- Home

- »

- Consumer F&B

- »

-

Canned Mushroom Market Size And Share Report, 2030GVR Report cover

![Canned Mushroom Market Size, Share & Trends Report]()

Canned Mushroom Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Nature, By Form (Whole, Sliced, Chopped, Others), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-620-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canned Mushroom Market Size & Trends

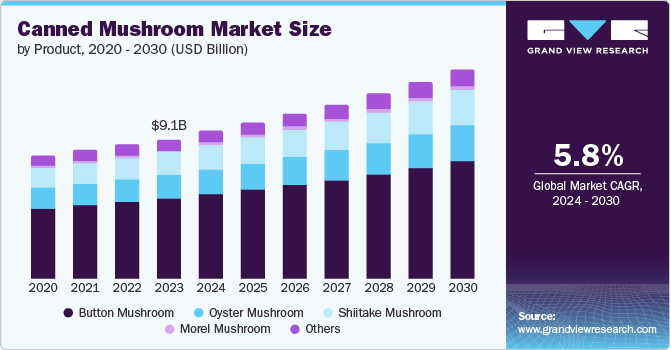

The global canned mushroom market size was valued at USD 9.09 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The growing consumer preference for convenient and long-lasting food products. Canned mushrooms, with their extended shelf life, offer an easy solution for individuals seeking to maintain a stock of nutritious vegetables without the need for frequent shopping trips. This convenience benefits busy urban dwellers and working professionals who prioritize time-saving and practical food options.

Another contributing factor is the increasing awareness of the health benefits associated with mushroom consumption. Mushrooms are rich in essential nutrients, including vitamins, minerals, and antioxidants, making them healthier for health-conscious consumers. The convenience of canned mushrooms allows individuals to incorporate these healthful ingredients into their diets with minimal effort, supporting the growing trend towards healthier eating habits.

Moreover, canned mushrooms in culinary applications have also boosted their demand. They can be used in a wide variety of dishes, from soups and stews to salads and pizzas, making them a staple ingredient in many households. The expansion of the food service industry, particularly in emerging markets, has further fueled the demand for canned mushrooms. Restaurants, hotels, and catering services value the consistency and ease of storage that canned mushrooms provide, ensuring a steady supply of quality ingredients without the challenges associated with fresh produce. As the foodservice sector continues to grow globally, the reliance on convenient and reliable ingredients like canned mushrooms is expected to increase.

Finally, advancements in food processing and preservation technologies have improved the quality and taste of canned mushrooms, which consumers prefer. Enhanced canning techniques ensure the mushrooms retain their nutritional value and flavor, reducing the gap between fresh and canned products. This technological progress has helped overcome traditional reservations about canned foods, further driving their popularity.

Product Insights

The button mushroom segment held the largest revenue share of 57.2% in 2023. Button mushrooms are widely used in the widespread culinary world. They are known for their mild flavor and smooth texture, making them a staple in various cuisines worldwide. Their adaptability in dishes ranging from soups and stews to pizzas and kinds of pasta has solidified their place in many kitchens. The convenience of canned button mushrooms further enhances their use, allowing for quick meal preparation without compromising on taste or nutritional value. Button mushrooms contain the mineral selenium, which acts as an antioxidant and keeps the immunological function healthy. Additionally, button mushrooms are high in potassium and low in salt, which helps in the proper functioning of the heart by controlling blood pressure and encouraging muscular contractions.

The shiitake mushroom segment is expected to witness the fastest CAGR of 6.5% over the forecasted period. Shiitake mushrooms are used in the production of healthcare or pharmaceutical products. Their application as an essential ingredient in the medical industry drives the market, as they are widely used as health supplements. Individuals are becoming more aware of the importance of health and fitness in life, and as a result, per capita spending on functional and nutritious food is increasing.

Nature Insights

The conventional segment dominated the market in 2023. The cost-effectiveness of conventional farming methods drives the segment growth. Conventional farming typically involves synthetic fertilizers and pesticides, which result in higher yields and lower production costs. These savings are often passed on to consumers in the form of lower prices, for budget-conscious shoppers. Another factor contributing to the rising demand is the familiarity and established market presence of conventional canned mushrooms. For many consumers, conventional products have long been a staple in their diets. The consistent availability and reliability of these products have built a strong brand loyalty over the years. Additionally, conventional canned mushrooms often have a longer shelf life due to the preservatives used. This is a significant advantage for retailers and consumers looking for convenient, long-lasting pantry items.

