- Home

- »

- Alcohol & Tobacco

- »

-

Canned Wines Market Size & Share, Industry Report, 2030GVR Report cover

![Canned Wines Market Size, Share & Trends Report]()

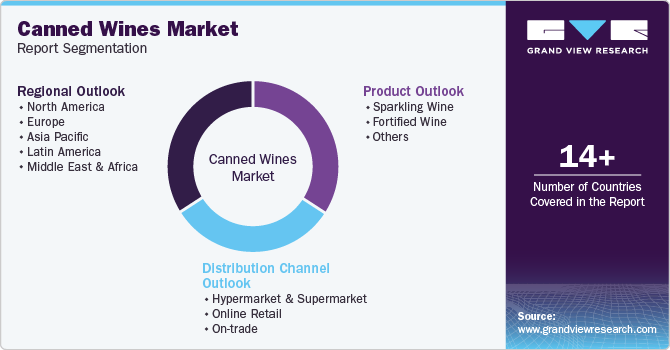

Canned Wines Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sparkling, Fortified), By Distribution Channel (Hypermarket & Supermarket, Online Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-212-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canned Wines Market Summary

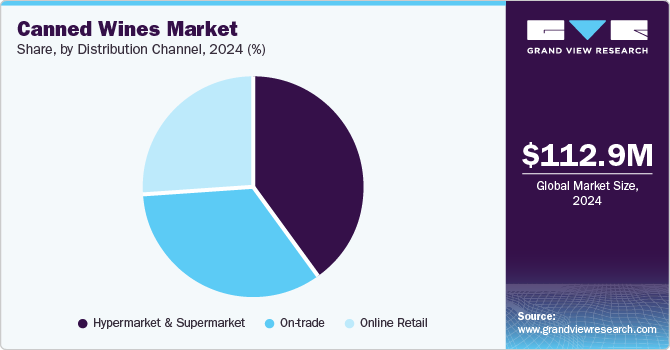

The global canned wines market size was estimated at USD 112.9 million in 2024 and is projected to reach USD 211.5 million by 2030, growing at a CAGR of 11.1% from 2025 to 2030. The steadily increasing demand for portable, convenient, and single-serve beverages, particularly among the younger population, is a major driver for market growth worldwide.

Key Market Trends & Insights

- The North America canned wines market accounted for the largest revenue share of 37.7% globally in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024

- By product, the sparkling wine segment accounted for the largest revenue share of 60.3% in the canned wines industry in 2024.

- By product, the fortified wine segment is expected to advance at the fastest CAGR in the market from 2025 to 2030.

- By distribution channel, the supermarket & hypermarket segment accounted for the largest revenue share in the global canned wines industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 112.9 Million

- 2030 Projected Market Size: USD 211.5 Million

- CAGR (2025-2030): 11.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, consumer inclination toward ready-to-drink (RTD) products, owing to their busy lifestyles and hectic work schedules, has helped boost product demand, especially in developed and emerging markets. With weekend getaways, camping, and hiking becoming widely popular, sales of products such as canned beverages have witnessed a sharp rise, as they allow consumers to enjoy drinking while avoiding issues associated with conventional bottles, such as spillage or breakage.

The rapidly expanding health- and wellness-focused population, especially in developed economies such as the U.S. and Western European countries, has provided noticeable growth opportunities to companies involved in the canned wines industry. Canned wines often come in lighter, lower-alcohol varieties, which align with the growing wellness movement. Many consumers are looking for beverages that fit into their healthier lifestyles, with a focus on moderation, lower calorie content, and fewer additives, and these products often cater to such user preferences. The single-serving nature of canned wines helps control alcohol intake, a growing trend in many economies where consumers are aiming to avoid overconsumption of alcohol. Canned wines are also more affordable than bottled wines, making them an attractive option for budget-conscious consumers. The lower cost of production and packaging for these cans generally results in a lower retail price, which is particularly appealing in casual or everyday drinking scenarios.

A continued focus on the environment and sustainability concerns have emerged as other promising drivers for market growth. Canned wine is often seen as a more environment-friendly option than bottled wine, especially due to the recyclability of aluminum cans. With growing concerns over plastic and glass waste presented by conventional bottled wine, many consumers prefer the lower environmental impact of cans. Canned wines address the global demand for sustainable products and eco-conscious consumer choices. Aluminum cans are lighter and more compact than glass bottles, reducing transportation costs and the product's overall carbon footprint.

