- Home

- »

- Consumer F&B

- »

-

Canned Tuna Market Size & Share, Industry Report, 2030GVR Report cover

![Canned Tuna Market Size, Share & Trends Report]()

Canned Tuna Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Skipjack, Yellowfin), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-985-2

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Canned Tuna Market Summary

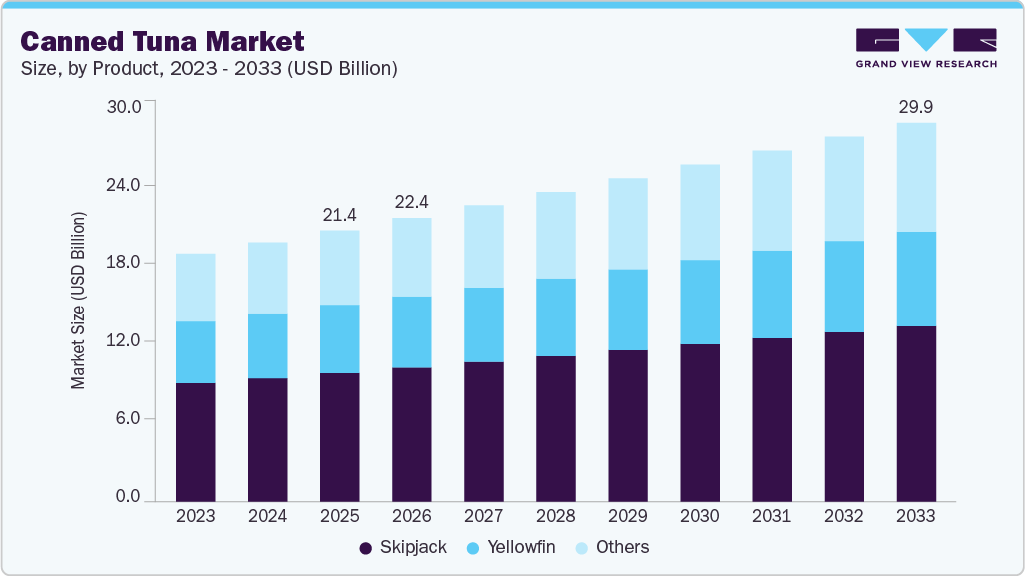

The global canned tuna market size was estimated at USD 21.39 billion in 2025 and is projected to reach USD 29.90 billion by 2033, growing at a CAGR of 4.2% from 2026 to 2033. The expansion of the global canned tuna industry is largely supported by rising disposable incomes and the growing penetration of convenient, ready-to-eat protein options across both developed and emerging economies.

Key Market Trends & Insights

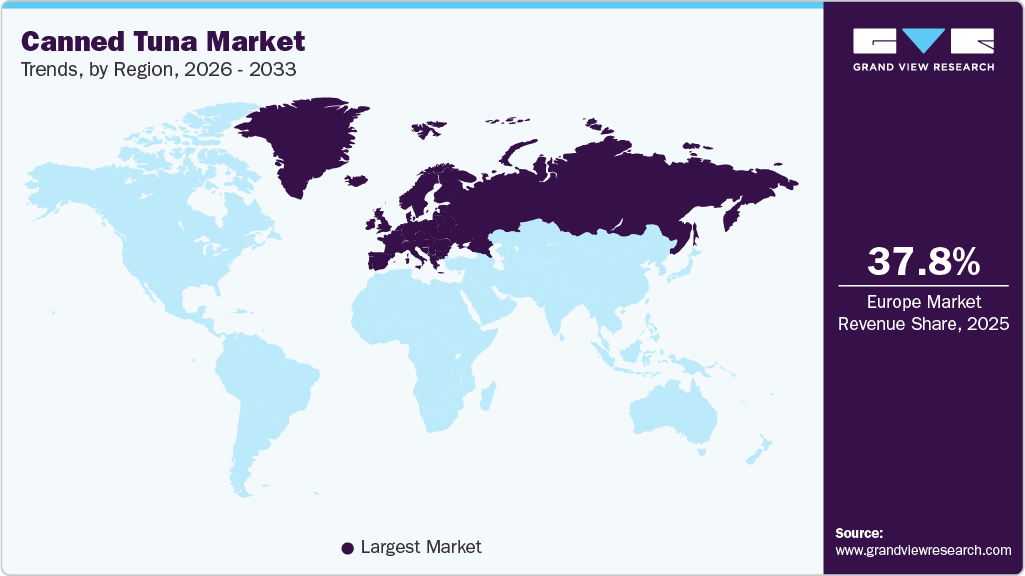

- Europe dominated the global canned tuna market with the largest revenue share of 37.8% in 2025.

