- Home

- »

- Next Generation Technologies

- »

-

Cannabis Vertical Farming Market, Industry Report, 2030GVR Report cover

![Cannabis Vertical Farming Market Size, Share & Trends Report]()

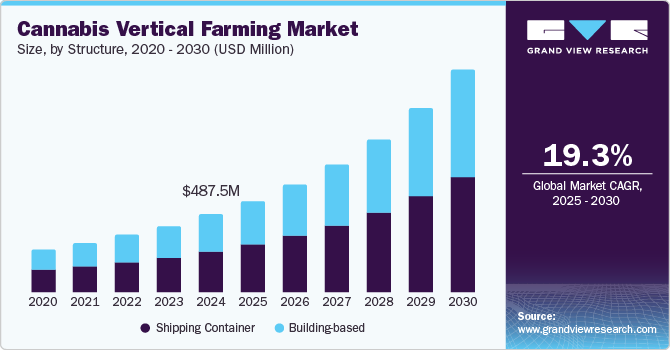

Cannabis Vertical Farming Market (2025 - 2030) Size, Share & Trends Analysis Report By Structure (Shipping Container, Building-based), By Component, By Growing Mechanism (Aeroponics, Hydroponics, Aquaponics), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-158-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannabis Vertical Farming Market Trends

The global cannabis vertical farming market size was estimated at USD 487.5 million in 2024 and is anticipated to grow at a CAGR of 19.3% from 2025 to 2030. The evolving landscape of cannabis legalization, both for medical and recreational use, is opening up opportunities for efficient and controlled cultivation methods as medical cannabis requires certain pharmacological characteristics which can be obtained using vertical farming techniques. Maximum crop yield, better quality, and proper utilization of space are multiple aspects that concern the farmers. Also, quality is an important aspect in the cannabis industry in order to achieve better byproducts. Vertical farming includes hydroponics and aeroponics that aid in attaining better quality, maximize crop yield, and precise management of environment condition thus making vertical farming most preferred method among cannabis farmers.

In the competitive and highly regulated cannabis industry, successful cultivation requires the ability to predict the future and efficiently manage space. Vertical farming has emerged as a crucial solution to maximize production and profits. By deploying this method, cultivators can optimize canopy square footage while reducing the cost of goods sold (COGs). Vertical farming allows for the continuous cultivation of high-quality cannabis on a large scale throughout the year. It is an efficient and profitable approach that attracts outside investments, bringing valuable efficiencies from established industries. Vertical farming enhances square footage utilization, resulting in a significant increase in cannabis output, surpassing traditional single-tier room cultivation. This approach, although initially costly, offers a faster return on investment (ROI) and sustainable practices, such as water conservation, LED lighting technology, and automation. As the industry evolves, vertical farming is poised to be the future of cannabis cultivation, providing a competitive edge in this market.

Vertical farming is gaining attention in the cannabis industry due to its ability to address challenges related to space, energy efficiency, and financial constraints. Both small and large-scale cultivators are facing limitations in these areas, hindering their growth prospects. The concept of vertical farming involves maximizing available space by growing crops on stacked shelves or vertical walls, allowing for a higher plant density per square foot. This method also facilitates resource-efficient cultivation techniques such as hydroponics and aeroponics, contributing to improved efficiency and production metrics.

One of the primary issues in urban areas with high rental costs and limited space is the scarcity of growing space for cannabis cultivation. Vertical farming offers a solution through stacked or true vertical growing, utilizing movable shelves with different rack levels or allowing plants to grow outward from vertical columns or walls. Both approaches expand the production canopy and efficiently utilize limited floor space. Furthermore, energy efficiency is a concern in cannabis cultivation, as maintaining specific environmental conditions is essential for plant growth. Traditional setups often waste energy due to the distance between light sources and plants, leading to inefficiencies.

Vertical farming addresses this issue by replacing conventional high-pressure sodium lights with energy-efficient LED lights. This approach delivers uniform lighting and also enables better control over environmental factors. It results in higher yields, more efficient resource utilization, and increased profitability. The phased approach of vertical farming allows operators to align their cultivation process with their business growth, providing a cost-effective solution that matches their timelines. By embracing vertical farming, marijuana cultivators can overcome these challenges and position themselves for success in the industry, ultimately driving improved business outcomes.