The canned wine category has seen significant innovation in flavor and product offerings. This includes sparkling wines, flavored wine spritzers, and wine blends, which appeal to a broader range of consumer tastes. The ability to experiment with different flavor profiles and wine-based cocktails in a convenient format has helped expand the appeal of canned wines. These beverages are also available in trending options such as sangria, wine spritzers, and flavored wines, attracting a wider consumer base, including those new to wine or looking for a casual alternative.

Product Insights

The sparkling wine segment accounted for the largest revenue share of 60.3% in the canned wines industry in 2024. Sparkling canned wines, such as sparkling rosé, Prosecco, and wine spritzers, cater to a broad demographic and offer a portable alternative to conventional bottled sparkling wines. Canned sparkling wines come in smaller, single-serve portions, which reduces waste and appeals to individuals who prefer not to open a complete bottle. This is particularly important in markets where sparkling wine is not consumed frequently, as consumers are less likely to finish it. The widespread popularity of this type of wine has compelled major brands as well as startups to launch innovative offerings. For instance, in June 2023, the female-led wine company NICE, based in London, announced the launch of its first-ever canned sparkling wine that contains 10% ABV (alcohol by volume) and is available in 200ml cans. This white wine offering joined the company's existing range of Pale Rosé (12% ABV), Malbec (13.5% ABV), and Sauvignon Blanc (11.5% ABV) products.

The fortified wine segment is expected to advance at the fastest CAGR in the market from 2025 to 2030. The rising demand for craft and artisanal beverages has encouraged producers to offer premium canned fortified wines. These products are generally associated with higher-quality or boutique brands, attracting consumers seeking unique experiences. Fortified wines such as sherry, port, and vermouth are experiencing a resurgence due to interest in vintage drinks and traditional, artisanal beverages, allowing brands to launch these products in canned formats.

Distribution Channel Insights

The supermarket & hypermarket segment accounted for the largest revenue share in the global canned wines industry in 2024. The growing presence of physical shopping outlets and the opportunity to boost product visibility have created significant demand for these distribution channels among canned wine companies. Supermarkets and hypermarkets, on their part, have expanded their canned wine selections in response to rising demand. These retail channels are capitalizing on the popularity of canned beverages by offering a variety of brands and price points, making them accessible to a wide audience. Retailers often use promotions, discounts, and in-store displays to increase the chances of impulse purchases. Tasting events or featured product spots can also drive awareness and interest among prospective buyers.

The online retail segment is expected to advance at the fastest CAGR in the global market during the forecast period. Improving Internet connectivity worldwide and increasing usage of social media platforms by wine brands have resulted in substantial product sales through online channels. Online retail platforms often provide a wider selection of products than conventional brick-and-mortar stores. Additionally, online retailers generally offer a range of options, including different wine types (rosé, red, white, and sparkling), brands, and price points, catering to a broad spectrum of consumer tastes and preferences. Moreover, with sustainability being a key factor for consumers who make conscious purchasing decisions, extensively researching and comparing brands online allows them to find wines that align with their environmental values easily.

Regional Insights

The North America canned wines market accounted for the largest revenue share of 37.7% globally in 2024. Increasing wine consumption among regional consumers and the availability of several wine brands in the canned format have aided regional growth. Canned wines are often perceived as a more affordable alternative to bottled wines, especially among younger consumers and the middle-class demographic in the U.S. and Canada. This has made them an attractive option for budget-conscious consumers, particularly in casual and social settings. Moreover, the Millennial and Generation Z demographics are drawn to the novelty, affordability, and sustainability aspects of cans. Canned wine thus appeals to younger consumers who seek convenience and a modern image that aligns with their lifestyles.

U.S. Canned Wines Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by the strong sales of wine in the economy and growing competition among various brands that have led to innovative offerings. According to the U.S. Wine Industry Insights report by 8Wines, in 2023, the per-person consumption of wine in the country was 4.7 liters, with the total annual wine consumption standing at 18.5 billion liters. The increasing popularity of Ready-to-drink (RTD) beverages and advanced packaging processes that address sustainability concerns have created notable growth avenues for the U.S. market. Manufacturers are also increasingly introducing RTD options with lower alcohol content that incorporate natural ingredients to cater to the health-conscious customer base. This has helped create more avenues for product sales, aiding industry advancement.

Europe Canned Wines Market Trends

The Europe canned wines industry accounted for a notable revenue share globally in 2024. The increasing consumption of alcoholic beverages by regional consumers during outdoor events such as picnics, music festivals, sports events, and hiking has helped sustain strong sales of RTD products. Sustainability is a major driver in Europe, where consumers are highly attuned to environmental issues. Canned wines are often marketed as more eco-friendly than bottled wine due to the recyclability of aluminum and the lower carbon footprint associated with their production and transport. Many established wine-producing countries, such as France, Italy, and Spain, are seeing local producers embrace canned wines and RTD options to reach new audiences, particularly younger or urban consumers who may not prefer traditional wine consumption.