The organic segment is expected to grow at the fastest CAGR over the forecast period. Organic mushrooms are produced without using artificial chemicals and fertilizers. Increasing awareness among consumers about organic and healthy food drives the demand for organic mushrooms. Rising concerns about environmental sustainability encourage consumers to purchase organic consumables. The rising trend of plant-based food is also driving the organic mushroom market growth.

Form Insights

Whole segment dominated the market in 2023 with the highest market revenue share. There is an increasing consumer inclination toward convenience and ready-to-use food products. Whole canned mushrooms offer ease of use in various culinary applications, from soups and stews to pizzas and salads, for both home cooks and professional chefs. This convenience factor is especially relevant in today's fast-paced lifestyle, where consumers seek time-saving food solutions without compromising on quality or flavor. Another factor contributing to the rising demand is the growing awareness and appreciation of mushrooms' nutritional benefits. Whole mushrooms retain their natural texture and flavor better than sliced or diced counterparts, which can appeal to health-conscious consumers. They are rich in essential nutrients, such as vitamins, minerals, and antioxidants, which support overall health. As consumers become more educated about the health benefits of mushrooms, their preference for whole canned mushrooms, which they perceive as less processed and more wholesome, is increasing.

Sliced segment is expected to grow at the fastest CAGR over the forecast period. Sliced mushrooms save time and effort for consumers who seek ready-to-use meal ingredients. This convenience benefits busy individuals and families who want to prepare nutritious and flavorful dishes quickly. As lifestyles become increasingly hectic, the demand for easy-to-use food products has surged, making sliced mushrooms a preferred choice. Moreover, the food service industry's preference for sliced mushrooms contributes to their increased demand. Restaurants, catering services, and other food service providers often opt for pre-sliced mushrooms to streamline their operations and maintain consistency in their dishes. The reduced preparation time and labor costs associated with using sliced mushrooms for these businesses further boost market demand.

Application Insights

The Household segment dominated the market with a lucrative market share. The increasing popularity of home cooking and meal preparation. With a growing interest in culinary exploration and health-conscious eating, more consumers are experimenting with various ingredients, including mushrooms, to enhance their homemade dishes. Canned mushrooms provide a versatile option that can be easily incorporated into a wide range of recipes, from soups and stews to pasta and pizza, making them a staple in many kitchens.

Restaurant segment is projected to experience the highest CAGR of 6.15% in the forecasted period. The ease of storage and extended shelf life of canned mushrooms drives the segment growth. Fresh mushrooms have a relatively short shelf life and require specific storage conditions to maintain their freshness, which can be challenging and costly for restaurants to manage. In contrast, canned mushrooms can be stored for extended periods without the need for refrigeration, reducing waste and lowering operational costs associated with inventory management. Additionally, the cost-effectiveness of canned mushrooms is another critical factor driving their demand in the restaurant segment. Restaurants operate on tight margins and are constantly seeking ways to optimize their food costs. Canned mushrooms are often more affordable than fresh mushrooms, providing a cost-effective alternative that allows restaurants to offer a variety of mushroom-based dishes without significantly increasing their expenses.

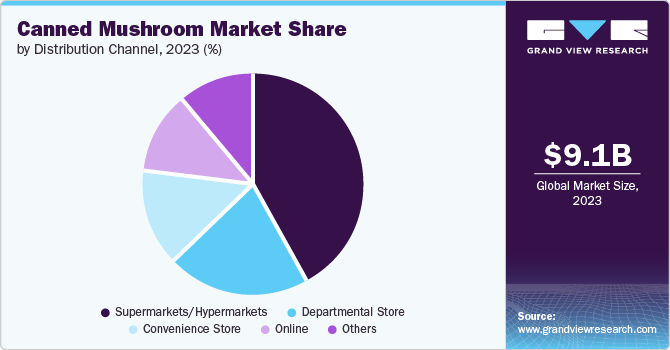

Distribution Channel Insights

Supermarket/Hypermarket segment dominated the market with the highest revenue share in 2023. The ease of purchasing mushrooms with other groceries and the advantage of bulk purchases contribute to the dominance of supermarkets/hypermarkets. Supermarkets and hypermarkets are crucial in reaching consumer preferences through product visibility, attractive displays, and promotions. Additionally, the wide range of canned mushrooms provided by supermarkets and hypermarkets drives the increasing demand for canned mushrooms.