- The canned tuna market in Italy is expected to grow significantly from 2026 to 2033.

- By product, the skipjack segment led the market with the largest revenue share of 47.5% in 2025.

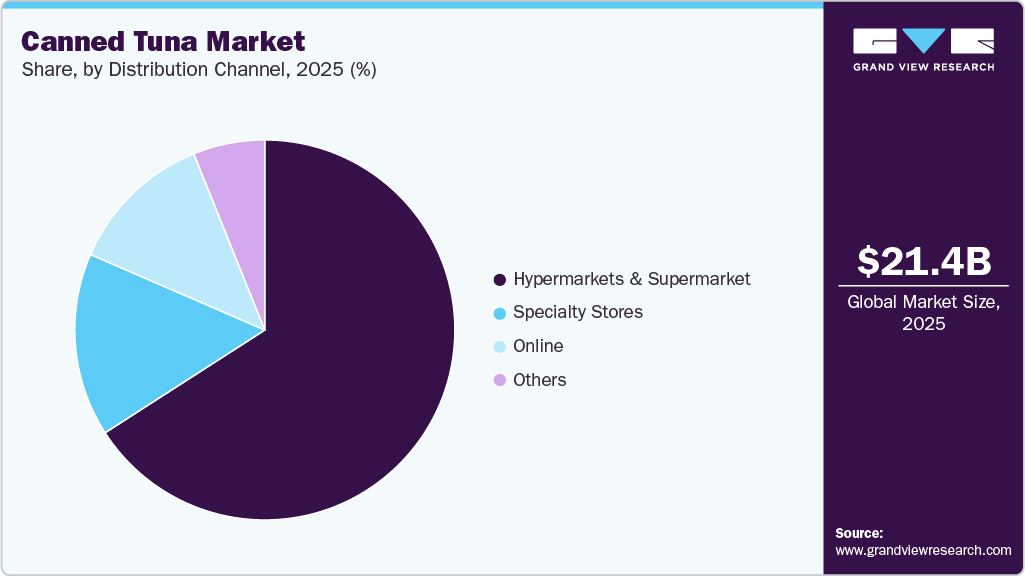

- By distribution channel, the hypermarkets & supermarkets segment led the market with the largest revenue share of 74.4% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 21.39 Billion

- 2033 Projected Market Size: USD 29.90 Billion

- CAGR (2026-2033): 4.2%

- Europe: Largest market in 2025

Increasing participation in out-of-home activities and changing dietary habits have accelerated the demand for shelf-stable seafood products, with canned tuna remaining a preferred choice due to its affordability, long shelf life, and nutritional profile. Furthermore, the market benefits from the rising consumption of packaged seafood among health-conscious consumers who value high-protein, low-fat meal solutions.There is a rising demand for ready-to-eat food products. With fast-paced lifestyles and busy work schedules, consumers seek easy-to-prepare meals that do not compromise nutrition. Canned tuna is a versatile ingredient for salads, sandwiches, and cooked dishes, catering to home cooks and the foodservice industry. This convenience factor has led to increased consumption across various demographic segments.

Over the past few years, the consumption of seafood has increased significantly across the globe owing to its rich taste, nutritional properties, and smaller carbon footprint compared to other meat and beef products. A blog by the National Fisheries Institute suggested that 88% of all families in the U.S. have consumed canned tuna. In addition, this fish is one of the top five most-consumed seafood globally. The tuna industry has witnessed a paradigm shift in recent years due to rising production and price competition, technological advances, and shifting consumer demand.

Advancements in packaging and sustainable fishing practices are vital to shaping the market landscape. Companies are adopting eco-friendly packaging solutions and responsible sourcing strategies to appeal to environmentally conscious consumers. As sustainability concerns grow, brands that emphasize ethical fishing practices and recyclable packaging are gaining a competitive edge. This trend is expected to drive market growth by attracting a wider consumer base.

In June 2024, John West introduced EcoTwist, a patent-pending canned tuna tower featuring a SmartStrip that allows cans to be separated by twisting. This innovation eliminates plastic wrapping and utilizes a lighter can design, maintaining the same tuna quantity while saving over 400 metric tons of steel annually. Hailed as the most significant packaging advancement in the UK’s ambient tuna market in two decades, EcoTwist enhances sustainability, improves consumer convenience, and strengthens supply chain efficiency, reinforcing John West’s leadership in responsible packaging solutions.

Consumer Insights

The demand for canned tuna has been steadily rising as consumers increasingly prioritize convenience, nutrition, and affordability in their food choices. Canned tuna is widely perceived as a reliable source of lean, high-quality protein, making it attractive to health-conscious consumers who are reducing their intake of red meat and processed meats. The product’s long shelf life, portability, and versatility in meal preparation further enhance its appeal, particularly among working professionals, students, and households seeking quick meal solutions. Moreover, innovations in flavor profiles such as lemon pepper, chili, Mediterranean blends, and olive oil variants have broadened its relevance across demographic groups, particularly Millennials and Gen Z, who show greater openness to global flavors and ready-made meal options.