Structure Insights

The shipping container segment dominated the cannabis vertical farming market with a revenue share of 53.0% in 2024 and is expected to remain dominant between 2025 and 2030. This growth is attributed to the ability of the structure to help grow crops irrespective of the geographic location. Using shipping containers for hemp or marijuana cultivation offers several compelling advantages for growers. Firstly, they significantly boost production by providing precise environmental control, resulting in healthier and more robust crops. Shipping containers are accessible to both new and experienced operators due to their turnkey nature, quick setup, and minimal resource requirements. They also offer flexibility in terms of location selection, whether in urban or rural areas, and their portability in shipping containers simplifies transportation and relocation. Shipping containers also minimize the risk of crop failure by providing controlled, pest-resistant environments, and in case of contamination, it is contained in one area, reducing product loss. Furthermore, they save space and facility costs, especially since they can be stacked for increased production without requiring more space. Moreover, shipping containers enhance security, which is vital in this industry, offering remote monitoring and management of the entire system 24/7.

The building-based segment is anticipated to register the fastest CAGR of 19.6% over the forecast period. Building-based cannabis vertical farming operations can incur substantial costs, encompassing both initial capital investments and ongoing operational expenses. Larger vertical farms typically rely on funding from venture capital or investment firms to get started. Locating an appropriate site can pose difficulties, especially in urban regions where land and building costs are elevated. The day-to-day running costs involve expenditures on labor, energy, and essential supplies required for planting, harvesting, and potentially preserving the crop.

However, building-based farming helps minimize the cultivation cost and involves larger farming areas than single farming land, hence ensuring food security. Many companies are utilizing building-based controlled environment techniques to cater to challenges associated with marijuana cultivation. For instance, The Grove, a medical marijuana dispensary near Las Vegas, sought to optimize its space for marijuana cultivation. Montel, Inc., a mobile storage solutions provider, delivered a solution by installing twenty-nine 42-foot-long carriages in four rooms, using powered mobile racking to increase The Grove's storage capacity to over 6,380 square feet. This innovative system accommodates plants, equipment, and other components, offering flexibility and robust weight-bearing capabilities, ultimately enhancing the efficiency and organization of the cannabis cultivation facility.

Component Insights

Based on component, the cannabis vertical farming market is segmented into hardware, software, and services. The hardware segment dominated the market with a revenue share of 61.8% in 2024. Hardware is crucial for regulating the vertical farming environment and is further categorized into lighting, climate control, hydroponic components, and sensors. The lighting sub-segment led the hardware market and accounted for 27.5% in 2024. The substantial share held by the lighting segment is due to vertical farms' reliance on artificial lighting, which provides the necessary light intensity for marijuana growth. The utilization of LED grow lights in vertical farming offers enhanced efficiency due to their customizable light spectra, extensive color options, prolonged operational lifespans, effective heat management, and compact form factors.

This investment in LED grow lights is preferred over traditional luminaires like High-Pressure Sodium (HPS) or fluorescent grow lights, which may have a lower initial cost but are more prone to quicker burnout. The climate control sub-segment is anticipated to register the fastest CAGR of 19.6% over the forecast period. Climate control farming is a method where crops are cultivated within a controlled environment, such as a shipping container or a greenhouse, for precise regulation of factors like carbon dioxide, light, water, pH levels, humidity, and nutrients to support marijuana and hemp growth. The primary objective of climate control farming is to ensure optimal growth conditions and protection for the duration of the crop's development, often used to ensure the provision of essential nutrients for crop growth.

The software segment is expected to register a CAGR of 20.5% over the forecast period, owing to the rapid adoption of advanced farming practices and its essential role in optimizing and automating various aspects of the cultivation process. Software solutions offer advanced capabilities, including data analytics and real-time adjustments, enabling growers to enhance productivity, crop quality, and resource utilization. This technological advancement is particularly valuable in the cannabis industry, where precision and consistency are paramount. As marijuana cultivation becomes increasingly sophisticated and regulated, the demand for software solutions that ensure compliance, quality control, and operational efficiency drives the rapid growth of this segment.