Online segment is expected to grow with the fastest CAGR of 7.3% in the forecasted period. the convenience and accessibility offered by online shopping platforms have significantly contributed to this trend. Consumers can browse a wide variety of canned mushroom products, compare prices, read reviews, and make purchases from the comfort of their homes. This ease of access is particularly appealing to busy individuals and those living in remote areas where traditional brick-and-mortar stores may not have diverse product selections. Another driving factor is the increasing penetration of smartphones and the internet, which has revolutionized how people shop. E-commerce platforms have optimized their mobile interfaces to provide a seamless shopping experience, thus catering to the growing number of consumers who prefer shopping on their phones. Additionally, targeted advertising and personalized recommendations have enhanced the shopping experience, making it more likely for consumers to purchase canned mushrooms online.

Regional Insights

North America canned mushroom market is anticipated to witness the fastest-growing CAGR over the forecast period. Canned mushrooms offer a ready-to-use solution that saves time in meal preparation, especially for busy lifestyles where convenience is a top priority. This convenience factor extends beyond households to restaurants, catering services, and other food service establishments where efficient ingredient management is crucial.

U.S. Canned Mushroom Market Trends

U.S. accounted for a significant market share in the regional canned mushroom market. Canned mushrooms provide a reliable and consistent supply throughout the year. Unlike fresh mushrooms, which are subject to seasonal availability and price fluctuations, canned mushrooms ensure a stable source of this versatile ingredient. This reliability is crucial for households and food service businesses, supporting continuous demand and usage in various culinary applications. Additionally, canned mushrooms are more affordable than their fresh counterparts, offering a cost-effective solution for consumers looking to manage their grocery budgets without sacrificing quality or taste. This affordability makes canned mushrooms accessible to a broader population segment, from budget-conscious households to large-scale food service operations.

Asia Pacific Canned Mushroom Market Trends

Asia Pacific held the largest market share of 36.4% globally in 2023. Urbanization and changing lifestyles lead to a preference for convenient and ready-to-eat food products, including canned mushrooms. The increasing middle class in countries such as China and India drives demand for diverse and nutritious food options. Canned mushrooms, which offer a longer shelf life and ease of storage, fit well into the busy schedules of urban consumers. Furthermore, increasing awareness of the health benefits of mushroom consumption, such as their high nutritional value and low-calorie content, contributes to this trend.

The canned mushroom market in China has witnessed a significant growth in 2023. The rising disposable income among Chinese consumers. As they have more money to spend, people increasingly seek quality and diverse food options. Canned mushrooms are often perceived as a premium product due to their consistent quality and long shelf life. This perception, combined with the convenience factor, makes canned mushrooms a preferred choice among middle-class consumers who are willing to pay more for products that offer both quality and convenience. Furthermore, the strong growth of the food service industry in China has significantly contributed to the increased demand for canned mushrooms. Restaurants, particularly those specializing in hotpots, soups, and various stir-fried dishes, often use canned mushrooms for their consistent quality and ease of use. This sector's expansion, fueled by the booming dining-out culture and the popularity of food delivery services, has driven up the demand for convenient and reliable ingredients like canned mushrooms.

The India canned mushroom market is projected to grow rapidly in the forecasted period. Canned mushrooms offer convenience and year-round availability, which appeals to urban consumers with busy lifestyles. They eliminate the need for cleaning and preparation, making them a convenient choice for modern households. Additionally, the growth of the retail sector in India, including the expansion of supermarkets and online grocery platforms, has made canned mushrooms more accessible to a wider consumer base. These distribution channels ensure that canned mushrooms reach urban and semi-urban areas efficiently, meeting the demand from diverse demographics nationwide.

Europe Canned Mushroom Market Trends

The European canned mushroom market is projected to grow rapidly. European consumers are increasingly following the trend of veganism, resulting in a growing demand for canned mushrooms. Increasing investment in modern agriculture methods and processing techniques drives market growth. Canned mushrooms provide convenience and increased shelf life, which drives the demand for canned mushrooms in the European market.