Markets such as Japan, South Korea, and Australia have strong canned seafood consumption patterns, with Japan showing high per-capita intake of canned mackerel, tuna, and sardines. Emerging markets, including India, Indonesia, Thailand, and the Philippines, are seeing rising adoption of canned meats and seafood driven by increased workforce participation and demand for convenient meal options.

Affordability is another key factor driving the popularity of canned tuna. Compared to fresh seafood and several meat categories, canned tuna remains cost-effective, offering accessible nutrition at a stable price point. This has been especially relevant during periods of food inflation, when consumers tend to shift toward shelf-stable protein sources. Sustainability has also emerged as an important purchasing criterion. Labels indicating dolphin-safe practices, pole-and-line fishing, and Marine Stewardship Council (MSC) certification influence buying decisions, reflecting growing consumer awareness about ethical seafood sourcing and environmental responsibility.

The broader trend toward ready-to-eat (RTE) and canned foods is rooted in modern lifestyle changes. Urbanization, long working hours, rising female workforce participation, and the proliferation of small urban kitchens have collectively reduced the time consumers are willing or able to spend on elaborate cooking. As a result, products that require minimal preparation are becoming integral to weekly meal routines. Canned foods, including tuna, offer a practical solution by providing quick, convenient options without compromising basic nutritional needs. Post-pandemic behavioral shifts have further reinforced demand, with many consumers maintaining well-stocked pantries for emergencies and preferring packaged foods due to perceived hygiene and safety.

Product Insights

The skipjack segment led the market with the largest revenue share of 47.5% in 2025, driven by affordability, widespread availability, and strong consumer demand. As a versatile and cost-effective protein source, skipjack is widely used in canned tuna products, making it a staple for households and the food service industry. It has lower mercury levels than other tuna species, enhancing its appeal among health-conscious consumers. The rising preference for convenient and nutritious meal options continues to propel the global market growth for skipjack tuna.

In August 2024, Wild Planet launched its Limited Edition Wild Tuna Snack Pack in collaboration with Simple Mills and Chosen Foods. On Wild Planet’s website, the pack features sustainably caught Skipjack Wild Tuna with dill pickle, lemon juice, and sea salt, along with nutrient-rich almond flour crackers and avocado oil mayo for a convenient, wholesome snack.

The yellowfin segment is predicted to grow at the fastest CAGR of 4.2% from 2026 to 2033. Yellowfin tuna is widely valued for its firm texture, rich flavor, and high protein content, making it a preferred choice for gourmet dishes and sushi. Increasing demand for sustainably sourced seafood and advancements in fishing and processing technologies further enhance market accessibility. Its rising popularity in retail and food service continues to support its steady growth.

Distribution Channel Insights

The hypermarkets & supermarkets segment led the market with the largest revenue share of 65.9% in 2025. Their widespread presence, extensive product selection, and convenience factors significantly shaped consumer purchasing preferences. These large-scale stores offer an accessible shopping experience where customers can compare brands, take advantage of promotional offers, and purchase canned tuna in bulk. As demand for canned seafood continues to grow due to its affordability and long shelf life, hypermarkets and supermarkets remain the primary choice for consumers seeking both variety and value. Their influence is expected to persist in the market, driving competition and innovation among manufacturers aiming to secure a strong presence within these high-traffic retail spaces.

The online segment is expected to grow at the fastest CAGR of 6.0% over the forecast period. The segment growth is driven by increasing consumer preference for convenience, wider product availability, and competitive pricing offered by e-commerce platforms. As digital shopping evolves, improved logistics, subscription-based seafood delivery services, and enhanced customer engagement through personalized recommendations are anticipated to accelerate online sales. The shift toward online purchasing reflects broader trends in the food industry, where digital platforms are becoming essential for consumers and businesses aiming to expand their market reach.

Regional Insights

The canned tuna market in North America is expected to grow at a moderate CAGR of 4.2% from 2026 to 2033. The region's strong retail presence, including major supermarket chains and expanding online platforms, contributed to substantial market growth. North American consumers are increasingly emphasizing sustainably sourced seafood, driving industry shifts toward responsible fishing practices and eco-friendly packaging. As manufacturers continue introducing premium, health-conscious canned tuna products, analysts anticipate steady expansion in the coming years, further solidifying North America’s position as a key player in the global canned seafood industry. In May 2025, Chicken of the Sea introduced its Wild Caught Light Tuna Packet with Ghost Pepper, offering a bold new flavor for spice enthusiasts. The product features 15 grams of protein per 2.5-ounce packet. Consumers can enjoy it on its own or incorporate it into meals for a balanced heat experience.