Growing Mechanism Insights

The hydroponics segment registered the largest market share of 47.0% in 2024 and is expected to remain dominant between 2025 and 2030. Hydroponics is a favored cultivation method known for its cost-effectiveness and simplicity of operation. It involves plant growth without soil, with a mineral solution used in place of traditional soil for nourishing the plant roots. Moreover, hydroponics eliminates the risk of soil-borne diseases caused by organisms. The growing consumer awareness of pesticide-related concerns is anticipated to drive increased demand for hydroponics. This method provides better control over plant nutrition, ensuring that roots receive the necessary nutrients when needed, resulting in healthier plants, faster growth, and consistent outcomes.

Additionally, hydroponics is water-efficient, reducing the demand for freshwater by up to 80% compared to traditional farming methods, with the added benefit of nutrient water recycling. Furthermore, hydroponic systems are more affordable to install than aeroponic and aquaponics methods, offering a high return on investment by enabling rapid marijuana plant growth, shorter farming cycles, and increased output and quality. These factors have contributed to the widespread adoption of hydroponics in the cannabis cultivation industry.

The aeroponics segment is expected to register a significant growth rate from 2025 to 2030. This system, similar to hydroponics, doesn't rely on soil for plant growth. In aeroponics, plant roots are suspended in a dark chamber and regularly sprayed with a nutrient-rich solution, eliminating the need for a growing medium. Aeroponics offers several advantages in marijuana cultivation, including space efficiency, improved nutrient absorption, and higher-quality yields. With no need for a growing medium, marijuana plants can be placed closer together, making it space-efficient. This method promotes more efficient nutrient absorption as plant roots have direct access to oxygen and nutrients through a moisture mist. This results in rapid growth and the development of high-quality buds with abundant trichomes. However, aeroponics can involve high initial setup costs, requiring specialized equipment and a consistent supply of electricity and water to maintain plant development, thus hampering market growth.

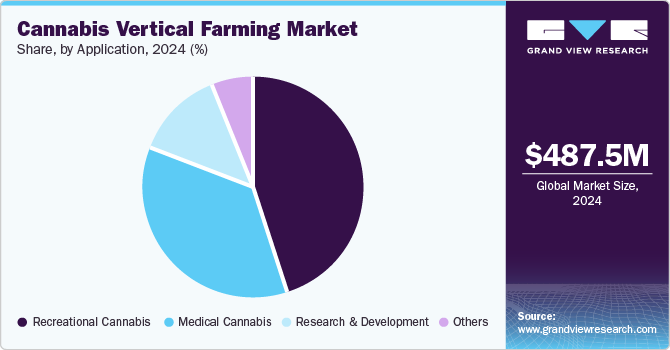

Application Insights

The recreational cannabis segment registered the largest market share of 44.9% in 2024 and is expected to remain dominant between 2025 and 2030. The increasing legalization and acceptance of recreational marijuana in various regions have substantially increased demand, promoting market growth. Moreover, recreational cannabis often controls a higher price point compared to medical cannabis, making it a suitable choice for commercial cultivation. Additionally, recreational cannabis requires consistent quality and potency to meet the expectations of discerning consumers, which can be achieved more reliably through controlled vertical farming practices. This precision in environmental control, lighting, and nutrient management ensures that the final product consistently meets quality standards, which is particularly vital for recreational cannabis cultivation.

The medical cannabis segment is anticipated to grow at the fastest CAGR of 19.8% over the forecast period. Cannabis is known to encompass more than 560 various compounds, with 120 of them being cannabinoids. Among these cannabinoids, delta 9-tetrahydrocannabinol, and cannabidiol stand out as the two major compounds, each possessing distinct pharmacological characteristics and significant therapeutic potential. Cultivating medical-grade cannabis in an open field is highly challenging, and thus, vertical farming facilities have become the preferred choice. Vertical farming is the ideal choice for cultivating medical-grade cannabis due to its precise environmental control, ensuring consistent quality and year-round production. It offers enhanced security, reduced disease and pest risks, efficient space utilization, and optimized resource use. These factors make vertical farming a reliable and effective method for meeting the stringent requirements for the cultivation of medical cannabis.