The UK canned mushroom market is projected to witness steady growth in the coming years. The growing awareness and preference among consumers for shelf-stable foods drives the market growth for canned mushrooms. Canned mushrooms offer a convenient and long-lasting alternative to fresh mushrooms, catering to busy lifestyles where convenience and durability are prioritized over perishability. Another significant driver is the expanding culinary landscape and consumer experimentation with global cuisines. Canned mushrooms provide an accessible way for home cooks and chefs to incorporate diverse flavors and textures throughout the year. This versatility extends beyond traditional British cuisine, supporting a broader adoption across various culinary traditions prevalent in the UK. Moreover, the canned food industry in the UK has undergone advancements in processing technology and packaging innovations. These advancements have improved canned mushrooms' quality, taste, and nutritional value, addressing previous concerns about texture and flavor compared to fresh alternatives. As a result, consumers increasingly perceive canned mushrooms as a viable and high-quality option for cooking and meal preparation.

Canned mushroom Germany market is witnessing a rapid growth in this industry. Changes in dietary habits and a growing preference for convenience foods have fueled the demand for canned mushrooms. These products offer convenience and versatility in cooking, catering to busy lifestyles where consumers seek quick and easy meal solutions without compromising quality or nutrition. Furthermore, advancements in agriculture techniques have also played a crucial role. Germany has been at the forefront of implementing innovative agricultural practices to improve yield and quality. Techniques such as controlled environment agriculture (CEA), which includes hydroponics and vertical farming, have enabled year-round production of mushrooms in controlled conditions. This not only ensures consistent supply but also maintains high-quality standards that are essential for canning processes.

Key Canned Mushroom Company Insights

Some of the key companies include Giorgio Fresh Co.; Costa Group; Bonduelle Group; B&G Foods, Inc.; OKECHAMP S.A.

-

Giorgio Fresh Co. is an integrated processor and national distributor of the value-added mushroom products for the retail, food service and industrial markets. Its range of products includes canned and jarred mushrooms under the Giorgio, Pennsylvania Dutchman, and Brandywine brands, frozen IQF mushrooms, sauces and toppings for chain restaurants.

-

Costa Group cultivates button, cup, and flat mushrooms in white and brown varieties, each harvested at various points in the growth process. The company produces a plentiful supply of both white and brown Agaricus mushrooms, with the white Agaricus being the most widely cultivated mushroom in Australia.

Key Canned Mushroom Companies:

The following are the leading companies in the canned mushroom market. These companies collectively hold the largest market share and dictate industry trends.

- Bonduelle Group

- Giorgio Fresh Co.

- B&G Foods, Inc.

- Costa Group

- OKECHAMP S.A.

- Monterey Mushrooms, Inc.

- Prochamp

- THE MUSHROOM COMPANY

- Shanghai Finc Food Co., Ltd.

- Dhruv Agro

Recent Developments

-

In January 2024, Giorgio Foods announced the launch of a new line of stuffed mushrooms, expanding its product offerings. The company aims to meet the growing demand for convenient and flavorful meal options. The latest product line will feature various stuffing flavors, catering to diverse tastes. Giorgio's expansion into stuffed mushrooms aligns with current trends toward ready-to-eat and gourmet food choices.

Canned Mushroom Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.55 billion

Revenue forecast in 2030

USD 13.43 billion

Growth Rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, form, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Germany, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Chile, Saudi Arabia

Key companies profiled

Bonduelle Group; Giorgio Fresh Co.; B&G Foods, Inc.; Costa Group; OKECHAMP S.A.; Monterey Mushrooms, Inc.; Prochamp; THE MUSHROOM COMPANY; Shanghai Finc Food Co., Ltd.; Dhruv Agro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Canned Mushroom Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global canned mushroom market report based on product, nature, form, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Button Mushroom

-

Shiitake Mushroom

-

Oyster Mushroom

-

Morel Mushroom

-

Others

-

-

Nature Outlook (Revenue, USD Billion, 2018 - 2030)

-

Organic

-

Conventional

-

-

Form Outlook (Revenue, USD Billion, 2018 - 2030)

-

Whole

-

Sliced

-

Chopped

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Household

-

Restaurants

-

-

Distribution Channel Outlook(Revenue, USD Billion, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Departmental Store

-

Convenience Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Chile

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.