary Services), Movora (Animal MedTech), and Nextmune (Veterinary Specialty Pharma). Vimian itself is owned by a Swedish investment company called Fidelio Capital. Movora, established in 2020, specializes in providing orthopedic implants to veterinarians and universities. Movora has strengthened its position in the veterinary orthopedics market through a series of mergers and acquisitions. These include BioMedtrix specializing in canine hip, knee, elbow, and trauma fields of orthopedics; KYON providing veterinary surgical instruments and implants; Veterinary Orthopedic Implants offering a wide portfolio of implants; and IMEX Veterinary Inc.

Application Insights

The TPLO segment dominated the market for canine orthopedics and accounted for the largest revenue share of 25.0% in 2021. It is a preferred procedure for the treatment of CCL rupture in dogs, in particular large-breed dogs. It may also be recommended for moderate and small breeds. CCL disease can affect dogs of all ages, sizes, and breeds, but rarely cats. Most vulnerable dog breeds include Rottweiler, Staffordshire Terrier, Newfoundland, Mastiff, Chesapeake Bay Retriever, Akita, Saint Bernard, and Labrador Retriever.

The TTA segment is anticipated to grow the fastest over the forecast period. The joint reconstruction segment is also expected to register notable growth owing to product advancement and a growing number of surgeries in dogs. BioMedtrix’s Canine Total Knee system, for example, aims at restoring pain-free functional mobility. It consists of an implant system with femoral and tibial components that can be interchanged based on requirements to cater to specific sizes. Some instruments used during knee replacement surgeries are screwdriver shafts, compression screws, and pin cutters.

Product Insights

The implants segment dominated the market for canine orthopedics and held the largest revenue share in 2021. The segment is expected to grow at a high rate over the forecast period. The growing prevalence of bone disorders and traumatic injuries has led to the high adoption of implants. BioMedtrix, for instance, holds 16 patents in veterinary orthopedic implants, which is further expected to drive the market for canine orthopedics. With rapid technological advancements, demand for implants in the field of canine orthopedics is increasing. The rising incidence of severe musculoskeletal injuries or orthopedic disorders, such as cruciate ligament tears and hip and elbow dysplasia, has led to an increase in the need for surgeries and thus, implants.

Various instruments used in orthopedic surgeries include bone cutting forceps, bone files, bone fragment forceps, bone holding forceps, drill guides, bone rasps, and bone tamps. GerVetUSA offers an extensive surgical instruments portfolio that comprises bone cutting forceps, bone files, bone rasps, and more. In bone cutting forceps category alone, the company offers over a dozen options in different sizes, such as 5 ½”, 6”, 7 ¼”, 7 ½”, and 8 ¾”, and designs such as curved, straight, and angled.

End-use Insights

The veterinary hospitals and clinics segment held the dominant share of the market for canine orthopedics in 2021. The others segment is projected to grow the fastest over the coming years. The others segment comprises veterinary research centers and ambulatory care units. The availability of a multitude of treatment options as well as diagnostic capabilities in veterinary hospitals and clinics is a key driver for the segment.

According to a 2019 survey by dvm360, company-owned animal hospital chains are on the rise in the U.S. For instance, Mars, Inc. owns the Banfield Pet Hospital chain, VCA Animal Hospitals, BluePearl Specialty, and Emergency Pet Hospitals, among others, with a total exceeding 2,000 hospitals. This opens opportunities for companies to use their products and technology at company-owned hospitals, thus supporting their growth strategies.

Regional Insights

North America dominated the canine orthopedics market and accounted for a revenue share of over 35.0% in 2021. The large share of the market in the region is due to the large canine pet population, adoption of pet insurance, presence of key players, and growing pet health concerns. For example, according to the Banfield Pet Hospital, ligament/tendon conditions, arthritis, degenerative joint disease, and hip/pelvis conditions were the most common orthopedic ailments affecting dogs in 2017. This is estimated to propel segment growth.

In Asia Pacific, the market for canine orthopedics is estimated to witness the fastest CAGR of over 9.0% over the next few years. This is owing to the rising presence of local players, increasing pet dog population, and expenditure on pets. Narang Medical Limited, India, is an ISO, CE, and WHO-GMP certified manufacturer and supplier of canine orthopedic implants and instruments. The company offers its veterinary portfolio to more than 80 countries. Its portfolio includes TPLO plates, locking plates, screws, pins and wires, drill bits and bone taps, and general instruments.

Key Companies & Market Share Insights

The market for canine orthopedics is competitive in nature. Market players deploy multiple strategic initiatives that include product development, product launches, distribution partnerships, collaborations, and mergers and acquisitions. For instance, in June 2019, Kyon AG was acquired by Fidelio Capital, and it later became a part of Movora Company, established by Fidelio. Kyon AG specializes in veterinary orthopedic implants, instruments, and services. In addition, in December 2020, N2 UK Ltd. - a manufacturer and supplier of veterinary orthopedic and trauma care products, launched a range of instruments and implants to expand its product lineup. Some of the prominent players in the canine orthopedics market include:

-

B. Braun Melsungen AG

-

Movora

-

STERIS

-

DePuy Synthes (Johnson & Johnson)

-

AmerisourceBergen Corporation

-

Arthrex, Inc.

-

Orthomed (UK) Ltd (Infiniti Medical)

-

Veterinary Instrumentation

-

Fusion Implants

-

Narang Medical Limited

Canine Orthopedics Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 239.5 million

Revenue forecast in 2030

USD 455.2 million

Growth Rate

CAGR of 8.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Netherlands; Japan; China; India; Australia; South Korea; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

B. Braun Melsungen AG; Movora; STERIS; DePuy Synthes (Johnson & Johnson); AmerisourceBergen Corporation; Arthrex, Inc.; Orthomed (UK) Ltd (Infiniti Medical); Veterinary Instrumentation; Fusion Implants; Narang Medical Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this report, Grand View Research has segmented the global canine orthopedics market on the basis of application, product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Implants

-

Plates

-

TPLO Plates

-

TTA Plates

-

Specialty Plates

-

Trauma Plates

-

Others

-

-

Others

-

-

Instruments

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

TPLO

-

TTA

-

Joint Replacement

-

Trauma

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global Canine Orthopedics market size was estimated at USD 221.7 million in 2021 and is expected to reach USD 239.5 million in 2022.

b. The global Canine Orthopedics market is expected to grow at a compound annual growth rate of 8.36% from 2022 to 2030 to reach USD 455.2 million by 2030.

b. North America held over 35% of the Canine Orthopedics market in 2021. The large share of the North American region is due to the large canine pet population, adoption of pet insurance, presence of key players and growing pet health concerns.

b. Some key players operating in the Canine Orthopedics market include B. Braun Melsungen AG, Movora, STERIS, DePuy Synthes (Johnson & Johnson), AmerisourceBergen Corporation, Arthrex, Inc., Orthomed (UK) Ltd (Infiniti Medical), Veterinary Instrumentation, Fusion Implants, and Narang Medical Limited.

b. Key factors that are driving the market growth include growing pet dog ownership, adoption of dog insurance policies, initiatives by key market players, and a growing number of veterinary orthopedic surgeries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."