Regional Insights

In terms of revenue, North America cannabis vertical farming market dominated the global market in 2024 with a share of approximately 32.9% and is expected to remain dominant between 2025 and 2030. The increasing legalization movement within North America is one of the driving factors for the growth of the market. U.S. dominated the market due to 37 of the 50 U.S. states legalizing the medical use of marijuana. It has created a substantial and expanding market for cannabis products. For instance, in August 2023, the U.S. Department of Health and Human Services initiated an evaluation of the classification of marijuana under the Controlled Substances Act, potentially easing restrictions on the substance, marking the first time a federal agency has considered rescheduling marijuana to a lower level. Presently, marijuana is classified as a Schedule I drug, along with substances such as LSD and heroin, but the review may consider reclassifying it as a Schedule III drug, which has a lower potential for physical or psychological dependence. This regulatory environment has encouraged innovation and investment in the cannabis industry, including vertical farming.

U.S. Cannabis Vertical Farming Market Trends

The cannabis vertical farming market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The rising demand for cannabis vertical farming in the U.S. is propelled by legalization trends, the need for space and resource efficiency, and the pursuit of consistent, high-quality production. These factors collectively contribute to the expanding adoption of vertical farming techniques in the cannabis sector. Vertical farming allows cultivators to maximize production within limited spaces by stacking plants in vertically arranged layers. This method is particularly beneficial in urban areas where real estate is scarce and expensive, enabling higher yields per square foot compared to traditional farming methods.

Asia Pacific Cannabis Vertical Farming Market Trends

The Asia Pacific region is anticipated to witness the fastest growth rate of 19.8% over the projected period, owing to several key factors. The region is experiencing a surge in demand for cannabis, both for medical and recreational use. Legal changes and evolving regulations in some Asian countries have encouraged investments in the cannabis industry, facilitating market growth. The substantial and growing population in Asia Pacific has contributed to a robust demand for marijuana products, making vertical farming a viable solution to meet this need. Furthermore,

The cannabis vertical farming market in Thailand is expected to grow at a significant CAGR from 2025 to 2030. The adoption of advanced agricultural technologies and increased investments and innovations have spurred the adoption of vertical farming in the cannabis industry, making it a competitive and promising choice for cultivation in the Asia Pacific. For instance, in January 2022, Roto-Gro and CannAcubed announced a partnership to launch a favorable marijuana vertical farming project in Thailand, marking RotoGro's entry into the marijuana market. CannAcubed has secured an agreement in Thailand that outlines the establishment of a commercial-scale marijuana cultivation facility for CBD-infused beverages and a Biotech Cannabis Cancer Treatment Hub. RotoGro has been selected as the technology partner for this endeavor. Together, both companies would be advancing the project, showcasing RotoGro's cutting-edge technology for high-quality cannabis vertical farming cultivation in Thailand.

Europe Cannabis Vertical Farming Market Trends

The cannabis vertical farming market in Europe is expected to grow at a significant CAGR from 2025 to 2030. Several European countries are progressively legalizing cannabis for medical and, in some cases, recreational use. This shift is expanding the market for cannabis products and necessitating efficient cultivation methods to meet the increasing demand. For instance, Germany's recent removal of cannabis from its narcotics list positions it to become one of the largest federally legal cannabis markets. Additionally, the growing acceptance and legalization of cannabis in Europe are creating substantial economic opportunities. Companies are investing in vertical farming to capitalize on the expanding market, leading to job creation and economic growth in the agricultural and technological sectors.

Key Cannabis Vertical Farming Company Insights

Some of the key players operating in the market include Village Farms International, Inc. and Agrify Corporation, among others.

-

Village Farms International, Inc. is a North American company focused on greenhouse-based agriculture, specializing in both fresh produce and cannabis cultivation. Village Farms International, Inc. operates in three key segments: produce, cannabis, and energy. The produce segment involves the cultivation and marketing of greenhouse-grown vegetables, such as tomatoes, cucumbers, and bell peppers, primarily in North America. The cannabis segment includes cannabis cultivation through its subsidiary Pure Sunfarms in Canada and hemp-based CBD products via Balanced Health Botanicals in the U.S. The energy segment focuses on managing energy operations that support the company's greenhouse facilities, improving efficiency and sustainability.

Growers Supply Co. BC and Green Living Technologies are some of the emerging market participants in the target market.

-

Green Living Technologies International (GLTI) specializes in the design and manufacture of sustainable green infrastructure, including green roofs, green walls, and vertical farming systems. Green living Technologies International (GLTI) offers patented green roof systems that manage stormwater and enhance energy efficiency, as well as vertical cultivation solutions with their Vertical Cultivation System (VCS)® for green walls. The company’s products are made from environmentally safe materials, including recycled aluminum and stainless steel, in alignment with LEED standards.