Asia Pacific Canned Wines Market Trends

The Asia Pacific region is expected to advance at the fastest CAGR in the global market during the forecast period. The region's steadily increasing population of beverage consumers and a substantial younger demographic have created opportunities for market players to launch novel products targeting different customer segments. A report published in 2024 stated that while the overall wine market in Japan has witnessed a downturn, canned wines have shown a noticeable surge in popularity, with companies such as Suntory Holdings and Mercian benefitting from this trend. The outlook for RTD beverages in India has similarly been positive in recent years. In 2023, John Distilleries, an Indian company that develops distilled beverages, outlined its plans to launch canned wines for its Big Banyan wine portfolio in the near future. Such developments are expected to result in strong regional market growth.

China accounted for the largest revenue share in the Asia Pacific market for canned wines in 2024. The country holds significant promise for alternative wine products due to the growing urbanization and increasing preference for alcoholic beverages among Chinese consumers. As a result, there has been a proliferation of emerging brands that aim to offer innovative products. For instance, the brand WiMo, created in 2021, raised significant funding in 2022, targeting first-time health-conscious wine consumers. Furthermore, according to Tianyancha, a business inquiry platform, the country had over 115,000 businesses that sold low-alcohol products, with several of these companies exploring product launches in new formats. These factors are expected to help the country sustain a promising market for canned wine products in the coming years.

Key Canned Wines Company Insights

Some major companies involved in the global canned wines industry include E. & J. Gallo Winery, Canned Wine Co., and Union Wine Company, among others.

-

E. & J. Gallo Winery is a family-owned winery headquartered in Modesto, California, which is involved in developing premium and innovative wines. The company has a broad portfolio of wine offerings, including Alamos, Apothic, Ballatore, Bella Sera, Dolcea, Estancia, Hahn, Liberty Creek, and Madria Sangria. In June 2023, Gallo announced the acquisition of the female-led beverage brand Bev and its premium canned wines and spritzers portfolio. The company's Bev product range includes Bev Rosé, Bev Noir, Bev PRIDE, Bev Gris, Bev Blanc, Bev Glitz, Bev Glow, Bev Glam, and Bev Brite.

-

Canned Wine Co., a winery based in Bath, England, produces and sells high-quality wines in environmentally friendly packaging. The company has an extensive product range, including Verdejo 2022 - Rueda, Gamay 2021 - Loire Valley, Sparkling Chardonnay 2022, Viognier 2022, St Laurent 2020, and Old Vine Garnacha 2020, among others. It further offers a 'Build A Box' feature that allows buyers to select 3, 6, or 12 cans from the brand's portfolio that are then delivered to their homes.

Key Canned Wines Companies:

The following are the leading companies in the canned wines market. These companies collectively hold the largest market share and dictate industry trends.

- E. & J. Gallo Winery

- Union Wine Company

- Sans Wine Co.

- Sula Vineyards Limited

- SUNTORY HOLDINGS LIMITED

- Canned Wine Co.

- Maker Wine Company

- Archer Roose Wines

Recent Developments

-

In January 2025, GALLO and Spritz Society announced an agreement where GALLO would aid in the expansion of the retail distribution for Spritz Society's canned product range. This agreement has been initiated in the states of Illinois, South Carolina, Florida, and Texas in the U.S., with nationwide expansion across major retail outlets expected in March 2025. GALLO would be involved in the distribution of canned products, including Pink Lemonade, Lemon Iced Tea, Peach, and Pickle cocktails.

-

In August 2024, Archer Roose announced the availability of its Sauvignon Blanc cans across more than 150 Dave & Buster's locations throughout the U.S. This is part of the company's strategy of collaborating with major entertainment venues to boost product visibility and sales, building on previous agreements with Regal Cinemas, as well as sports stadiums such as BMO Stadium (Los Angeles) and Shell Energy Stadium (Houston).

Canned Wines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 125.2 million

Revenue forecast in 2030

USD 211.5 million

Growth Rate

CAGR of 11.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Argentina, South Africa

Key companies profiled

E. & J. Gallo Winery; Union Wine Company; Sans Wine Co.; Sula Vineyards Limited; SUNTORY HOLDINGS LIMITED; Canned Wine Co.; Maker Wine Company; Archer Roose Wines

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Canned Wines Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global canned wines market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sparkling Wine

-

Fortified Wine

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & Supermarket

-

Online Retail

-

On-trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Argentina

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.