U.S. Canned Tuna Market Trends

The canned tuna market in the U.S. is expected to grow significantly over the forecast period, driven by increasing consumer demand for convenient, protein-rich seafood options. Expanding e-commerce and direct-to-consumer platforms is crucial in market acceleration, providing greater accessibility and variety to shoppers. Health-conscious consumers gravitate toward sustainably sourced products, prompting manufacturers to innovate with eco-friendly packaging and responsibly caught tuna. In October 2024, Bumble Bee Seafood expanded its award-winning seafood lineup with 11 new products, including flavored albacore tuna, innovative tuna snack kits, low-sodium albacore, and premium sardines and shrimp.

Europe Canned Tuna Market Trends

Europe dominated the global canned tuna market with the largest revenue share of 37.8% in 2025. The region's strong preference for canned seafood, driven by convenience, nutritional benefits, and sustainability concerns, contributed to its dominant position. European consumers increasingly favor responsibly sourced tuna, with certifications such as the Marine Stewardship Council (MSC) playing a crucial role in their purchasing decisions. In addition, established European seafood brands and retailers continue to innovate, offering premium canned tuna products that cater to evolving consumer tastes. In May 2023, Thai Union’s European Seafood Investment Portugal (ESIP) inaugurated its Peniche Can Store at its Peniche facility in Portugal. The store featured ESIP’s brand Peniche Can by Thai Union, along with its newly launched Peniche Can Surf, a tuna salad line catering to active lifestyles.

Italy Canned Tuna Market Trends

The canned tuna market in Italy is expected to grow significantly from 2026 to 2033. The canned tuna market in Italy is rising due to its strong alignment with consumer preferences for convenient, affordable, and protein-rich foods that fit traditional Italian diets. Increasing demand for long-shelf-life products, growth in ready-to-eat meals and salads, and busy urban lifestyles are supporting higher consumption. In addition, rising health awareness, preference for Mediterranean style eating habits, and the availability of premium, sustainably sourced canned tuna variants are further strengthening market growth.

Asia Pacific Canned Tuna Market Trends

The canned tuna market in the Asia Pacific is expected to grow at a significant CAGR of 4.6% from 2026 to 2033. Demand for canned tuna in the Asia-Pacific region is rising strongly, driven by multiple converging consumer and structural trends. Rapid urbanization and rising disposable incomes across emerging markets are driving greater purchases of convenient, shelf-stable protein sources, and canned tuna fits this profile perfectly. At the same time, evolving dietary preferences, driven by health awareness and the demand for lean animal protein, are increasing the appeal of tuna, which is recognized for its high protein content and favorable nutrient profile.

Key Canned Tuna Company Insights

The presence of a few established players and new entrants characterizes the market. Many big players are increasing their focus on the growing trend of the canned tuna industry. Players in the market are diversifying their service offerings in order to maintain market share.

Key Canned Tuna Companies:

The following key companies have been profiled for this study on the canned tuna market.

- Frinsa

- Century Pacific Food Inc.

- Jealsa

- Thai Union Group PCL.

- Bumble Bee Foods, LLC.

- Grupo Calvo

- Wild Planet Foods

- Aneka Tuna Indonesia

- American Tuna

- Ocean Brands GP.

Recent Developments

-

In July 2025, The Maldives government announced a new partnership with a Chinese firm, Jingweidao brand team, to produce the first sample batch of canned tuna using locally caught Maldivian fish. This collaboration aims to leverage the China-Maldives Free Trade Agreement for zero import duties and expand the Maldivian seafood market.

-

In December 2024, Oman's Simak, owned by Fisheries Development Oman, has launched its first commercial canned tuna products for the domestic market, inaugurating a factory in Duqm capable of producing over 100 million cans per year (about 30,000 metric tons of seafood). The facility uses advanced technology, water conservation, and solar energy to align with Oman’s Vision 2040 for food security and sustainability.

Canned Tuna Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 22.37 billion

Revenue forecast in 2033

USD 29.90 billion

Growth rate

CAGR of 4.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand & New Zealand; Brazil; South Africa

Key companies profiled

Frinsa; Century Pacific Food Inc.; Jealsa; Thai Union Group PCL.; Bumble Bee Foods, LLC.; Grupo Calvo; Wild Planet Foods; Aneka Tuna Indonesia; American Tuna; Ocean Brands GP.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Canned Tuna Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global canned tuna market based on the product, distribution channel, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Skipjack

-

Yellowfin

-

Others

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.