Key Cannabis Vertical Farming Companies:

The following are the leading companies in the cannabis vertical farming market. These companies collectively hold the largest market share and dictate industry trends.

- Village Farms International, Inc.

- Growers Supply Co. BC

- Green Living Technologies

- Bosmann Val Zaal

- Agrify Corporation

- STX Inc.

- Urban Crop Solutions

- Fluence

- AEssense Corporation.

- Heliospectra

- BIOFLORAL INC.

- Agriair LLC

- Cropking Incorporated

Recent Developments

-

In November 2024, CropKing, Incorporated, Ohio-based company specializing in controlled environment agriculture (CEA), announced a collaboration with Lubing Systems, L.P., to enhance their global distribution capabilities. This partnership aims to make CropKing's Nutrient Film Technique (NFT) channels more accessible internationally by reducing lead times and shipping costs.

-

In February 2024, Urban Crop Solutions established a state-of-the-art research center in Málaga, Spain, in collaboration with "Eliven Tropical." This facility is designed to advance indoor vertical agriculture in southern Spain. A key feature is the ModuleX system, a modular cultivation setup that allows precise control over temperature, humidity, and lighting, enabling the simultaneous cultivation of various crops.

-

In September 2023, urban-gro, Inc. announced signing contracts exceeding USD 3 million with four clients in the cannabis industry, encompassing architecture, design, engineering, and equipment integration services for projects in Midwestern U.S., Northeastern U.S., and Western Europe. The company anticipates revenue from these contracts being recognized primarily over the next three quarters, reflecting positive developments in their cannabis sector initiatives and continued progress with existing clients while expanding into new projects, particularly in Western Europe.

Cannabis Vertical Farming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 570.6 million

Revenue forecast in 2030

USD 1,377.2 million

Growth rate

CAGR of 19.3% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Structure, component, growing mechanism, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Malta; Italy; Spain; Thailand; New Zealand; South Korea; Singapore; Australia; Mexico; Uruguay; South Africa

Key companies profiled

Village Farms International Inc.; Grower's Supply Co. BC; Green Living Technologies; Bosmann Val Zaal; Agrify Corporation; STX Inc.; Urban Crop Solutions; Fluence; Aessense Corporation; Heliospectra ; BIOFLORAL INC.; Agriair LLC; Cropking Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannabis Vertical Farming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cannabis vertical farming market report based on structure, component, growing mechanism, application, and region:

-

Structure Outlook (Revenue, USD Million, 2017 - 2030)

-

Shipping container

-

Building-based

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Lighting

-

Hydroponic components

-

Climate control

-

Sensors

-

-

Software

-

Services

-

System Integration & Consulting

-

Managed Services

-

Assisted Professional Services

-

-

-

Growing Mechanism Outlook (Revenue, USD Million, 2017 - 2030)

-

Hydroponics

-

Aeroponics

-

Aquaponics

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Medical Cannabis

-

Recreational Cannabis

-

Research and Development

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Malta

-

Italy

-

Spain

-

-

Asia Pacific

-

Thailand

-

New Zealand

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Uruguay

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cannabis vertical farming market size was estimated at USD 487.5 million in 2024 and is expected to reach USD 570.6 million in 2025.

b. The global cannabis vertical farming market is expected to grow at a compound annual growth rate of 19.3% from 2025 to 2030 to reach USD 1,377.2 million by 2030.

b. North America dominated the cannabis vertical farming market with a share of 32.9% in 2024, driven by the increasing legalization movement and regulatory changes, such as the potential reclassification of marijuana under the Controlled Substances Act, fostering innovation and investment in vertical farming within the cannabis industry.

b. The key players in the cannabis vertical farming market include Village Farms International Inc., Grower's Supply Co. BC, Green Living Technologies, Bosmann Val Zaal, Agrify Corporation, STX Inc., Urban Crop Solutions, and Fluence.

b. Key growth factors include the ability of vertical farming in the cannabis industry to address challenges related to space, energy efficiency, and financial constraints. Furthermore, the increasing legalization and acceptance of recreational and medical cannabis in various regions have substantially increased demand, promoting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.